Oklahoma Surety Agreement

Description

How to fill out Surety Agreement?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Through the site, you can locate thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can find the latest versions of forms such as the Oklahoma Surety Agreement in just a few moments.

If you already possess a subscription, Log In to download the Oklahoma Surety Agreement from the US Legal Forms collection. The Download button will appear on each form you access. You can find all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Acquire the form and download it to your device. Edit. Fill out, revise, and print and sign the downloaded Oklahoma Surety Agreement. Every template you add to your account does not expire and is yours indefinitely. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you require. Access the Oklahoma Surety Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

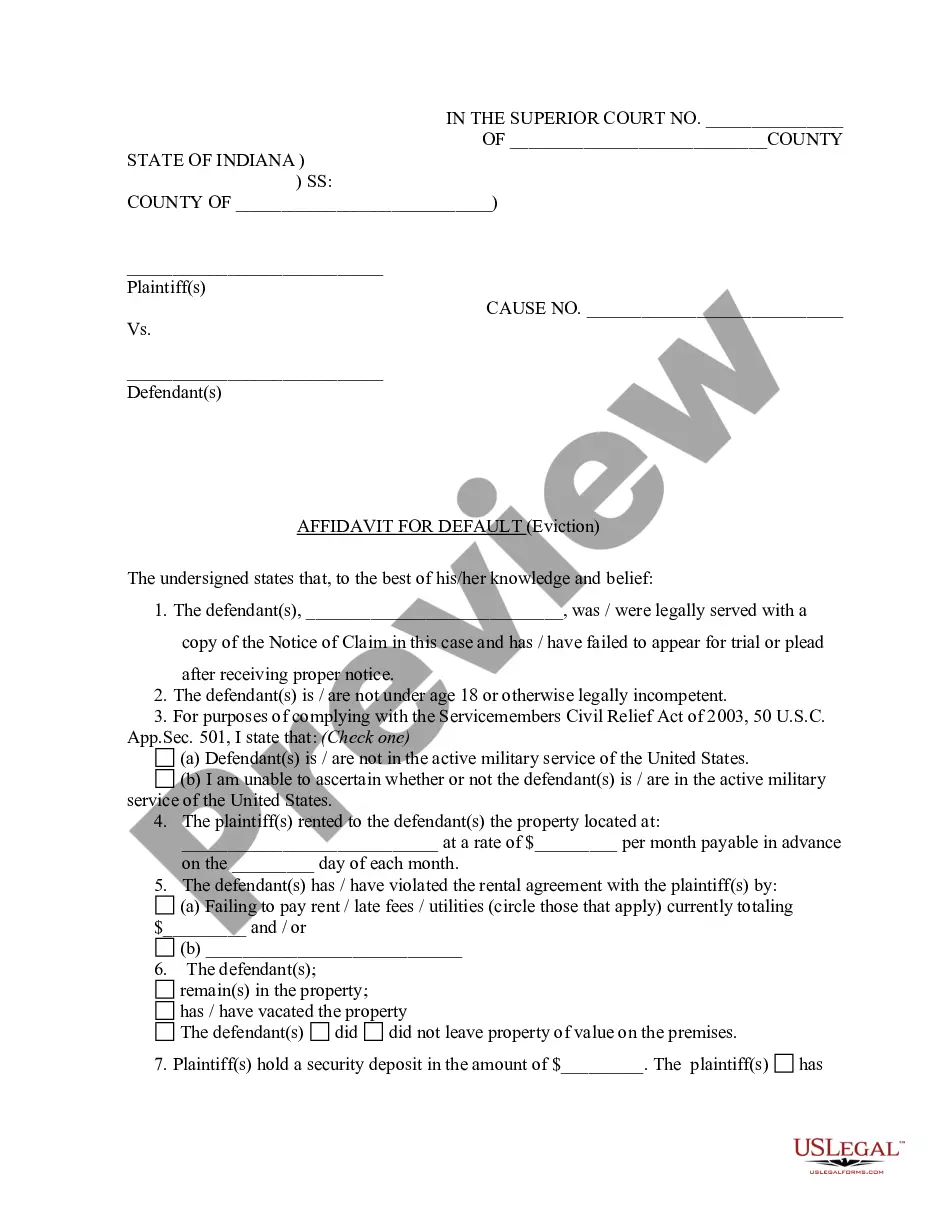

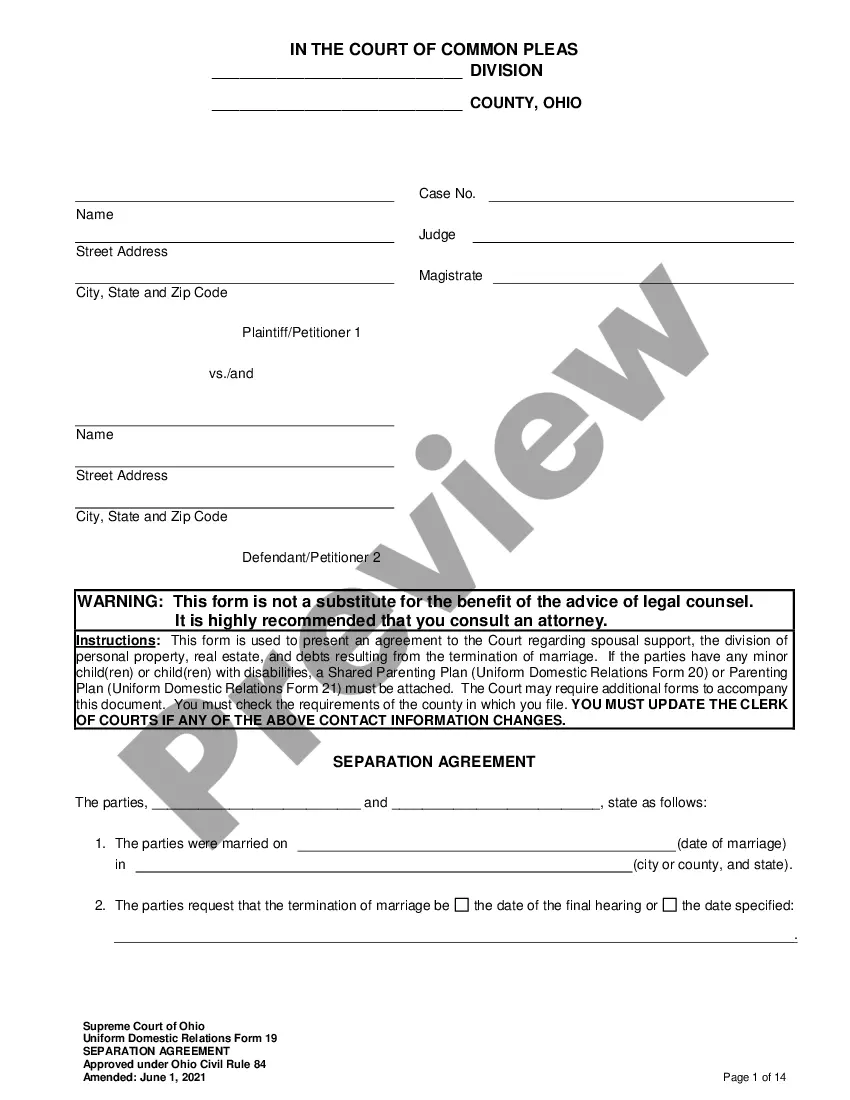

- Click the Review button to examine the content of the form.

- Read the form description to confirm that you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Surety bonds are legally binding contracts that ensure obligations will be met between three parties: The principal: whoever needs to obtain the bond. The obligee: the one requiring the bond (often a government agency) The surety: the insurance company guaranteeing the principal can fulfill the obligation.

A person who is offering surety must have acceptable residential proof. He may be a tenant, licensee. A beggar can also stand as surety provided he should have some acceptable residential proof. Sometimes, one person may come forward to stand as surety for more than one accused.

