Ohio Self-Employed Lifeguard Services Contract

Description

How to fill out Self-Employed Lifeguard Services Contract?

Are you in a situation where you need paperwork for both business or personal reasons almost every day.

There are numerous legitimate document templates available online, but finding those you can trust is challenging.

US Legal Forms offers a vast selection of form templates, such as the Ohio Self-Employed Lifeguard Services Contract, that are crafted to comply with federal and state regulations.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or a credit card.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and hold an account, simply Log In.

- Then, you can download the Ohio Self-Employed Lifeguard Services Contract template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you require and ensure it is for your specific area or county.

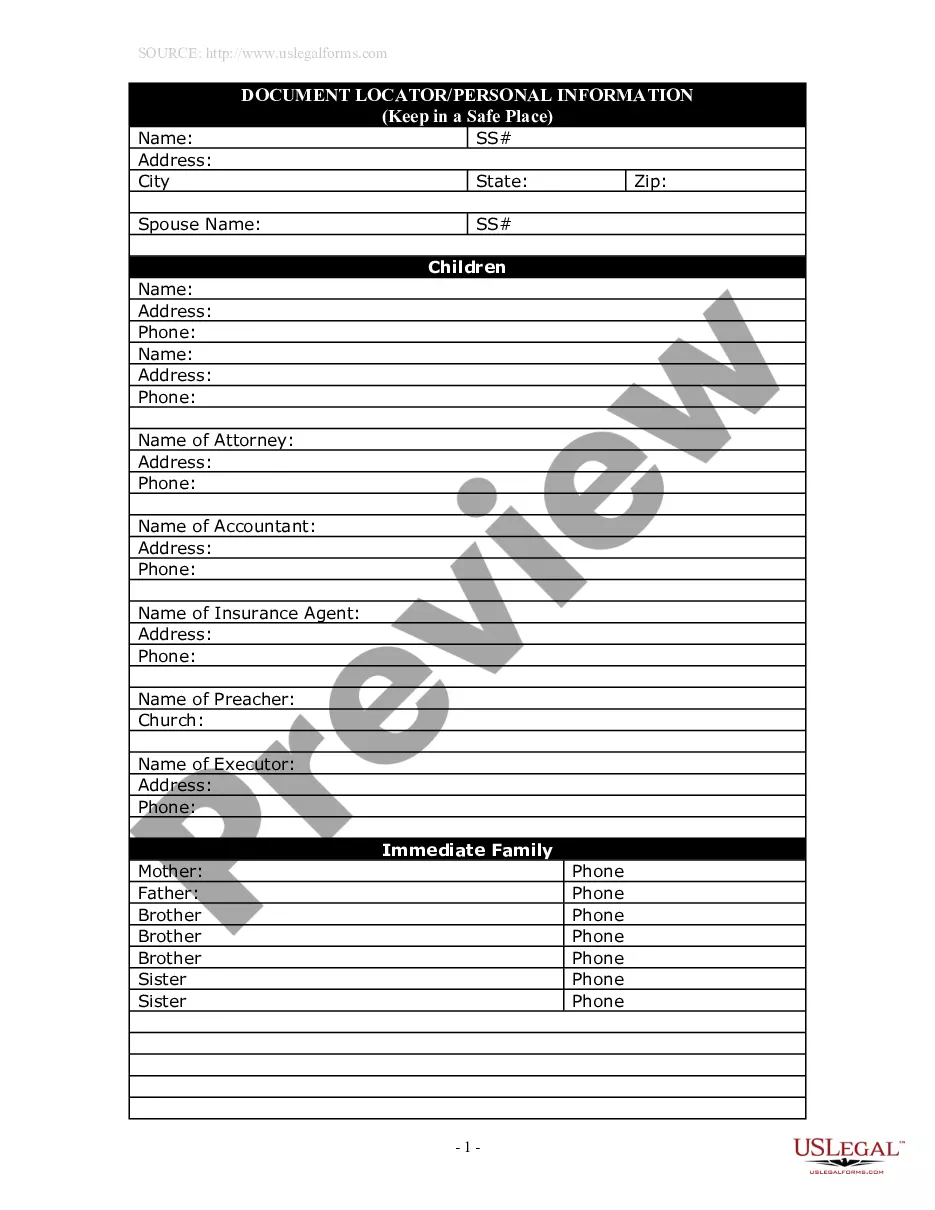

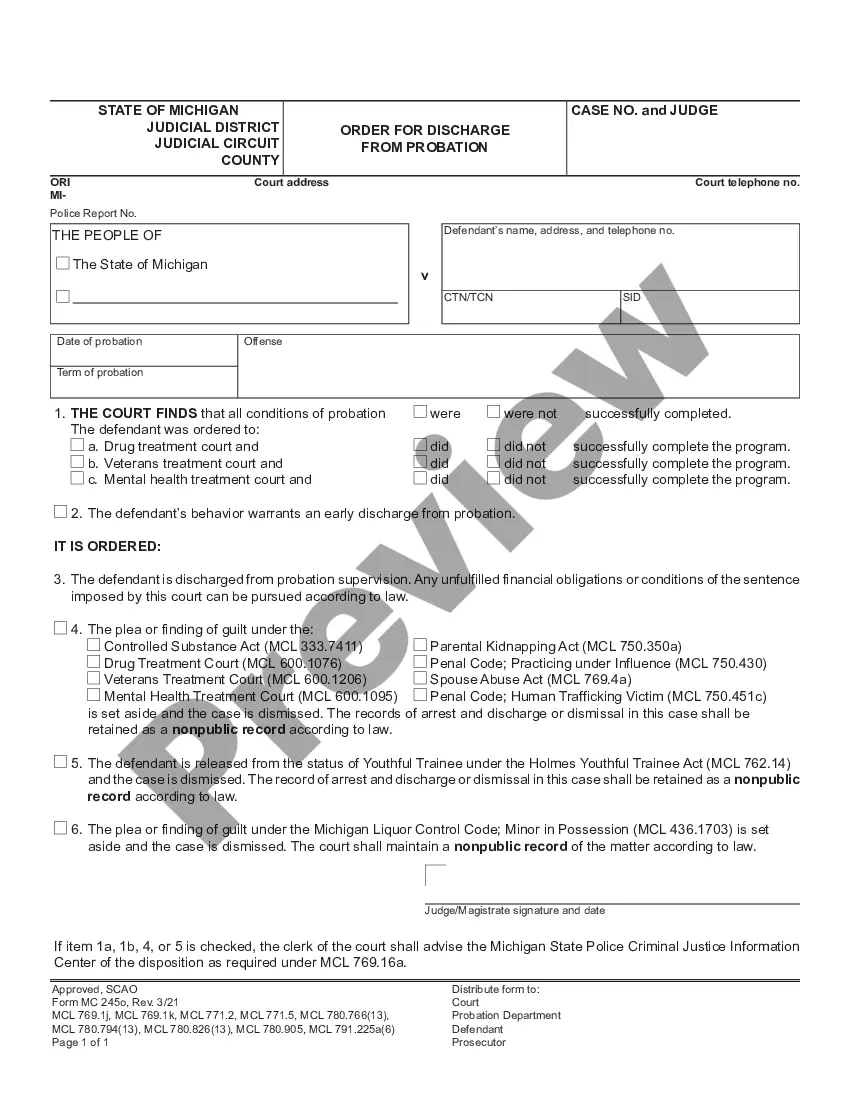

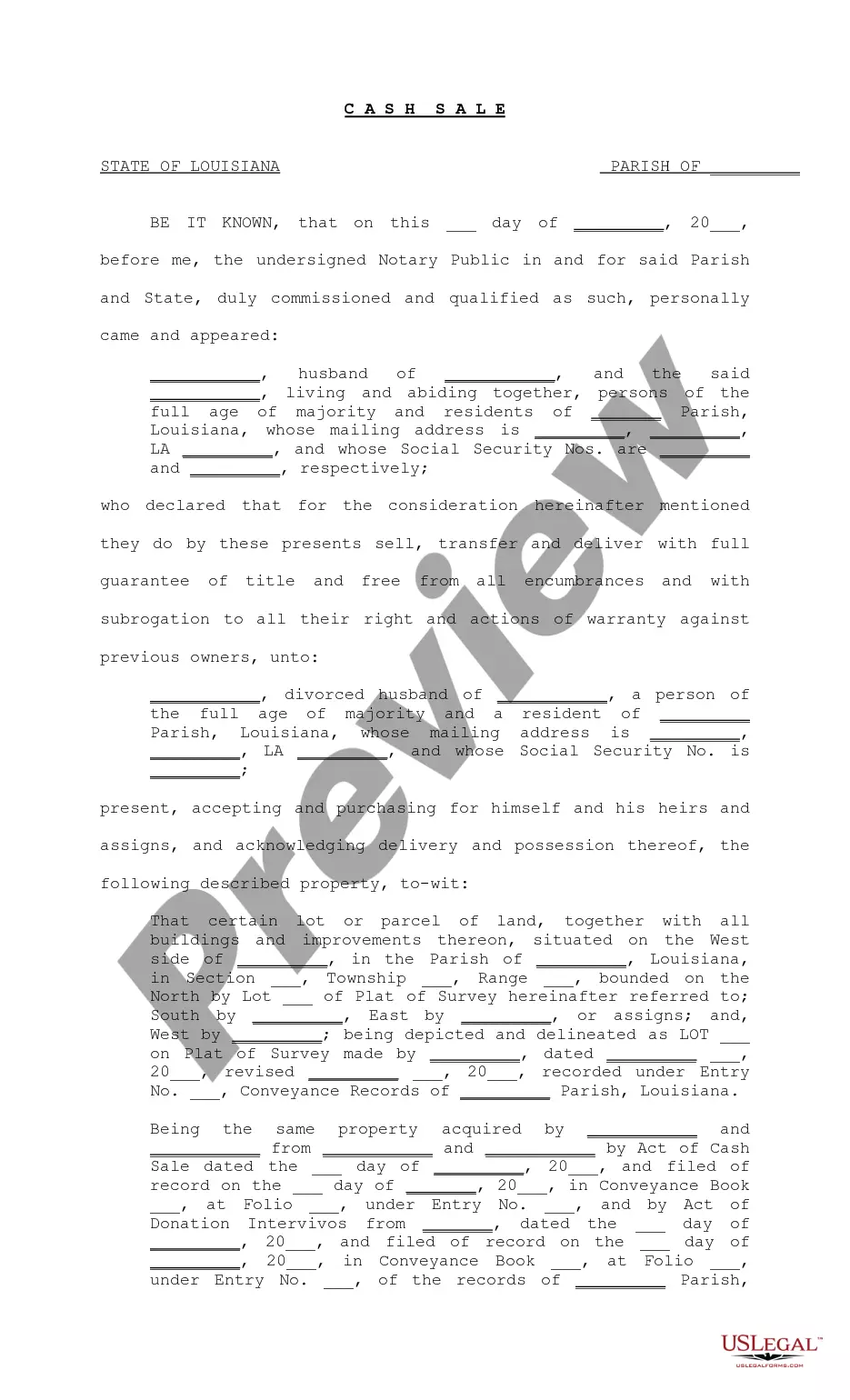

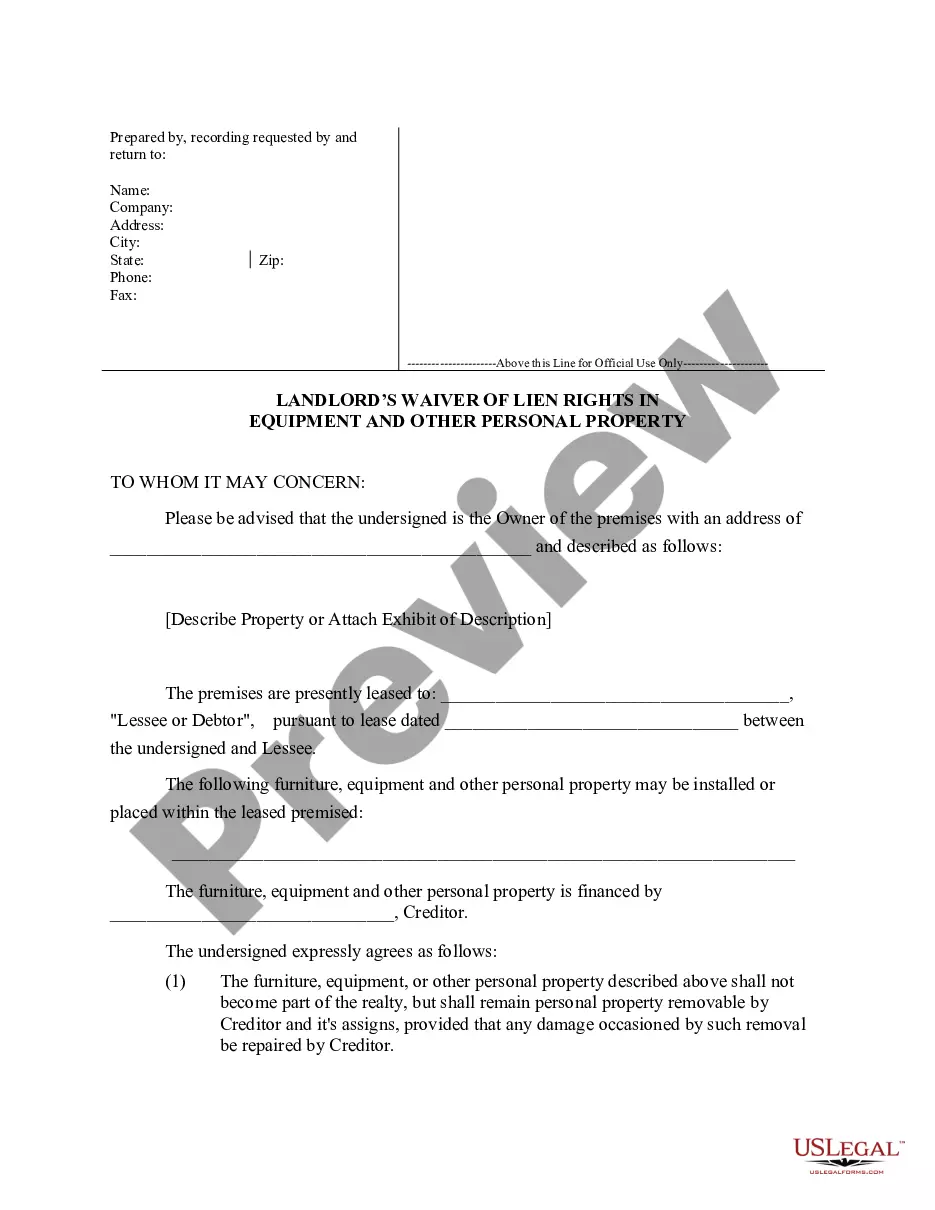

- Utilize the Preview button to review the document.

- Read the description to confirm you have selected the correct template.

- If the template does not meet your needs, use the Search field to find a template that fulfills your requirements.

- Once you find the right template, click Download now.

Form popularity

FAQ

General liability insurance is essential for independent contractors because: It protects you and your business. Independent contractors have the same legal obligations and liability exposures as larger firms. They can be sued for damaging client property, causing bodily harm, or advertising injury.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

10 steps to setting up as a contractor:Research the regulations and responsibilities surrounding contractors.Be prepared to leave your permanent role and set up as a limited company.Consider your tax position and understand IR35.Decide whether to form a limited company or join an umbrella organisation.More items...?

Contract work provides greater independence, it can give you more predictable control of your work, and for many people, greater job security than traditional full-time employment. However, you are responsible for your own taxes, contracts, benefits and vacations.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Protect Yourself When Hiring a ContractorGet Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.Consider Hiring Specialized Pros for Additional Guidance.Go With Your Gut.