Oklahoma Qualified Domestic Trust Agreement

Description

How to fill out Qualified Domestic Trust Agreement?

Selecting the appropriate legal document layout can be a challenge.

Of course, there are numerous templates accessible online, but how can you find the legal format you require.

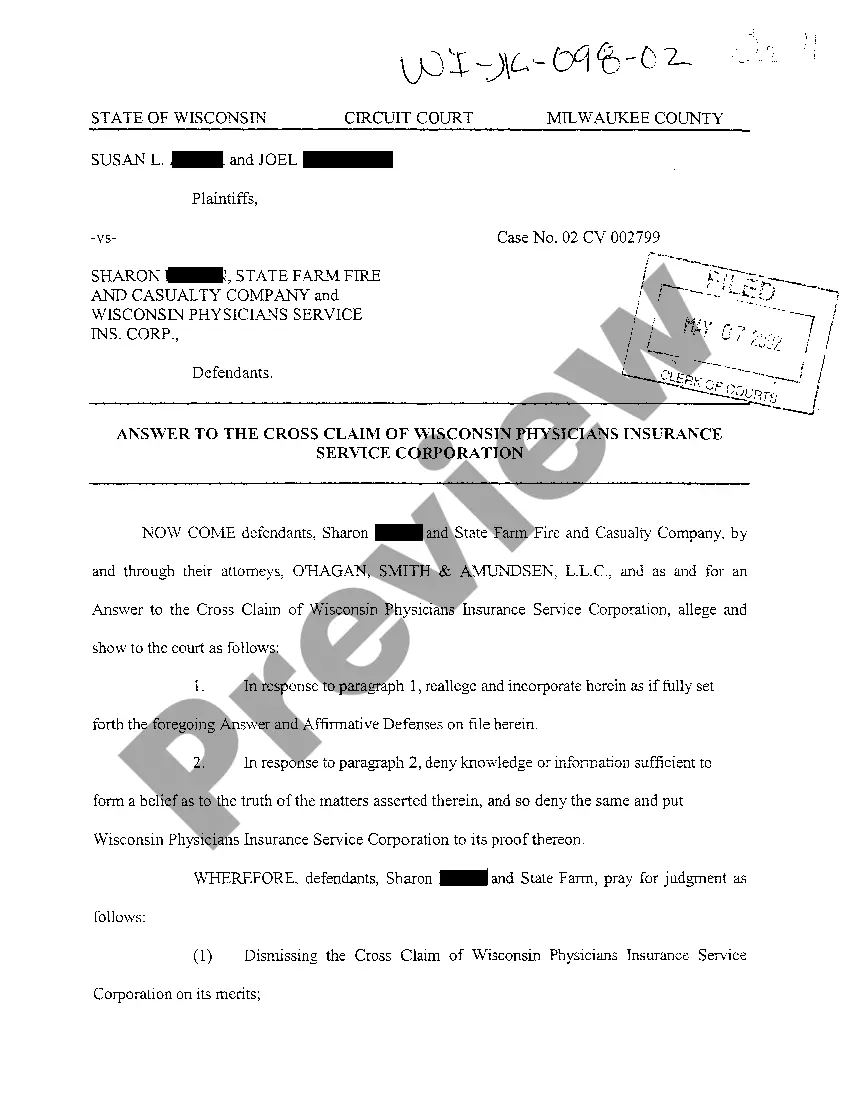

Utilize the US Legal Forms website. This service provides thousands of templates, such as the Oklahoma Qualified Domestic Trust Agreement, which can be utilized for both business and personal needs.

You can review the form using the Preview button and read its description to confirm it is the right choice for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Oklahoma Qualified Domestic Trust Agreement.

- Use your account to search for the legal forms you've accessed before.

- Visit the My documents section of your account to obtain another copy of the document you need.

