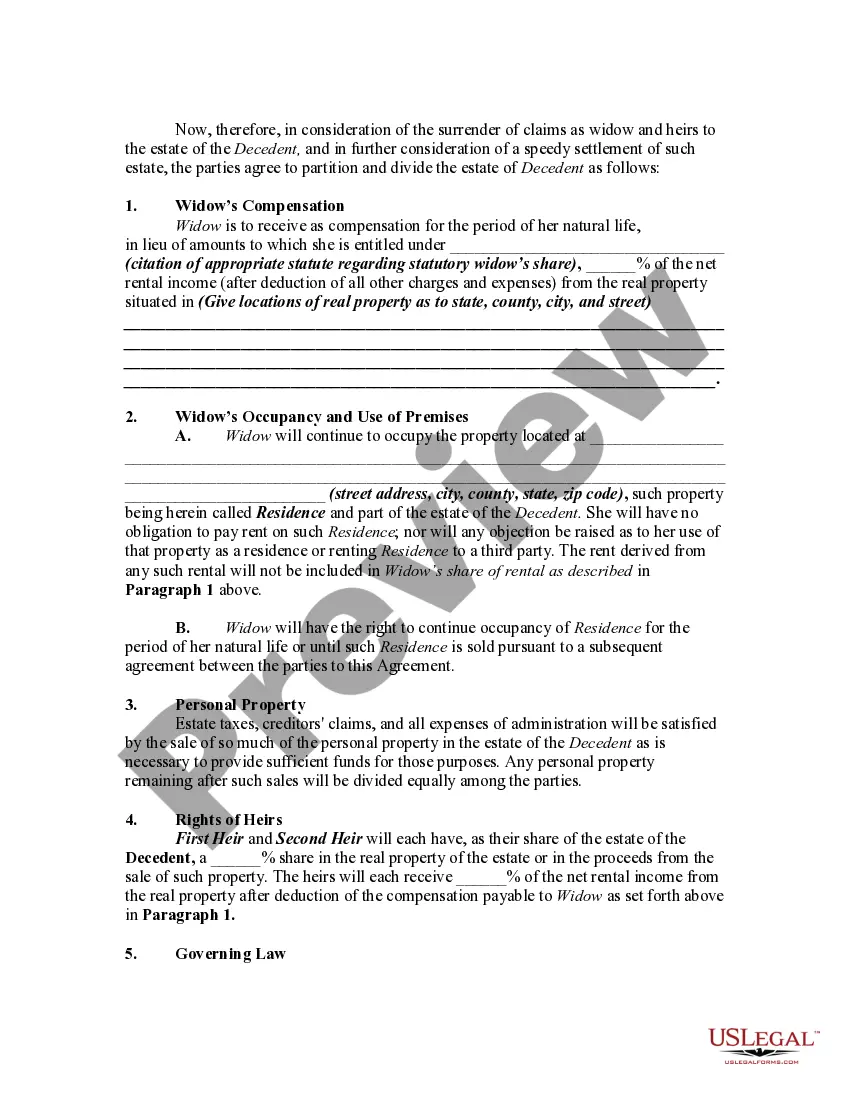

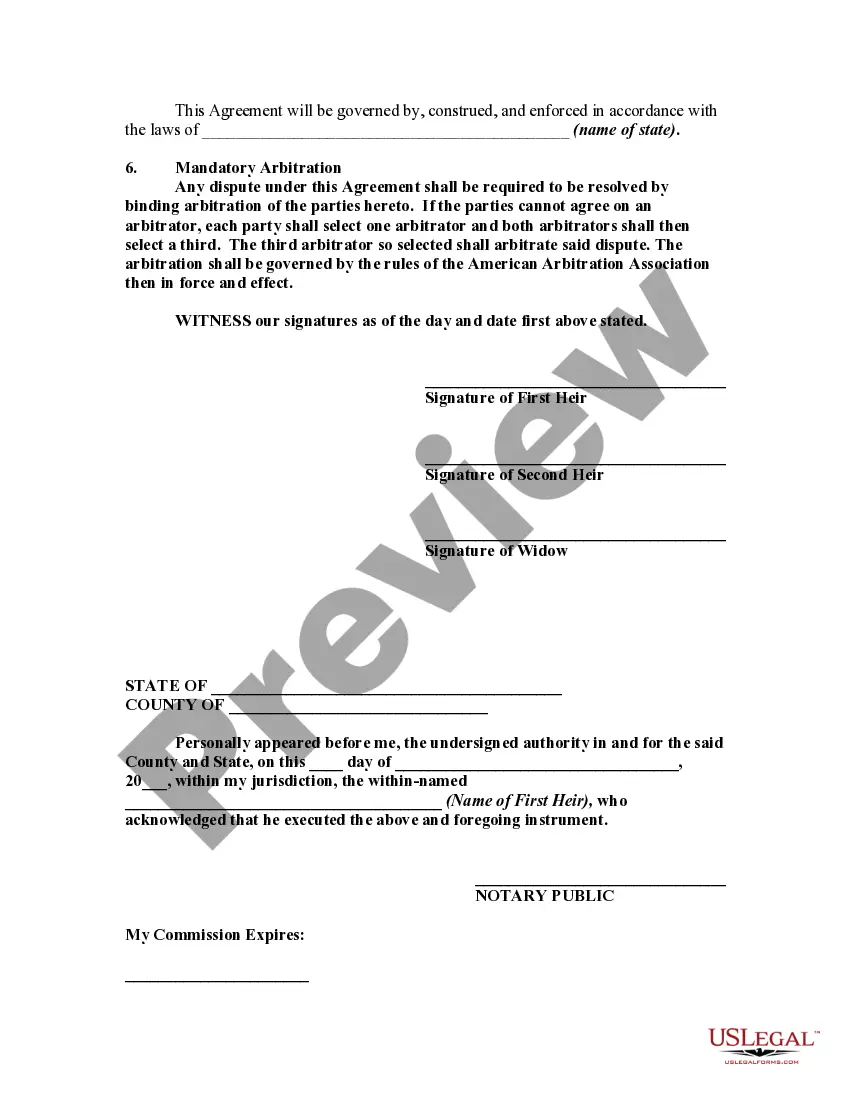

Are you currently in a situation that you need to have papers for possibly business or personal uses almost every time? There are tons of lawful document templates available on the Internet, but getting ones you can trust is not easy. US Legal Forms offers thousands of kind templates, much like the Ohio Agreement Between Widow and Heirs as to Division of Estate, that happen to be composed to meet state and federal specifications.

In case you are already knowledgeable about US Legal Forms site and get a free account, merely log in. After that, you may acquire the Ohio Agreement Between Widow and Heirs as to Division of Estate template.

If you do not have an bank account and would like to begin using US Legal Forms, follow these steps:

- Discover the kind you need and ensure it is for that proper area/area.

- Make use of the Review switch to review the form.

- Look at the information to ensure that you have selected the proper kind.

- If the kind is not what you are searching for, make use of the Search area to obtain the kind that fits your needs and specifications.

- Whenever you get the proper kind, just click Acquire now.

- Choose the prices strategy you desire, submit the specified information and facts to create your bank account, and buy the transaction making use of your PayPal or credit card.

- Decide on a convenient document formatting and acquire your copy.

Locate all the document templates you possess bought in the My Forms menus. You can get a additional copy of Ohio Agreement Between Widow and Heirs as to Division of Estate whenever, if required. Just go through the needed kind to acquire or produce the document template.

Use US Legal Forms, by far the most extensive variety of lawful forms, to save time and avoid blunders. The service offers appropriately created lawful document templates that can be used for a range of uses. Make a free account on US Legal Forms and start making your life a little easier.