Ohio Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

US Legal Forms - one of many biggest libraries of legitimate types in the States - delivers a wide range of legitimate file layouts you can down load or produce. Using the web site, you can find a large number of types for business and specific functions, sorted by categories, states, or key phrases.You can find the most recent models of types just like the Ohio Sample Letter to City Clerk regarding Ad Valorem Tax Exemption in seconds.

If you already possess a subscription, log in and down load Ohio Sample Letter to City Clerk regarding Ad Valorem Tax Exemption in the US Legal Forms library. The Obtain key will appear on each type you look at. You have accessibility to all previously saved types inside the My Forms tab of your respective bank account.

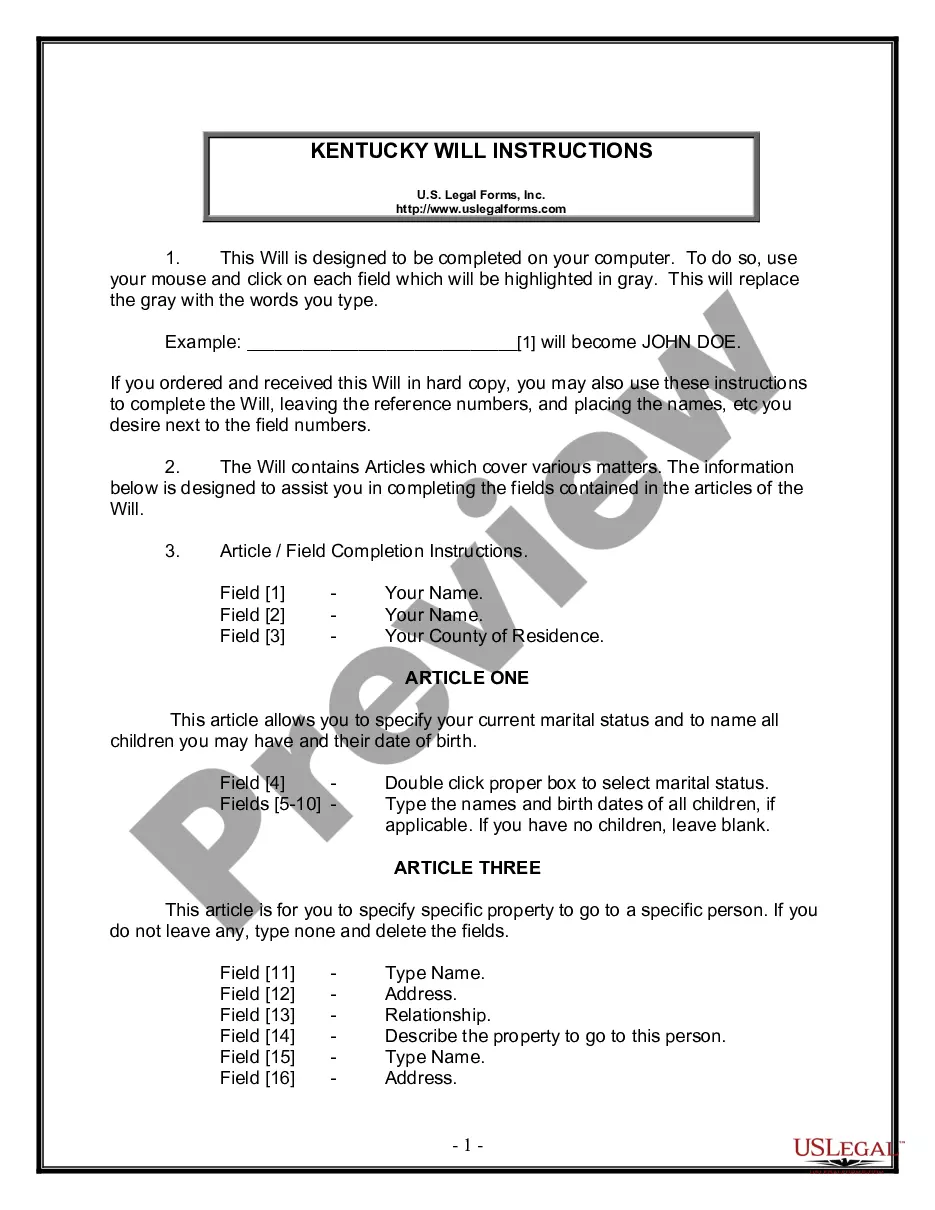

If you wish to use US Legal Forms the very first time, listed here are simple directions to help you began:

- Ensure you have selected the right type for your personal town/county. Go through the Preview key to review the form`s content. Read the type information to ensure that you have selected the appropriate type.

- In case the type doesn`t fit your demands, make use of the Look for area near the top of the display screen to obtain the one which does.

- If you are pleased with the shape, validate your choice by clicking on the Acquire now key. Then, choose the rates strategy you prefer and give your accreditations to sign up for an bank account.

- Method the financial transaction. Utilize your Visa or Mastercard or PayPal bank account to accomplish the financial transaction.

- Pick the structure and down load the shape on your own product.

- Make modifications. Load, change and produce and signal the saved Ohio Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

Each and every design you included in your account lacks an expiration particular date and is also your own forever. So, in order to down load or produce yet another copy, just go to the My Forms section and click on in the type you need.

Obtain access to the Ohio Sample Letter to City Clerk regarding Ad Valorem Tax Exemption with US Legal Forms, probably the most comprehensive library of legitimate file layouts. Use a large number of professional and state-distinct layouts that meet up with your organization or specific demands and demands.

Form popularity

FAQ

The Homestead Exemption is a property tax reduction available by application to seniors (age 65 or older) and the disabled (permanent/total). In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners.

Who should be filing exempt on taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam. Many items used in farming or manufacturing.

An entity can become tax-exempt by meeting the requirements set forth by the IRS. There are several categories of tax-exempt status for charitable, religious, educational, and scientific organizations. The type of tax-exempt status needed will depend on the nature of the organization's activities.

Visit IRS.gov to apply to become a tax-exempt organization. Also, contact the Ohio Department of Taxation and your county and local governments to determine how to apply for applicable exemptions. Register with the Ohio Attorney General's Office if entity is a charitable organization.

(A) The following property shall be exempt from taxation: (1) Real property used by a school for primary or secondary educational purposes, including only so much of the land as is necessary for the proper occupancy, use, and enjoyment of such real property by the school for primary or secondary educational purposes.

Visit IRS.gov to apply to become a tax-exempt organization. Also, contact the Ohio Department of Taxation and your county and local governments to determine how to apply for applicable exemptions. Register with the Ohio Attorney General's Office if entity is a charitable organization.

Tax-exempt customers Some customers are exempt from paying sales tax under Ohio law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.