Are you presently inside a situation the place you need to have files for sometimes organization or personal uses virtually every day time? There are tons of legal document templates accessible on the Internet, but discovering kinds you can rely on isn`t straightforward. US Legal Forms provides 1000s of develop templates, such as the New York How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACTA Red Flags Rule, which can be composed in order to meet federal and state specifications.

When you are currently familiar with US Legal Forms internet site and get a free account, simply log in. After that, it is possible to down load the New York How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACTA Red Flags Rule web template.

Unless you provide an accounts and would like to start using US Legal Forms, adopt these measures:

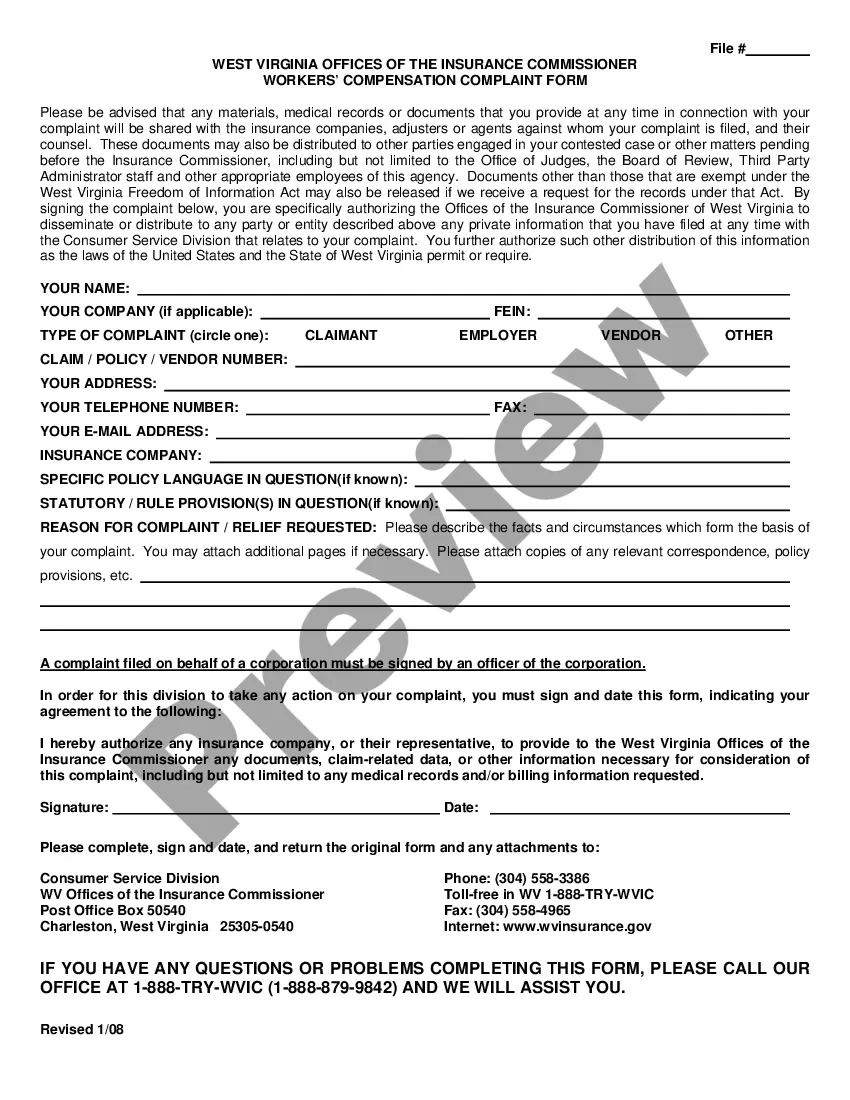

- Get the develop you will need and make sure it is for your appropriate town/county.

- Utilize the Review option to analyze the form.

- Read the information to actually have selected the right develop.

- When the develop isn`t what you`re searching for, use the Lookup area to find the develop that suits you and specifications.

- Once you get the appropriate develop, click on Buy now.

- Select the costs prepare you desire, complete the necessary details to make your bank account, and pay for an order making use of your PayPal or bank card.

- Decide on a handy document structure and down load your version.

Locate each of the document templates you have purchased in the My Forms food list. You can obtain a additional version of New York How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACTA Red Flags Rule at any time, if required. Just select the necessary develop to down load or print out the document web template.

Use US Legal Forms, the most considerable variety of legal varieties, to conserve some time and steer clear of errors. The assistance provides appropriately produced legal document templates which can be used for a range of uses. Generate a free account on US Legal Forms and commence generating your daily life a little easier.