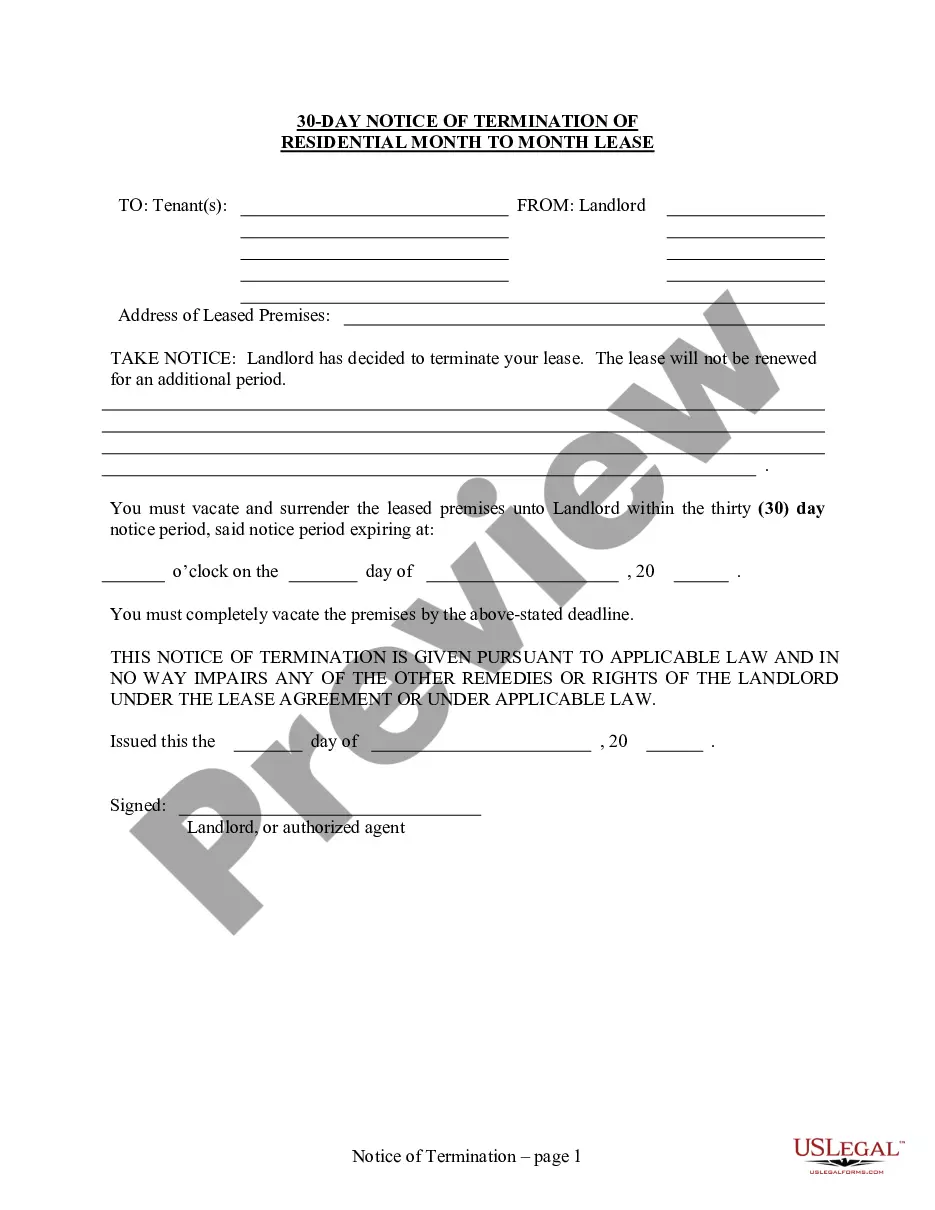

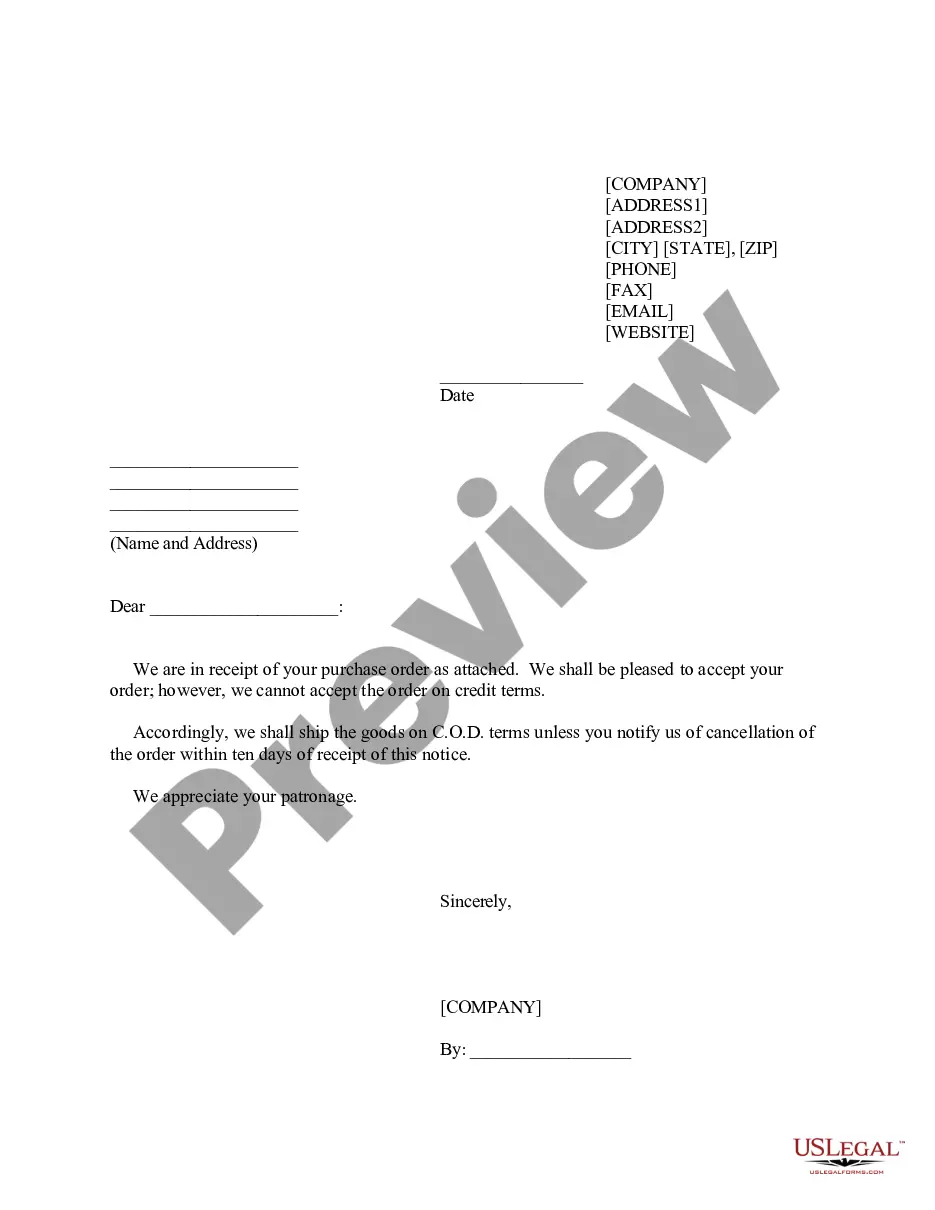

This form is a sample letter in Word format covering the subject matter of the title of the form.

Ohio Sample Letter for Exemption - Relevant Information

Description

How to fill out Sample Letter For Exemption - Relevant Information?

Are you in a circumstance where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of document templates, such as the Ohio Sample Letter for Exemption - Relevant Information, which are designed to comply with state and federal regulations.

Once you have obtained the correct document, click Acquire now.

Select the pricing plan you desire, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Sample Letter for Exemption - Relevant Information template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it corresponds to the appropriate city/region.

- Utilize the Review button to examine the document.

- Read the description to confirm that you have selected the correct document.

- If the document is not what you are looking for, use the Search field to find the document that suits your needs and requirements.

Form popularity

FAQ

To fill out a certificate of exemption, begin by entering your business information, including name and address, as well as the nature of the exemption. Next, clearly indicate the type of exempt sale or use and include any relevant identification numbers. An Ohio Sample Letter for Exemption - Relevant Information can serve as a helpful resource to assist you in correctly filling out the certificate.

Filling out a tax exemption form involves gathering necessary information about your organization or the specific transaction you wish to exempt. Clearly state the reason for the exemption, and provide supporting documents as required. Using an Ohio Sample Letter for Exemption - Relevant Information can guide you through the details to ensure accurate completion.

