Oklahoma Stock Retirement Agreement

Description

How to fill out Stock Retirement Agreement?

If you wish to obtain, download, or print authentic document templates, utilize US Legal Forms, the largest variety of valid forms available online.

Use the site’s simple and user-friendly search function to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you locate the form you need, click the Purchase now button. Choose your preferred payment plan and enter your details to create an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Oklahoma Stock Retirement Agreement with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to obtain the Oklahoma Stock Retirement Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

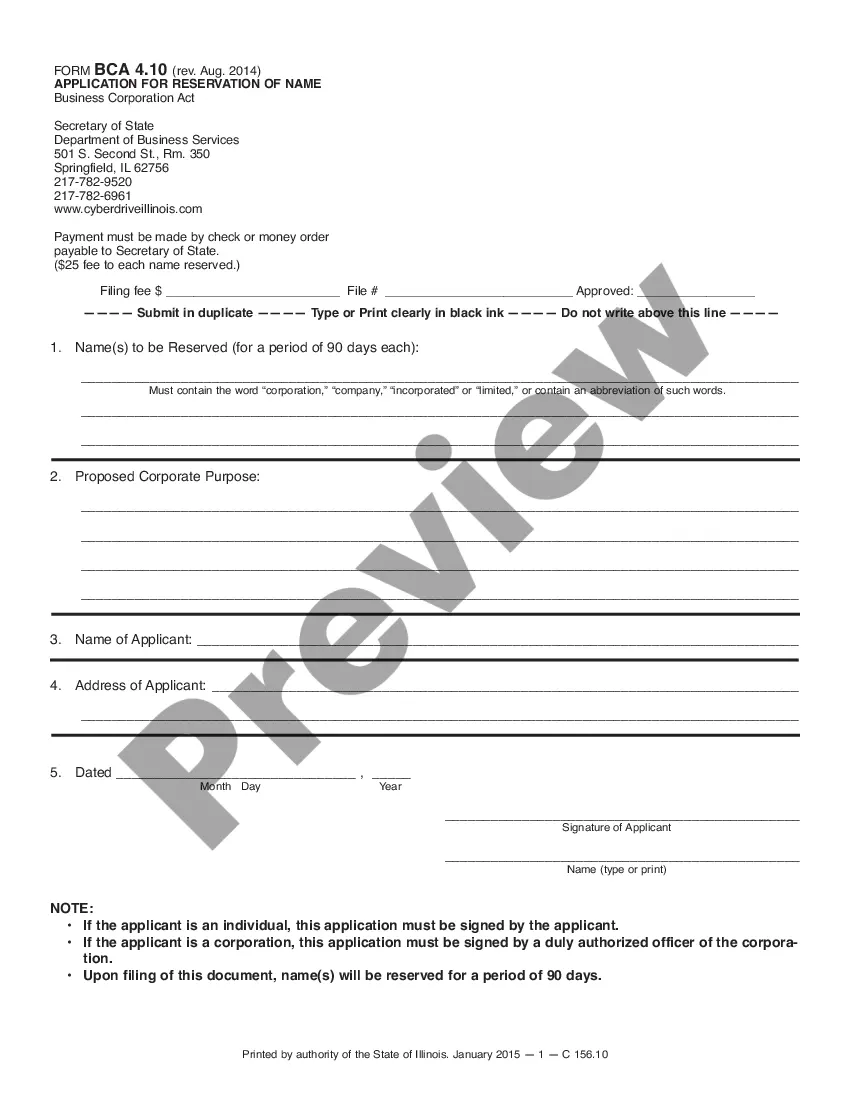

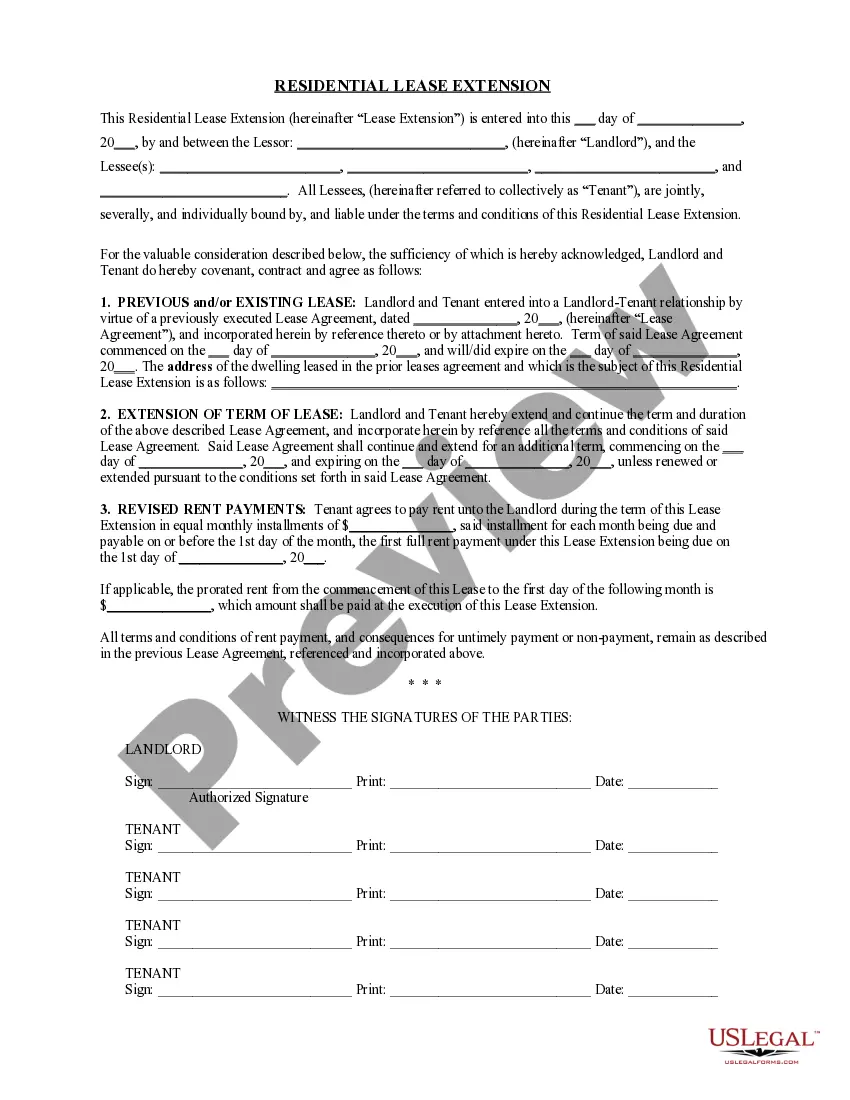

- Step 2. Use the Preview feature to view the form’s contents. Be sure to read the instructions.

- Step 3. If you find the form unsatisfactory, utilize the Search field at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

The $1000 a month rule for retirement suggests that individuals should aim to have enough savings to generate at least $1000 in monthly income during retirement. This approach helps retirees budget and manage their expenses effectively. Utilizing resources like the Oklahoma Stock Retirement Agreement can help you strategize how to meet your financial goals and ensure a comfortable retirement.

The new 4% rule for retirement suggests that retirees can withdraw 4% of their retirement savings annually without running out of funds. This rule aims to provide a stable income over a 30-year retirement span. To effectively plan your withdrawals and make informed decisions, a thorough understanding of documents such as the Oklahoma Stock Retirement Agreement becomes essential.

Yes, Oklahoma state employees do receive a pension through programs like OPERS. This system provides monthly benefits based on salary and years of service. To maximize your retirement planning, consider utilizing tools like the Oklahoma Stock Retirement Agreement to help manage your retirement assets effectively.

The 90 rule allows Oklahoma teachers to retire without a penalty if their age and years of service total 90 or more. For instance, if you are 55 years old and have 35 years of service, you can retire at that age. This rule provides valuable flexibility and peace of mind for educators thinking about retirement. Your Oklahoma Stock Retirement Agreement will outline how this rule applies to you.

