Ohio Contract with Employee to Work in a Foreign Country

Description

How to fill out Contract With Employee To Work In A Foreign Country?

Selecting the ideal legal document template may be challenging.

Of course, there are numerous templates accessible online, but how do you obtain the legal document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Ohio Contract with Employee to Work in a Foreign Country, which you can use for both business and personal purposes.

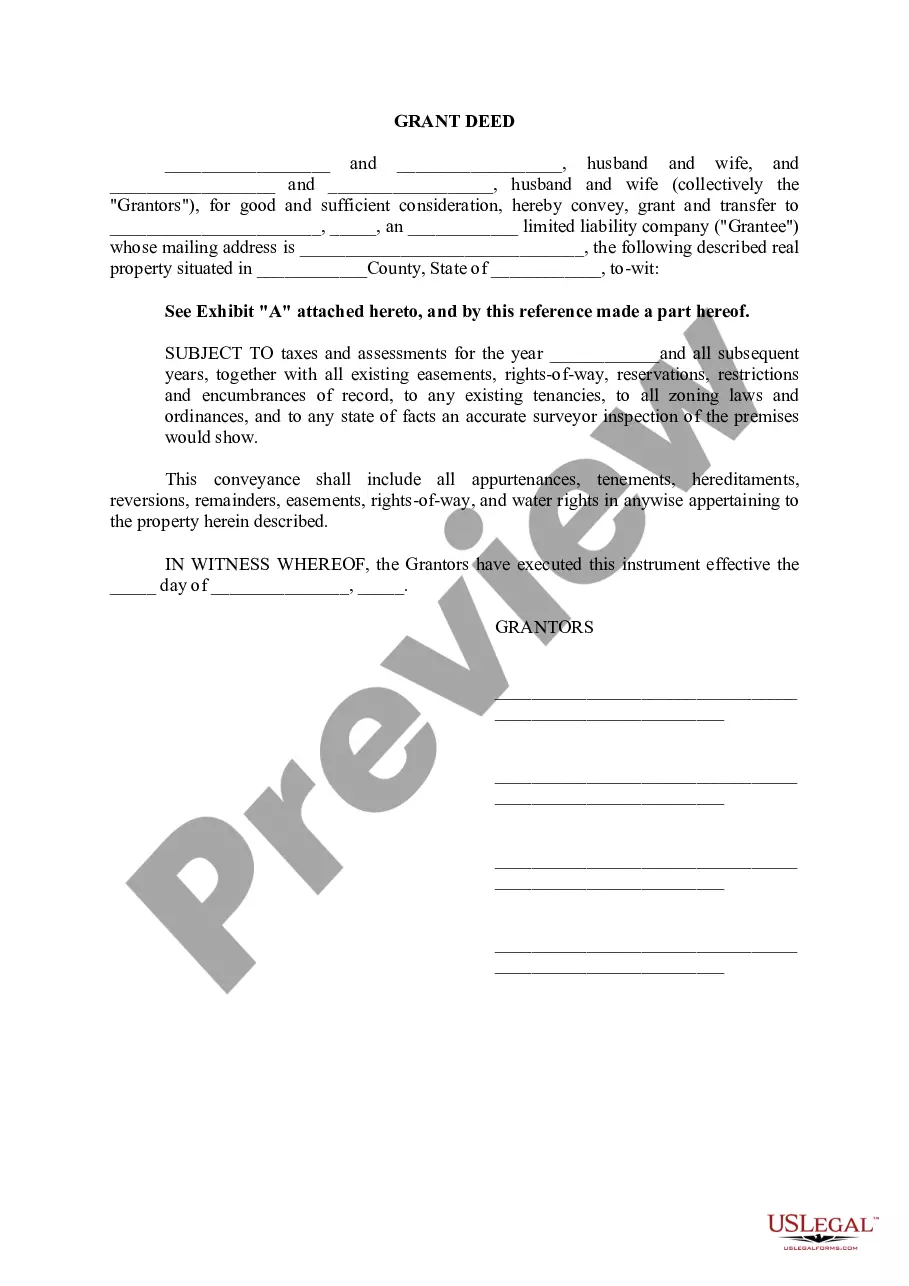

First, verify that you have selected the correct document for your area/state. You can review the form using the Preview button and examine the form description to ensure this is indeed the right one for you.

