New York Marketing of Production

Description

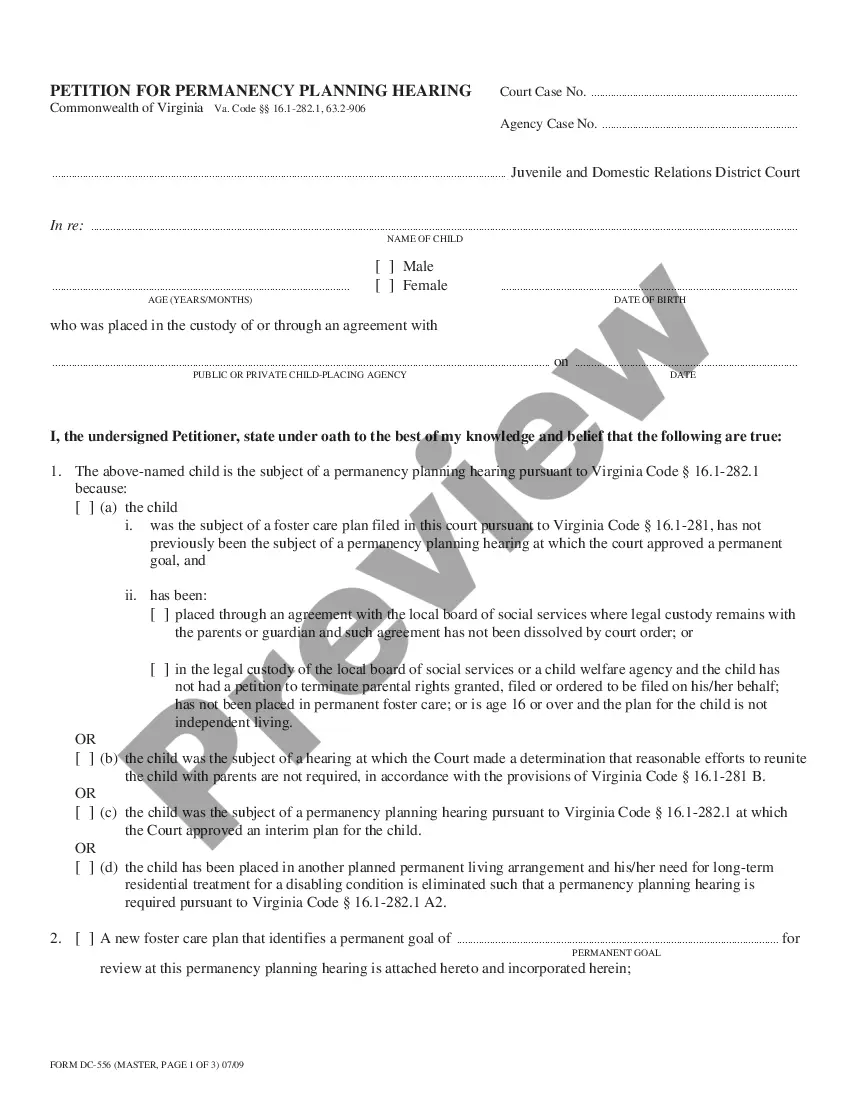

How to fill out Marketing Of Production?

Choosing the best lawful papers template can be quite a have difficulties. Needless to say, there are a variety of web templates accessible on the Internet, but how would you discover the lawful kind you require? Use the US Legal Forms site. The support offers 1000s of web templates, for example the New York Marketing of Production, that you can use for organization and private needs. Each of the varieties are examined by specialists and fulfill state and federal needs.

Should you be presently signed up, log in for your account and then click the Acquire button to have the New York Marketing of Production. Make use of your account to appear with the lawful varieties you may have acquired previously. Go to the My Forms tab of the account and have one more backup of the papers you require.

Should you be a whole new customer of US Legal Forms, here are simple recommendations for you to follow:

- First, make sure you have chosen the proper kind to your city/region. You are able to check out the form making use of the Review button and read the form description to ensure it is the best for you.

- When the kind will not fulfill your expectations, utilize the Seach discipline to discover the right kind.

- Once you are certain the form is proper, select the Get now button to have the kind.

- Choose the pricing program you would like and enter in the needed info. Create your account and purchase an order using your PayPal account or Visa or Mastercard.

- Choose the data file format and acquire the lawful papers template for your gadget.

- Comprehensive, change and printing and sign the acquired New York Marketing of Production.

US Legal Forms will be the most significant library of lawful varieties in which you will find numerous papers web templates. Use the service to acquire professionally-produced files that follow status needs.

Form popularity

FAQ

Here is the step-by-step process you need to follow to form a Limited Liability Company in New York. Select a Business Name. ... Appoint a New York Registered Agent. ... Create an LLC Operating Agreement. ... Publish a Notice in 2 Local Newspapers. ... Open a Business Bank Account. ... Choose Your Tax Structure. ... Get a Website (Optional)

Follow these 6 easy steps: Name Your LLC. Choose a Registered Agent. File the NY Articles of Organization. Follow Publication Requirements. Create an Operating Agreement. Get an EIN.

Vendors selling taxable goods and services must register Sales of tangible personal property are subject to New York sales tax unless they are specifically exempt. Sales of services are generally exempt from New York sales tax unless they are specifically taxable.

Companies producing a qualified musical and theatrical production in a Level 1 qualified New York City production facility can receive tax credits of 25 percent of qualified production expenditures up to $3 million per production.

How to Start a corporation in New York Choose a name for your business. ... Designate a Registered Agent in New York. ... File Your Certificate of Incorporation in New York. ... Create your Corporate Bylaws. ... Appoint your Corporate Directors. ... Hold the First Meeting of the Board of Directors. ... Authorize the issuance of shares of stock.

Mail filings: In total, mail filing approvals for New York LLCs take 8 1/2 months. This accounts for the 8 month processing time, plus the time your documents are in the mail. Online filings: Online filings for New York LLCs are approved immediately if you file your documents during business hours.

In New York, both single-member LLCs and multi-member LLCs are typically required to pay an annual filing fee. The amount of filing fee you are required to pay depends on the gross income of your LLC that comes from New York in the previous tax year. The fee can vary from $25 to $4,500.

In order to actually form your LLC, you'll have to file Articles of Organization (Form 1336-f). The articles are what officially register your LLC with the state, and the New York LLC filing fee is paid when you file these articles. The filing fee is $200, and there is no way to reduce it.