The earliest age to retire for members of the Oklahoma Public Employees Retirement System (Opers) generally starts at 62 years old. However, if you have completed at least 30 years of service, you can retire earlier without penalty. Knowing these age requirements helps you plan your career and retirement timeline more effectively. Review your Oklahoma Stock Retirement Agreement to learn about your specific options.

To be vested in the Oklahoma teacher retirement system, you need to serve at least five years. This period allows you to earn a retirement benefit that you can claim later in life. Planning your career within those five years can help you make informed decisions about your future. Your Oklahoma Stock Retirement Agreement is essential in this planning.

In Oklahoma, teachers must work a minimum of five years to become vested in the state retirement system. Being vested means you have a right to receive retirement benefits at a later date, even if you leave your teaching position. This security is vital for teachers planning their financial future. A clear understanding of your Oklahoma Stock Retirement Agreement can help you maximize this benefit.

If you decide to leave your teaching position in Oklahoma, your retirement benefits will depend on your vesting status. If you are vested, you can access your benefits at retirement age, or you may choose to receive a refund of your contributions. If you are not yet vested, you will forfeit the pension plan benefits but will still keep your contributions. It's important to review your Oklahoma Stock Retirement Agreement to understand your options.

The Oklahoma retirement exclusion allows certain retirees to exclude a portion of their retirement income from state taxes. To qualify, you must receive income from a retirement plan, which may include benefits from the Oklahoma Stock Retirement Agreement. Specific limits and eligibility criteria apply, so it's crucial to review your situation. Utilizing resources from U.S. Legal Forms can simplify understanding this exclusion and help you maximize your retirement benefits.

The 90 rule in Oklahoma allows teachers to retire when their age and years of service total at least 90. This rule applies to those participating in the Oklahoma Stock Retirement Agreement, ensuring that educators can enjoy their hard-earned retirement sooner. It's important to calculate your total, as meeting this requirement can significantly impact your retirement timeline. Consider reaching out to an advisory service for personalized guidance.