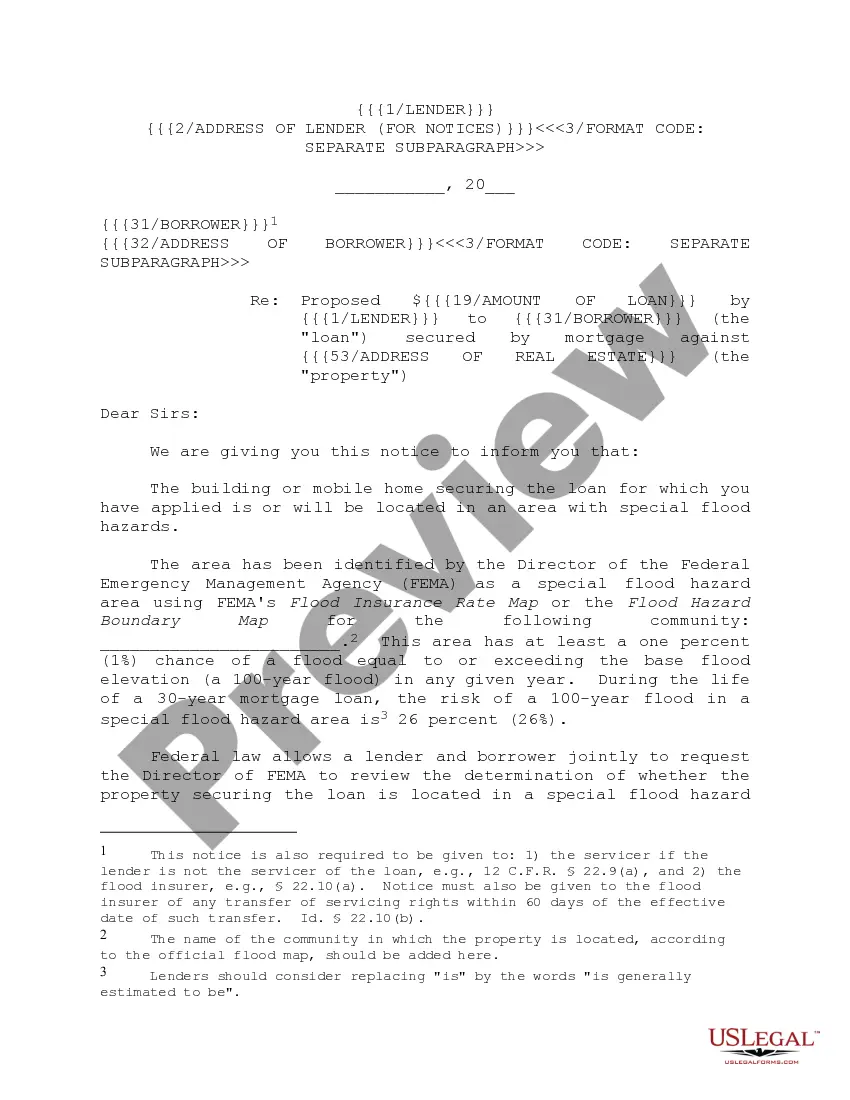

"Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance" is a American Lawyer Media form. This form servesnotice to special hazards availability of Federal Disaster Relief Assistance.

New York Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance

Description

How to fill out Notice Of Special Flood Hazards Availability Of Federal Disaster Relief Assistance?

It is possible to devote hours on the web looking for the legal file web template that meets the federal and state needs you require. US Legal Forms provides thousands of legal types which are evaluated by professionals. It is simple to acquire or print out the New York Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance from your assistance.

If you already have a US Legal Forms profile, you are able to log in and click the Download option. After that, you are able to full, edit, print out, or sign the New York Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance. Each legal file web template you get is your own property for a long time. To acquire one more backup associated with a obtained type, go to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms internet site initially, stick to the easy directions below:

- Initially, ensure that you have selected the right file web template to the region/area of your liking. Browse the type information to ensure you have chosen the correct type. If available, take advantage of the Review option to look through the file web template as well.

- If you would like get one more variation of your type, take advantage of the Search discipline to obtain the web template that fits your needs and needs.

- Upon having identified the web template you would like, simply click Buy now to proceed.

- Pick the costs strategy you would like, enter your credentials, and sign up for your account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal profile to purchase the legal type.

- Pick the file format of your file and acquire it in your product.

- Make modifications in your file if required. It is possible to full, edit and sign and print out New York Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance.

Download and print out thousands of file web templates using the US Legal Forms website, that offers the most important assortment of legal types. Use professional and express-certain web templates to tackle your organization or specific requires.

