New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

It's feasible to invest time online seeking the valid document template that meets your state and federal standards.

US Legal Forms offers a vast array of legitimate forms that have been reviewed by professionals.

You can conveniently obtain or create the New York Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP through our services.

First, ensure that you have selected the correct document template for the area/town of your choice. Review the template description to confirm you have chosen the right one. If available, utilize the Review button to preview the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- Every legal document template you purchase is yours indefinitely.

- To acquire another copy of any purchased template, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

RMA stands for Request for Mortgage Assistance, a crucial document used in the loan modification process. This document allows homeowners to present their financial difficulties to lenders, paving the way for modifications. If you are submitting a New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, the RMA is an essential component of your application. It helps streamline communication and defines your needs to the lender clearly.

A mortgage loan modification can be a wise choice, especially if you are struggling to meet your current payments. It allows you to adjust your loan terms to create a more manageable financial situation. When considering a New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, think about the long-term benefits it could bring. It's important to evaluate your situation thoroughly and seek advice to determine if this path is suitable for you.

A HAMP loan modification adjusts the terms of your mortgage to make it more affordable based on your financial situation. It often includes lowering your interest rate or extending your loan term. By submitting a New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you can take the first step toward improving your circumstances. This modification aims to prevent foreclosure and help you maintain your home securely.

As of 2025, HAMP is no longer active, but alternatives remain for those seeking mortgage modification. While HAMP provided significant assistance, you can still explore different programs and options that may offer relief. You can initiate a New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP today, as many lenders offer their own versions of support to help you navigate financial challenges. Investigating your alternatives is key to finding the right path.

HAMP stands for the Home Affordable Modification Program, a federal initiative designed to assist homeowners facing financial difficulties. It provides options for modifying mortgage loans to prevent foreclosure. If you're considering a New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you may find it offers solutions to stay in your home while managing your payments effectively. This program focuses on creating sustainable solutions for troubled homeowners.

A HAMP modification refers to a change made to your mortgage terms under the Home Affordable Modification Program. This program helps homeowners who are struggling to make their mortgage payments. Through a New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you can potentially reduce your monthly payment or lower your interest rate. This approach aims to make your mortgage more affordable and within reach.

