New York Private Investigator Agreement - Self-Employed Independent Contractor

Description

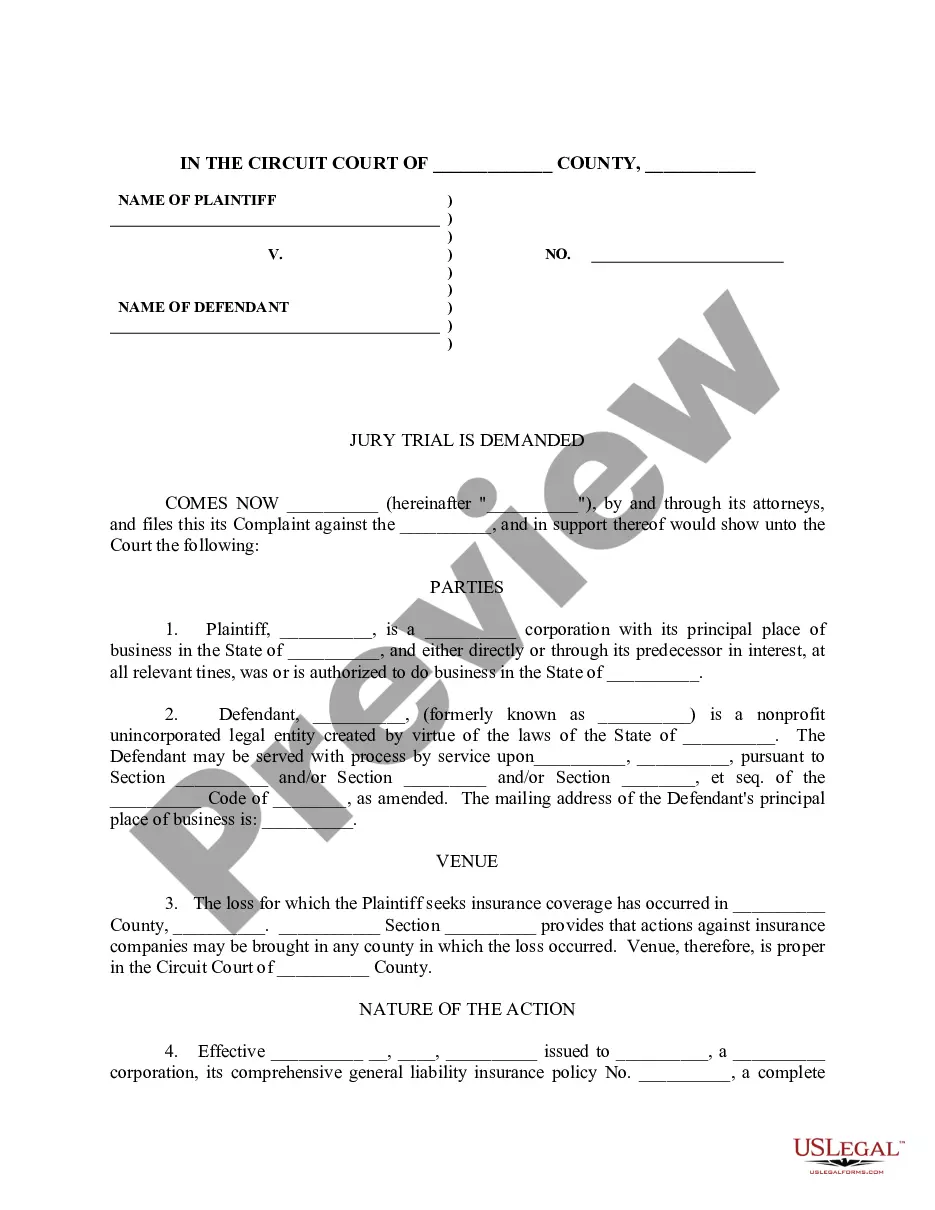

How to fill out Private Investigator Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or create.

By utilizing the website, you can obtain thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms such as the New York Private Investigator Agreement - Self-Employed Independent Contractor within seconds.

If you already possess a membership, Log In to download the New York Private Investigator Agreement - Self-Employed Independent Contractor from the US Legal Forms database. The Download button will appear on every form you view. You can access all previously saved forms within the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved New York Private Investigator Agreement - Self-Employed Independent Contractor. Each template you add to your account does not have an expiration date and belongs to you permanently. Thus, if you want to download or print another copy, just navigate to the My documents section and click on the form you need. Access the New York Private Investigator Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive library of legal document templates. Utilize a plethora of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Firstly, ensure you have selected the appropriate form for your city/state.

- Click the Review button to examine the form's content.

- Read the form description to confirm that you have picked the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, validate your selection by clicking the Purchase now button.

- Then choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

Some 1099 workers only work on one project at a time, but many serve multiple clients, providing a service within their expertise. Independent contractors, such as freelancers and consultants, are self-employed, so they're business owners themselves.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.