Oklahoma Packing Slip

Description

How to fill out Packing Slip?

If you require to summarize, obtain, or create validated document templates, utilize US Legal Forms, the largest variety of legal forms available online.

Employ the website's straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for commercial and personal purposes are organized by type and state, or by keywords.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Oklahoma Packing Slip.

- Use US Legal Forms to find the Oklahoma Packing Slip with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to acquire the Oklahoma Packing Slip.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the correct form for your city/state.

- Step 2. Use the Preview option to review the content of the form. Make sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the page to find alternative options within the legal form template.

- Step 4. Once you find the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your information to register for an account.

Form popularity

FAQ

Winning a court case in a different state can carry various implications, especially concerning tax obligations. You must report any income resulting from your win, even if it occurred outside Oklahoma. Including details from your Oklahoma Packing Slip will help you accurately report this income on your Oklahoma tax return. To navigate these complexities, consider reaching out to a legal expert in tax law for tailored advice.

To obtain Form 936 in Oklahoma, you can visit the Oklahoma Tax Commission's website, where you can download the form directly. Alternatively, you can request it through their customer service. Including your Oklahoma Packing Slip can expedite the process by ensuring the proper documentation accompanies your request. Making sure you have the right forms will save you time and effort during tax season.

The 514 PT form in Oklahoma is a document used for tax purposes, particularly for individuals qualifying for certain deductions. This form serves as a request for a personalized tax statement from the Oklahoma Tax Commission. When submitting the 514 PT form, it is wise to accompany it with your Oklahoma Packing Slip to provide a clear record of your income. This can help streamline your tax filing process.

Filing an Oklahoma tax return is necessary if you meet certain income thresholds established by the state. This requirement ensures that individuals contributing to Oklahoma's economy are in compliance with tax laws. When filing, you might find it helpful to include your Oklahoma Packing Slip, as it contains important information related to your earnings. This can simplify your filing process and ensure accuracy.

If you earn income in Oklahoma, you may need to file an Oklahoma return. It is crucial to assess your residency status and the sources of your income. Filing an Oklahoma return may involve submitting an Oklahoma Packing Slip that details your income for accurate processing. Always consider consulting a tax professional to understand your specific requirements.

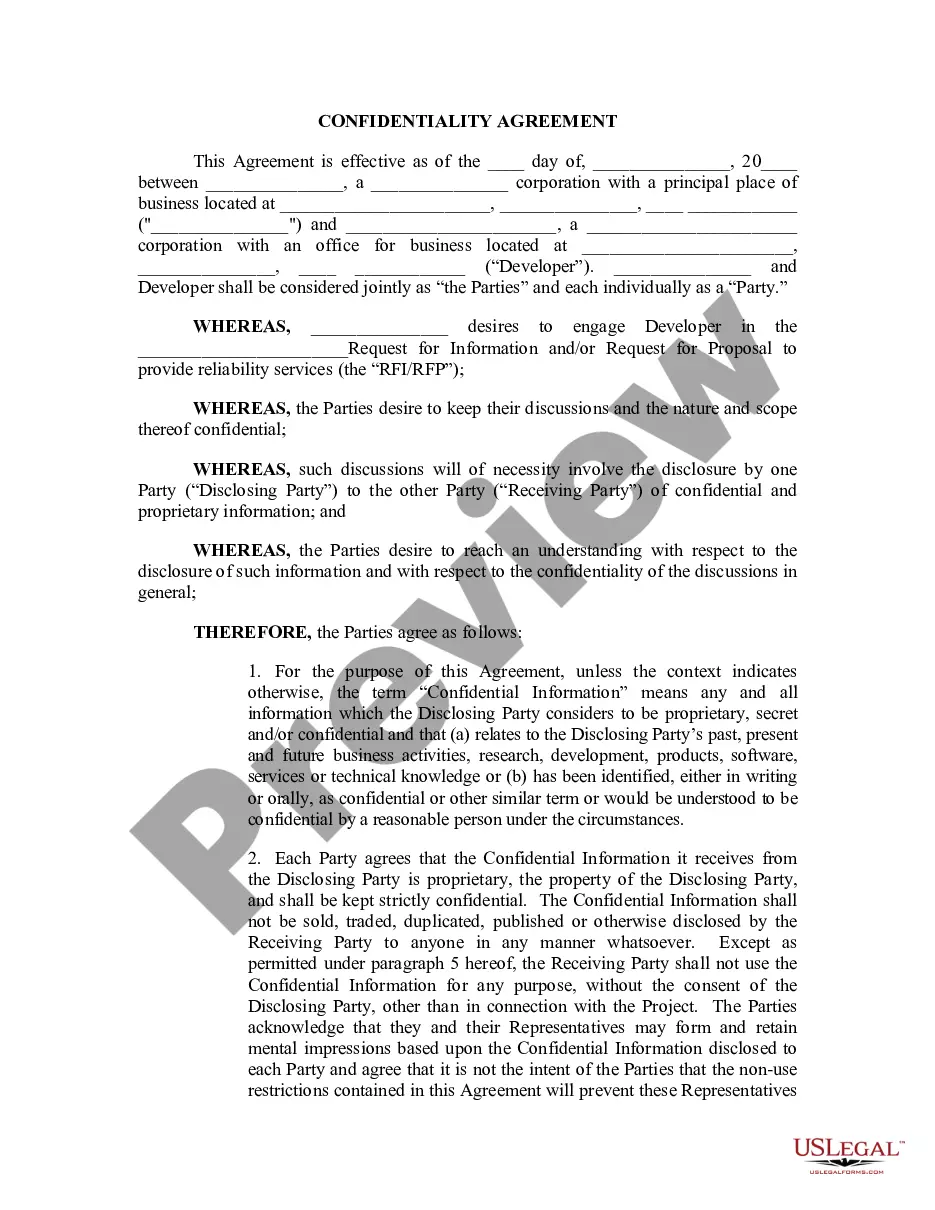

Reading a packing label on an Oklahoma Packing Slip involves identifying key information such as the sender's details, recipient's address, tracking number, and delivery method. This label should match the information on your packing slip to avoid any shipping errors. Familiarizing yourself with these details enhances the delivery experience.

An Oklahoma Packing Slip contains vital details such as the names and addresses of both the sender and recipient, order specifics, and item descriptions with quantities. This document acts as a guide for both shipping and receiving parties to verify that the order matches the expectations. It's an essential part of logistics.

Typically, an Oklahoma Packing Slip is placed inside the package. This placement allows you to easily find it upon opening the shipment. However, in some cases, it may be attached outside for quick access during delivery inspections.

Reading an Oklahoma Packing Slip is straightforward. Begin with the header for shipping information, then proceed to the list of items. Check the quantities and descriptions against your order to ensure everything matches before accepting the delivery.

To fill out an Oklahoma Packing Slip, start by entering the shipping and billing details accurately. Then, list each item included in the package along with their quantities and any relevant product codes. Make sure to double-check your entries to ensure accuracy, as this helps prevent confusion and miscommunication.