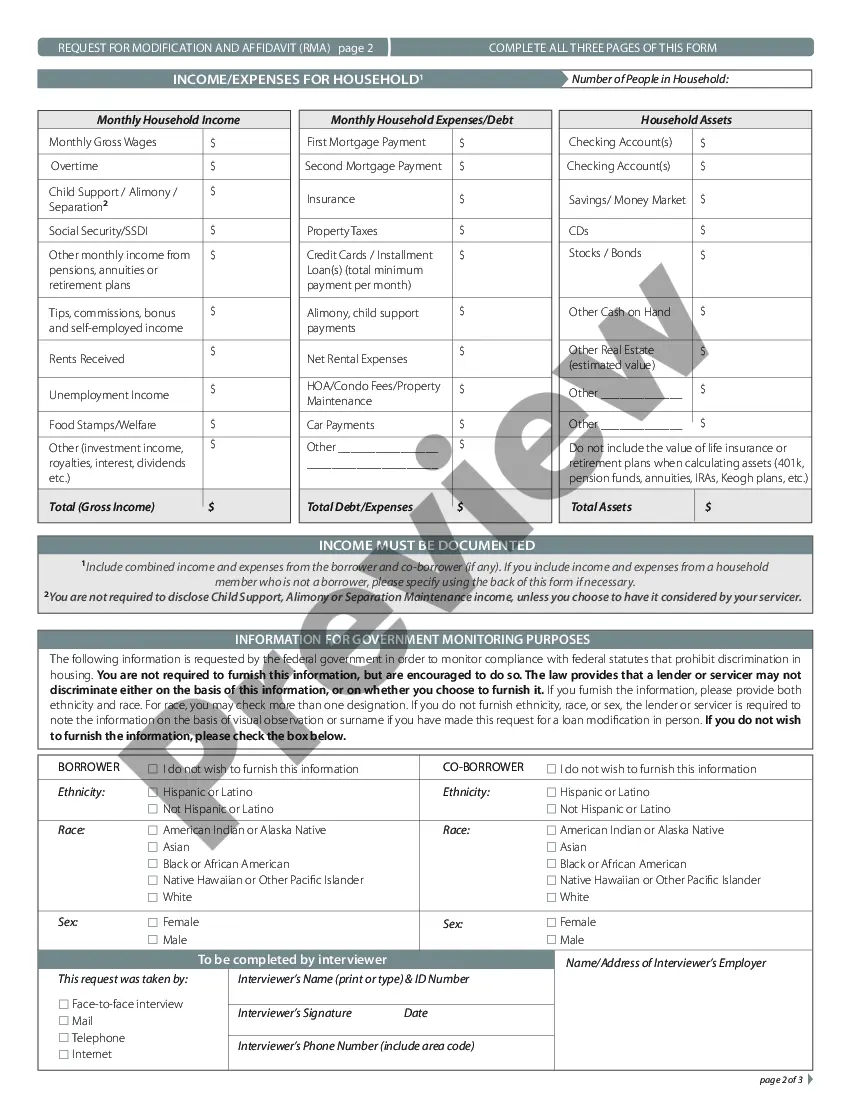

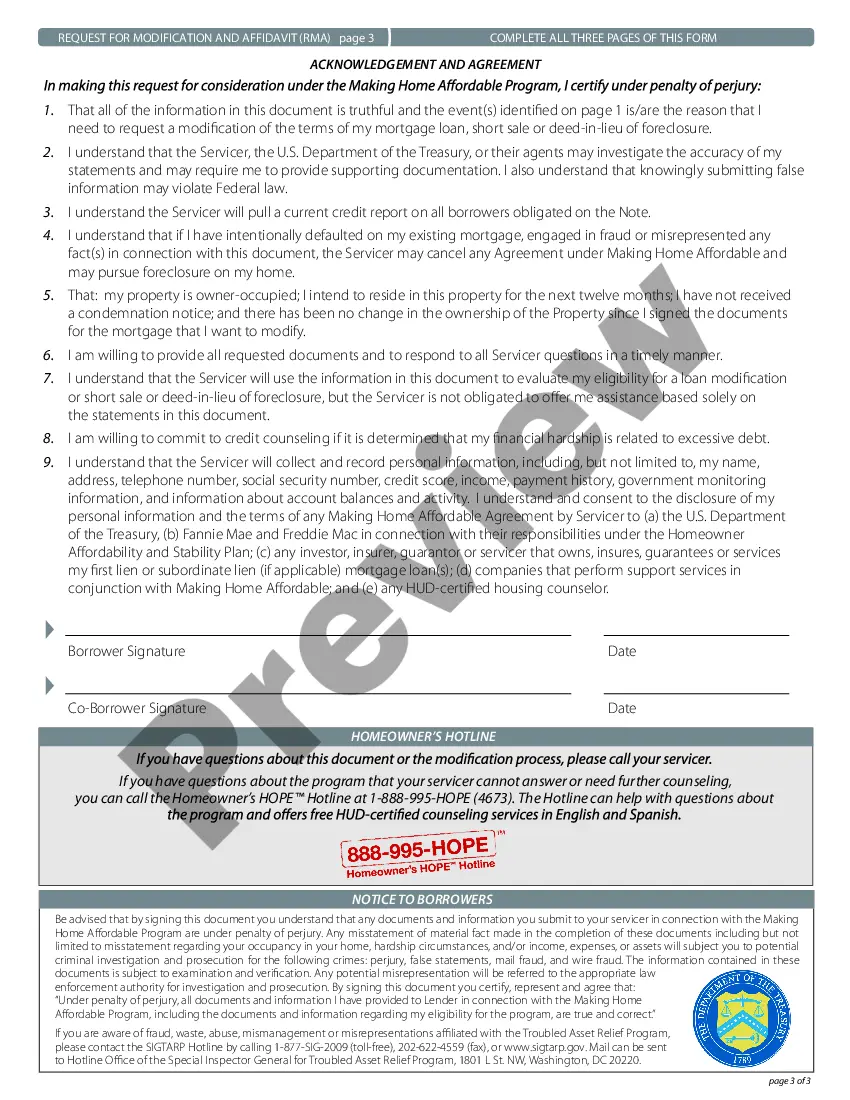

To apply for a loan modification under the New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you need to gather essential financial documents, such as proof of income and tax returns. Next, access the official program application forms either through your lender or the ulegalforms platform, which can simplify the process. Fill out the application accurately, ensuring you meet all the eligibility criteria, then submit it to your lender. Following submission, be prepared to communicate with your lender for updates and additional information.

The HAMP loan modification program, or Home Affordable Modification Program, aims to help homeowners avoid foreclosure by providing a way to lower their mortgage payments. By submitting a New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, eligible borrowers can have their monthly payments adjusted based on their income and current financial situation. This program benefits those who find themselves in financial hardship and helps maintain homeownership.

In the context of mortgages, RMA stands for Request for Mortgage Assistance. This term is often associated with the New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. This request allows homeowners to seek assistance in modifying their loans, particularly in situations where they are struggling to keep up with mortgage payments due to financial distress.

The process of making a loan modification involves several key steps, starting with submitting a formal request for a New York Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. After your request, the loan servicer will review your financial documents, assess your eligibility, and offer a modified mortgage plan. Throughout this process, communication with your servicer is crucial, as they will provide updates and additional requirements.