Ohio FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule

Description

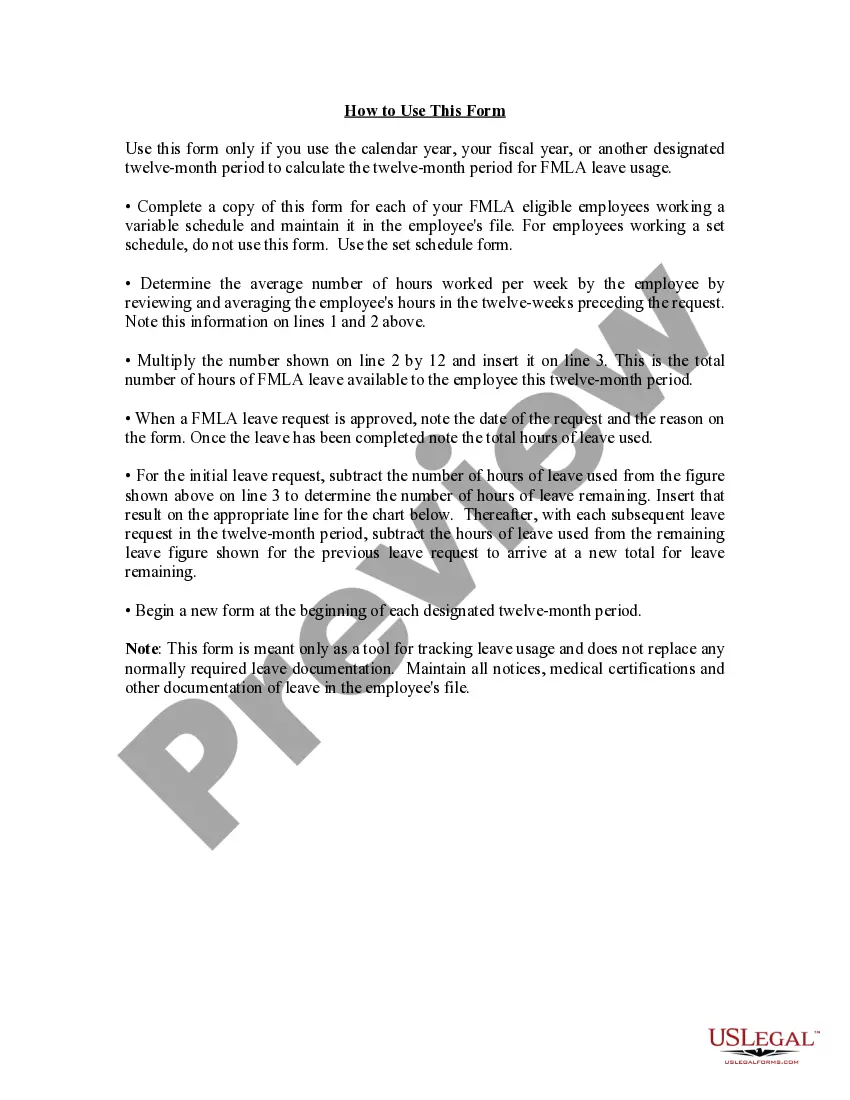

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Variable Schedule?

Selecting the appropriate legal document template can be challenging. Naturally, there are numerous templates accessible on the internet, but how can you find the legal document you require? Visit the US Legal Forms website.

The platform offers thousands of templates, including the Ohio FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule, suitable for both business and personal use. All the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log Into your account and select the Acquire option to locate the Ohio FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule. Use your account to access the legal documents you may have previously purchased. Visit the My documents section of your account to obtain another copy of the document you require.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Ohio FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download professionally crafted documents that adhere to state requirements.

- First, make sure you have chosen the correct form for your location/state.

- You can browse the form using the Review option and check the form description to confirm it is suitable for your needs.

- If the form does not fulfill your requirements, use the Search field to find the appropriate form.

- When you are confident that the form is correct, click the Get now button to obtain the form.

