Oklahoma Promissory Note - Long Form

Description

How to fill out Promissory Note - Long Form?

Have you ever been in a location where you require documents for business or particular reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, including the Oklahoma Promissory Note - Long Form, which are designed to meet state and federal requirements.

When you find the appropriate form, click on Get now.

Select the payment plan you want, provide the necessary information to create your purchase, and complete your transaction using PayPal or your credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Oklahoma Promissory Note - Long Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

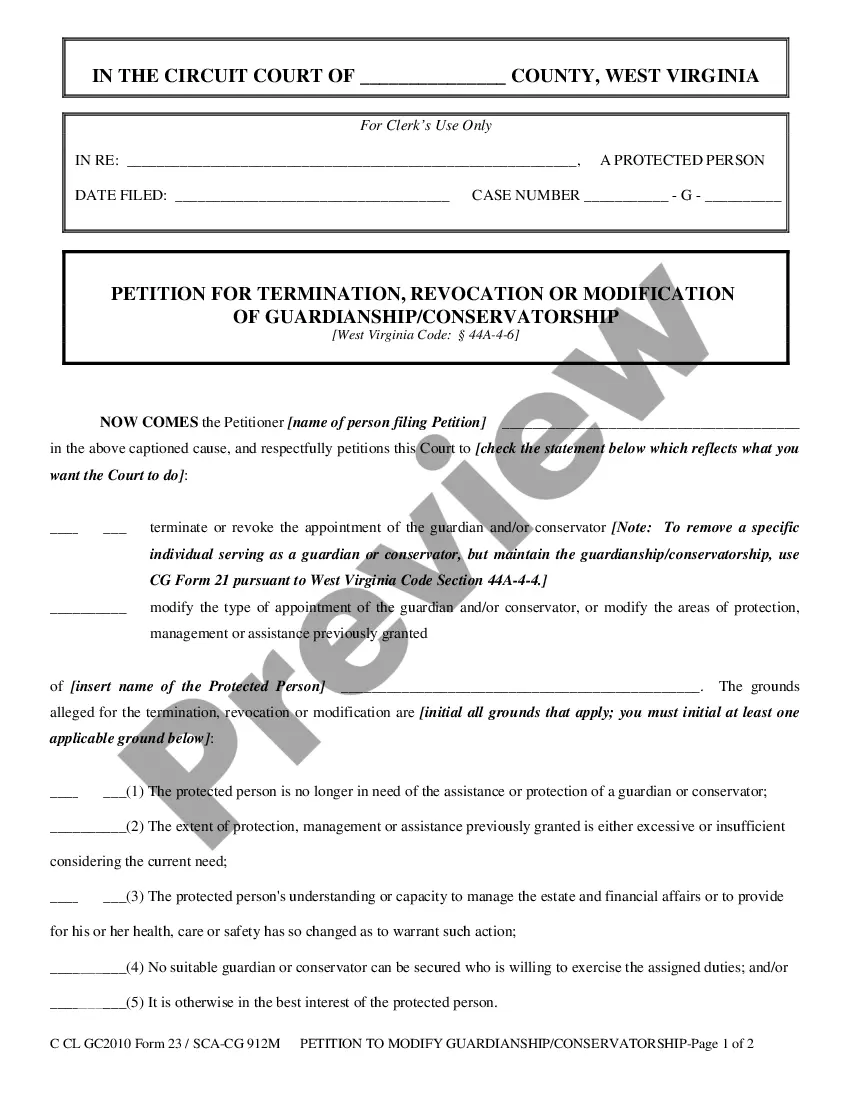

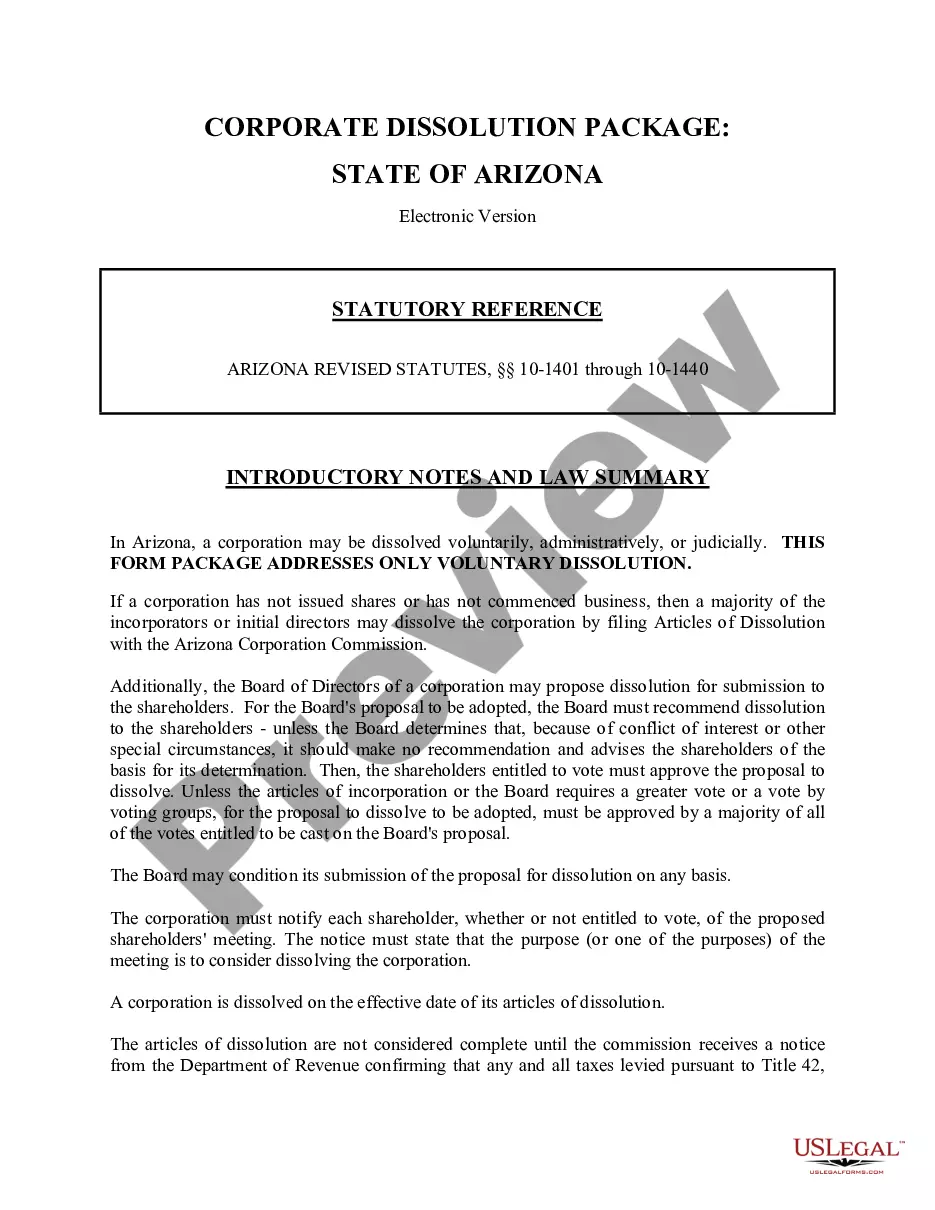

- Utilize the Preview button to check the template.

- Read the description to ensure you've selected the correct form.

- If the form is not what you're looking for, use the Search field to find a form that meets your needs.

Form popularity

FAQ

To fill out a promissory demand note, start by clearly identifying the parties involved. Include the borrower's name and the lender's name, along with the amount borrowed. Specify the repayment terms, including any interest rate, and mention that the note is a demand note, meaning the lender can request payment at any time. For a thorough guide, consider using the US Legal Forms platform to access a well-structured Oklahoma Promissory Note - Long Form template.

In Oklahoma, a promissory note is generally not filed with the court or any government office. Instead, you should keep the original document in a safe place, as it serves as the legally binding evidence of the debt. If you want to protect your interests further, consider filing a lien on the borrower's property through the appropriate county recorder's office. This step can offer additional security for your investment under the terms of the Oklahoma Promissory Note - Long Form.

Yes, a promissory note can be extended. To do this, both the borrower and lender must agree to the extension terms and create a written amendment to the existing Oklahoma Promissory Note - Long Form. This document should clearly outline the new maturity date and any adjustments to the interest rate or payment schedule. It is important that both parties sign and date this amendment to ensure that it is legally binding.

