Oklahoma Triple Net Lease

Description

How to fill out Triple Net Lease?

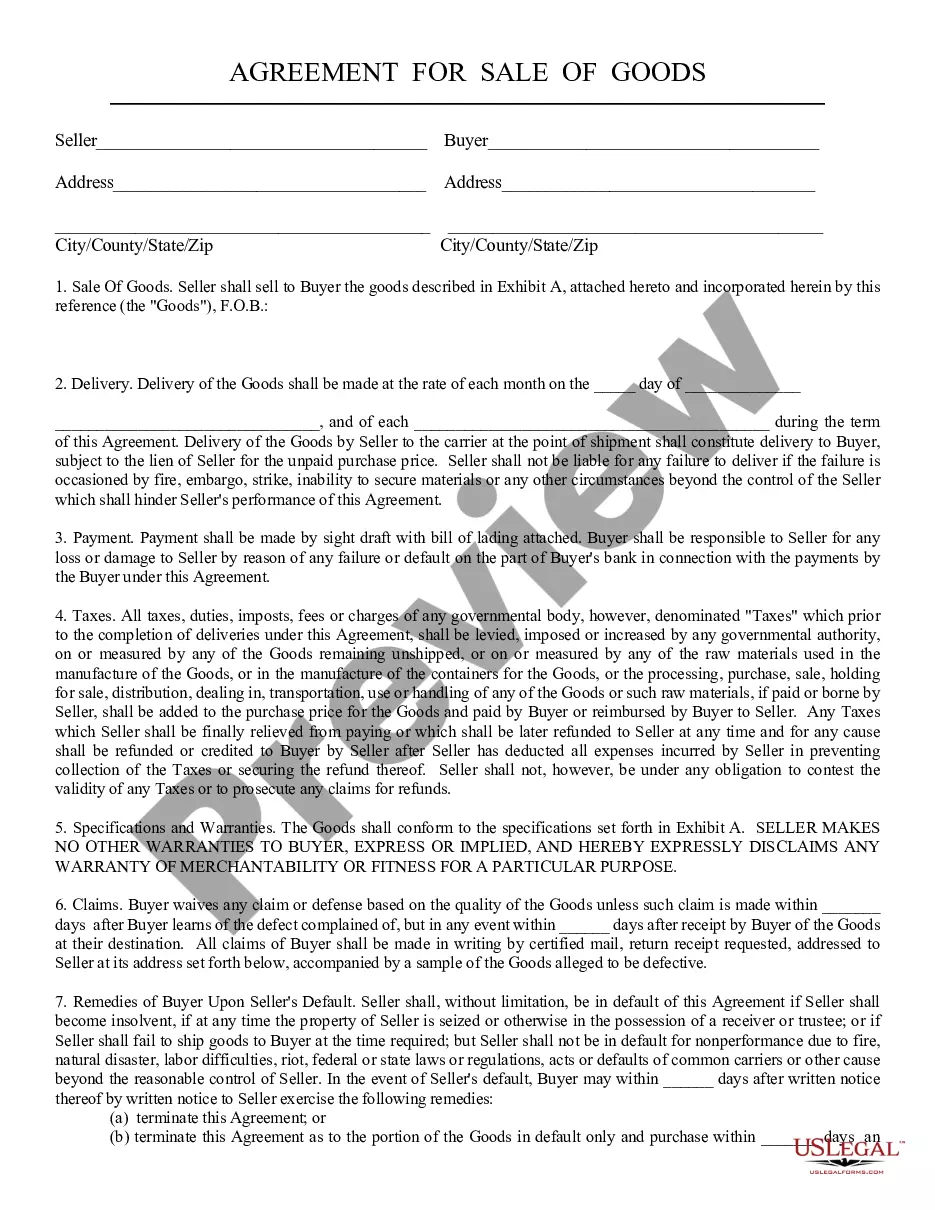

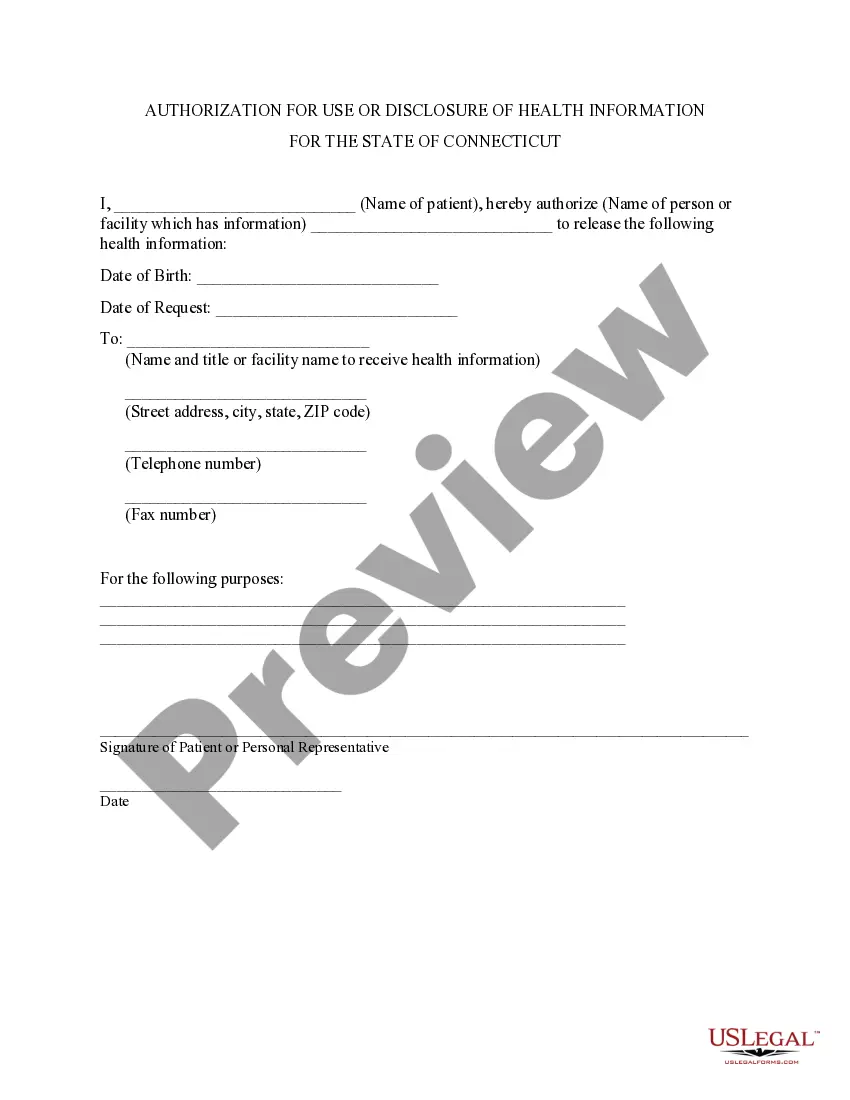

You can spend countless hours online attempting to locate the legal document template that fulfills the federal and state criteria you require.

US Legal Forms offers a plethora of legal forms that can be examined by specialists.

It is easy to obtain or print the Oklahoma Triple Net Lease from the services.

If available, utilize the Preview feature to browse the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Subsequently, you can complete, edit, print, or sign the Oklahoma Triple Net Lease.

- Every legal document template you purchase is yours to keep indefinitely.

- To obtain another copy of a purchased form, visit the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town you choose.

- Review the form details to confirm you have picked the correct template.

Form popularity

FAQ

While the Oklahoma Triple Net Lease provides several advantages, it also has disadvantages, such as the tenant's liability for all associated costs. If unexpected maintenance issues arise, tenants bear the financial burden, which could affect their bottom line. Additionally, landlords may encounter challenges if tenants fail to maintain the property properly. Being aware of these disadvantages can help both parties negotiate better lease terms.

The beauty of the Oklahoma Triple Net Lease lies in its structure, where tenants take on most operating expenses. This arrangement often leads to fewer headaches for landlords, allowing them to focus on other investments. Moreover, properties leased this way can attract serious investors looking for stable income streams. Understanding these unique features helps property owners and tenants make informed decisions.

Investing in an Oklahoma Triple Net Lease comes with risks, including fluctuating market conditions and unanticipated increases in property expenses. If a tenant struggles financially, the property owner could face payment delays or even loss of income. Additionally, reliance on a single tenant for income can create vulnerabilities. It's wise to assess the financial strength of potential tenants rigorously.

Calculating an Oklahoma Triple Net Lease involves adding the base rent with property taxes, insurance, and maintenance costs. Start with the annual expenses for the property, then divide them by the total square footage to find a per-square-foot rate. This rate is then multiplied by the leased space's size, providing the total monthly rent. Utilizing tools from platforms like uslegalforms can streamline this process for you.