To apply for tax-exempt status in Ohio, start by completing the appropriate application forms, which may vary based on the type of exemption you seek. After filling out the forms, submit them to the Ohio Department of Taxation along with any required documentation. Utilizing an Ohio Sample Letter for Exemption - Relevant Information can make this process smoother and ensure that you meet all necessary requirements.

In Ohio, valid reasons for claiming tax exemption include being a nonprofit organization, religious institution, or educational entity. Additionally, certain sales may qualify for exemption based on specific uses, such as manufacturing or agricultural activities. Understanding these reasons is crucial, and you can find an Ohio Sample Letter for Exemption - Relevant Information to assist you in the process.

Status Indians may claim an exemption from paying the eight per cent Ontario component of the Harmonized Sales Tax (HST) on goods or services at the point of sale. A Certificate of Indian Status card or Temporary Confirmation of Registration document is requires in order to claim this point of sale exemption.

LETTER OF EXEMPTION. This Letter of Exemption certifies that federal credit unions are exempt from all taxes imposed by the United States or by any state, territorial, or local taxing authority, except for local real or personal property tax.

An exemption or resale certificate is a form or document issued by a business to ensure sales tax is not applied to their invoice when they intend to resell their purchase.

Visit IRS.gov to apply to become a tax-exempt organization. Also, contact the Ohio Department of Taxation and your county and local governments to determine how to apply for applicable exemptions. Register with the Ohio Attorney General's Office if entity is a charitable organization.

Tax-free basic personal amounts For the 2022 tax year, the federal basic personal amount is $14,398 (for taxpayers with a net income of $155,625 or less). This means that an individual Canadian taxpayer can earn up-to $14,398 in 2022 before paying any federal income tax.

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam.