New York Self-Employed Awning Services Contract

Description

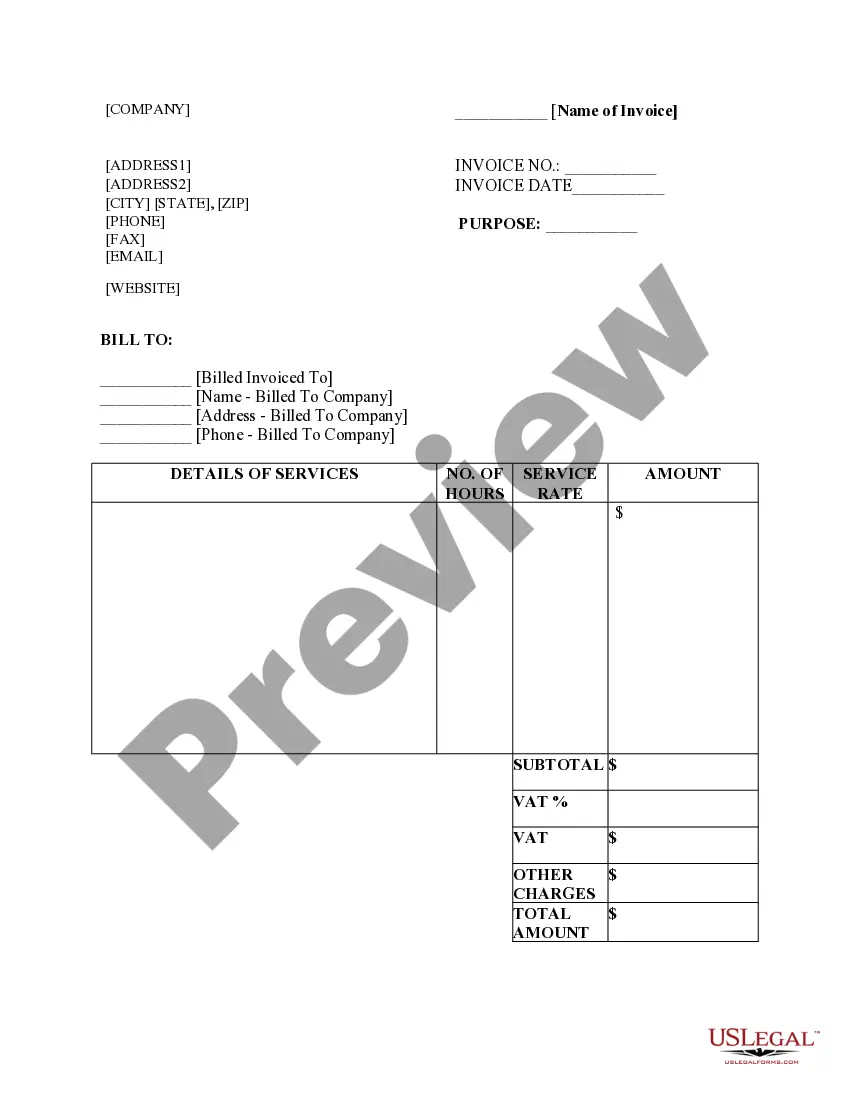

How to fill out Self-Employed Awning Services Contract?

Finding the appropriate legitimate document template can be a challenge. Obviously, there are numerous templates available online, but how can you obtain the official form you need? Utilize the US Legal Forms website. The service offers a plethora of templates, including the New York Self-Employed Awning Services Contract, which you can use for both business and personal purposes. All of the documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to access the New York Self-Employed Awning Services Contract. Use your account to browse through the legal templates you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your area/county. You can review the form using the Review button and read the form description to confirm this is the right one for you. If the form does not meet your requirements, utilize the Search section to find the appropriate form. Once you are confident that the form is suitable, click on the Get now button to retrieve the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete a purchase using your PayPal account or credit card. Select the submission format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired New York Self-Employed Awning Services Contract.

Overall, US Legal Forms provides a comprehensive solution for obtaining legally compliant documents tailored to your needs.

- US Legal Forms is the largest repository of legal templates where you can find a variety of document designs.

- Utilize the service to download properly crafted files that comply with state regulations.

- The templates are carefully vetted by professionals to ensure accuracy.

- A user-friendly interface makes it simple to navigate through the available forms.

- Access to previously purchased documents is easy through your account.

- The service offers flexibility in payment methods for your convenience.

Form popularity

FAQ

In New York City, you usually need a permit to put an awning on your property. This requirement helps ensure that the awning is safe and compliant with city standards. When considering a New York Self-Employed Awning Services Contract, make sure to discuss permit acquisition with your contractor to avoid any legal issues.

Yes, you can install an awning on your house, but you will typically need a permit to do so. This installation can enhance your outdoor space while providing shade and protection. If you're pursuing a New York Self-Employed Awning Services Contract, ensure that your contractor is familiar with the necessary regulations for home installations.

Yes, in most cases, a gazebo requires a permit in New York City. This requirement ensures that the structure meets zoning and safety regulations. If you're looking to include a gazebo in your plans, consider a New York Self-Employed Awning Services Contract to navigate the permit process efficiently.