The Oklahoma Triple Net Lease offers advantages such as lower property management responsibilities for landlords and predictable rental income. However, it's important to consider drawbacks, like potential increases in operating expenses that could arise. Landlords need to closely monitor property costs to avoid unexpected financial burdens. As a tenant, you may face higher expenses related to maintenance and taxes.

The difference between NNN and absolute NNN lies in the level of responsibility transferred to the tenant. A traditional NNN lease may still obligate landlords to cover certain major expenses, while an absolute NNN lease places all responsibilities, including structural repairs, on the tenant. For those exploring an Oklahoma Triple Net Lease, recognizing this distinction will help ensure you select a lease that aligns with your financial strategy. Understanding your responsibilities and those of your tenant is crucial.

An absolute NNN lease is a comprehensive lease agreement in which the tenant is responsible for all property-related expenses, eliminating the landlord's liability. This type of leasing arrangement maximizes the landlord’s investment. For anyone considering an Oklahoma Triple Net Lease, understanding the implications of absolute NNN leases can guide your decisions effectively. It's vital to review all terms before signing.

In Oklahoma, leases generally do not require notarization to be legally enforceable. However, having a lease notarized can add an extra level of assurance for both parties involved. It's wise to consult a legal professional when drafting an Oklahoma Triple Net Lease. This will help ensure all necessary terms are clear and enforceable.

'NNN' stands for triple net lease, which is a type of lease agreement where the tenant is responsible for all operating expenses. This includes property taxes, insurance, and maintenance costs. An Oklahoma Triple Net Lease is beneficial for landlords because it minimizes their financial obligations. Understanding NNN terms is essential when entering into any lease agreement.

The best triple net lease tenants typically include well-established national brands, such as fast-food chains or pharmacies. They often have strong financial backing, which means low risk for landlords. An Oklahoma Triple Net Lease with a reputable tenant can ensure steady income over a long period. Always conduct thorough background checks to identify reliable tenants.