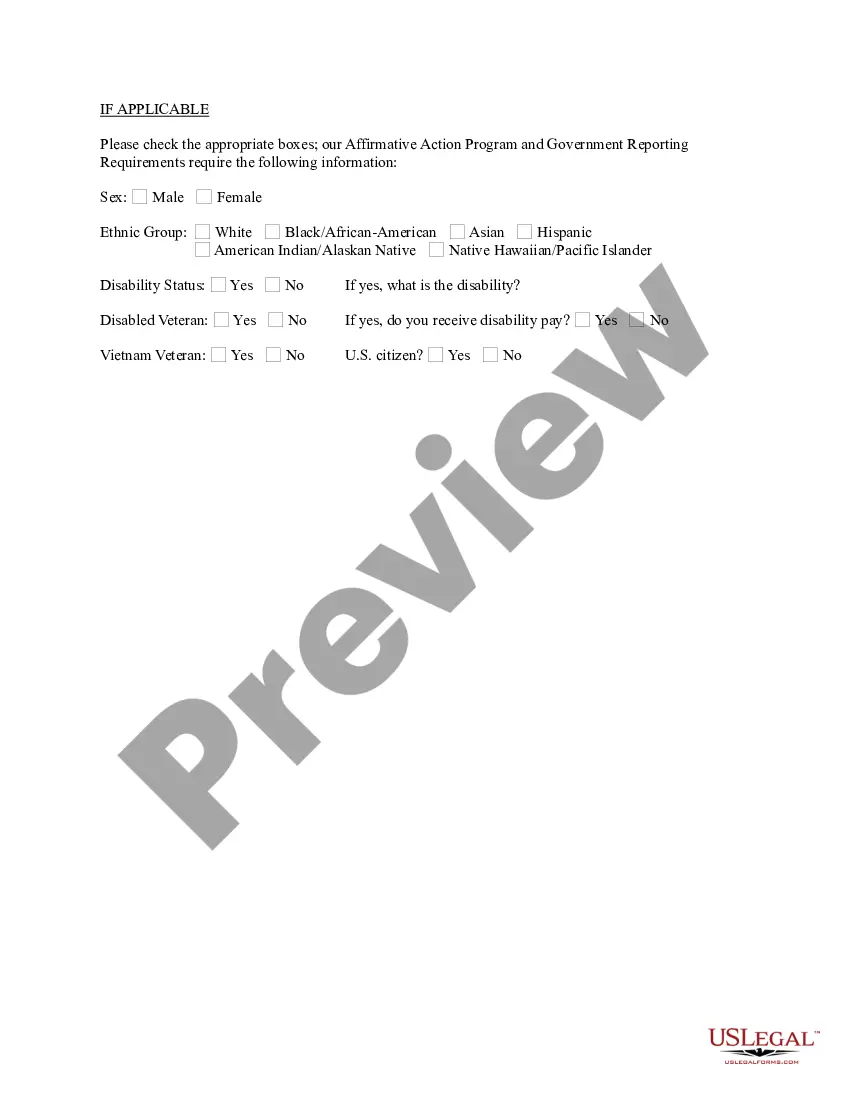

Oklahoma Post-Employment Information Sheet

Description

How to fill out Post-Employment Information Sheet?

Selecting the most suitable legal documents web template can be challenging.

It goes without saying that there are numerous templates accessible online, but how do you acquire the legal document you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- The platform offers a vast array of templates, such as the Oklahoma Post-Employment Information Sheet, suitable for both business and personal use.

- All forms are reviewed by professionals and comply with both federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to retrieve the Oklahoma Post-Employment Information Sheet.

- Use your account to view the legal forms you have previously purchased.

- Navigate to the My documents section of your account to download another copy of the document you need.

Form popularity

FAQ

In Oklahoma, full-time employment is 32 or more hours per week and individuals who are employed full-time are not eligible for unemployment benefits. If the hours drop below 32, there is potential to receive UI payments.

Employer 2021 SUI tax rates increased The deposit of federal CARES Act funds into the state UI trust fund did not occur soon enough to prevent an increase to the Oklahoma 2021 SUI tax rates. For 2021, SUI tax rates range from 0.3% to 7.5%, up from 0.1% to 5.5%. (Oklahoma Employment Security Commission website.)

To be monetarily qualified, you must have earned a minimum of $1,500 during your base period and have total wages of one and one-half times your high quarter. The minimum permissible weekly benefit amount one can earn in Oklahoma is $16 and a maximum of $520.

Oklahoma Withholding Tax Account IDIf you are a new business, register online with the Oklahoma Tax Commission.If you already have a Withholding Tax Account ID, you can find this number on correspondence from the Oklahoma Tax Commission. For additional assistance, please contact the agency at 405-521-3160.

Oklahoma Work Search RequirementsYou must be involved in a minimum of two activities per week (including work search contacts) in attempting to secure employment. f0de Work search contacts must be made within the week for which benefits are being claimed.

If your small business has employees working in Oklahoma, you'll need to pay Oklahoma unemployment insurance (UI) tax. The UI tax funds unemployment compensation programs for eligible employees. In Oklahoma, state UI tax is just one of several taxes that employers must pay.

You can possibly still collect Oklahoma unemployment benefits if you work less than full time. Your part-time wages will be applied against your claim. Earnings must be reported during the week you earn them, not when you actually receive payment.

Do You Need Help With SUI?Alabama. SUI Tax Rate: 0.65% - 6.8%Alaska. SUI Tax Rate: 1.00% - 5.4%Arizona. SUI Tax Rate: 0.05% - 12.76%Arkansas. SUI Tax Rate: 0.4% - 14.3%California. SUI Tax Rate: 1.5% - 6.2%Colorado. SUI Tax Rate: 0.62% - 8.15%Connecticut. SUI Tax Rate: 1.9% - 6.8%Delaware. SUI Tax Rate: 0.3% - 8.2%More items...

Required Workplace PostersEEOC. Spanish. Optimized for screen readers.EEOC Supplement. Spanish.E-Verify Participation Poster. E-Verify Participation Poster (Spanish)Right to Work Poster (English) Right to Work Poster (Spanish)Federal Minimum Wage.FMLA.Oklahoma Minimum Wage. Spanish.Oklahoma Whistleblowers Act.More items...

Oklahoma requires businesses with employees to register for a Unemployment Insurance (UI) tax account. Once your business has a UI account number your business needs to register on Oklahoma's EZ Tax Express website and set-up third party access.