- All templates are reviewed by professionals and meet state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Ohio Contract with Employee to Work in a Foreign Country.

- Use your account to browse the legal documents you have previously purchased.

- Visit the My documents section of your account to obtain an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines to follow.

Form popularity

FAQ

Non-compete agreements in Ohio are enforceable under specific conditions, including reasonableness in duration and geographical scope. When drafting an Ohio Contract with Employee to Work in a Foreign Country, companies should consider including a non-compete clause to protect their business interests. However, it's essential to be mindful of the legal standards to ensure enforceability.

In general, Ohio workers’ compensation covers employees who are injured in the course of their employment, regardless of where the work occurs, as long as the employment relationship is valid. However, specific circumstances may depend on the terms outlined in the employment contract, such as an Ohio Contract with Employee to Work in a Foreign Country. It is advisable for employers to consult with legal experts for detailed coverage guidelines.

For a contract to be valid in Ohio, it must have an offer, acceptance, and consideration, among other legal requirements. When creating an Ohio Contract with Employee to Work in a Foreign Country, ensure that the terms are mutually agreed upon and clearly laid out. A valid contract minimizes misunderstandings and establishes clear expectations between the involved parties.

Yes, employment contracts are generally enforceable in Ohio, provided they meet certain legal criteria. When drafting an Ohio Contract with Employee to Work in a Foreign Country, it's essential to ensure that the contract includes clear terms, is signed by both parties, and complies with Ohio law. A well-structured contract can protect the rights of both the employer and the employee.

Ohio is not classified as a no-fault state for employment, meaning that most employment terminations can be contested under valid reasons. Employees may challenge their dismissals depending on the terms outlined in their contracts, such as an Ohio Contract with Employee to Work in a Foreign Country. Understanding the state's employment laws is crucial for both employers and employees.

Yes, a US company can legally employ someone in another country, but it must adhere to both US and international labor laws. When employing someone overseas, companies should consider creating an Ohio Contract with Employee to Work in a Foreign Country that complies with local laws and the details of the employment agreement. This approach helps in avoiding costly legal disputes.

In 2024, Ohio will implement several updates to employment laws, focusing on workplace safety and employee rights. Employers must ensure compliance with these new regulations, especially if drafting an Ohio Contract with Employee to Work in a Foreign Country. Consulting with legal experts may be beneficial to navigate these changes effectively.

Ohio workers' compensation costs are calculated based on your payroll, industry classification, and claims history. Each employer's rate may vary, taking into account factors such as the type of work performed and the risk associated with that work. If you have an Ohio Contract with Employee to Work in a Foreign Country, this calculation may also encompass considerations of overseas work and responsibilities. Knowing how these rates are structured helps you manage costs effectively.

time employee in Ohio generally works fewer than 40 hours per week, but the specific number may vary based on employer policies. Understanding this distinction is important, particularly when setting up an Ohio Contract with Employee to Work in a Foreign Country. Employers need to recognize parttime status to comply with benefit eligibility and obligations under federal and state law. This clarity ensures that you manage workloads and expectations effectively.

Ohio workers' compensation operates on a no-fault basis, meaning employees do not need to prove negligence to receive benefits. When an employee suffers a work-related injury, they may receive medical benefits, wage replacement, and rehabilitation services. If you have an Ohio Contract with Employee to Work in a Foreign Country, navigating your obligations and understanding benefits becomes crucial for your employees' well-being. This system is designed to protect you and your staff from financial hardship due to work-related injuries.