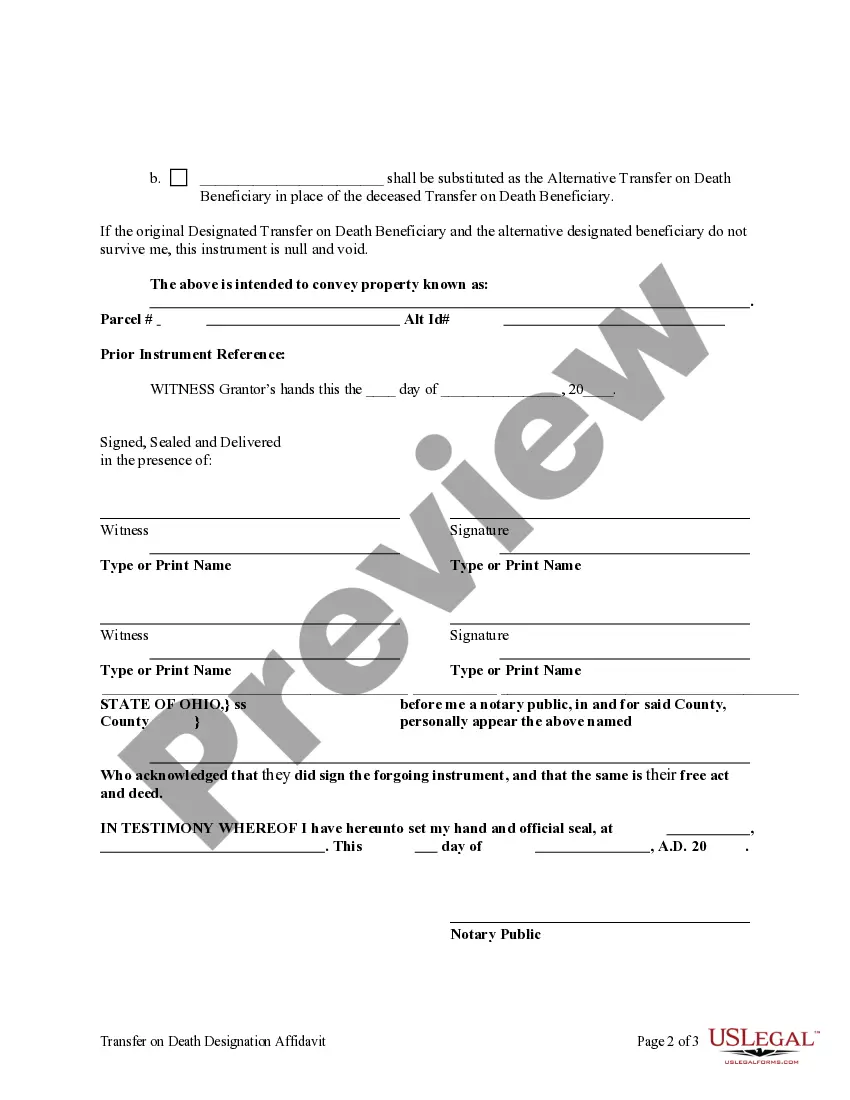

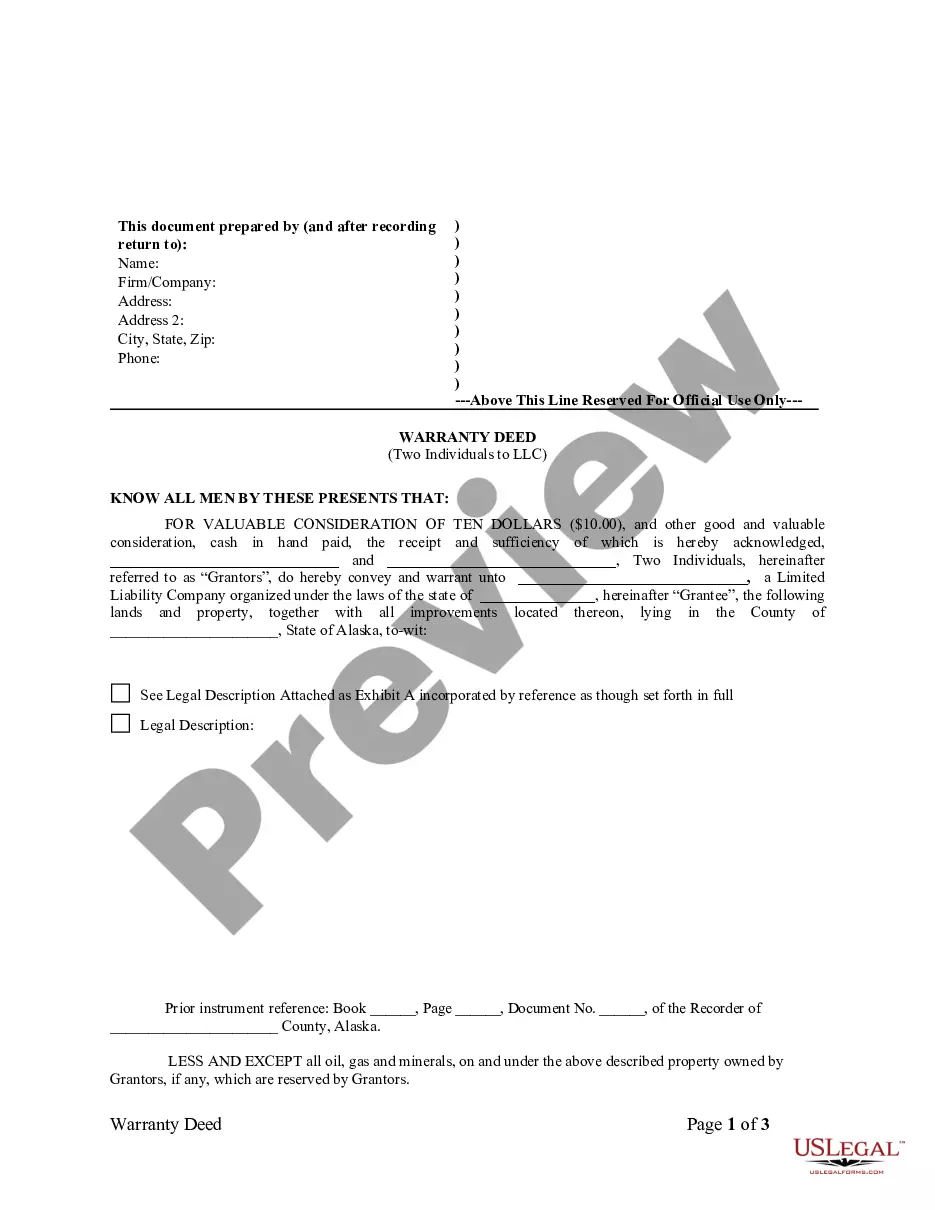

This form is a Transfer on Death Designation Affidavit where the affiants are husband and wife and the grantee is an individual. The transfer to the designated beneficiary is not effective until the death of both grantors. The affidavit may be canceled by designating a new transfer on death beneficiary in a new affidavit, selling the property, etc. This deed complies with all state statutory laws.

Ohio Transfer on Death Designation Affidavit - TOD from Husband and Wife to Individual

