New York Cease and Desist for Debt Collectors

Description

How to fill out Cease And Desist For Debt Collectors?

If you wish to finalize, retrieve, or create legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for commercial and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify and print or sign the New York Cease and Desist for Debt Collectors. Every legal document template you obtain is yours indefinitely. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again. Be proactive and download, and print the New York Cease and Desist for Debt Collectors with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your personal or business needs.

- Utilize US Legal Forms to acquire the New York Cease and Desist for Debt Collectors in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Obtain button to get the New York Cease and Desist for Debt Collectors.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

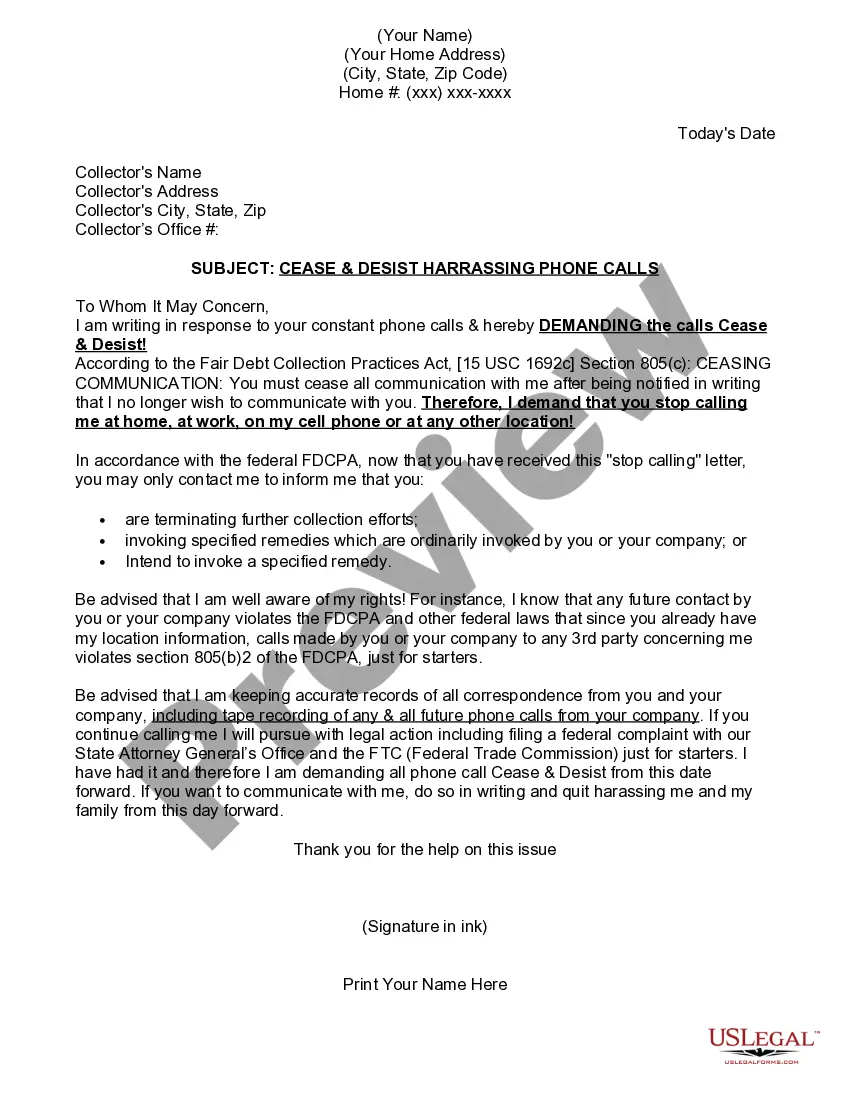

Yes, you can instruct a debt collector to cease and desist from contacting you. Once you send a New York Cease and Desist for Debt Collectors letter, the collector is legally obligated to stop all communication. This action can protect you from harassment and unwanted calls. Utilizing services such as US Legal Forms can streamline the process and ensure your rights are upheld.

Yes, you can write a cease and desist letter to a debt collector. This letter formally requests that the collector stop all communication regarding the debt. Using a New York Cease and Desist for Debt Collectors template can help you draft a clear and effective letter. Platforms like US Legal Forms provide accessible resources to guide you in creating a legally sound letter.

Yes, you can send a cease and desist letter to a debt collector at any time. This New York Cease and Desist for Debt Collectors letter stops them from contacting you. You can easily create a customized letter using platforms like US Legal Forms, which provides the necessary templates and guidance. Sending this letter empowers you to take control of your situation and reduces unwanted communication.

The 777 rule provides guidelines on how debt collectors must conduct themselves. Specifically, it refers to the timing and frequency of their communications. Under this rule, collectors must avoid harassing you by limiting the number of contacts and respecting your request for a New York Cease and Desist for Debt Collectors. Understanding this rule helps you establish your rights and protect yourself from aggressive collection tactics.

Yes, a debt collector can cease and desist from contacting you once you send a proper New York Cease and Desist for Debt Collectors letter. This letter informs the collector that you do not wish to be contacted further. After receiving your request, the collector must comply and stop all communication. However, this does not erase your debt; it simply limits how the collector can pursue you.

In New York, a debt typically becomes uncollectible after six years. This period begins from the date of the last payment or acknowledgment of the debt. Once this timeframe passes, a debt collector can no longer legally pursue you for payment. If you are facing aggressive collection efforts, consider using a New York Cease and Desist for Debt Collectors to protect your rights and stop unwanted communications.

A 609 letter is a request for verification of a debt under the Fair Credit Reporting Act. You can use this letter to ask the debt collector for proof that you owe the debt they claim. Including this letter in your strategy can complement your actions under New York Cease and Desist for Debt Collectors, ensuring you are fully informed about your debts.

Yes, cease and desist letters can be effective in stopping debt collectors from contacting you. Once the collector receives your letter, they are legally required to cease communication unless they have legal grounds to pursue the debt further. This process is part of the protective measures available under New York Cease and Desist for Debt Collectors, giving you peace of mind.

When writing a cease and desist letter to a debt collector, start with your contact information and date. Next, clearly state your request for them to stop contacting you and reference any relevant laws. You can find templates on platforms like US Legal Forms, which offer tools specifically designed for New York Cease and Desist for Debt Collectors.

The 11-word phrase often used to stop debt collectors is, 'I do not wish to communicate with you regarding this debt.' This clear statement informs the collector of your desire to cease all communication. Utilizing this phrase is part of the broader strategy of New York Cease and Desist for Debt Collectors, helping you gain control over the situation.