Ohio Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

Have you ever been in a situation where you need documents for particular business or specific purposes occasionally.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms provides a wide array of form templates, such as the Ohio Notice of Adverse Action - Non-Employment - Due to Credit Report, created to meet state and federal regulations.

Choose a convenient paper format and download your copy.

Access all the document templates you have purchased in the My documents section. You can always obtain another copy of the Ohio Notice of Adverse Action - Non-Employment - Due to Credit Report as needed. Just click on the desired form to download or print the document template. Use US Legal Forms, the most extensive selection of legal forms, to save time and prevent mistakes. The service offers expertly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Ohio Notice of Adverse Action - Non-Employment - Due to Credit Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

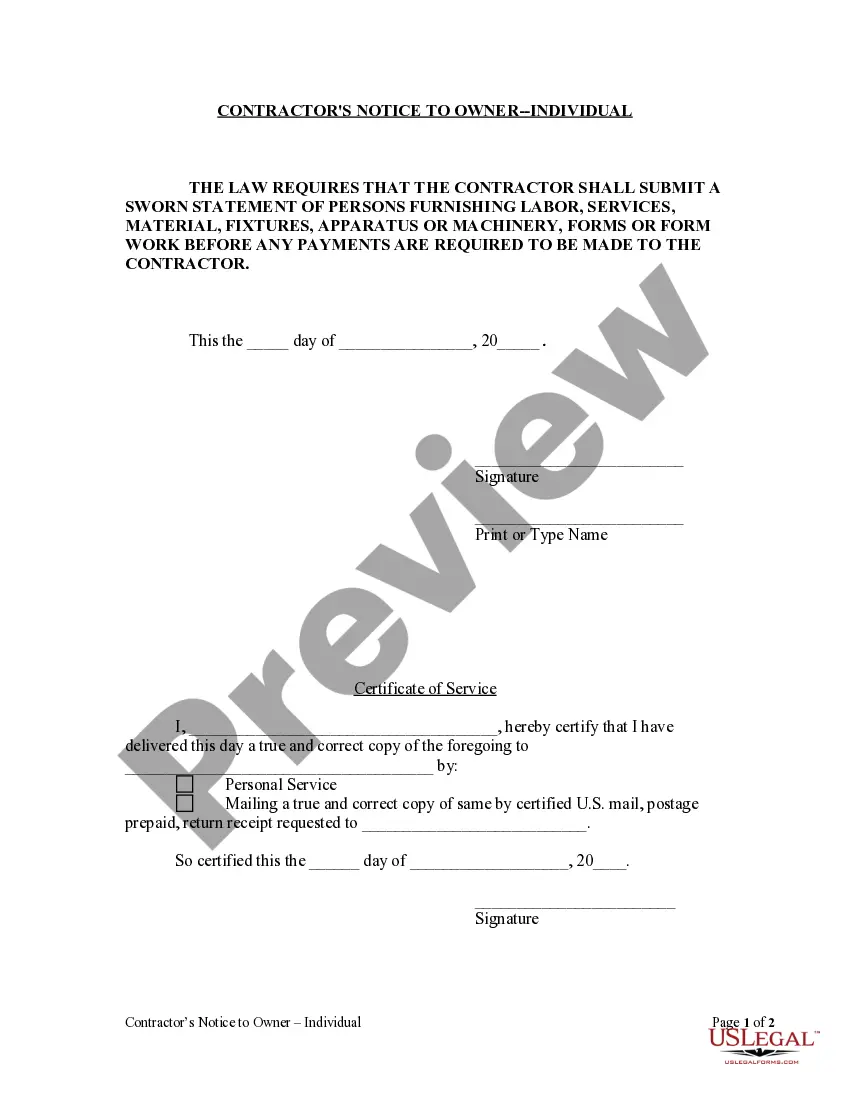

- Utilize the Preview button to review the document.

- Check the details to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you have the correct form, click Purchase now.

- Select the payment plan you desire, enter the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

Form popularity

FAQ

Continue with the hire or take adverse action Taking adverse action is regrettable for both the organization and the candidate, but eventually you'll need to decide to rescind your job offer or proceed with hiring.

In the credit score exception notices, creditors are required to disclose the distribution of credit scores among consumers who are scored under the same scoring model that is used to generate the consumer's credit score using the same scale as that of the credit score provided to the consumer.

Although employers must request your permission before obtaining your credit report, the FCRA does not prevent employers from denying you a job or promotion, or even terminating you on the basis of your negative credit--even if your credit report is incorrect.

An adverse action notice is an explanation that issuers must give you if you're denied credit or if you're given less favorable financing terms based on your credit history. You may also get an adverse action notice if your credit is a reason an employer turns you down for a job.

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

Again, a credit check likely won't affect your chances of getting a job unless you're pursuing a financial or management position or may be privy to sensitive information. If you plan to work with a company's finances, the hiring managers want to make sure you handle money responsibly.

An adverse action notice will not hurt your credit score or show up on your credit report. However, if the creditor pulls a hard credit inquiry, this may temporarily lower your scoreand all hard inquiries remain on your credit report for two years.

Again, a credit check likely won't affect your chances of getting a job unless you're pursuing a financial or management position or may be privy to sensitive information. If you plan to work with a company's finances, the hiring managers want to make sure you handle money responsibly.

Unfortunately, while federal laws prevent discrimination in the workplace regarding race and gender, no such laws exist to prevent being denied a job due to poor credit history. So yes, in most states your credit report can influence the hiring decision.

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.