Oklahoma Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

You are able to invest hours online attempting to find the lawful document format that fits the state and federal specifications you require. US Legal Forms offers a large number of lawful kinds that are reviewed by experts. You can easily obtain or produce the Oklahoma Self-Employed Independent Contractor Employment Agreement - commission for new business from the assistance.

If you currently have a US Legal Forms accounts, you can log in and then click the Down load switch. Afterward, you can full, revise, produce, or sign the Oklahoma Self-Employed Independent Contractor Employment Agreement - commission for new business. Each and every lawful document format you acquire is your own property permanently. To acquire one more copy associated with a obtained kind, go to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms site for the first time, stick to the basic recommendations beneath:

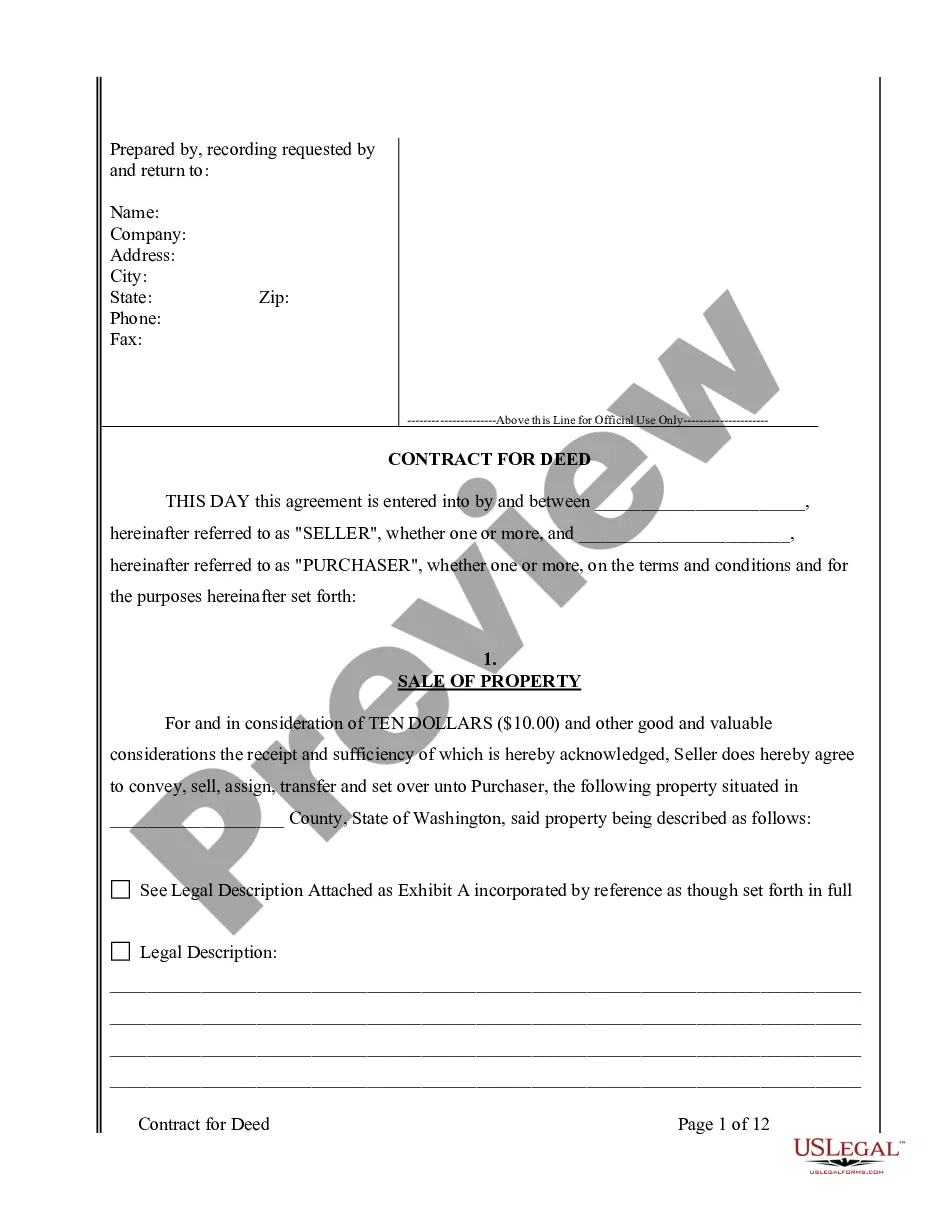

- Initially, be sure that you have selected the right document format for the area/metropolis of your choosing. Read the kind outline to ensure you have chosen the proper kind. If available, use the Review switch to search from the document format as well.

- If you wish to discover one more edition of your kind, use the Lookup area to obtain the format that meets your requirements and specifications.

- Upon having found the format you want, click Get now to proceed.

- Choose the prices program you want, type your references, and register for an account on US Legal Forms.

- Total the financial transaction. You can use your charge card or PayPal accounts to purchase the lawful kind.

- Choose the formatting of your document and obtain it to the gadget.

- Make changes to the document if required. You are able to full, revise and sign and produce Oklahoma Self-Employed Independent Contractor Employment Agreement - commission for new business.

Down load and produce a large number of document templates making use of the US Legal Forms site, that offers the greatest collection of lawful kinds. Use professional and express-particular templates to handle your organization or person requirements.

Form popularity

FAQ

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Independent Contractors - Independent contractors are not "employees" and therefore are not covered under Oklahoma workers' compensation law.