This form is a general release. The releasor agrees to release and forever discharge the releasee, and any of the releasee's agents or servants who claim to be liable for injuries and damages relating to a certain occurrence.

Oklahoma Release - General

Description

How to fill out Release - General?

You have the capability to spend time online searching for the valid document template that meets the state and federal stipulations you will require.

US Legal Forms offers a vast array of valid forms that are vetted by experts.

You can download or print the Oklahoma Release - General from this service.

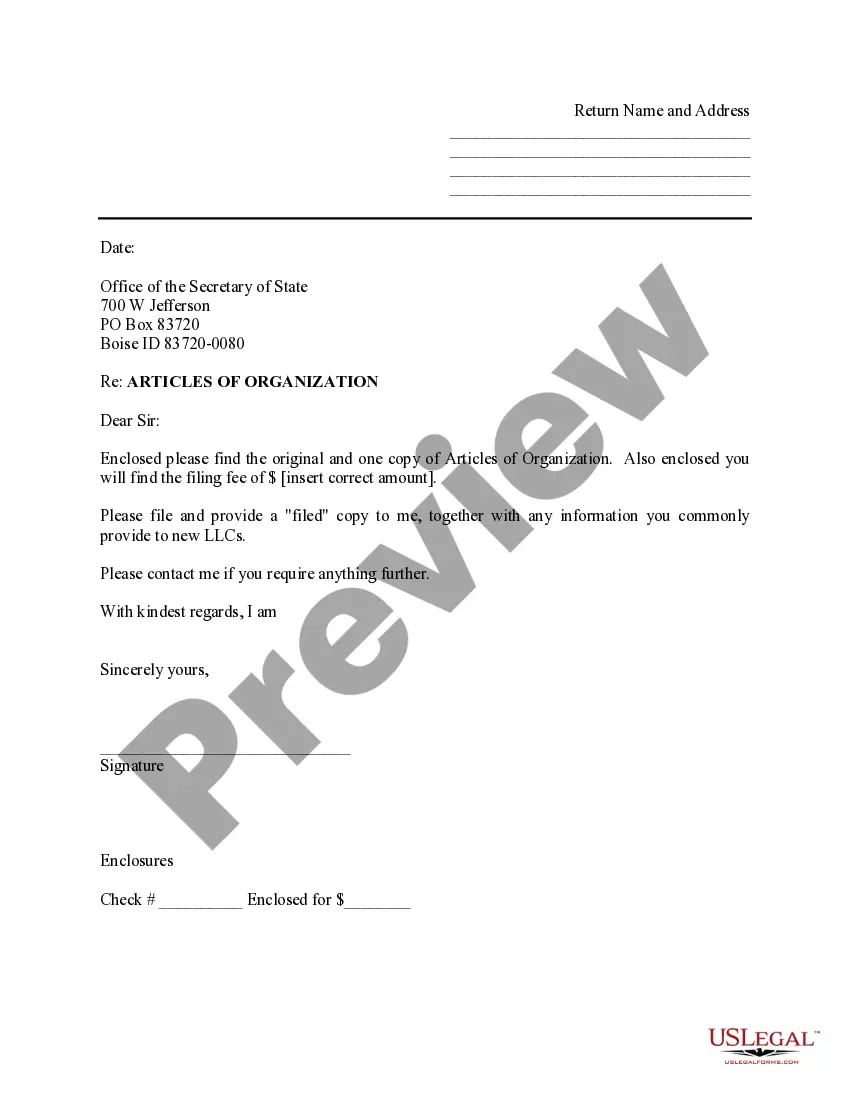

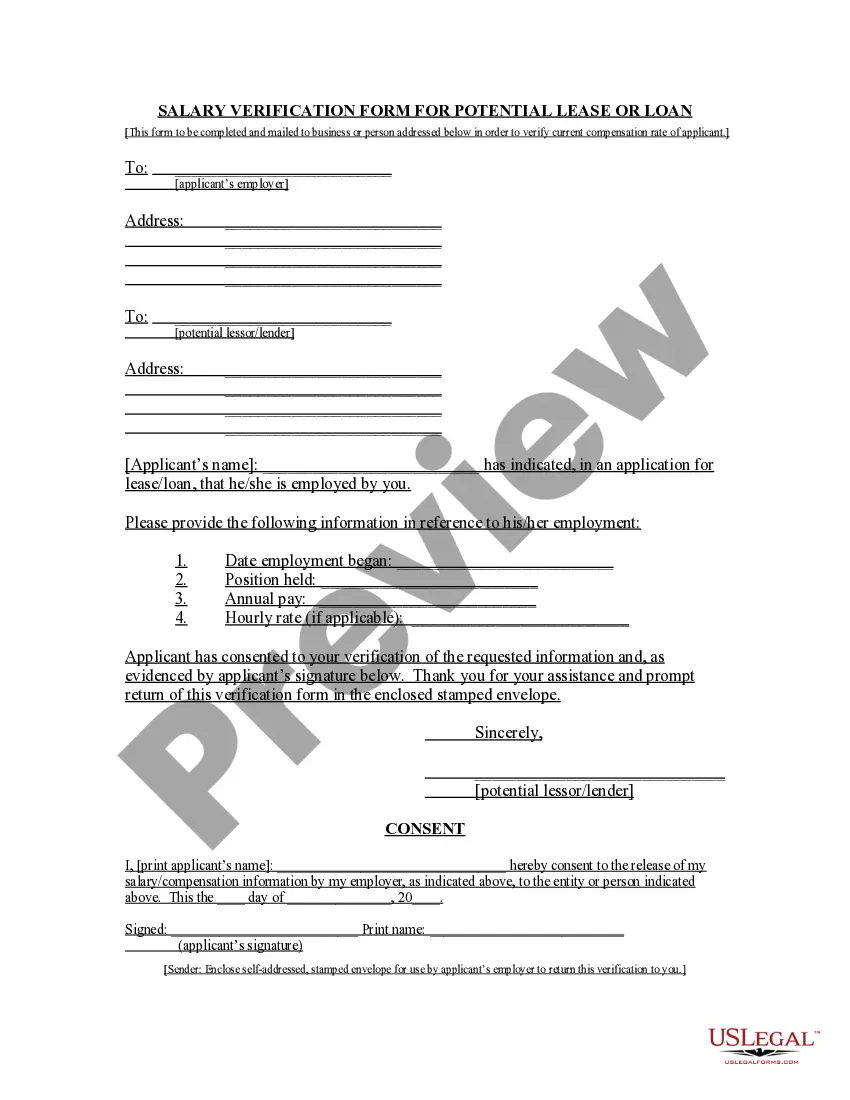

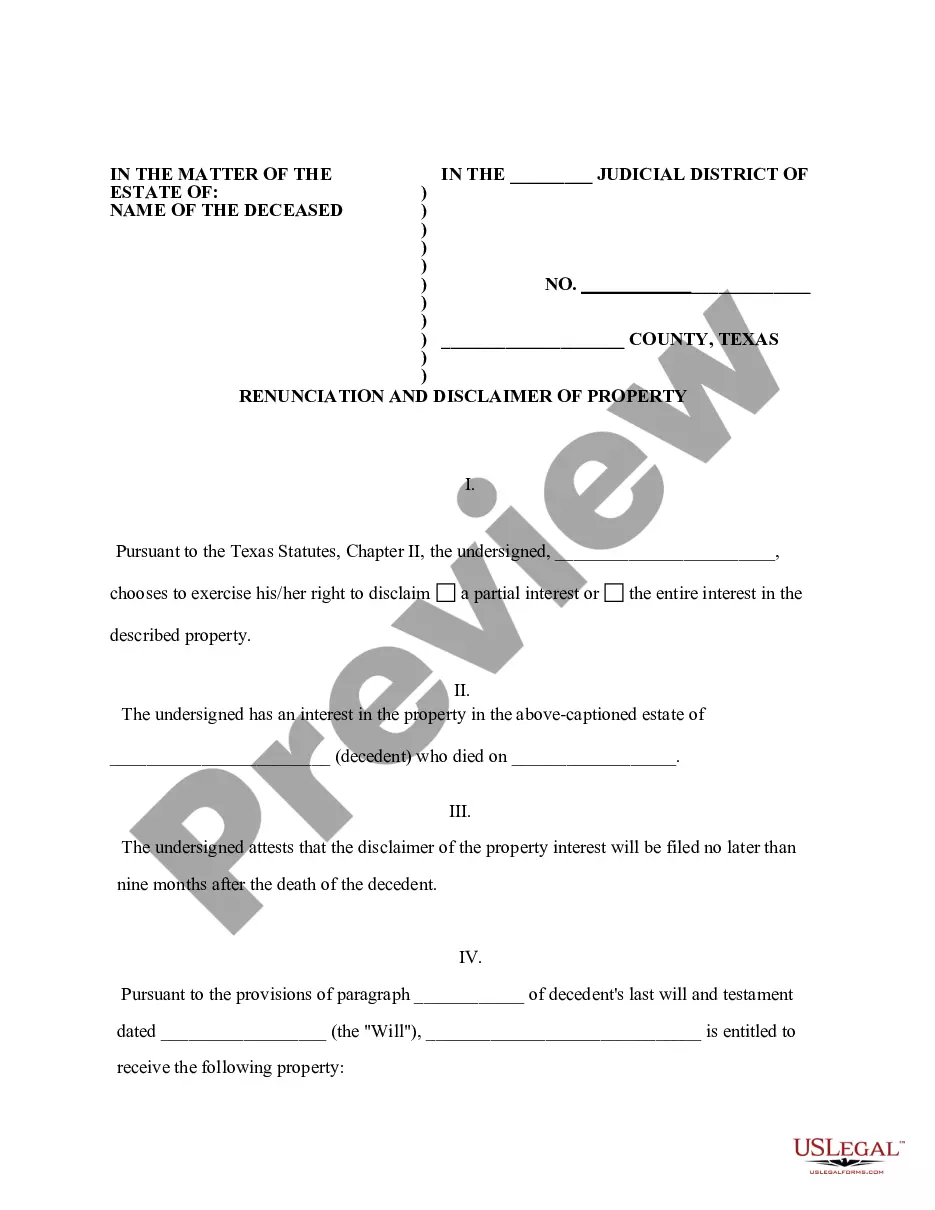

If available, utilize the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, edit, print, or sign the Oklahoma Release - General.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click on the respective option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for your region/area of interest.

- Review the form description to make sure you have chosen the right form.

Form popularity

FAQ