- Choose the pricing plan you prefer and provide the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

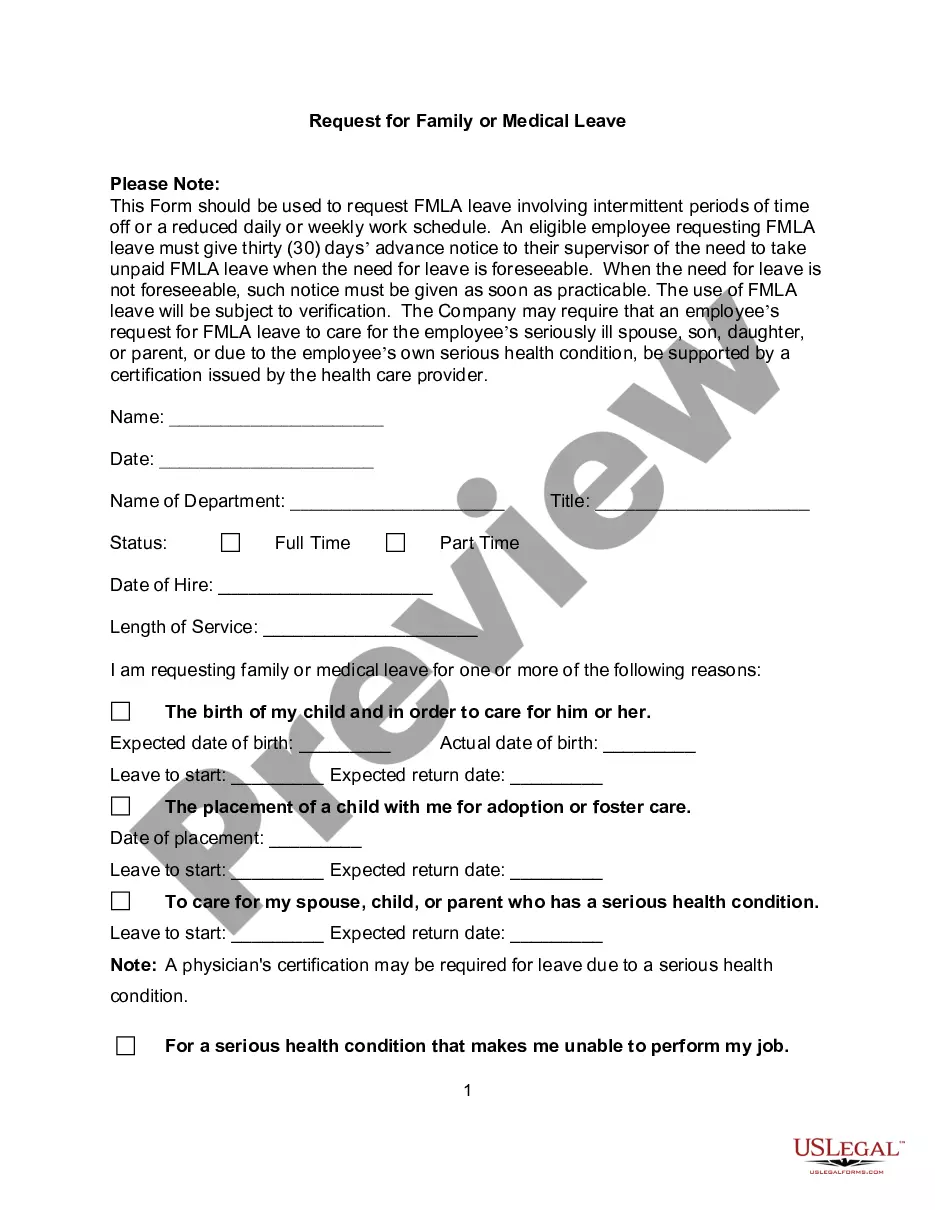

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022 Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

You make this calculation according to the employee's regular workweek. For example, an employee who regularly works a five-day work week and eight hours a day, is entitled to 480 hours of leave: 12 weeks x 40 hrs/wk.

CALCULATION OF LEAVE USAGEThe amount of FMLA leave taken is divided by the number of hours the employee would have worked if the employee had not taken leave of any kind (including FMLA leave) to determine the proportion of the FMLA workweek used.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022

The employee's actual workweek is the basis for determining the employee's FMLA leave entitlement. An employee does not accrue FMLA leave at any particular hourly rate. FMLA leave may be taken in periods of whole weeks, single days, hours, and in some cases even less than an hour.

One of the easiest methods by which an employer can track FMLA leave is to place all employees on a calendar year track. This means that each employee can take 12 weeks of FMLA leave anytime between January and December, and the calculations reset on January 1 of each year.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

The amount of FMLA leave taken is divided by the number of hours the employee would have worked if the employee had not taken leave of any kind (including FMLA leave) to determine the proportion of the FMLA workweek used.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.