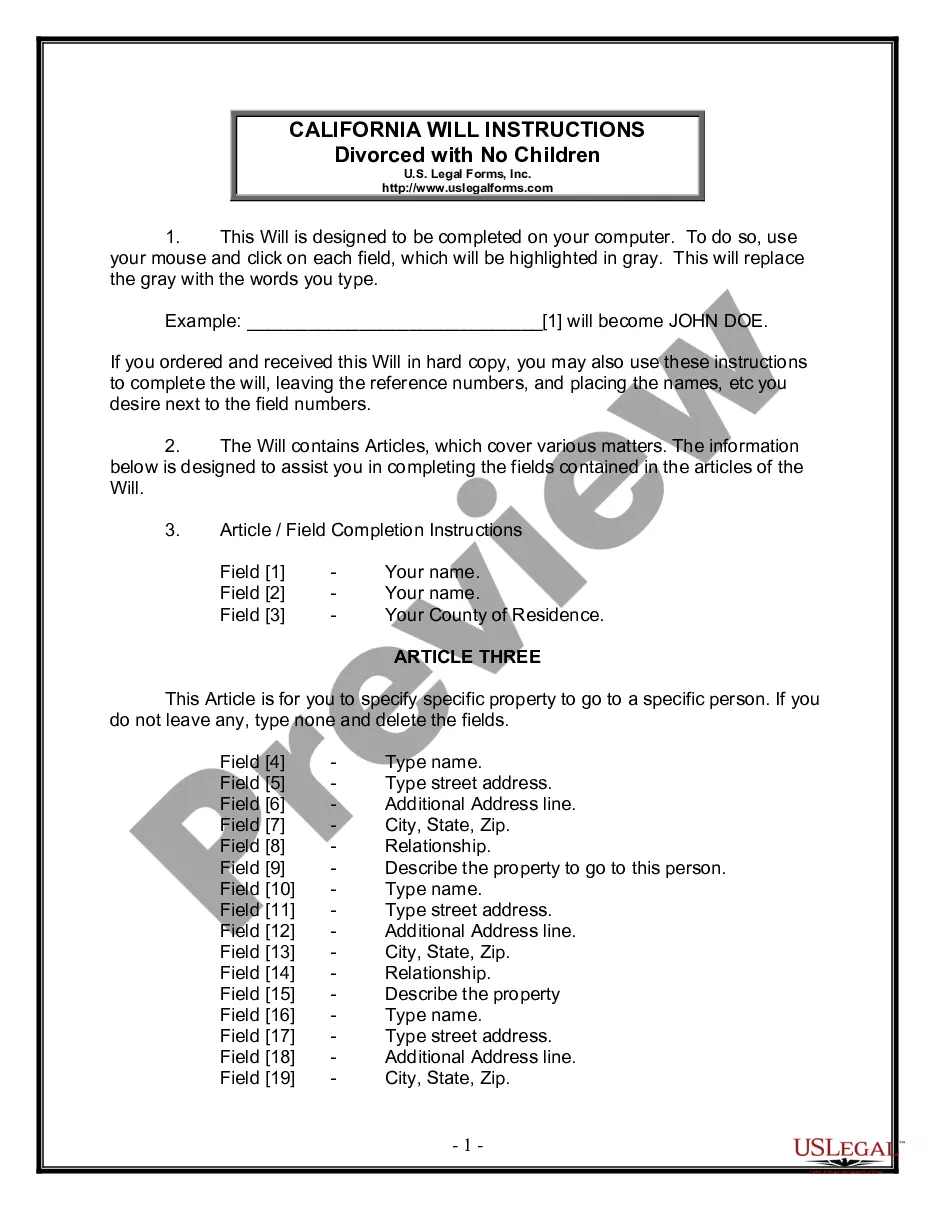

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct template for your state/region.

