This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

If you wish to complete, acquire, or print out lawful document layouts, use US Legal Forms, the biggest selection of lawful varieties, which can be found online. Use the site`s simple and convenient research to discover the paperwork you want. Numerous layouts for organization and specific purposes are categorized by categories and says, or search phrases. Use US Legal Forms to discover the Ohio Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness with a few click throughs.

In case you are currently a US Legal Forms customer, log in for your bank account and click on the Down load button to have the Ohio Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. You may also accessibility varieties you in the past acquired in the My Forms tab of your respective bank account.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for your correct city/region.

- Step 2. Use the Preview choice to check out the form`s articles. Never forget to see the information.

- Step 3. In case you are unhappy with all the type, make use of the Look for area at the top of the display screen to locate other versions of the lawful type web template.

- Step 4. When you have found the shape you want, go through the Acquire now button. Choose the rates plan you prefer and put your references to sign up to have an bank account.

- Step 5. Process the transaction. You can utilize your charge card or PayPal bank account to finish the transaction.

- Step 6. Choose the formatting of the lawful type and acquire it on the gadget.

- Step 7. Total, revise and print out or sign the Ohio Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

Each and every lawful document web template you purchase is the one you have for a long time. You possess acces to each type you acquired within your acccount. Go through the My Forms area and select a type to print out or acquire once again.

Contend and acquire, and print out the Ohio Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness with US Legal Forms. There are many specialist and condition-certain varieties you can utilize to your organization or specific requirements.

Form popularity

FAQ

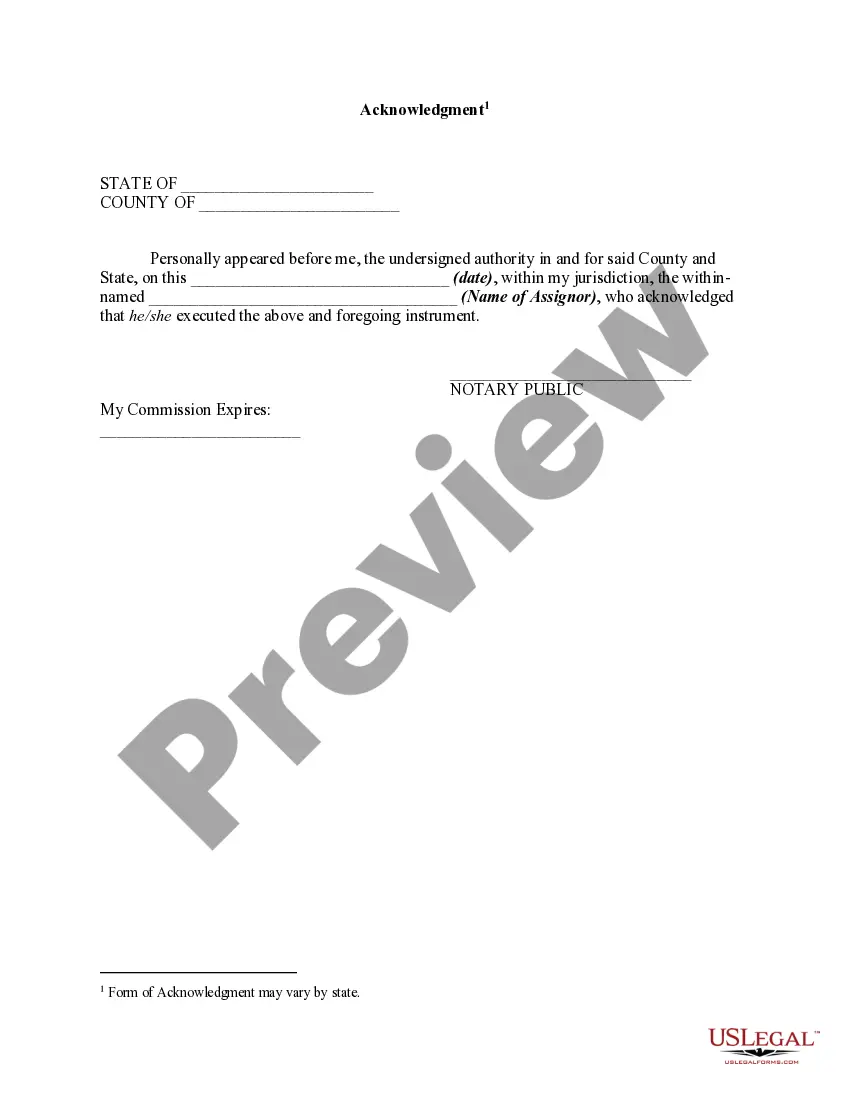

The signing shall be acknowledged by the grantor, mortgagor, vendor, or lessor, or by the trustee, before a judge or clerk of a court of record in this state, or a county auditor, county engineer, notary public, or mayor, who shall certify the acknowledgement and subscribe the official's name to the certificate of the ...

Section 5301.36 | Entry of satisfaction. (B) Within ninety days from the date of the satisfaction of a mortgage, the mortgagee shall record a release of the mortgage evidencing the fact of its satisfaction in the appropriate county recorder's office and pay any fees required for the recording.