Notify the MVD that you've gifted the vehicle. You will need to fill out a Notice of Transfer of Ownership and pay a $10 filing fee. The recipient will need to bring the signed title and vehicle registration, as well as proof of insurance, to their local MVD and pay a $17 title transfer fee.

To release a lien, the lien holder must sign and date two (2) release of lien forms. Mail one (1), signed and dated, copy of a lien release to the Oklahoma Tax Commission, P.O. Box 269061 Oklahoma City, Ok 73126, and one (1), signed and dated, copy of the lien release to the debtor.

(b) If the lender is out of business and no longer available, their lien may be released by the following procedure: (1) A certified letter, restricted delivery, requesting a lien release and listing the year, make, and vehicle identification number is to be sent to the lender's address listed on the Motor Vehicle

In the event a new vehicle is not registered within thirty (30) days from date of purchase, the penalty for the failure of the owner of the vehicle to register said vehicle within thirty (30) days shall be Twenty-five Dollars ($25.00), provided that in no event shall the penalty exceed an amount equal to the license

Though your lien holder will receive a separate document verifying their connection to the loan, you will be in possession of the title itself. There are only nine title-holding states: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin.

Our mailing address is: Oklahoma Tax Commission, Motor Vehicle Division Liens, P.O. Box 269061, Oklahoma City, Oklahoma 73126.

You not need both parties to be physically present at the time of notarization, but you can only notarize for the person who is appearing before you. The other person can have their signature notarized at another time.

What Do You Need To Transfer A Car Title In Oklahoma?The Oklahoma Certificate of Title, properly assigned and notarized.Current registration information (unless you're transferring a junk title).Proof of liability insurance.A completed odometer disclosure statement for vehicles 9 years old or newer.More items...

If you've paid off your car loan, you'll want to take the necessary steps to remove the lienholder's name from the title. In Oklahoma, you can do this by waiting to receive the lien release notice and original title from the lienholder after making your final payment.