Surety bonds are typically required for contractors who seek to work on high-cost government contracts. Even when not compulsory, surety bonds make sense when a contract requires performance, because they help compensate obligees when principals fail to meet their contractual obligations.

The surety always takes on a level of risk by writing a surety bond for a principal. To minimize this risk, the surety will typically use an underwriting process when deciding whether to issue a surety bond to a principal who has applied for one.

A: Surety bonds provide financial guarantees that contracts and other business deals will be completed according to mutual terms. Surety bonds protect consumers and government entities from fraud and malpractice. When a principal breaks a bond's terms, the harmed party can make a claim on the bond to recover losses.

How To Get A Surety Bond In OklahomaStep #1: Get Your Financial House in Order.Step #2: Contact a Surety Bond Agent.Step #3: Work With an Underwriter.Step #4: Sign Indemnity Agreement and Purchase Your Bond.

To work as a process server in Oklahoma, you are required to submit a $5,000 surety bond to the state along with your license application. Your bond protects the public and the OK court system from damages in the event you fail to abide by service of process laws. Your premium for this bond is $50.

The Oklahoma Secretary of State requires notary publics to post a $1,000 surety bond to protect the general public and the state from a notary public's mistakes, negligence, or misuse of the notary stamp and signature.

Surety Explained in Detail A surety bond is a legal binding agreement signed between three partiesthe lender, the trustee, and the guarantor. The obligee, generally a government agency, allows the principal to receive a security bond as a protection against future work output, normally a business owner or contractor.