Oklahoma Sample Letter for Debt Collection for Client

Description

How to fill out Sample Letter For Debt Collection For Client?

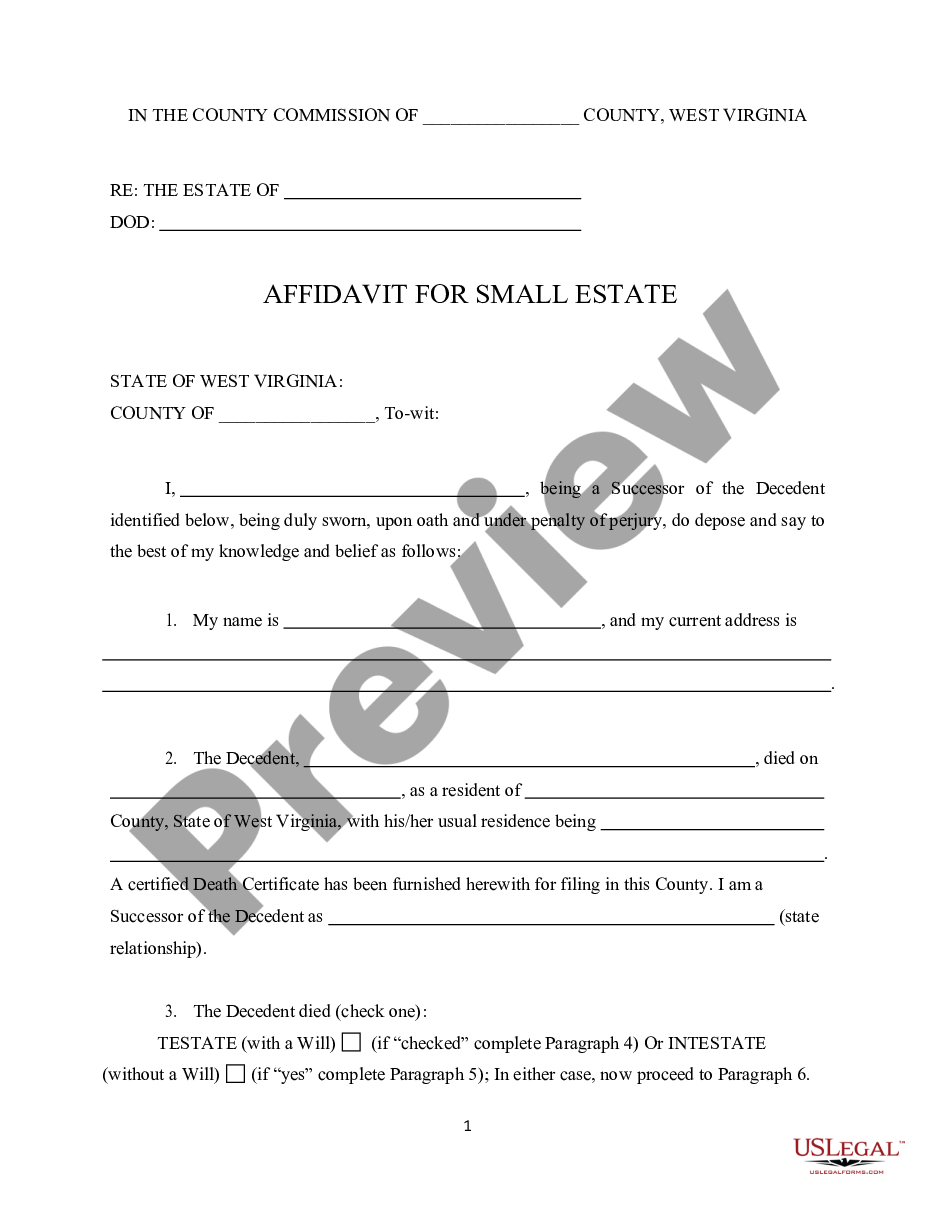

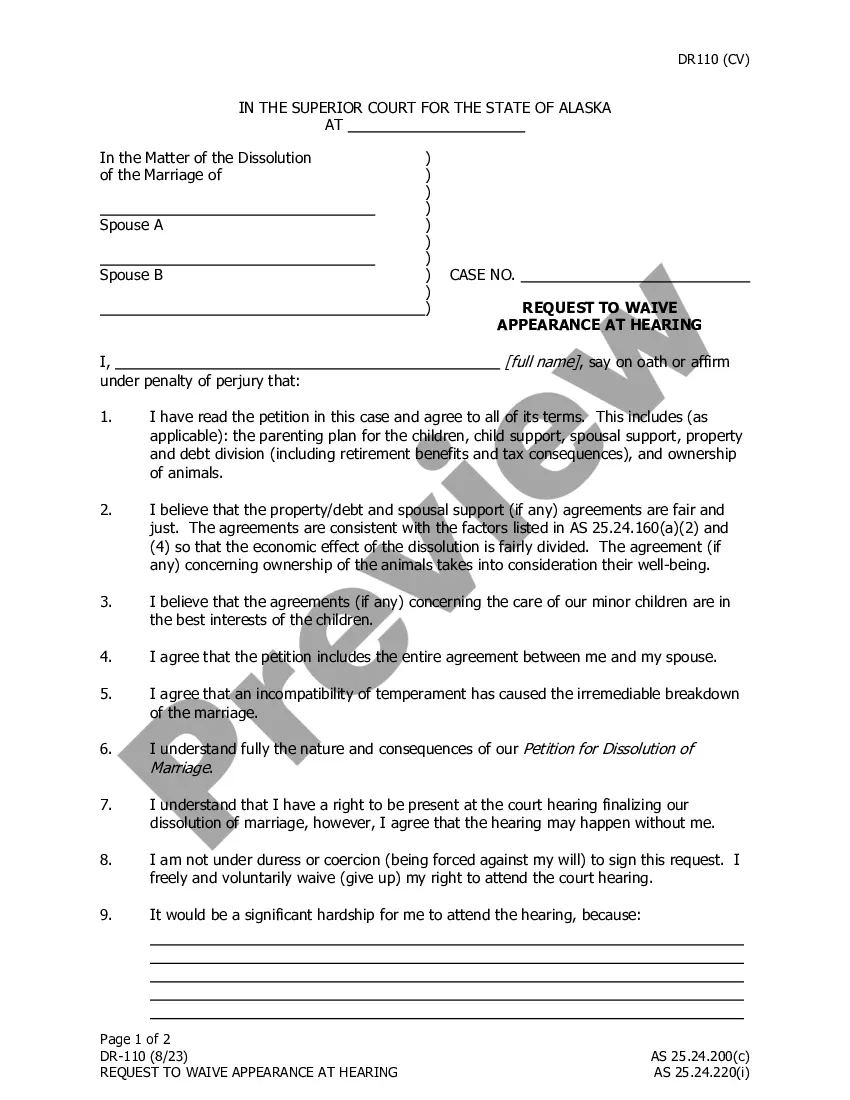

Are you in a situation where you frequently require documents for either business or personal purposes? There are numerous legitimate document templates available online, but finding reliable versions isn't easy. US Legal Forms offers a vast array of form templates, including the Oklahoma Sample Letter for Debt Collection for Client, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Oklahoma Sample Letter for Debt Collection for Client template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct city/state. Use the Review button to review the form. Read the description to confirm that you have selected the correct form. If the form isn’t what you’re looking for, utilize the Search field to find the form that fits your needs and requirements. Once you find the right form, click Purchase now. Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card. Choose a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Oklahoma Sample Letter for Debt Collection for Client at any time, if needed. Just click on the desired form to download or print the document template.

- Utilize US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life easier.

Form popularity

FAQ

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

This first collection letter should contain the following information: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vague.

This is a reminder of the past-due balance on your account for _______________ in the amount of ______________________. At the present time, your balance is ____(days)___ overdue. We will appreciate payment in full immediately. We have not received your payment on this past-due account.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice]. This payment is now [number of days since the due date] past due.

Summary: A "creditor" is not required to inform their clients before passing an account to collections. A debt collection agency is responsible for sending an initial demand letter, also known as a ?validation notice,? to notify your debtor about their account being assigned to the agency.