Form popularity

FAQ

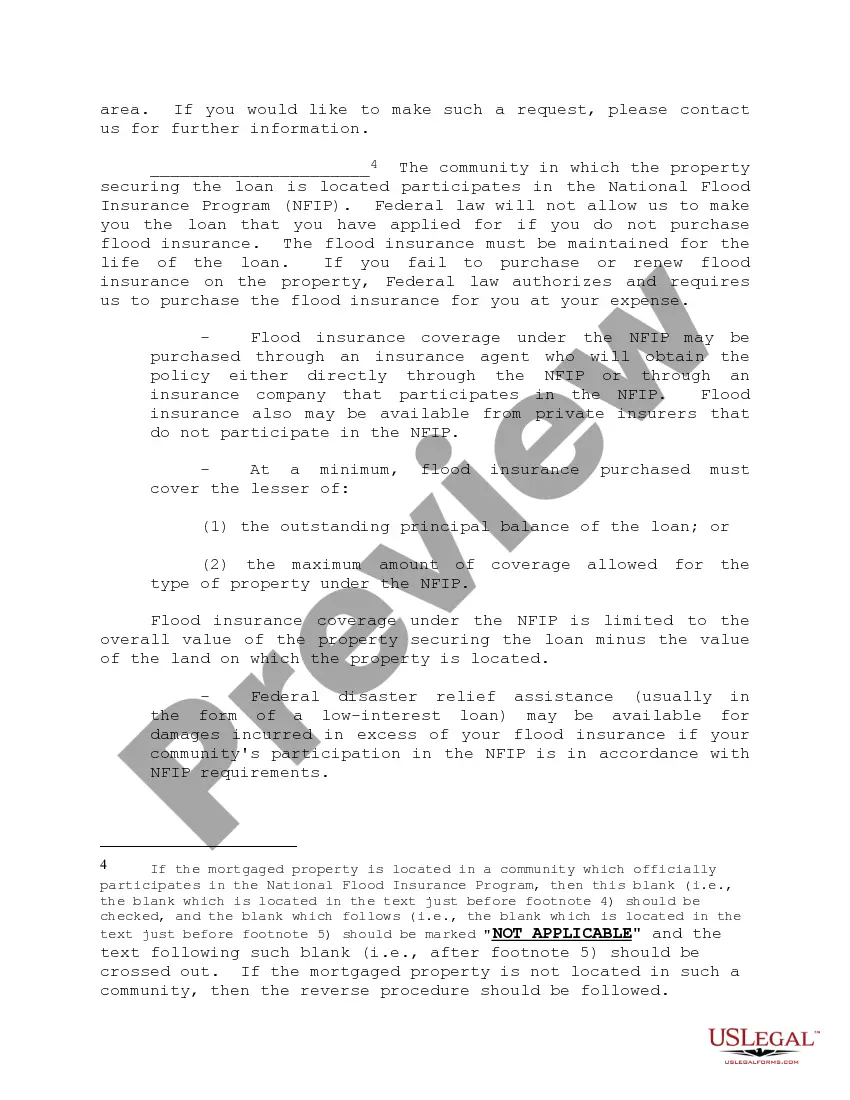

Flood insurance will be required if the home equity loan is secured by a building or mobile home located, or to be located, in an Special Flood Hazard Area (SFHA) in which flood insurance is available under the National Flood Insurance Act.

Designated loan means a loan secured by a building or mobile home that is located or to be located in a special flood hazard area in which flood insurance is available under the Act.

Before making a loan secured by a residential or nonresidential building or mobile home, a federally regulated lending institution must determine whether the structure is located, or will be located, in an SFHA for which flood insurance is available under the NFIP.

The FDPA requires federal financial regulatory agencies to adopt regulations prohibiting their regulated lending institutions from making, increasing, extending or renewing a loan secured by improved real estate or a mobile home located or to be located in an SFHA in a community participating in the NFIP unless the ...

The intended purpose of the loan, as opposed to the collateral, is the critical factor in the applicability of the flood insurance rules. Institutions may charge a fee for life-of-loan monitoring.

The minimum amount of flood insurance required must be at least equal to the lesser of the outstanding principal balance of the loan, the maximum amount available under the NFIP for the type of structure, or the insurable value of the property.

(1) A warning, in a form approved by the Administrator of FEMA, that the building or the mobile home is or will be located in a special flood hazard area; (2) A description of the flood insurance purchase requirements set forth in section 102(b) of the Flood Disaster Protection Act of 1973, as amended (42 U.S.C.