New York Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

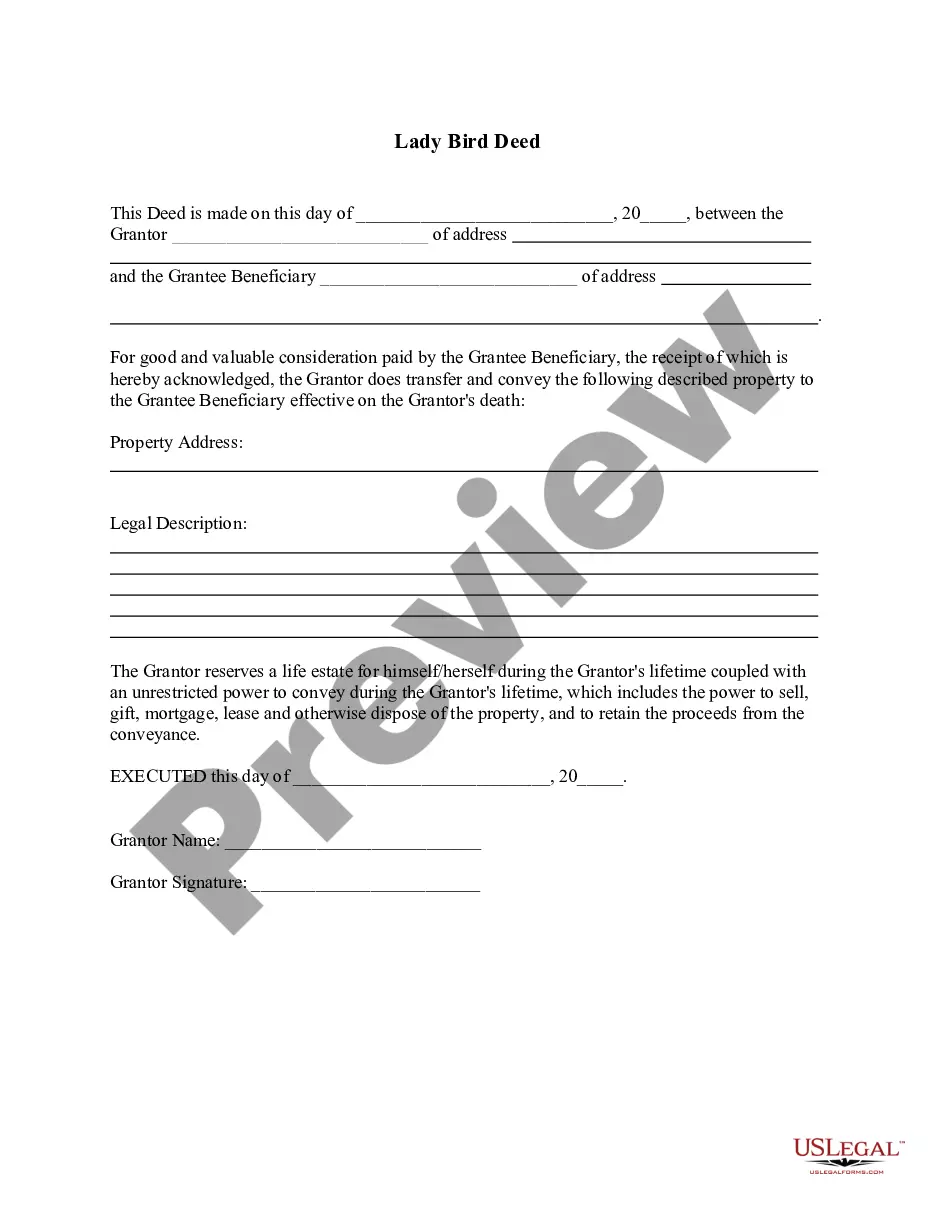

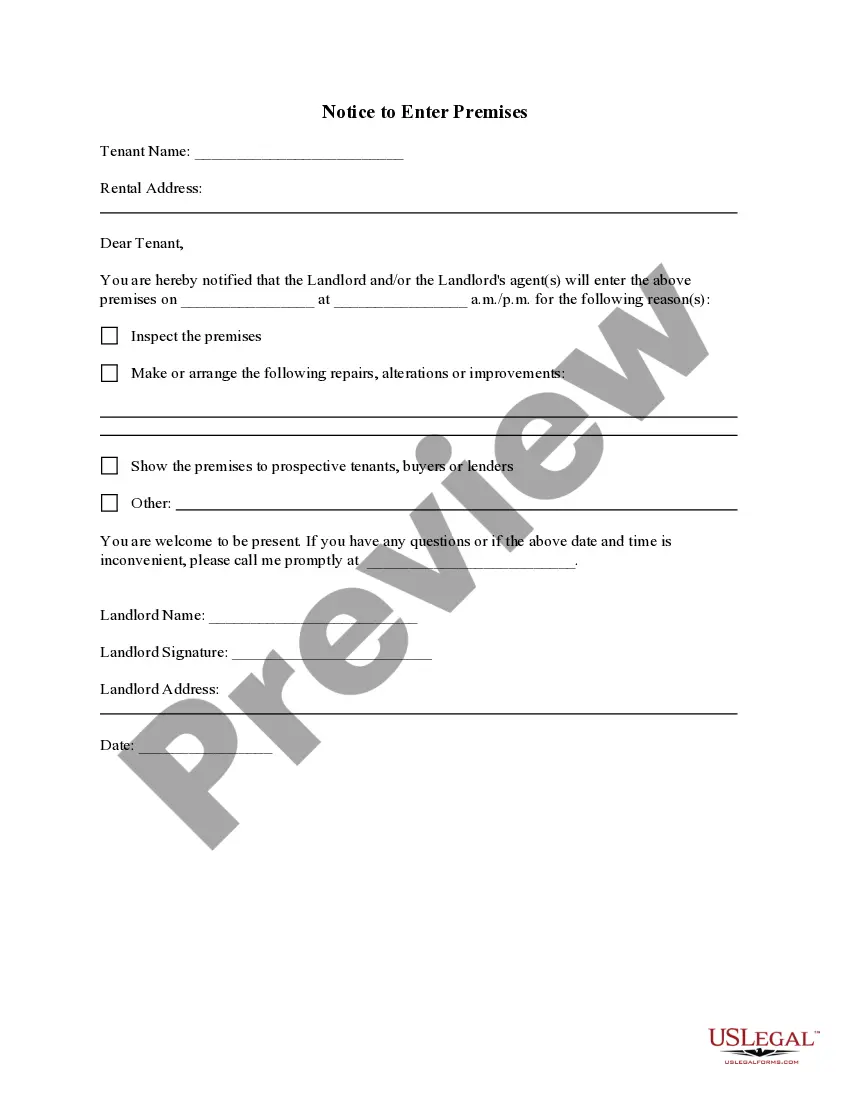

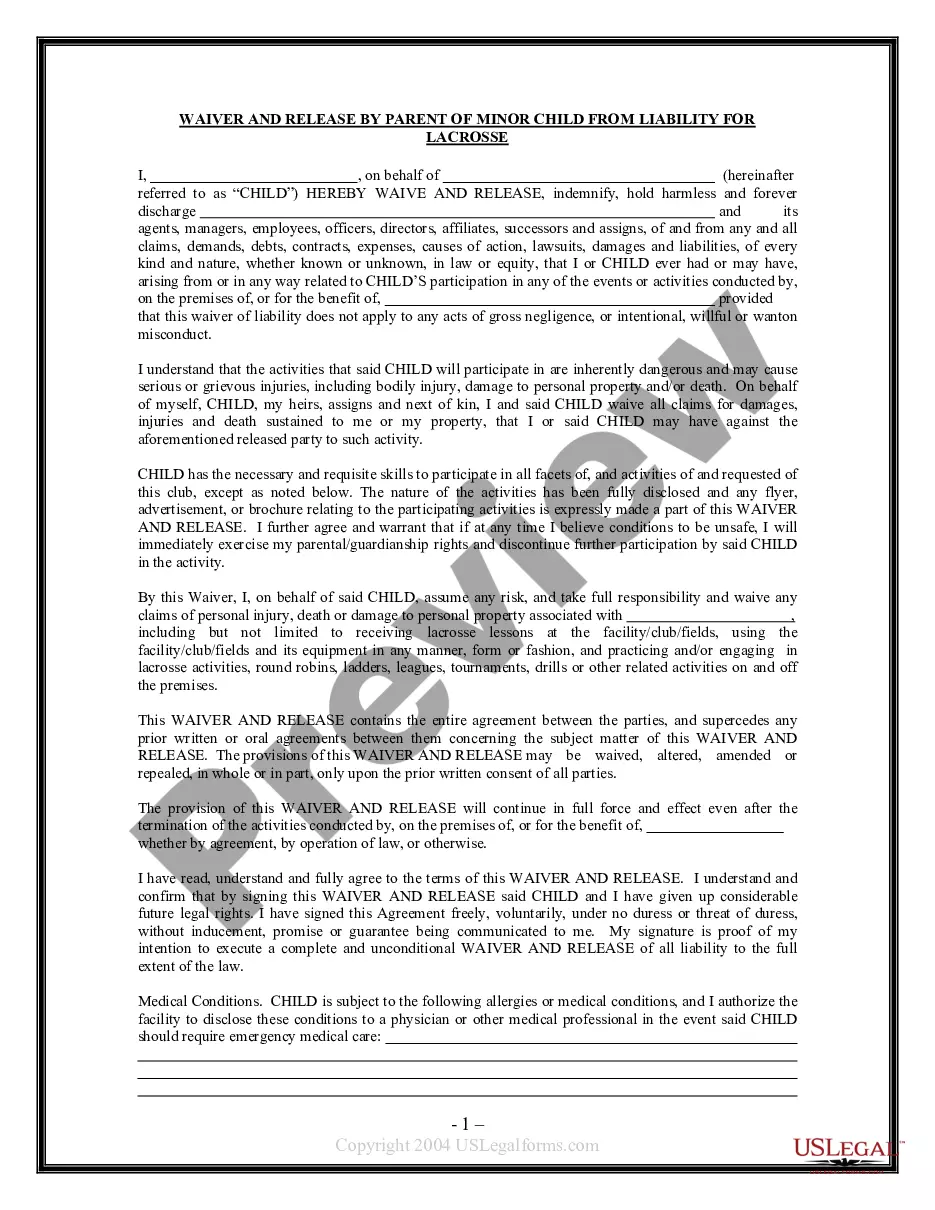

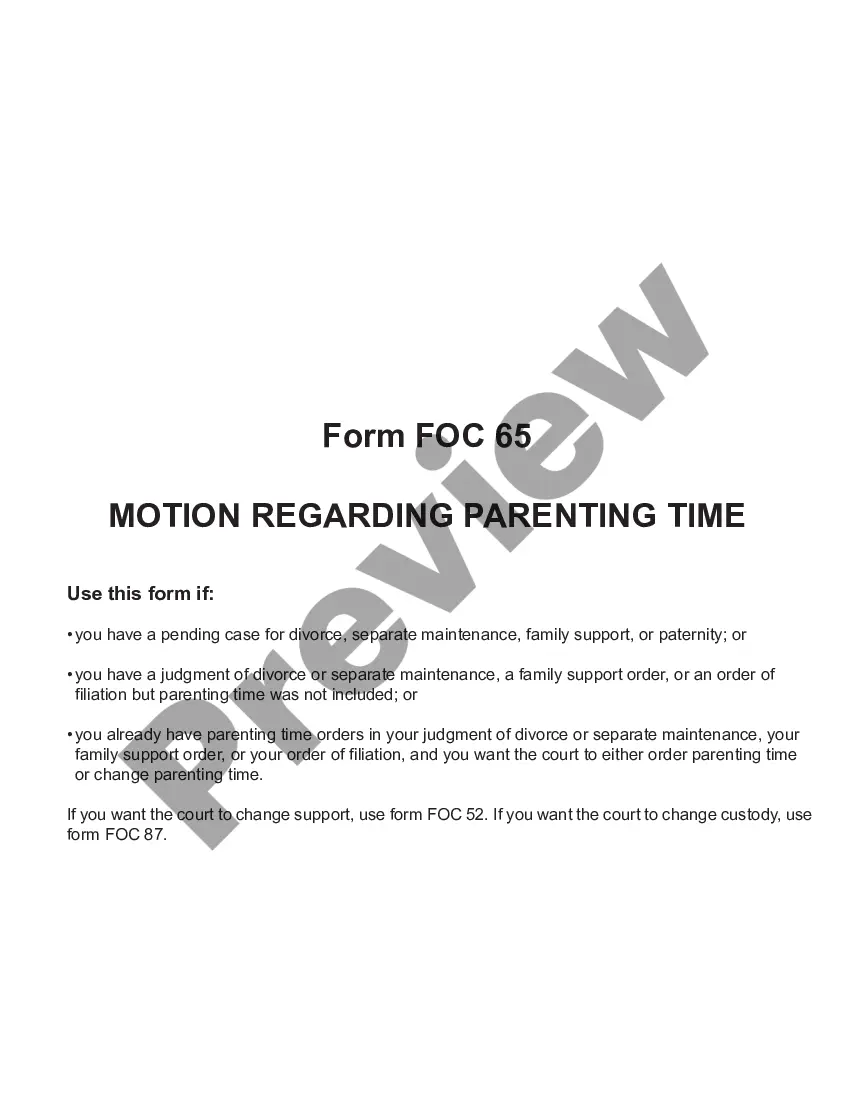

Are you in a situation where you need to have documents for both enterprise or specific uses virtually every working day? There are tons of legal record layouts available on the net, but locating ones you can rely isn`t easy. US Legal Forms gives thousands of develop layouts, such as the New York Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent, which can be published to satisfy federal and state specifications.

Should you be presently familiar with US Legal Forms web site and possess an account, just log in. After that, it is possible to obtain the New York Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent design.

Unless you come with an account and want to begin to use US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is for your right area/county.