Form popularity

FAQ

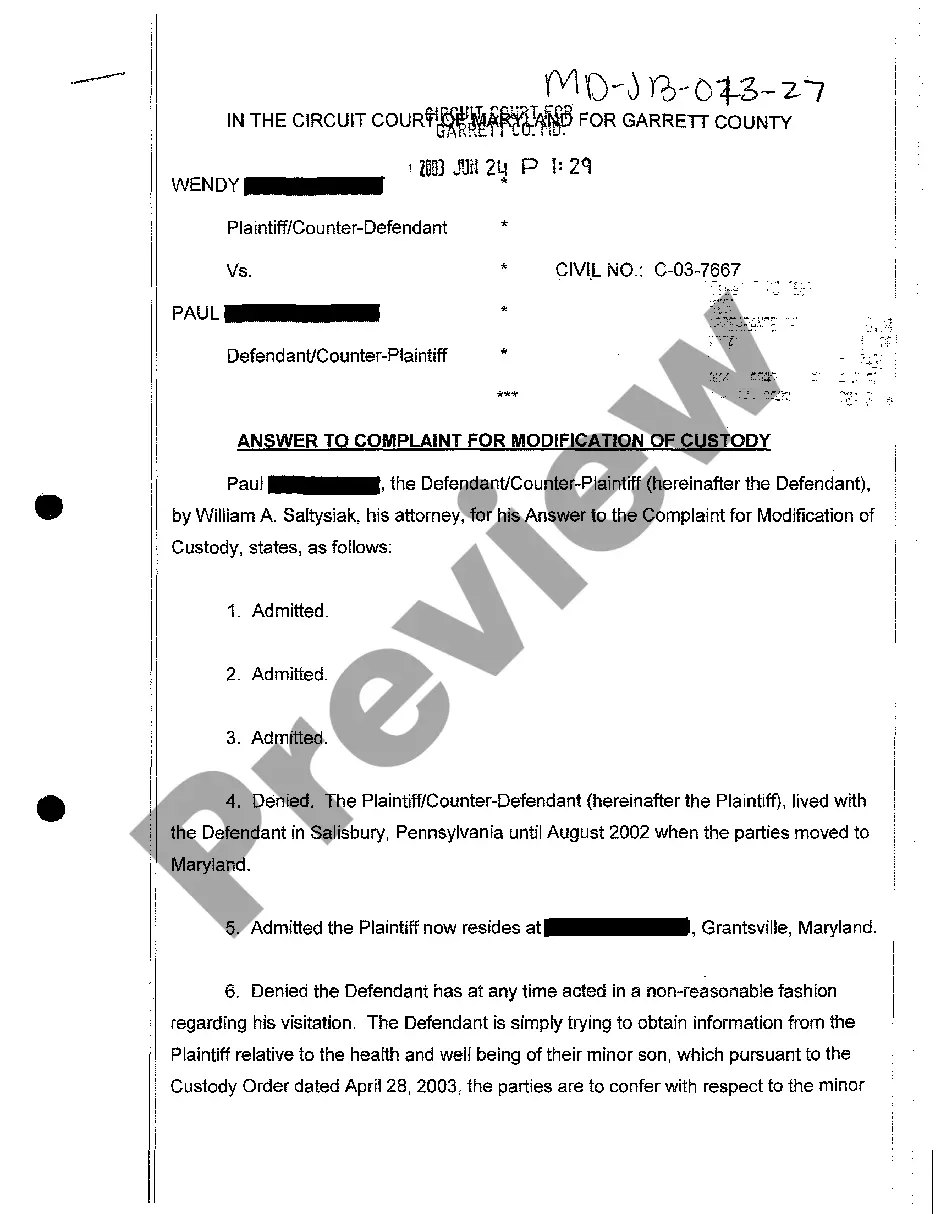

For estates that are less than those amounts, no QDOT is needed since no federal estate tax would be due. However, for estates greater than those amounts, no marital deduction will be allowed if the surviving spouse is not a U.S. citizen and does not become a citizen by the time that the estate tax return is filed.

A Qualified Terminable Interest Property (QTIP) trust is a type of marital trust. They are often used when a grantor has children from different marriages. The surviving spouse still serves as the initial beneficiary.

A qualified domestic trust (QDOT) is a special kind of trust that allows taxpayers who survive a deceased spouse to take the marital deduction on estate taxes, even if the surviving spouse is not a U.S. citizen.

In the State of Oklahoma, a living trust must be notarized, so you will have to consult with a legal professional in order to create one. Will (Last Will and Testament) A Will is necessary to distribute any assets which have not been transferred into the trust.