Yes, a retractable awning usually requires a permit in New York City, as it is considered a permanent structure. This regulation helps ensure safety and compliance with city codes. When entering a New York Self-Employed Awning Services Contract, confirm that your contractor is aware of the permit requirements for retractable awnings.

Homeowners in NYC can make minor alterations or repairs without a permit, including replacing an existing awning. However, significant changes or new installations typically require a permit. If you're considering a New York Self-Employed Awning Services Contract, it's essential to clarify what is permissible without a permit.

Generally, you will need planning permission for an awning in NYC if it is attached to a building. This process helps maintain the aesthetic and structural integrity of the neighborhood. For those entering a New York Self-Employed Awning Services Contract, understanding the planning permission process is crucial for a successful installation.

Yes, in most cases, you do need a permit for an awning in New York City. This requirement ensures that the awning meets safety and design standards. If you're considering a New York Self-Employed Awning Services Contract, it's wise to check with your local authorities regarding specific permit requirements.

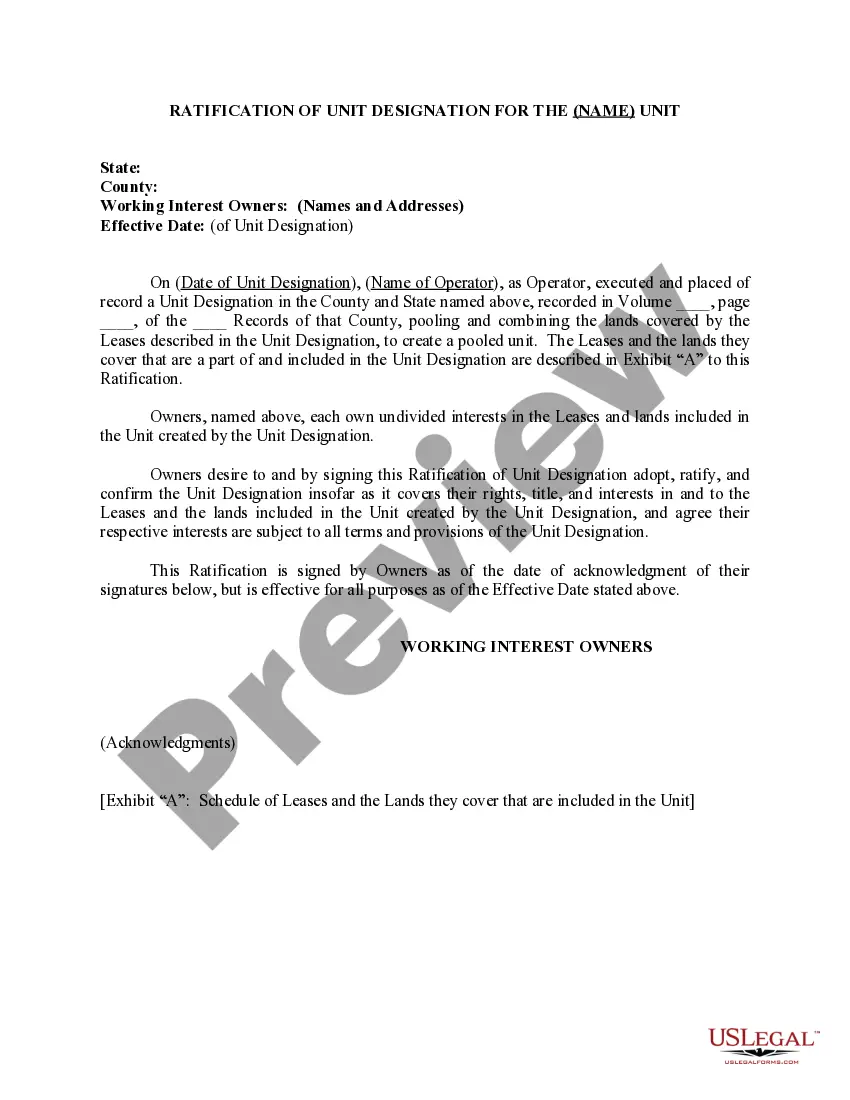

New York does not require a contractor's license for all types of contracting work, but specific trades may have licensing requirements. For awning services, it is crucial to comply with local regulations and obtain any necessary permits. Utilizing a New York Self-Employed Awning Services Contract can help clarify your obligations and protect both you and your clients. Always stay informed about local laws to ensure you are operating legally.

To establish yourself as an independent contractor, start by defining your services and target market. Create a comprehensive New York Self-Employed Awning Services Contract that outlines your offerings, payment terms, and responsibilities. Building a portfolio and networking with potential clients can also enhance your visibility and credibility. Consider registering your business and obtaining any necessary permits to operate legally.

In New York, you can work as a contractor without a license for certain jobs, but this does not apply to all services. If you provide awning services, it's essential to understand the local regulations and requirements. While you may operate without a license initially, having a proper New York Self-Employed Awning Services Contract can help you establish credibility and protect your interests. Always check local laws to ensure compliance.