Description

Key Concepts & Definitions

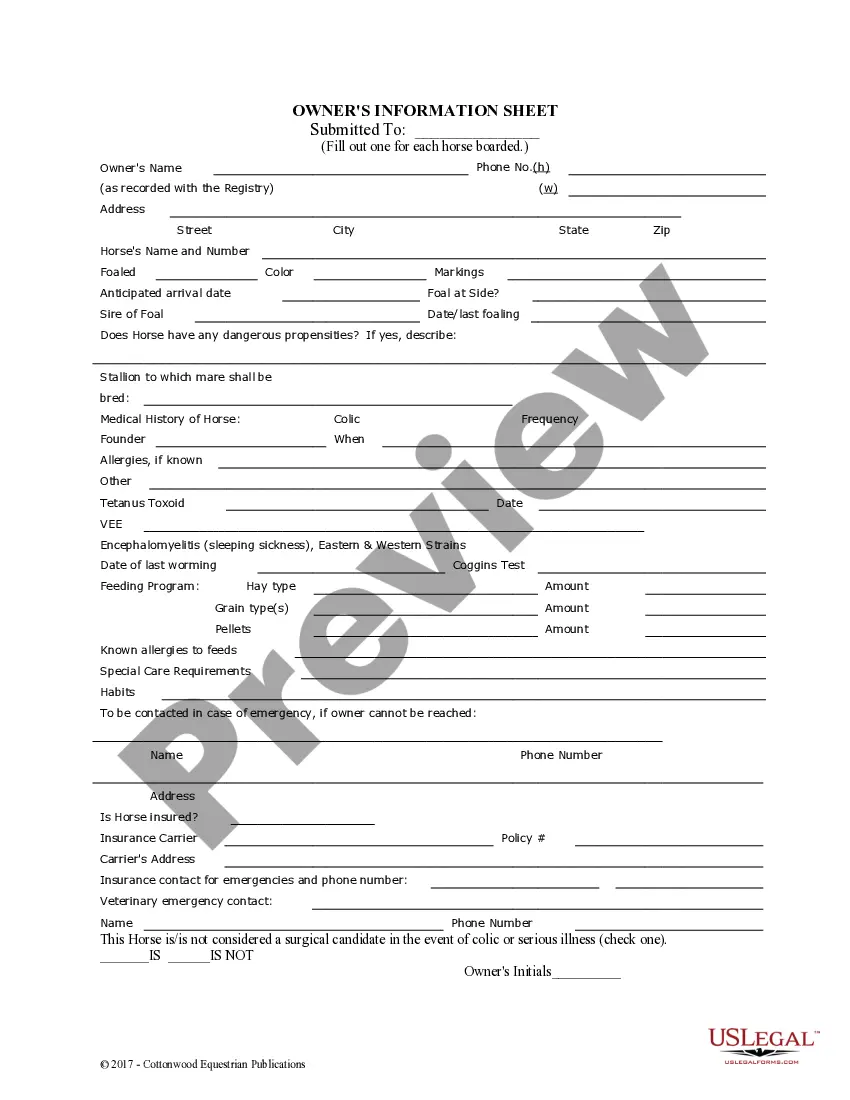

Transfer on Death Designation Affidavit (TOD): This legal document allows property owners to name a beneficiary who will receive their property automatically upon their death, without needing to go through probate. It is commonly used for transferring real estate and is filed with the county recorder in the property's county, such as Franklin County in the United States. County Recorder: The government official responsible for keeping land records including deeds, affidavits, and death designations. Real Property: Land and anything permanently affixed to it, such as buildings.

Step-by-Step Guide to Filing a TOD Affidavit

- Consult an attorney or the local Bar Association to understand legal requirements specific to your county, such as those in Franklin County.

- Obtain a Transfer on Death Designation Affidavit form from your county recorders office.

- Complete the form with details such as the property description and the beneficiarys information. Ensure accurate details to avoid future disputes.

- Sign the affidavit in the presence of a notary to validate the document.

- File the completed affidavit with the county recorder. There might be a filing fee based on the countys standard charges, e.g., as per Franklin County's regulations.

- Keep a copy of the recorded affidavit for your records and provide a copy to your designated beneficiary.

Risk Analysis

- Legal Errors: Incorrect filling out of forms or failure to update the affidavit can lead to invalidation.

- Challenges to the Will: TOD affidavits might face challenges if not properly coordinated with other estate planning documents.

- Property Disputes: If not clearly described, the real estate in question may lead to disputes among potential heirs or mistaken transfers.

Pros & Cons

- Pros: Avoids probate; simplifies the transfer of property; can be revoked or changed any time before the owners death.

- Cons: Might not be comprehensive as a will (does not cover personal property, for instance); may lead to disputes if not clearly communicated to all parties involved.

Common Mistakes & How to Avoid Them

- Failing to Update: Always keep TOD affidavits updated with current information and beneficiaries.

- Insufficient Documentation: Ensure all descriptions and legal terms are clear and precise.

- Not Consulting Legal Help: Professional guidance is crucial to avoid potential legal pitfalls.

FAQ

- Can a TOD affidavit be contested? Yes, like any legal document, it can be contested on various grounds such as improper execution or coercion.

- Is a TOD applicable to all types of property? It mainly applies to real property and in some cases, certain personal properties depending on state law.

- What happens if the beneficiary predeceases the owner? The property will become part of the estate and go through probate unless a contingent beneficiary is named.

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Husband And Wife To Individual?