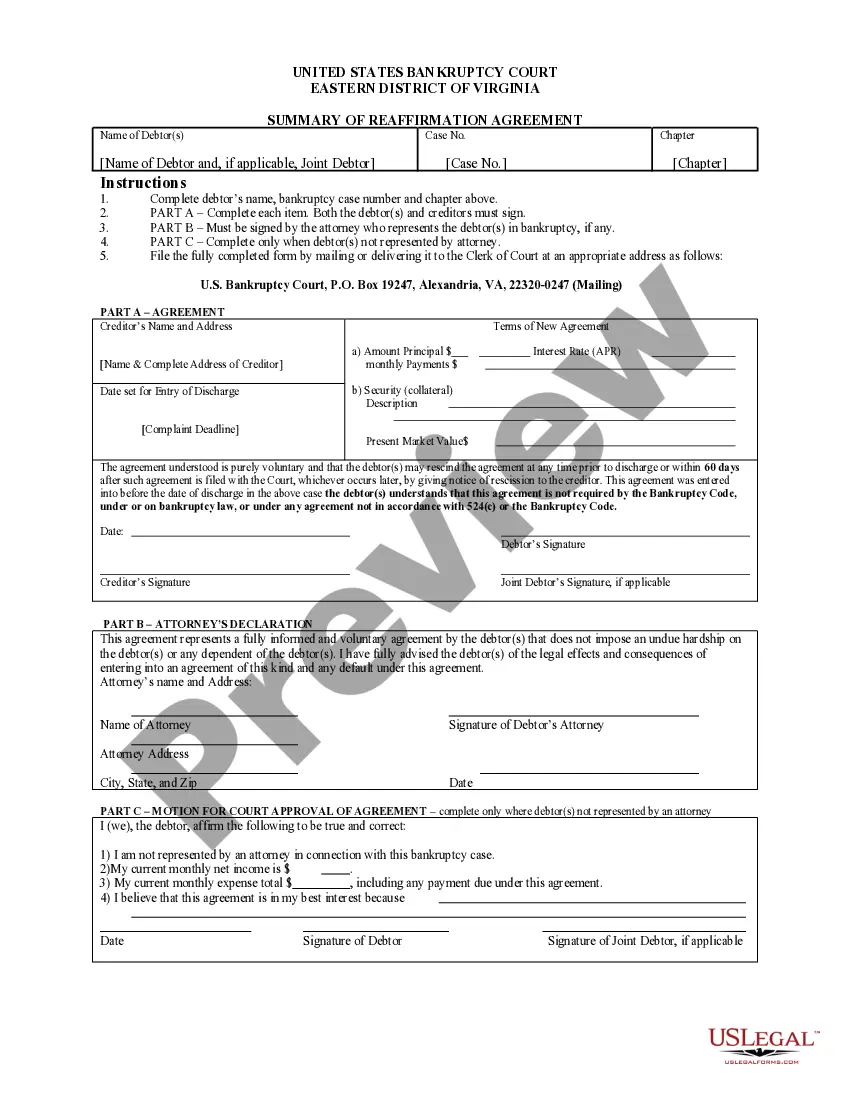

A domestic trust is any trust in which the following conditions are met: (1) A court within the U.S. must be able to exercise primary supervision over the administration of the trust. (2) One or more U.S. persons have the authority to control all substantial decisions of the trust.

Tax Consequences The QDOT is generally taxed as a simple trust for income tax purposes. This means that when the trust earns income, it MUST be distributed to the surviving spouse. The surviving spouse is then required to pay the income tax on that income based upon the surviving spouses own tax rates.

To be qualified, a trust must be valid under state law and must have identifiable beneficiaries. In addition, the IRA trustee, custodian, or plan administrator must receive a copy of the trust instrument. If a qualified trust is not structured correctly, disbursements are taxable by the IRS.

A QDOT (Qualified Domestic Trust) is a trust for the benefit of a surviving non-citizen spouse that defers the federal estate tax following the death of the first spouse. A Qualified Domestic Trust defers the federal estate tax because it qualifies for the unlimited marital deduction.

The unlimited marital deduction is a provision in the U.S. Federal Estate and Gift Tax Law that allows an individual to transfer an unrestricted amount of assets to their spouse at any time, including at the death of the transferor, free from tax.