New York Framework Contractor Agreement - Self-Employed

Description

How to fill out Framework Contractor Agreement - Self-Employed?

You can invest hours online looking for the valid document template that meets the state and federal requirements you need. US Legal Forms offers numerous legal forms that are vetted by professionals.

You can easily download or print the New York Framework Contractor Agreement - Self-Employed from this service. If you already have a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, edit, print, or sign the New York Framework Contractor Agreement - Self-Employed.

Every legal document template you purchase is yours permanently. To obtain another copy of the purchased form, go to the My documents tab and click the corresponding option. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the area/city of your choice. Read the form details to confirm you have chosen the right form. If available, utilize the Preview option to review the document template as well.

Utilize professional and state-specific templates to address your business or personal needs.

- If you want to find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- Once you have found the template you desire, click Get now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Select the format of the document and download it to your device.

- Make adjustments to your document if needed. You can complete, edit, sign, and print the New York Framework Contractor Agreement - Self-Employed.

- Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms.

Form popularity

FAQ

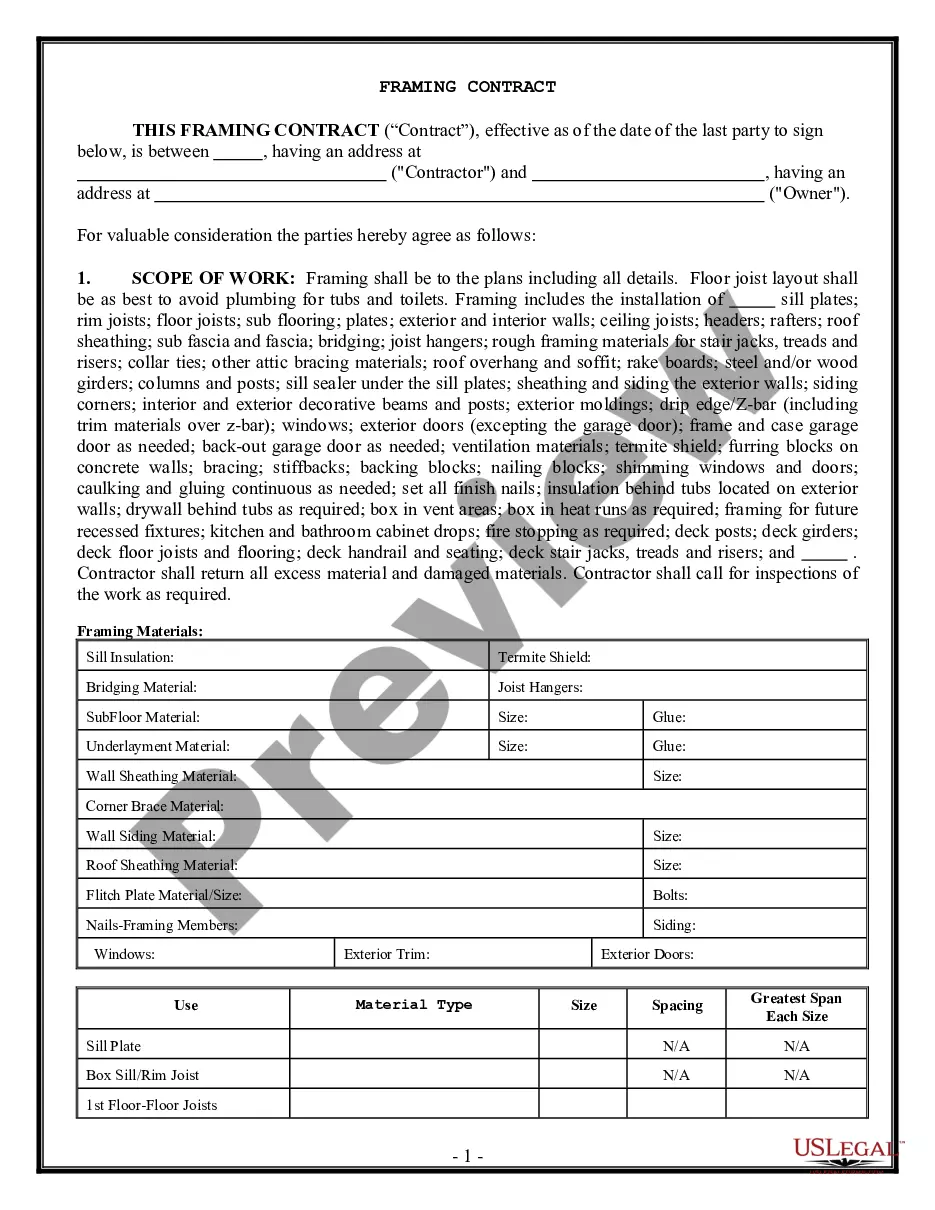

To write an independent contractor agreement, start with a title, such as the New York Framework Contractor Agreement - Self-Employed, for clarity. Clearly define the parties involved, the nature of the work, and compensation details. Also, include important terms such as confidentiality and dispute resolution. By following this structure, you can create a comprehensive agreement that protects everyone's interests.

Filling out an independent contractor form is straightforward. Begin by entering your name and contact details, followed by the client's information. Specify the nature of the services you will provide, as well as the payment structure. By using the New York Framework Contractor Agreement - Self-Employed template, you can streamline this process and ensure you cover all essential elements.

Yes, you can be self-employed and have a contract. In fact, having a contract is essential for self-employed individuals as it defines the relationship between you and your clients. The New York Framework Contractor Agreement - Self-Employed clarifies expectations and protects both parties. This allows you to work flexibly while establishing the terms of your services.

Filling out an independent contractor agreement, specifically the New York Framework Contractor Agreement - Self-Employed, involves several steps. Start by providing the general details, such as your name, contact information, and the client's information. Next, outline the scope of work and payment terms clearly to avoid misunderstandings. Lastly, ensure both parties sign the agreement to confirm acceptance of the terms outlined.

In New York State, the primary difference between an independent contractor and an employee lies in control and independence. An independent contractor operates their business with greater autonomy, while an employee follows directives set by their employer. Understanding this distinction is vital for compliance with labor laws and for drafting a clear New York Framework Contractor Agreement - Self-Employed. This clarity can prevent legal misunderstandings and ensure proper classification.

To create an independent contractor agreement, start by outlining the scope of work, payment terms, and deadlines. It's essential to include clauses that detail confidentiality, ownership of work, and termination conditions. Using the New York Framework Contractor Agreement - Self-Employed from uslegalforms can streamline this process, ensuring you include all necessary components. This thorough approach helps protect both parties involved.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

It is important to understand that there is a massive difference between 1099 Independent Contractors and W-2 employment on contract basis, who we often refer to simply as contractors. Independent Contractors are truly independent. No one is paying the employer share of taxes such as Social Security and Medicare.