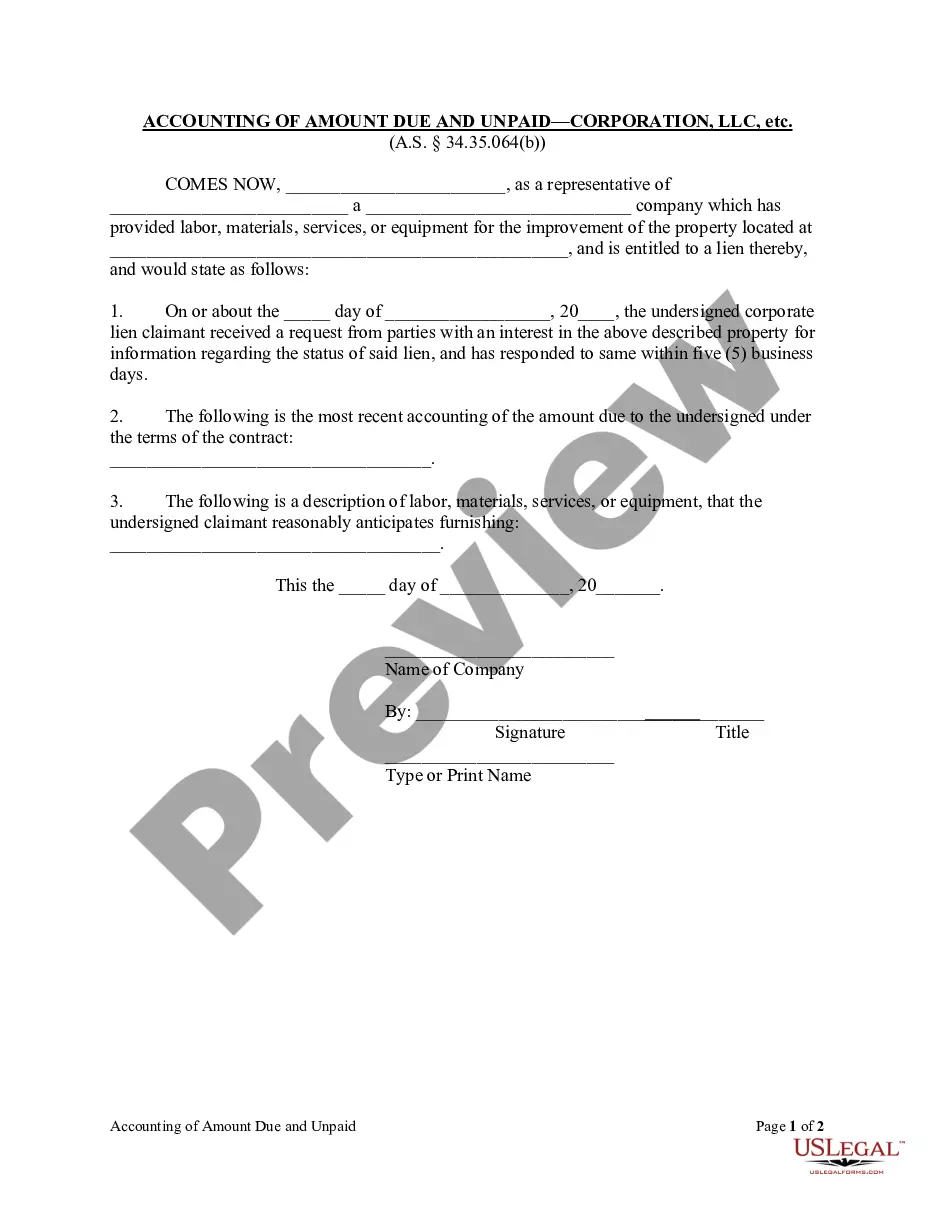

When it comes to submitting Ohio Transfer on Death Designation Affidavit - TOD from Husband and Wife to Individual, you probably think about a long process that requires finding a appropriate form among numerous very similar ones then needing to pay an attorney to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific template within just clicks.

For those who have a subscription, just log in and click Download to have the Ohio Transfer on Death Designation Affidavit - TOD from Husband and Wife to Individual form.

In the event you don’t have an account yet but want one, stick to the point-by-point guide listed below:

- Be sure the file you’re saving is valid in your state (or the state it’s needed in).

