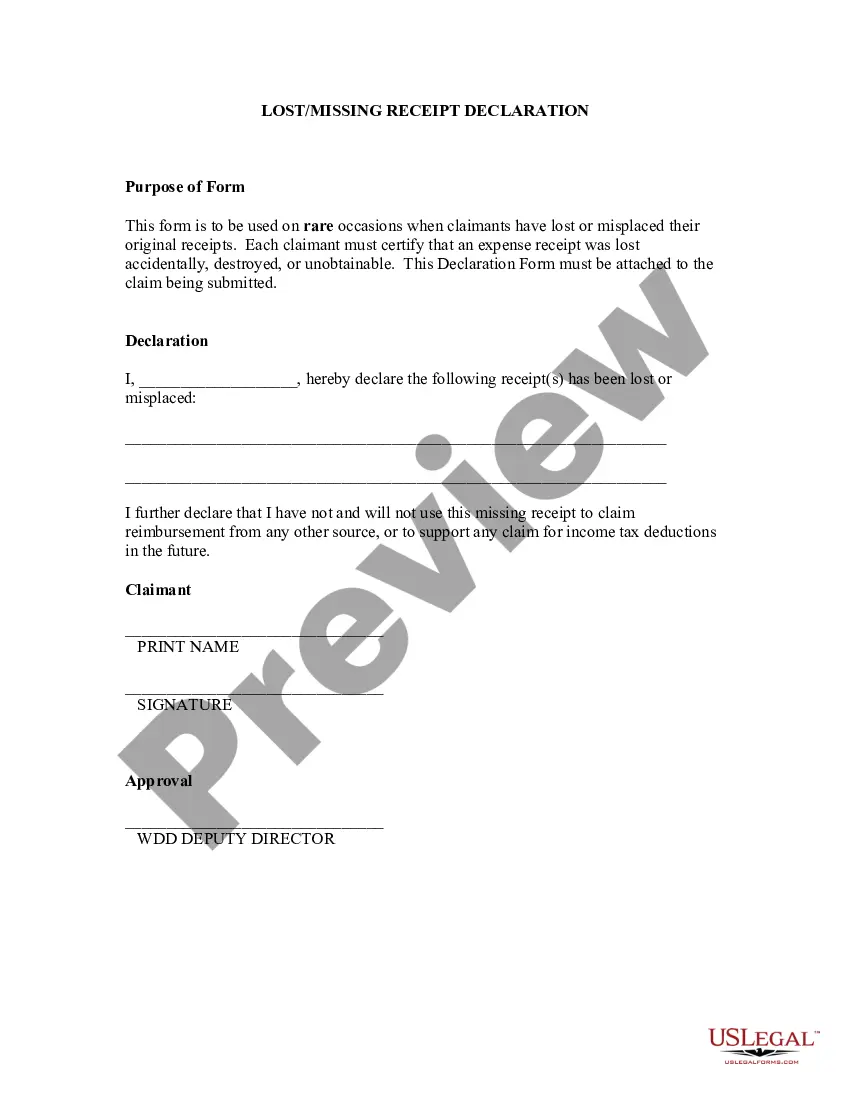

Oklahoma Lost Receipt Form

Description

How to fill out Lost Receipt Form?

Are you presently situated in a location where you often require documents for various corporate or individual activities every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of document templates, including the Oklahoma Lost Receipt Form, which are designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Choose the pricing plan you desire, fill in the necessary information to create your account, and complete your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oklahoma Lost Receipt Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/region.

- Use the Preview option to view the form.

- Check the description to confirm that you have selected the correct document.

- If the form is not what you’re looking for, use the Search field to find the template that meets your needs and specifications.

Form popularity

FAQ

The withholding tax for non-residents in Oklahoma generally applies to their income earned within the state. The exact rate may vary depending on the type of income. If you are a non-resident and you have lost important documents, the Oklahoma Lost Receipt Form might help you retrieve needed records effectively with Uslegalforms.

The Oklahoma resident, filing a joint federal return with a nonresident civilian spouse, may file an Oklahoma return as married filing separate. The resident will file on Form 511 using the married filing separate rates and reporting only his/her income and deductions.

This procedure is called a Court Ordered Title Approval and can be completed in about 2 weeks depending on holidays. NOTE: If the Judge approves your paperwork, he gets paid. If the Oklahoma Tax Commission finds an old lien from another state, it is your responsibility to provide the lien release.

Snap Title 42 is well known to this agency and is always notified of any changes. Our fee for this process is $195.00. COURT ORDERED TITLES $350.00. If you purchased a vehicle and were given a bill of sale, a Court Ordered Title Approval is your best solution in obtaining a legal title in your name.

This Form can be used to file a: Tax Return, Tax Amendment, Change of Address. Place an X in the Amended Return check-box at the top of the form. On Form 511, you should enter any amounts you paid with your original, accepted return, plus any amounts paid after it was filed on line 30.

Oklahoma Taxpayer Access Point (OkTAP) Frequently Asked Questions.

Give Us a Call! Commission can be reached at (405) 521-3160. The in-state toll free number is (800) 522-8165. Press 0 to speak to a representative.

The vehicle must be abandonedfor 30 days, must have a DMV printout from the state where it is registered, and that printout must include all of the vehicle information, owner information, vehicle tag information and any lien information on the vehicle. In essenceit must be extremely complete.

A Title 42 is a process that is done in order to retrieve a title to any vehicle (any vehicle that is required to have a title, by law in Oklahoma) such as a car, truck, motorcycle, scooter, boat/boat motor, van, RV, trailer, semi, mobile home, ATV, UTV, snowmobile, manufactured home, etc.

Form 511EF is the Oklahoma Individual Income Tax Declaration for Electronic Filing form.