Oklahoma Sample Letter for Creditor Notification of Estate Opening

Description

How to fill out Sample Letter For Creditor Notification Of Estate Opening?

Are you inside a situation the place you need documents for both organization or personal reasons just about every day? There are tons of lawful papers layouts available on the net, but discovering types you can depend on is not simple. US Legal Forms provides thousands of type layouts, just like the Oklahoma Sample Letter for Creditor Notification of Estate Opening, which are created to satisfy state and federal requirements.

In case you are already familiar with US Legal Forms web site and possess a merchant account, simply log in. Following that, you may down load the Oklahoma Sample Letter for Creditor Notification of Estate Opening format.

If you do not come with an bank account and need to start using US Legal Forms, abide by these steps:

- Obtain the type you require and ensure it is for your appropriate town/county.

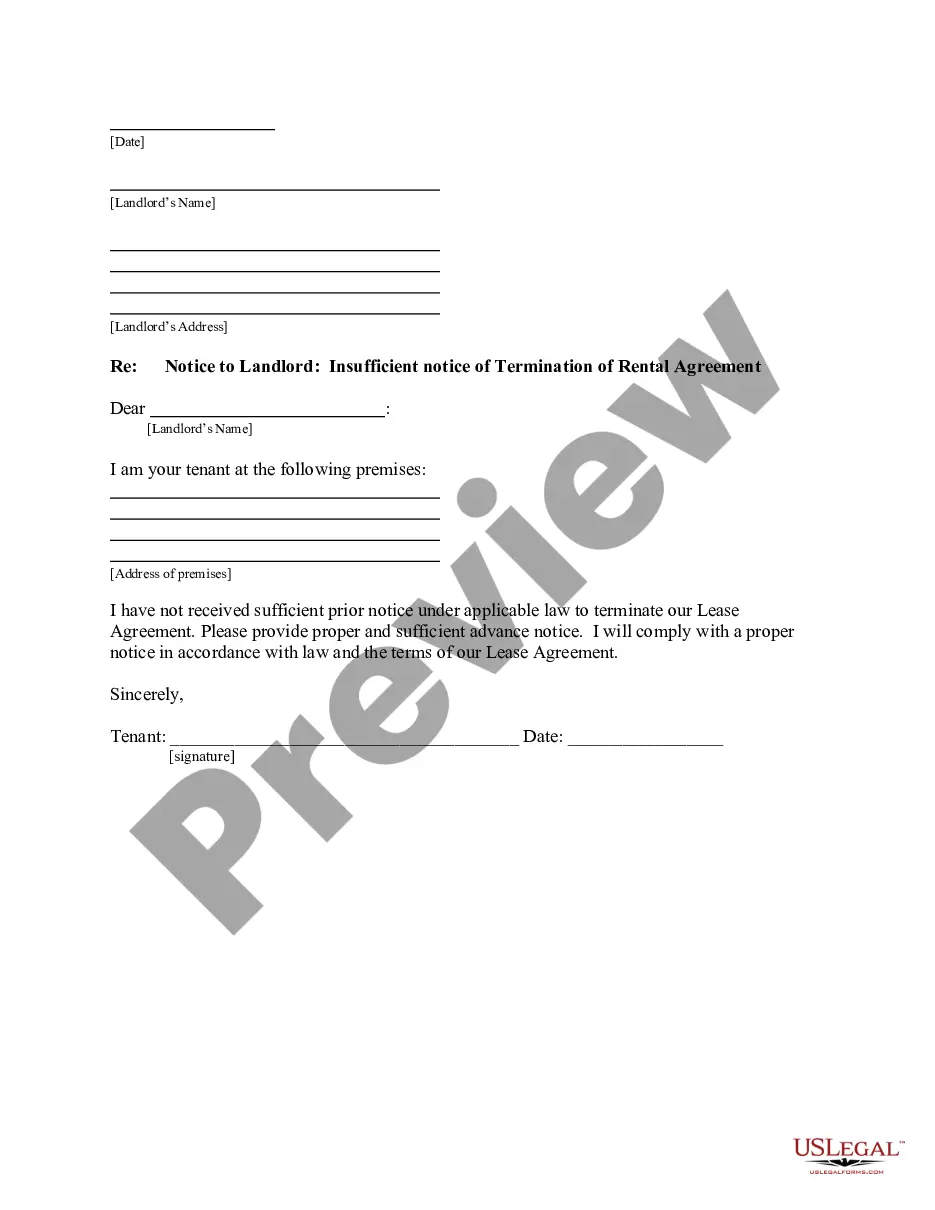

- Use the Preview switch to review the form.

- Look at the explanation to actually have chosen the appropriate type.

- When the type is not what you are trying to find, use the Lookup industry to obtain the type that meets your needs and requirements.

- Once you get the appropriate type, click Purchase now.

- Pick the costs program you want, complete the specified info to generate your money, and buy your order utilizing your PayPal or charge card.

- Pick a practical data file structure and down load your version.

Locate each of the papers layouts you have bought in the My Forms food selection. You can obtain a further version of Oklahoma Sample Letter for Creditor Notification of Estate Opening whenever, if required. Just go through the essential type to down load or printing the papers format.

Use US Legal Forms, by far the most considerable variety of lawful forms, in order to save time and avoid faults. The support provides skillfully produced lawful papers layouts that can be used for a variety of reasons. Make a merchant account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

The full probate procedure in Oklahoma is used if an estate is worth over $200,000. The simplified probate procedure may be available for estates worth less than $200,000.

A Letter of Appointment of Executor helps prove you have been put in charge of someone's estate after they have passed away. As Executor, you've been given the duty to manage the estate and carry out the directions of the will; however, a court may require official documentation.

In Oklahoma, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In Oklahoma, as a final step in the probate process, a personal representative must file a petition, set a hearing date, and go before the probate judge to officially close a probate case. After the hearing is complete, the probate judge will sign an order.

Oklahoma Probate Procedure Filing a Petition begin the Oklahoma Probate Procedure. Notice of Hearing must be given to all interested parties. Hearing on Petition naming Personal Representative or Executor. The Court will issue Letters of Administration appointing a Personal Representative or Executor. Notice to Creditors.

If the cumulative value of a deceased person's probate personal property (not including real estate) that would otherwise go through probate court is less than $50,000, that probate property can be obtained by the deceased person's successors by the use of a Small Estates Affidavit and thus avoid probate.

During the probate, all of your creditors will be given notice of the opportunity to file claims against your estate. The creditors will have about two months to file their claims. The personal representative of your estate will then have the opportunity to approve or deny those claims.

The court will issue Letters of Administration if there is no will. This appoints the person who will administer the estate. The family can agree on one or more people and in most cases the Court will do what the family agrees on.