- Do this by reading through the form’s description and through clicking the Preview option (if readily available) to view the form’s content.

- Click Buy Now.

- Pick the suitable plan for your financial budget.

- Join an account and select how you want to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Skilled legal professionals work on creating our samples to ensure that after downloading, you don't have to worry about enhancing content outside of your individual information or your business’s details. Join US Legal Forms and receive your Ohio Transfer on Death Designation Affidavit - TOD from Husband and Wife to Individual sample now.

Form popularity

FAQ

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

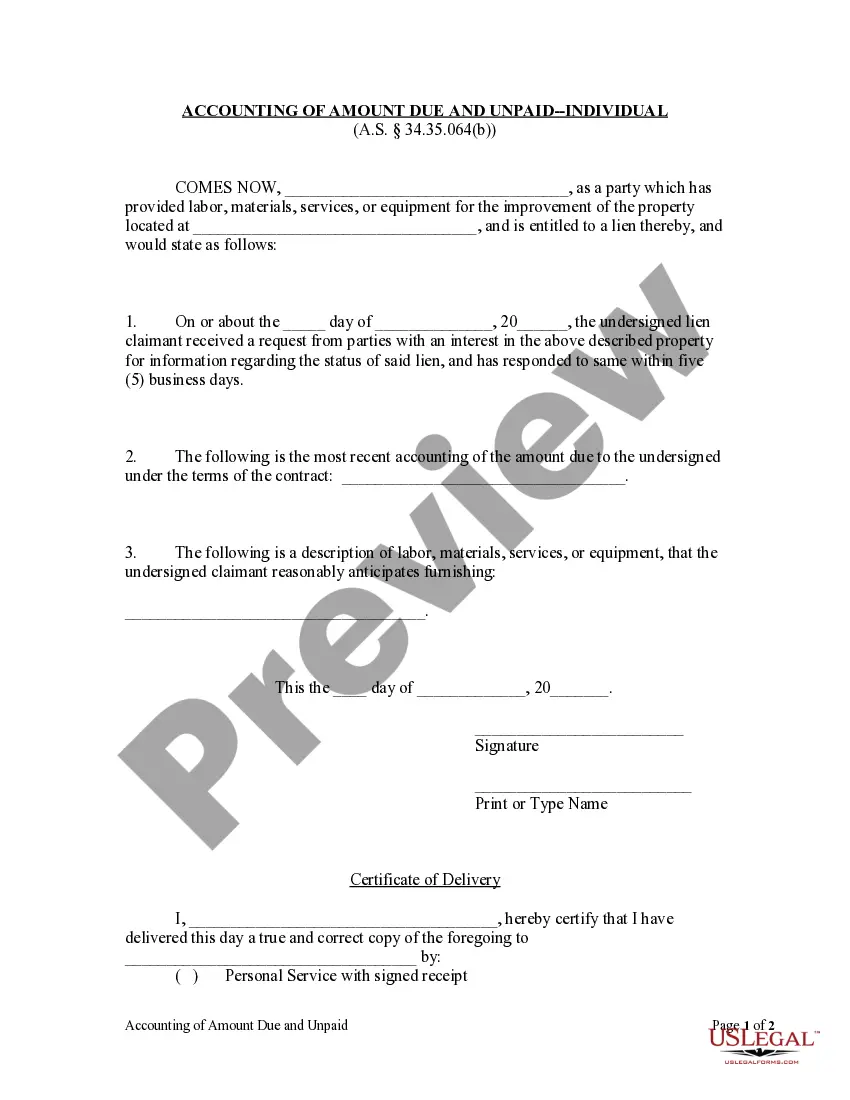

The amount that's in a TOD account at the time of your death is not taxable under federal law to the person who receives the account, although it may be taxable to your estate. If your beneficiary or the account are in a state with an inheritance tax, he may have to pay that.

