Ohio Masonry Services Contract - Self-Employed

Description

How to fill out Masonry Services Contract - Self-Employed?

You can dedicate time online searching for the legal document template that meets the federal and state requirements you have.

US Legal Forms provides thousands of legal forms that have been reviewed by professionals.

You can download or print the Ohio Masonry Services Contract - Self-Employed from my services.

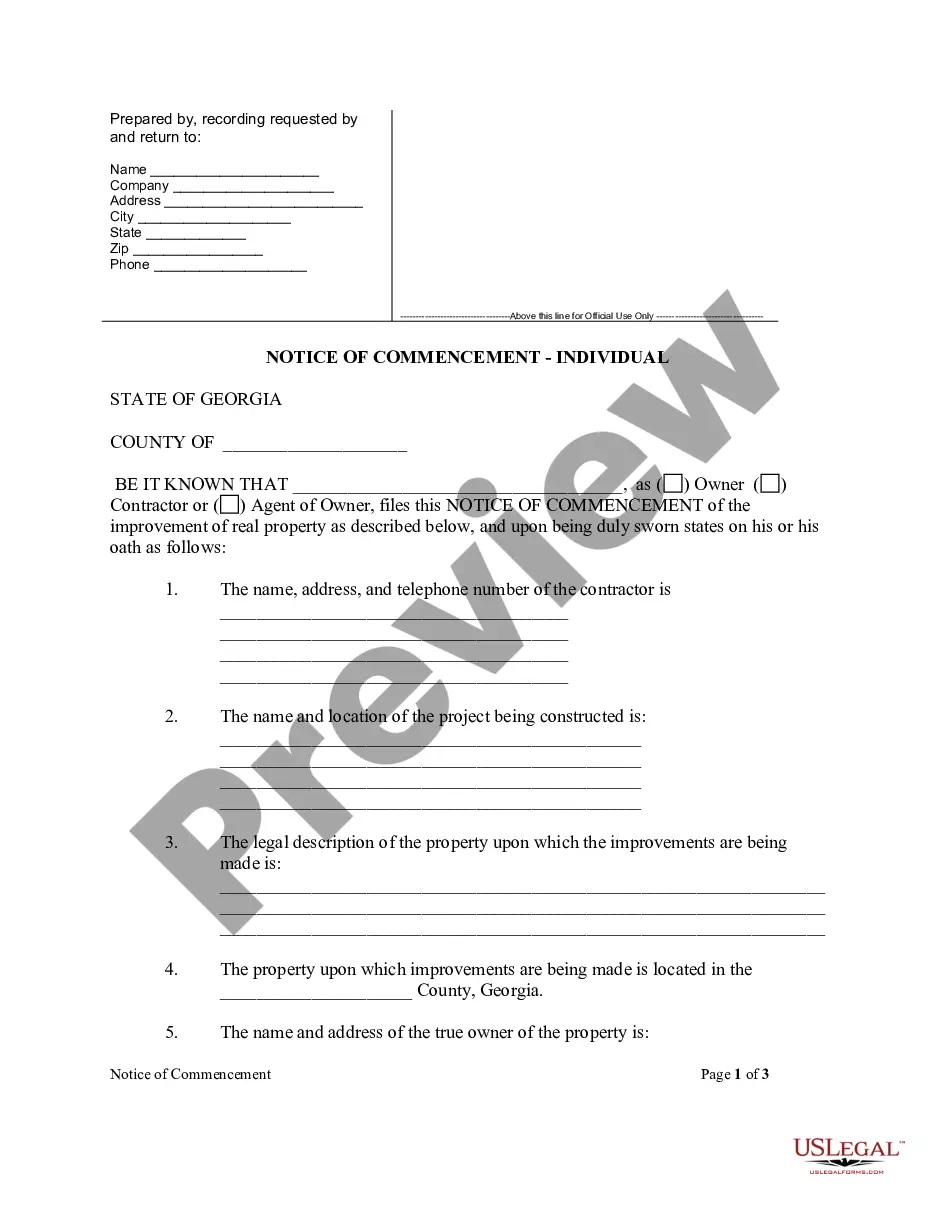

Review the form details to confirm that you have chosen the right form. If available, use the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then select the Download option.

- Next, you can complete, edit, print, or sign the Ohio Masonry Services Contract - Self-Employed.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/city of choice.

Form popularity

FAQ

Yes, if you plan to subcontract work in Ohio, you typically need to hold a valid license, especially in regulated trades. This step not only legitimizes your business but also builds trust with clients and general contractors. Having the right Ohio Masonry Services Contract - Self-Employed will further clarify your responsibilities and rights in the subcontracting arrangement.

Many trades in Ohio require a license, including plumbing, electrical work, and masonry. These licenses ensure that contractors meet safety and quality standards. If you plan to engage in Ohio Masonry Services Contracts - Self-Employed, ensure you acquire the proper licensure to operate successfully.

To become an independent contractor in Ohio, start by choosing a niche, such as masonry services, where you excel. Next, obtain any required licenses, set up your business structure, and market your services. Remember, the right Ohio Masonry Services Contract - Self-Employed can help you outline your terms with clients professionally.

Yes, subcontractors typically need a license in Ohio, especially if they perform skilled trades such as masonry. This requirement helps maintain standards in the construction industry. By ensuring you have the necessary licenses, you can work with peace of mind when handling Ohio Masonry Services Contracts - Self-Employed.

Yes, an independent contractor needs to obtain a business license in Ohio if they are operating legally. Even for Ohio Masonry Services Contracts - Self-Employed, having a proper license helps establish credibility with clients and ensures compliance with state regulations. You can check with your local government for specific requirements related to your business type.

To set up as a self-employed contractor, start by determining your business structure and registering your business name. Next, you’ll need to open a separate bank account for your business funds and set up an accounting system. Finally, securing an Ohio Masonry Services Contract - Self-Employed will help you establish a professional framework for your services.

Becoming a self-employed independent contractor involves several steps, including registering your business, obtaining any necessary permits, and setting up accounting systems. Marketing your services effectively to attract clients is also crucial. With an Ohio Masonry Services Contract - Self-Employed, you can clearly define your offerings and build trust with clients.

Becoming a subcontractor in Ohio involves understanding the subcontracting process and ensuring compliance with any relevant regulations. You need to market your services to general contractors and establish contracts outlining the scope of work. An Ohio Masonry Services Contract - Self-Employed can formalize your engagements and clarify responsibilities.

In Ohio, you can perform minor repairs and maintenance without a contractor license, but this varies by location and type of work. Certain larger projects may require a license, especially in the construction field. If you plan to operate under an Ohio Masonry Services Contract - Self-Employed, it’s critical to check local regulations on limits and requirements.

Typically, Ohio does not require a general independent contractor license. Yet, specific fields may have licensing needs. Understand the regulations relevant to your profession, particularly if your work relates to an Ohio Masonry Services Contract - Self-Employed. Researching your trade can save you time and ensure compliance.