The Ohio State of Delaware Limited Partnership Tax Notice is a significant document that provides important information regarding the tax obligations and requirements for limited partnership entities registered in Ohio and formed under Delaware laws. This notice serves as a vital communication tool between the state and the limited partnership, ensuring compliance and transparency in taxation matters. Keywords: Ohio State, Delaware, limited partnership, tax notice, tax obligations, requirements, compliance, transparency, taxation matters. There are different types of Ohio State of Delaware Limited Partnership Tax Notices relevant to various aspects of taxation. Some of these notices include: 1. Annual Tax Notice: This notice is issued annually to inform Delaware limited partnerships registered in Ohio about their tax obligations, including the filing deadline for tax returns, any updates to tax laws, and information on payment procedures. 2. Estimated Tax Notice: Limited partnerships may receive this notice when the state determines that estimated tax payments are required. It outlines the calculation methodologies and due dates for these payments, ensuring timely and accurate tax contributions. 3. Late Payment Notice: If a Delaware limited partnership fails to submit tax payments within the specified deadlines, they may receive a late payment notice. This notice serves as a reminder and provides information on penalties or interests that may be imposed for delayed payments. 4. Tax Audit Notice: In cases where the state identifies potential discrepancies or irregularities in a limited partnership's tax returns, a tax audit notice is issued. This notice notifies the partnership that they have been selected for an audit and provides instructions on the necessary steps to be taken for compliance and resolution. 5. Penalty Notice: If a Delaware limited partnership fails to comply with tax regulations, they may be subject to penalties. The penalty notice details the specific violation, the corresponding penalty amount, and any required actions to rectify the non-compliance. 6. Partnership Dissolution or Termination Notice: This notice is issued when a Delaware limited partnership decides to dissolve or terminate its operations. It informs the state about the intended cessation of activities, the effective date, and any outstanding tax obligations that need to be settled before dissolution. It is essential for Delaware limited partnerships operating in Ohio to be aware of these Ohio State of Delaware Limited Partnership Tax Notices, as they play a crucial role in maintaining their tax compliance and ensuring proper communication with the state authorities.

Ohio State of Delaware Limited Partnership Tax Notice

Description

How to fill out Ohio State Of Delaware Limited Partnership Tax Notice?

Are you in a situation where you require papers for both company or specific functions nearly every time? There are a variety of legitimate papers layouts available online, but locating versions you can rely on isn`t simple. US Legal Forms offers a large number of form layouts, much like the Ohio State of Delaware Limited Partnership Tax Notice, which are created in order to meet federal and state needs.

In case you are currently knowledgeable about US Legal Forms internet site and also have your account, merely log in. After that, you are able to down load the Ohio State of Delaware Limited Partnership Tax Notice web template.

Unless you offer an account and wish to start using US Legal Forms, adopt these measures:

- Get the form you need and ensure it is to the appropriate metropolis/area.

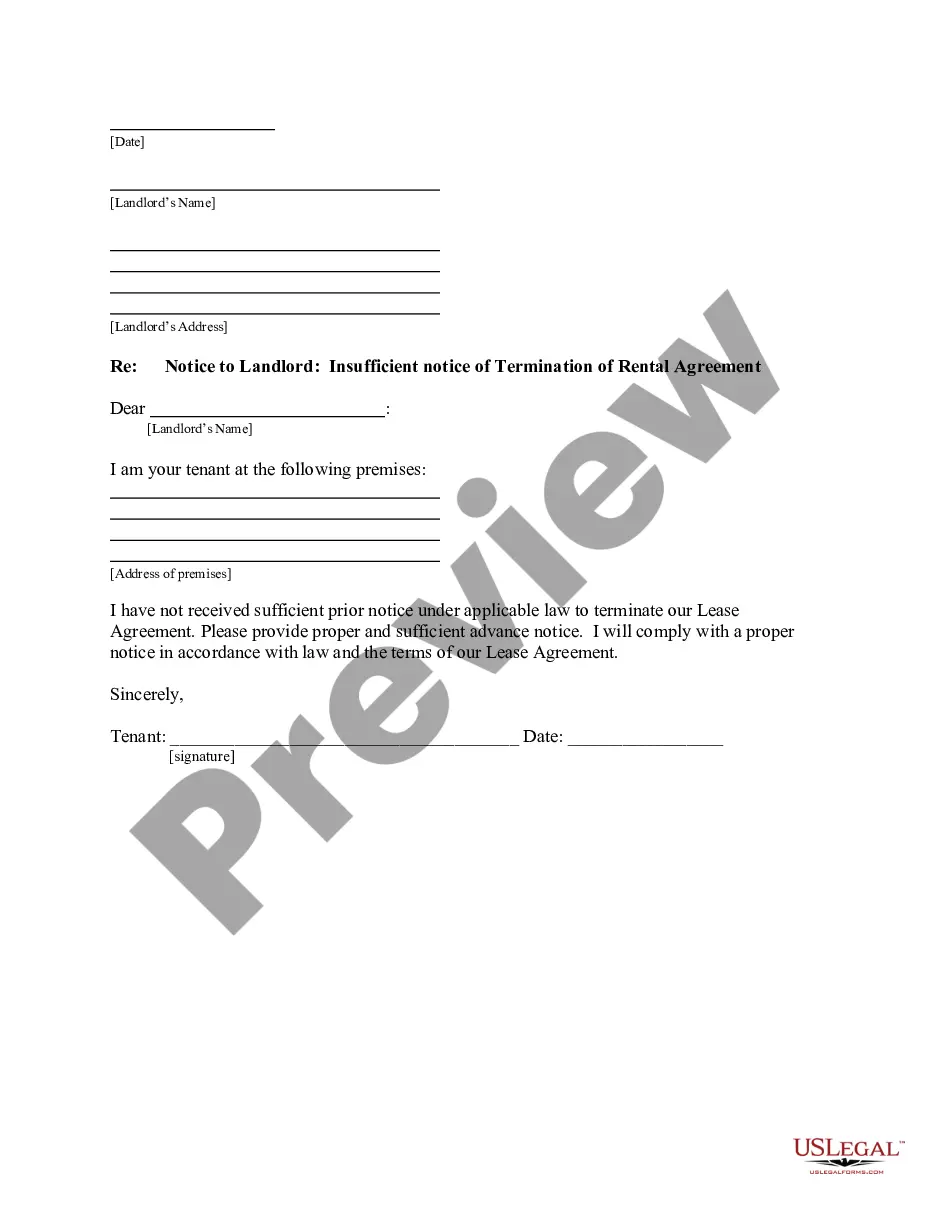

- Use the Review key to check the form.

- See the explanation to actually have selected the proper form.

- If the form isn`t what you are seeking, use the Look for field to get the form that suits you and needs.

- Whenever you find the appropriate form, just click Purchase now.

- Choose the pricing plan you desire, fill in the specified information to produce your bank account, and pay for the order using your PayPal or bank card.

- Decide on a convenient document format and down load your backup.

Get every one of the papers layouts you may have purchased in the My Forms food selection. You can aquire a further backup of Ohio State of Delaware Limited Partnership Tax Notice any time, if required. Just go through the needed form to down load or printing the papers web template.

Use US Legal Forms, probably the most considerable variety of legitimate forms, to save efforts and prevent faults. The services offers skillfully made legitimate papers layouts which you can use for a selection of functions. Generate your account on US Legal Forms and begin producing your lifestyle a little easier.