Ohio Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

Finding the correct legal document template can be a struggle.

Clearly, there are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers a wide array of templates, such as the Ohio Simple Equipment Lease, suitable for both business and personal use.

You can browse the form using the Preview button and review the form description to confirm it is the right one for you.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Ohio Simple Equipment Lease.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward steps you can follow.

- First, ensure that you have selected the correct form for your locality.

Form popularity

FAQ

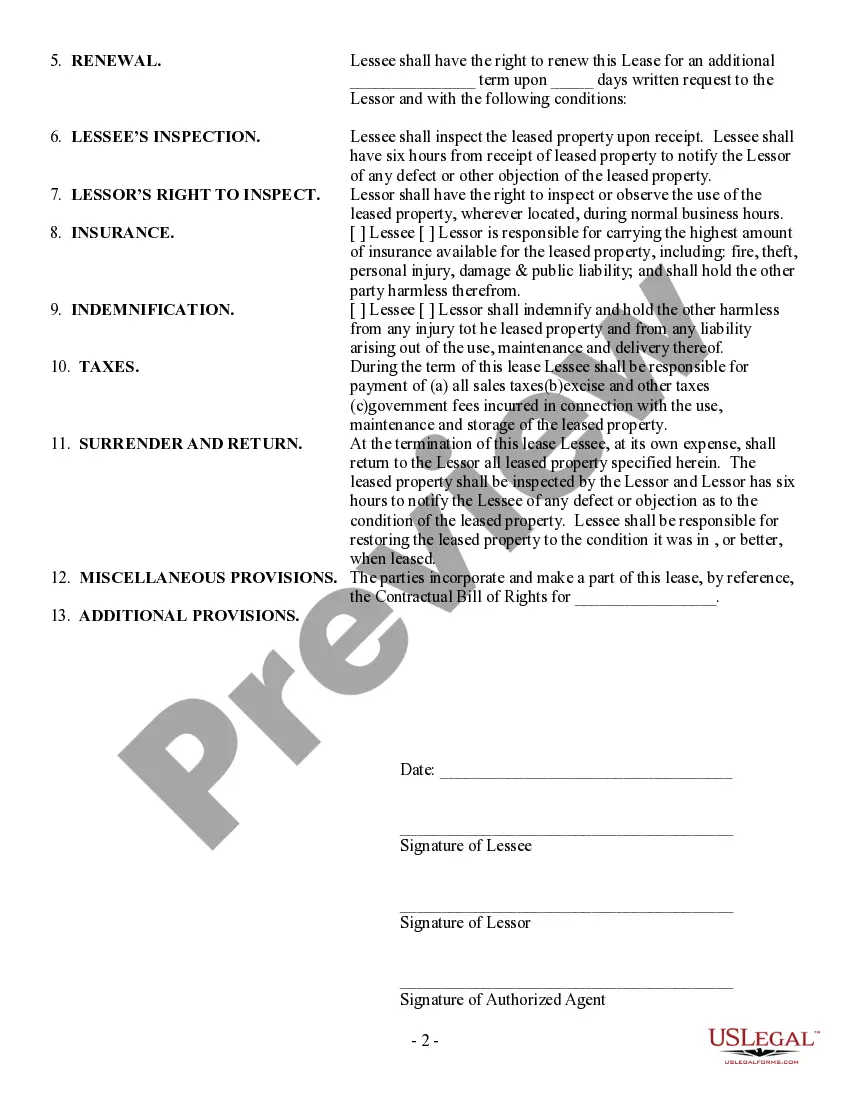

The structure of equipment leasing typically includes a lessee, a lessor, and specific lease terms. It outlines the duration of the lease, payment details, and any potential fees for early termination. For a clearer understanding, consider reviewing an Ohio Simple Equipment Lease through US Legal Forms, which outlines these components in an easy-to-understand format.

Filling out an Ohio residential lease agreement involves entering your property details, tenant information, and lease terms. You should clearly state rent amounts, deposit requirements, and maintenance responsibilities. To avoid common pitfalls, refer to an Ohio Simple Equipment Lease guide on US Legal Forms, which helps ensure compliance with Ohio laws and regulations.

Setting up an equipment lease involves defining the lease period, payment terms, and conditions for use. You should also include details about insurance and liability to ensure both parties understand their responsibilities. Utilizing an Ohio Simple Equipment Lease document from US Legal Forms can simplify this process and ensure all necessary components are included.

Creating a rental agreement for equipment requires clear terms to protect both parties. You should outline the rental duration, payment schedule, and responsibilities for maintenance. To streamline this process, consider using an Ohio Simple Equipment Lease template from US Legal Forms, which provides customizable options to suit your needs.

Yes, equipment rental fees in Ohio are generally subject to sales tax unless exempted. This means as a business, you need to be prepared to collect and remit that tax with your rental agreements. To ensure you're handling taxes correctly and to simplify the rental process, resources on uslegalforms can provide you with the necessary information.

Writing a lease agreement for equipment involves clearly stating the terms, including duration, payment structure, and responsibilities. You should also outline the maintenance requirements and what happens at the end of the lease. Consider utilizing templates available on platforms like uslegalforms to create a compliant and effective Ohio Simple Equipment Lease.

In Ohio, notarization is not a strict requirement for commercial leases, including an Ohio Simple Equipment Lease. However, having your lease agreement notarized can add a layer of legal integrity and help in cases of disputes. It’s a good practice to consult with a legal advisor to determine the best approach for your business.

In Ohio, equipment leases can be subject to sales tax unless exempted. If your lease does not qualify for an exemption, you may need to collect and remit sales tax based on the rental payments. To navigate this process confidently, consider seeking guidance through a platform like uslegalforms, which provides helpful resources on Ohio Simple Equipment Lease compliance.

In Ohio, certain items and services are exempt from sales tax, including specific lease transactions under an Ohio Simple Equipment Lease. Generally, items used for manufacturing or resale may qualify for this exemption. It's essential to review the Ohio Department of Taxation guidelines or consult with a tax advisor to determine your eligibility and ensure compliance.

An agreement for the use of equipment, often referred to as a lease, outlines the terms under which a party may use specific equipment. This includes details like duration, payment terms, and responsibilities for maintenance. For an effective Ohio Simple Equipment Lease, you can utilize US Legal Forms to create a comprehensive document that protects your interests.