As previously mentioned, a lawyer is not always necessary to create an Oklahoma Promissory Note - Long Form. With the right resources, like US Legal Forms, you can draft a legally sound document yourself. If you prefer, seeking legal advice could clarify any uncertainties and ensure all legal requirements are met.

Yes, you can make your own Oklahoma Promissory Note - Long Form without too much hassle. By using a template from reliable legal resources, you can customize it to fit your situation. Just ensure that you include essential details, such as the repayment terms and interest rate, to make it enforceable.

To obtain an Oklahoma Promissory Note - Long Form, you can start by visiting credible online legal platforms, such as US Legal Forms. These platforms offer customizable templates that you can fill out according to your specific needs. Once finalized, you can print and sign the document to make it legally binding.

An Oklahoma Promissory Note - Long Form can be as long as necessary, depending on the agreement between the involved parties. Often, the duration aligns with the repayment capacity and financial needs of the borrower. Ultimately, customizing the length promotes a practical approach to repayment.

A notarized Oklahoma Promissory Note - Long Form is indeed legally binding, as notarization adds a layer of verification to the document. This process helps protect all parties involved by confirming their identities and ensuring they understand the note's implications. Therefore, including notarization can strengthen the enforceability of the agreement.

Yes, an Oklahoma Promissory Note - Long Form generally has a specific time limit for repayment. This duration varies based on the agreement made between the lender and borrower. It's essential to set a clear deadline to determine when the borrower must complete their payments.

The format of an Oklahoma Promissory Note - Long Form typically includes essential elements such as the principal amount, interest rate, repayment schedule, and signatures from both parties. It’s crucial to clearly outline the terms to prevent misunderstandings later. Using a structured format helps ensure all parties understand their obligations.