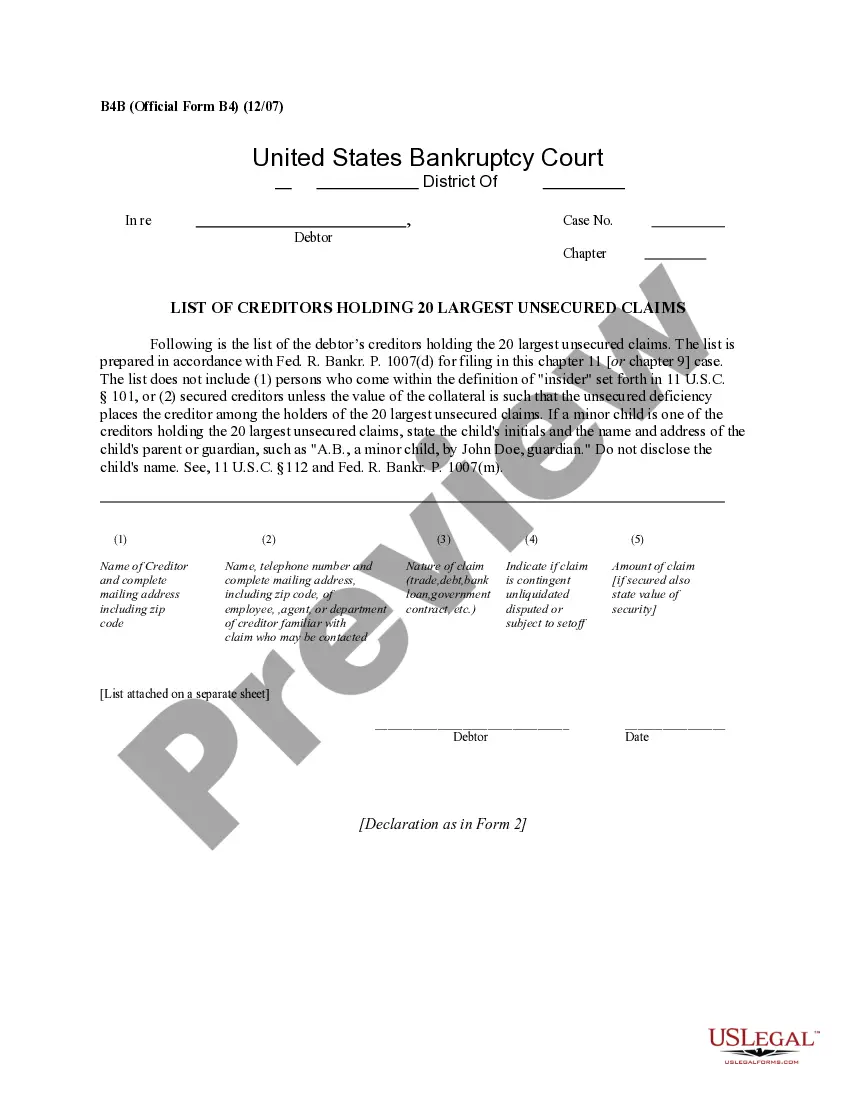

Ohio For Chapter 11 Cases: The List of Creditors Who Have the 20 Largest Unsecured Claims Against You Who Are Not Insiders (non-individuals)

