Oklahoma Return Authorization Form

Description

How to fill out Return Authorization Form?

It is feasible to invest hours online trying to discover the legal document template that aligns with the state and federal requirements you necessitate.

US Legal Forms provides countless legal templates that are evaluated by experts.

You can effortlessly obtain or print the Oklahoma Return Authorization Form from their service.

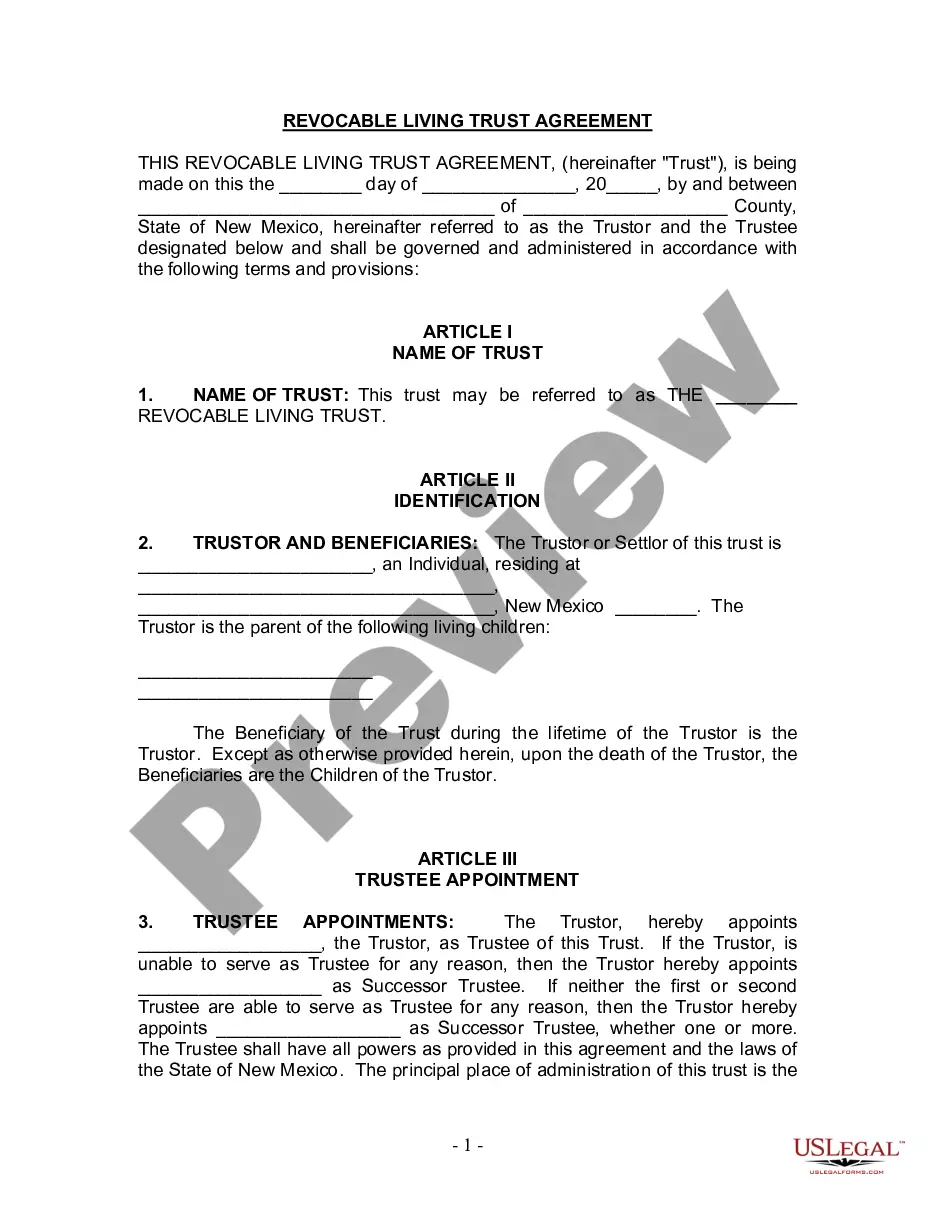

If available, utilize the Review option to examine the document format as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Oklahoma Return Authorization Form.

- Every legal document template you acquire is your property permanently.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your location/region.

- Review the form outline to verify that you have selected the appropriate form.

Form popularity

FAQ

The Oklahoma capital gain deduction typically applies to gains from the sale of real estate or tangible personal property. To qualify, assets should have been held for more than a year, and there may be specific stipulations related to the type of property sold. Knowing how to effectively document these transactions using the Oklahoma Return Authorization Form can streamline your claims and deductions.

Oklahoma form 512 is another important document that pertains to the state's corporate tax obligations. Companies file this form to report their income and determine the tax owed. Understanding the intertwined role of the Oklahoma Return Authorization Form in related processes is beneficial for effective tax planning and compliance.

Form 561 in Oklahoma refers specifically to the Oklahoma Return Authorization Form, which aids in the management of return processes for goods. This form ensures that businesses comply with return policies and allows for a smoother transaction workflow. Knowing how to properly fill out and submit this form can save time and mitigate potential issues related to returns.

Oklahoma form 200f is a franchise tax form used by companies operating in the state to report their annual tax obligations. This form ensures compliance with state tax laws and helps businesses calculate the franchise tax based on their activities and financial status. It's crucial to maintain accurate records, and understanding how the Oklahoma Return Authorization Form can work alongside this form can enhance your tax management.

Form 511 is Oklahoma’s individual income tax return form that residents must file each year. This form determines how much tax you owe or how much of a refund you can expect based on your income and deductions. Utilizing the Oklahoma Return Authorization Form when processing returns can ensure that any adjustments or claims related to your income tax filings are handled correctly.

To avoid Oklahoma capital gains tax on real estate, you can utilize various strategies such as investing in a qualified opportunity zone or enhancing your primary residence's exemption. Another effective method involves using a 1031 exchange to defer taxes on proceeds from property sales. Moreover, understanding the implications of the Oklahoma Return Authorization Form can help clarify any necessary compliance issues associated with such transactions.

The Oklahoma Return Authorization Form, known as form 561, is primarily used for authorizations related to the return of goods as per state regulations. This form helps streamline processes when goods need to be returned, ensuring compliance with local tax laws. By utilizing form 561, businesses and individuals can manage returns more efficiently and avoid unnecessary delays.

Mail your Oklahoma state tax return to the address provided in the instructions for the specific form you are completing. If you are mailing a payment, the address may differ from the no-payment returns. Always confirm the details on the official Oklahoma Tax Commission website for the latest updates. Utilizing the Oklahoma Return Authorization Form ensures your submission is precise and timely.

You should place the correct address on your tax return that corresponds with your current residency and any tax obligations. Ensure this address matches your identification records to prevent delays. Carefully check the IRS and Oklahoma Tax Commission instructions for the specific form you are using. The Oklahoma Return Authorization Form provides guidance for the accurate completion of your tax documents.

To file an amended Oklahoma state tax return, you will need to complete Form 511-X, the amendment form. This process allows you to correct any errors or changes from your original return. Be sure to reference the new information clearly to avoid confusion. The Oklahoma Return Authorization Form is an excellent tool to help you manage any amendments you make.