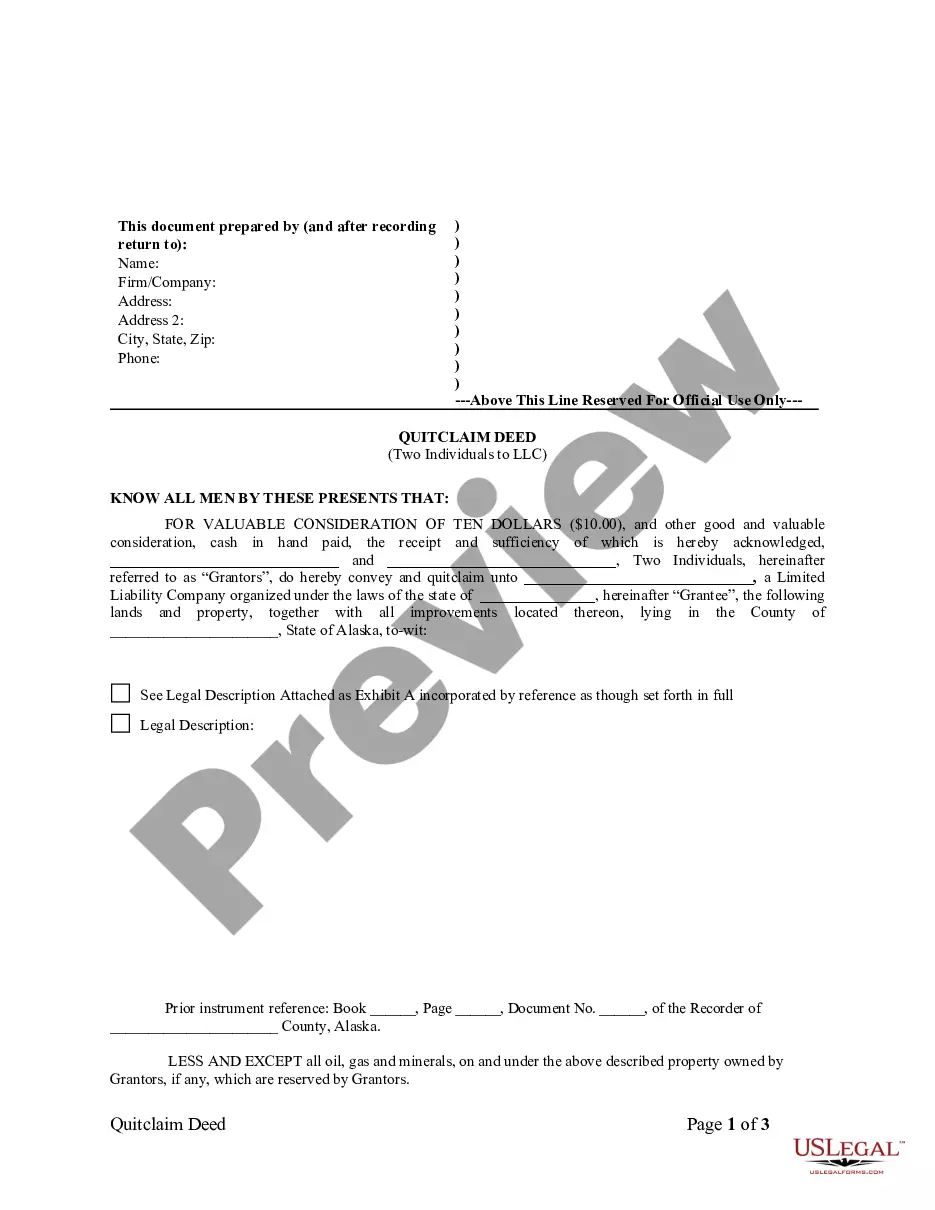

In Ohio, a Survivorship Deed is used to convey title to real estate to two or more people as joint tenants with rights of survivorship. Upon the death of an owner, the property passes to the surviving owner(s). A Survivorship Deed is commonly utilized to convey property to spouses.

If the deeds to the property are unregistered, it is possible to place a death certificate with the deeds, but it's advisable to register the title with the Land Registry at this point. Once this has been done, the property will then be registered in the name of the surviving joint owner.

A TOD Designation Affidavit is an effective upon death deed showing the clear intent of the owner of real property to directly transfer the ownership of the real property upon the owner's death to whomever the owner designates by name.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.

Survivorship Deeds contain special language that enables the property to transfer to the surviving owner(s) upon the deceased owner's death.A Transfer-On-Death Designation Affidavit allows the owner of Ohio real estate to designate one or more beneficiaries of the property.