Description

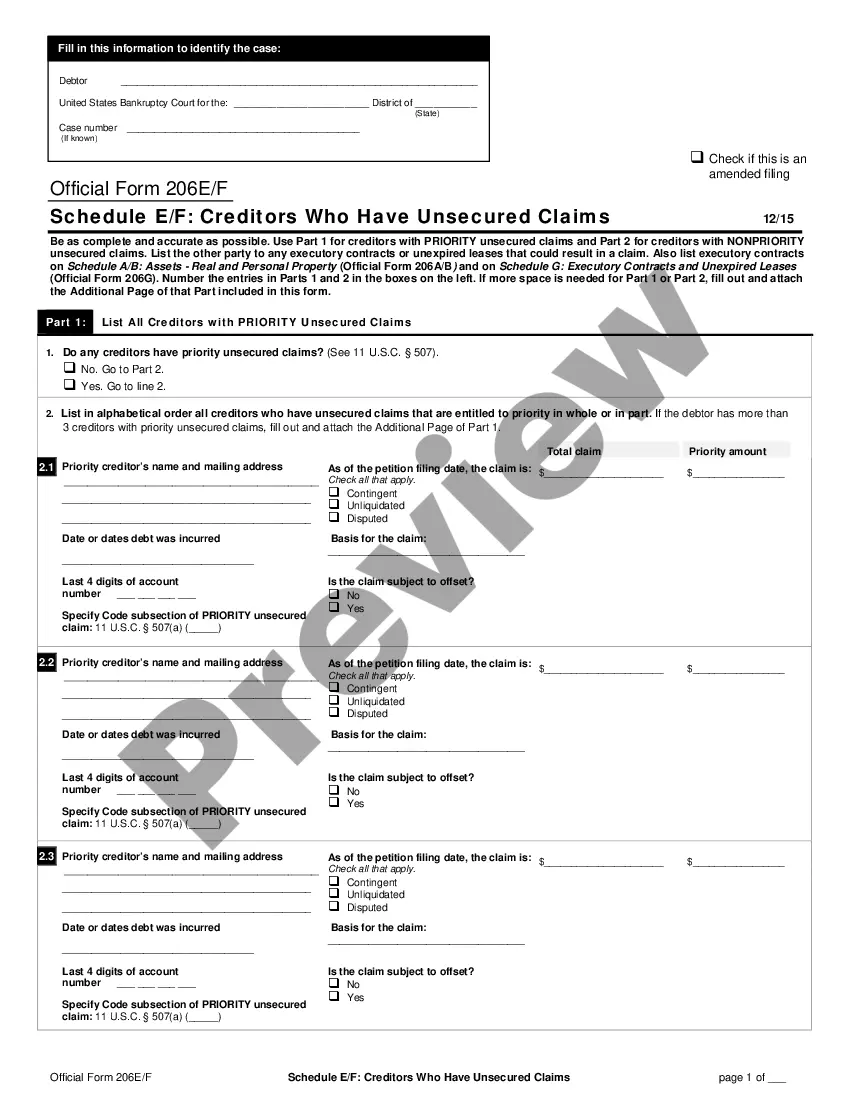

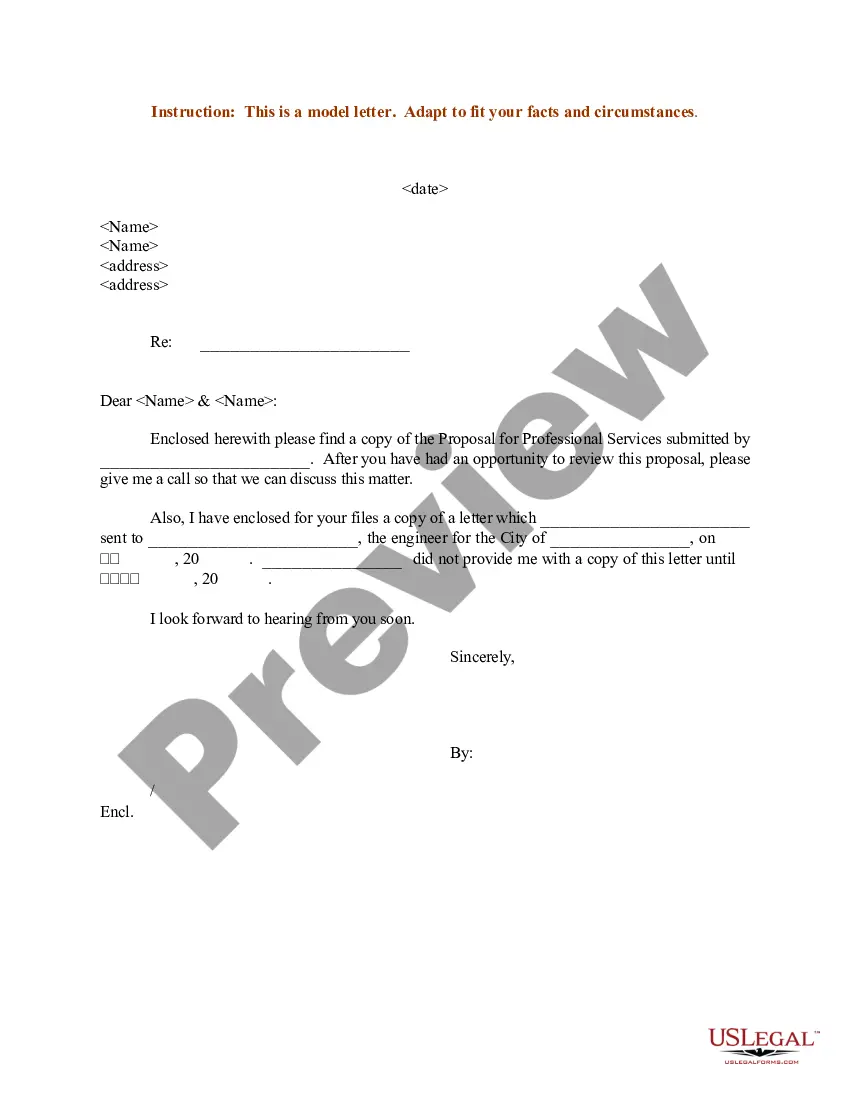

How to fill out For Chapter 11 Cases: The List Of Creditors Who Have The 20 Largest Unsecured Claims Against You Who Are Not Insiders (non-individuals)?

US Legal Forms - one of many most significant libraries of legitimate forms in America - offers a wide range of legitimate papers web templates you may down load or print out. Making use of the site, you may get a huge number of forms for organization and person uses, categorized by classes, states, or keywords and phrases.You can find the newest variations of forms such as the Ohio Notice of Need to File Proof of Claim Due to Recovery of Assets - B 204 within minutes.

If you have a membership, log in and down load Ohio Notice of Need to File Proof of Claim Due to Recovery of Assets - B 204 through the US Legal Forms catalogue. The Acquire key can look on every kind you look at. You have accessibility to all formerly saved forms inside the My Forms tab of your bank account.

If you would like use US Legal Forms the very first time, here are straightforward directions to obtain started off:

- Be sure to have chosen the right kind for the metropolis/region. Click the Review key to examine the form`s content. Read the kind description to actually have chosen the correct kind.

- If the kind doesn`t suit your demands, use the Look for area near the top of the monitor to obtain the one which does.

- In case you are content with the form, affirm your decision by clicking on the Purchase now key. Then, choose the prices plan you like and offer your credentials to sign up for an bank account.

- Process the transaction. Make use of bank card or PayPal bank account to finish the transaction.

- Select the structure and down load the form on your gadget.

- Make alterations. Fill out, modify and print out and indication the saved Ohio Notice of Need to File Proof of Claim Due to Recovery of Assets - B 204.

Every single format you put into your bank account does not have an expiration date and it is your own property forever. So, if you wish to down load or print out an additional copy, just visit the My Forms area and click on the kind you require.

Obtain access to the Ohio Notice of Need to File Proof of Claim Due to Recovery of Assets - B 204 with US Legal Forms, one of the most comprehensive catalogue of legitimate papers web templates. Use a huge number of professional and state-specific web templates that satisfy your small business or person requires and demands.