FindLaw Newsletters Stay up-to-date with how the law affects your life Legal Maximum Rate of Interest8% (§1343.01)Penalty for Usury (Unlawful Interest Rate)Excess interest applied to principal (§1343.04)Interest Rates on JudgmentsContract rate (§1343.02), otherwise 10% (§1343.03)1 more row

(1) If a law, including an administrative rule, of this state prescribes the time a payment is required to be made or reported, when the payment is required by that law to be paid or reported. (2) If the payment is for services rendered, when the rendering of the services is completed.

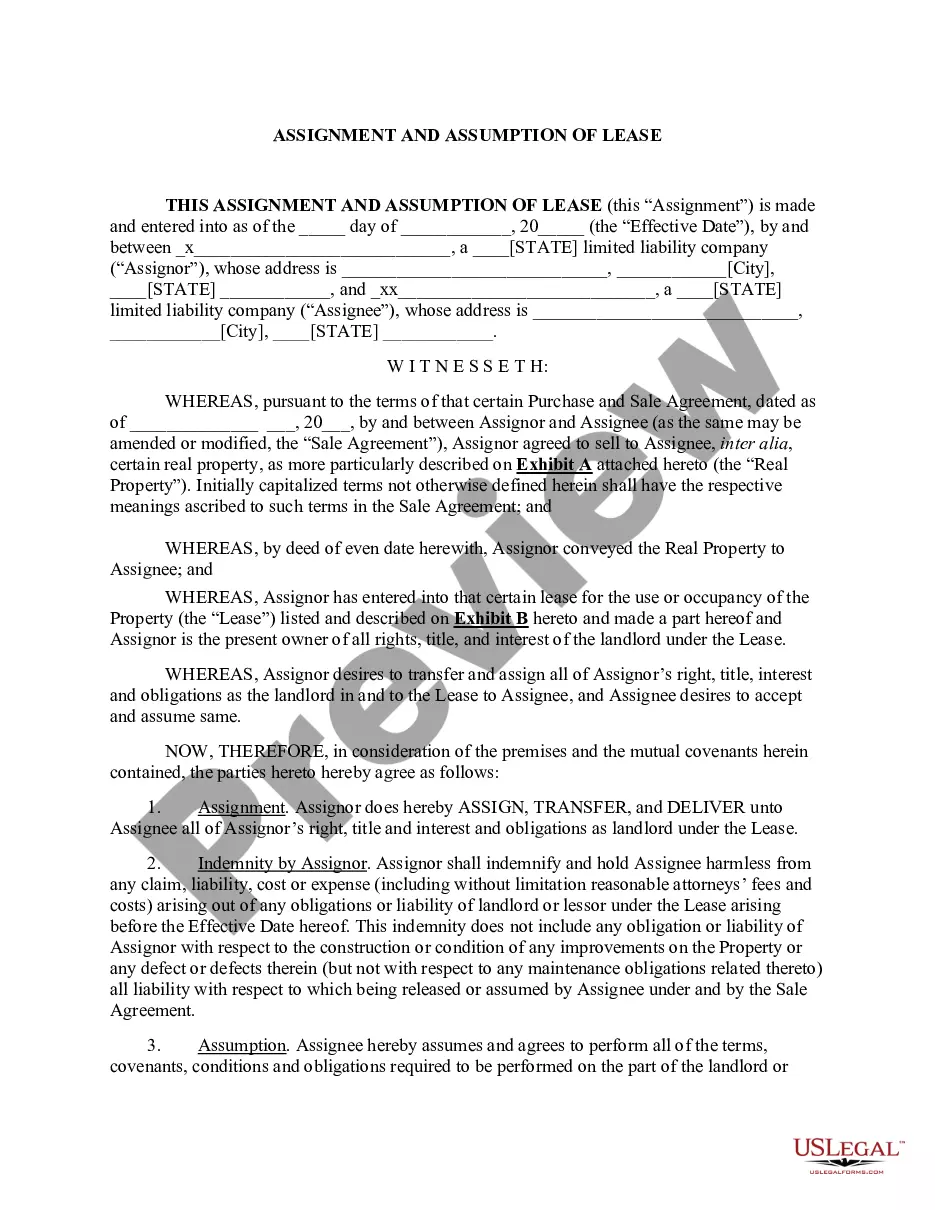

Conveyances,' mandates, inter alia, that all leases of any interest in real property shall be signed by the lessor, attested to by two witnesses, and bear a certificate of acknowledgement subscribed to by a proper authority. Exempted from the operation of the statute are leases for a period of less than three years.

ORC 5705.41 (D) requires that no subdivision or taxing unit shall make any contract or give any order involving the expenditure of money unless there is attached thereto a certificate of the Treasurer of the subdivision that the amount required to meet the obligation has been lawfully appropriated for such purpose and ...

Section 5301.233 | Mortgage may secure unpaid balances of advances made.

An individual who is a party to an in-person, telephone or electronic conversation, or who has the consent of one of the parties to the conversation, can lawfully record it or disclose its contents, unless the person is doing so for the purpose of committing a criminal or tortious act. Ohio Rev. Code § 2933.52.