Oklahoma Aging of Accounts Receivable

Description

How to fill out Aging Of Accounts Receivable?

It is feasible to spend hours online trying to locate the official document template that fulfills the federal and state requirements you need.

US Legal Forms offers numerous legal forms that are evaluated by experts.

You can easily acquire or print the Oklahoma Aging of Accounts Receivable through the service.

If you wish to find another version of the form, use the Search field to locate the template that suits you and your requirements.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Next, you can complete, modify, print, or sign the Oklahoma Aging of Accounts Receivable.

- Each legal document template you obtain is yours indefinitely.

- To get another copy of a purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have chosen the correct document template for the region/town of your choice.

- Review the form description to make certain you have selected the appropriate form.

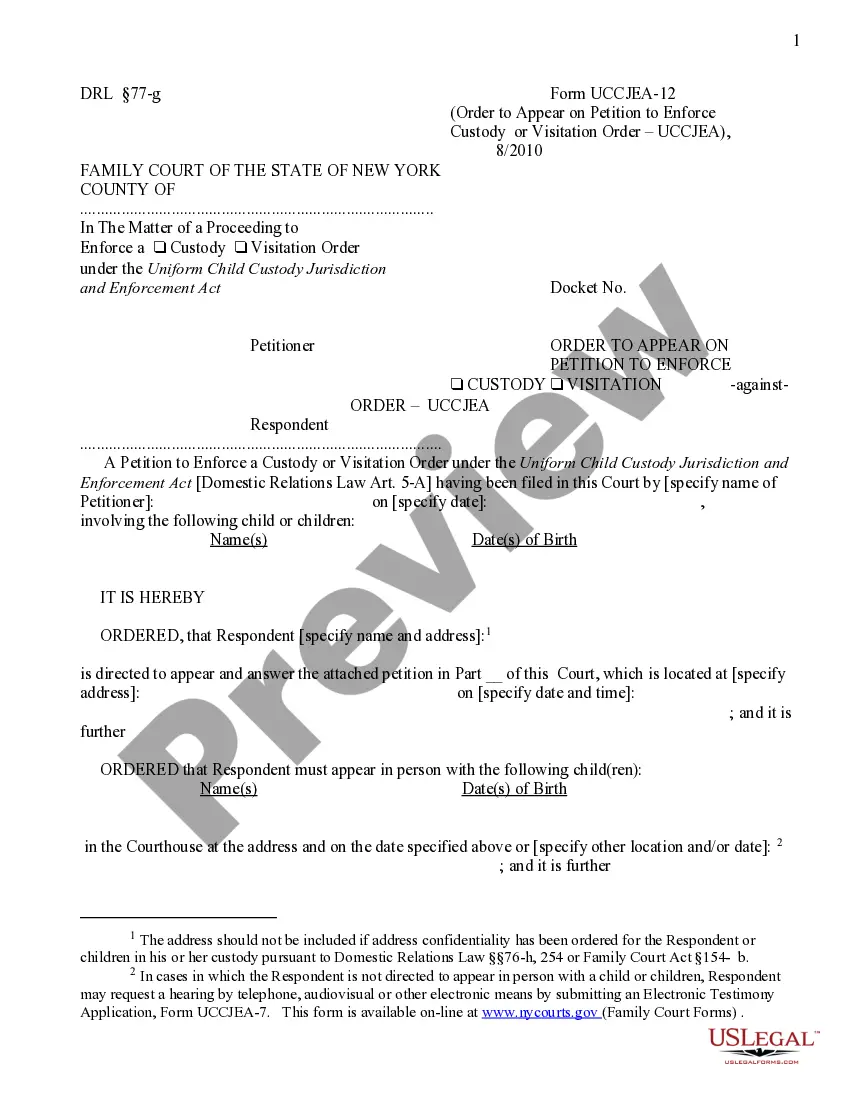

- If available, utilize the Preview button to view the document template as well.

Form popularity

FAQ

Yes, Oklahoma generally follows federal extension rules regarding tax filings. This means that if you file for a federal extension, it typically applies to your state return as well, streamlining the process of managing your aging accounts receivable. It’s important to check specific state deadlines to ensure compliance. For detailed guidance on extensions, uslegalforms can be an invaluable resource.

In Oklahoma, any partnership that generates income must file a partnership tax return. This requirement is essential to report earnings and manage the aging of accounts receivable effectively. Failing to file can lead to penalties, so it’s crucial to stay compliant. For support with filing and understanding your tax obligations, visit uslegalforms, where you’ll find comprehensive resources.

The oil depletion allowance in Oklahoma allows companies to deduct a portion of the costs associated with extracting oil. This can affect overall profitability, especially for businesses managing aging accounts receivable. Understanding this allowance can be crucial for budgeting and tax planning. To learn more about maximizing deductions, consider resources available through uslegalforms.

Oklahoma WTP 10003 is a form that pertains to withholding tax processes within the state. This form provides essential information for managing tax on income, which is particularly important for those with aging accounts receivable. By accurately completing this form, you can avoid delays and ensure proper tax compliance. For detailed instructions and templates, check out uslegalforms.

Yes, Oklahoma does allow for a composite tax return for certain entities, which simplifies the filing process for partnerships. This option is particularly beneficial for taxpayers dealing with the aging of accounts receivable as it consolidates multiple individual returns. By utilizing a composite return, you can reduce your administrative burden. uslegalforms can offer you the necessary forms and guidance to ensure compliance.

The Oklahoma Rule 710 50 19 1 outlines specific guidelines that govern tax matters related to the aging of accounts receivable in Oklahoma. This rule is essential for taxpayers who want to manage their receivables effectively. Understanding these rules can help prevent unnecessary penalties and enhance compliance. You can explore resources available at uslegalforms to assist you in navigating these regulations.

When you identify accounts receivable as uncollectible, record the write-off by debiting the bad debt expense account and crediting the accounts receivable account. This adjustment reflects the loss and keeps your financial records accurate. An understanding of this process is crucial for those handling the Oklahoma Aging of Accounts Receivable.

To record aging accounts receivable, maintain detailed records of outstanding invoices. Categorize them based on how long they have been overdue, such as 30, 60, or 90 days. This practice not only helps manage collections but also provides insights into the Oklahoma Aging of Accounts Receivable.

Writing off old accounts receivable involves recognizing that certain debts will not be collected. You adjust your accounting records to reflect this decision, which can clarify your company's true financial standing. This is particularly important in managing the Oklahoma Aging of Accounts Receivable.

Preparing an accounts receivable aging schedule requires listing all accounts receivable, identifying the invoice dates, and categorizing them by age. Use software or spreadsheets to make the process efficient. A well-structured aging schedule helps you manage the Oklahoma Aging of Accounts Receivable effectively.