Form popularity

FAQ

A person can keep as many cars, trucks, or motorcycles that the person owns, as long as none of these vehicles has any equity. However, if an automobile has equity a person can only protect one such vehicle in a chapter 7 bankruptcy as long as the equity in the item does not exceed the $3,675 allowance.

Attach redacted copies of any documents that support the claim, such as promissory notes, purchase orders, invoices, itemized statements of running accounts, contracts, judgments, mortgages, and security agreements.

In an involuntary chapter 7 case, a proof of claim is timely filed if it is filed not later than 90 days after the order for relief under that chapter is entered.

In Chapter 7 bankruptcy, there are two reasons why it is possible to lose your property: you have secured debt (tied to real property, like a car or a house) and you have stopped paying on it and have no means to continue to pay on it, or your property is deemed valuable enough by the court to sell in order to satisfy ...

You can keep up to $500 in cash in your bank account or on hand. There is also a wildcard exemption, where you can exempt up to $1,325 for any property you choose. So technically, you could keep $1,825 of your cash when filing for Chapter 7 bankruptcy in Ohio.

How to File Chapter 7 Bankruptcy in Ohio Gather Up Your Financial Documents. ... Attend an Approved Credit Counseling Course. ... Complete Bankruptcy Filing Forms. ... Pay Your Chapter 7 Filing Fee. ... Print Your Bankruptcy Forms. ... File Your Bankruptcy Petition in Person. ... Send Documents to Your Assigned Bankruptcy Trustee.

Also, general unsecured debts are generally discharged under Chapter 7 without you having to repay them. In a Chapter 13 case, most people will be able to discharge all unsecured debts, however, higher income earners may have to pay a portion of the general unsecured debts depending on their income.

The Chapter 13 bankruptcy process involves these steps: You must attend a credit counseling course within 180 days before filing your Chapter 13 petition. You must prepare your petition on forms provided by the court. ... You must present a proposed repayment plan to the court within 14 days of filing your petition.