- Make use of the Review switch to analyze the shape.

- Browse the explanation to ensure that you have selected the appropriate develop.

- When the develop isn`t what you are trying to find, utilize the Search field to obtain the develop that fits your needs and specifications.

- Once you discover the right develop, just click Buy now.

- Opt for the rates program you desire, complete the required information to generate your account, and pay for the transaction with your PayPal or bank card.

- Decide on a handy data file formatting and obtain your duplicate.

Locate every one of the record layouts you possess purchased in the My Forms menus. You can aquire a further duplicate of New York Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent at any time, if needed. Just click on the necessary develop to obtain or print out the record design.

Use US Legal Forms, by far the most considerable assortment of legal forms, to conserve efforts and steer clear of mistakes. The assistance gives appropriately manufactured legal record layouts that you can use for a variety of uses. Generate an account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

In simple words, a pledge is a promise to repay a loan, and collateral is what you lose if you don't keep your promise. For example, I can take a loan from a friend, pledge to return it within 30 days, and offer my bike as collateral. As long as I return the loan within 30 days, the bike is safe.

Types of Collateral When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include cars?only if they are paid off in full?bank savings deposits, and investment accounts.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

The term is also used to denote the property which constitutes the security. The pledge is a type of security interest.

A securities lending agreement governs the terms of a security lending loan. The agreement includes the type of collateral ? cash, securities or LOC ? of value equal to or greater than 100% of the loaned security. The borrower of the security will pay a lending fee, which is typically paid monthly to the lender.

Several types of collateral can be used for a secured personal loan. Your options may include cash in a savings account, a car or a house. There are two types of loans you can obtain from banks or other financial institutions: secured loans and unsecured loans.

Mortgages, charges, pledges and liens are all types of security. The main types of quasi-security are guarantees and indemnities, comfort letters, set-off, netting, standby credits, on demand guarantees and bonds and retention of title (ROT) arrangements.

Collateral of "guarantees" are additional forms of security you can provide the lender. If for some reason, the business cannot repay its bank loan, the bank wants to know there is a second source of repayment.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Collateral is an asset pledged by a borrower, to a lender (or a creditor), as security for a loan.