Oklahoma Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Letter To Creditor Confirming Agreement That Monthly Payments Be Temporarily Postponed?

Are you presently in a place in which you require papers for either enterprise or personal purposes almost every working day? There are a variety of legal record layouts available on the net, but getting types you can trust isn`t effortless. US Legal Forms offers 1000s of form layouts, much like the Oklahoma Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed, that are published to satisfy state and federal requirements.

If you are currently knowledgeable about US Legal Forms site and get an account, simply log in. Afterward, you may down load the Oklahoma Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed web template.

If you do not come with an profile and wish to begin to use US Legal Forms, follow these steps:

- Get the form you want and make sure it is for that proper city/region.

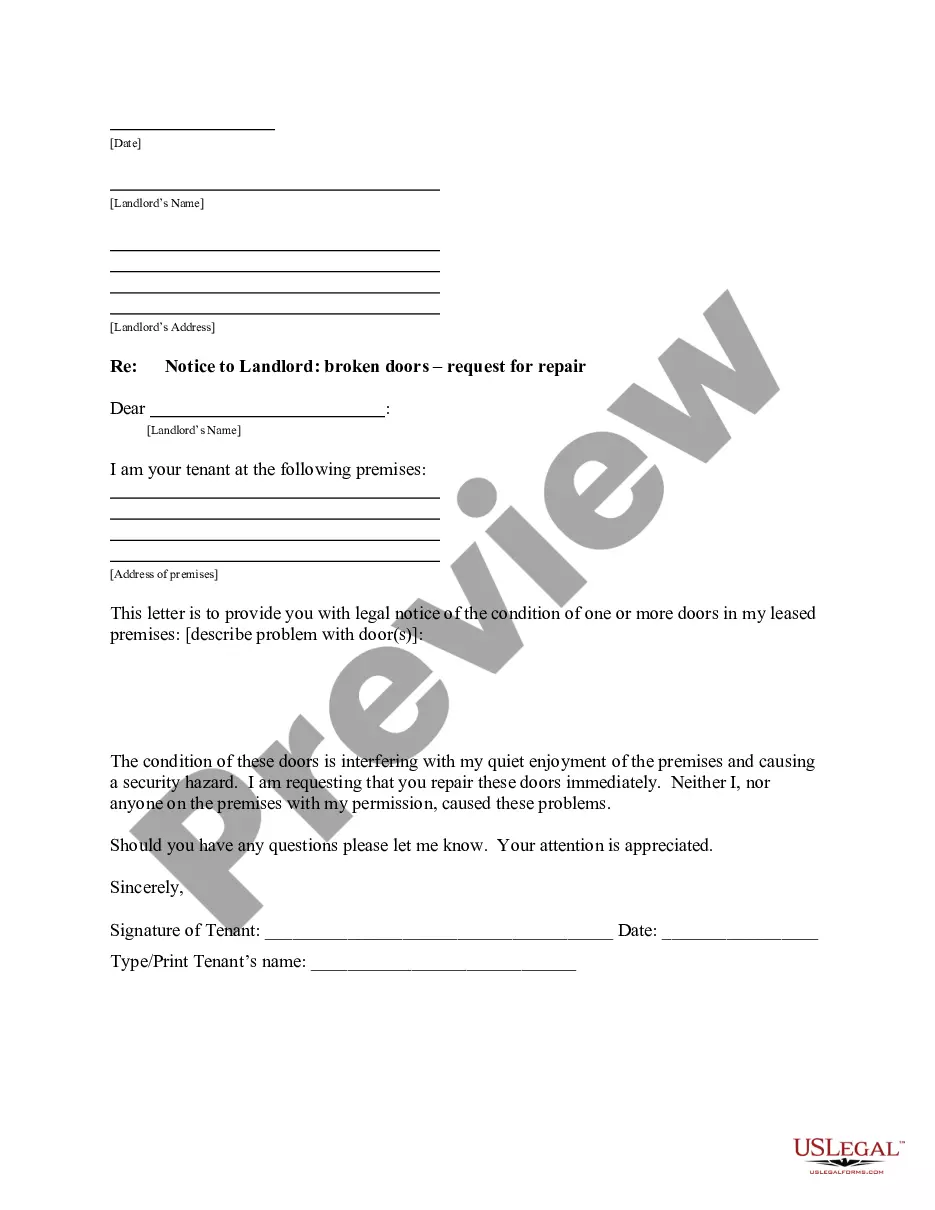

- Utilize the Review switch to examine the form.

- Look at the information to actually have selected the proper form.

- When the form isn`t what you`re searching for, take advantage of the Research discipline to obtain the form that fits your needs and requirements.

- If you discover the proper form, click Purchase now.

- Choose the prices prepare you need, submit the specified information and facts to generate your money, and pay money for your order making use of your PayPal or bank card.

- Select a handy document file format and down load your copy.

Find each of the record layouts you may have purchased in the My Forms food list. You can get a additional copy of Oklahoma Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed any time, if possible. Just select the necessary form to down load or printing the record web template.

Use US Legal Forms, the most substantial collection of legal forms, to save some time and steer clear of faults. The assistance offers skillfully made legal record layouts that can be used for a variety of purposes. Generate an account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

How to Write a Deferment LetterWrite exactly why you cannot currently begin paying off your loan.Indicate in your letter when the condition that made you unable to repay the loan began and when you expect it to end.Add references if possible.

You can call your utility company to ask about pausing payments. You may be able to defer payments on your mortgage, credit card, auto loan, private student loan, or personal loan by calling your bank.

I) Grant me/us moratorium of three months for payment of all installments/EMI of my aforesaid Loan Account that are falling due between March 1, 2020 and and extend the existing repayment schedule of our/my said loan as also the residual tenor, by three months.

One of these options, known as deferred payments, involves an agreement reached between a borrower and a lender or creditor that allows the borrower to pause or suspend payments that would have otherwise been required.

A credit card that offers zero interest rates is an example of a deferred payment arrangement, since the bank that supplies the line of credit will collect the monthly payments without the revenue that would normally be guaranteed by the interest added.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

The typical deferral period ranges from 1 to 6 months. Borrowers are expected to resume payments after the deferral period ends. Some borrowers may not use the entire deferral period. Others might ask for an extension in order to continue payment deferral.

How to prepare to talk with your creditorsThe specifics of your account. If you're calling to discuss a current account or loan, be sure to have a current statement on hand.An explanation of your situation.A repayment option/plan.Proof of your situation.A cool head.

Whether you're in arrears or struggling to keep on top of your regular payments, asking your creditors to freeze interest and charges can help you clear your debts and get back on track quicker. They may agree to freeze interest for an agreed length of time if you tell them about your financial difficulties.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.