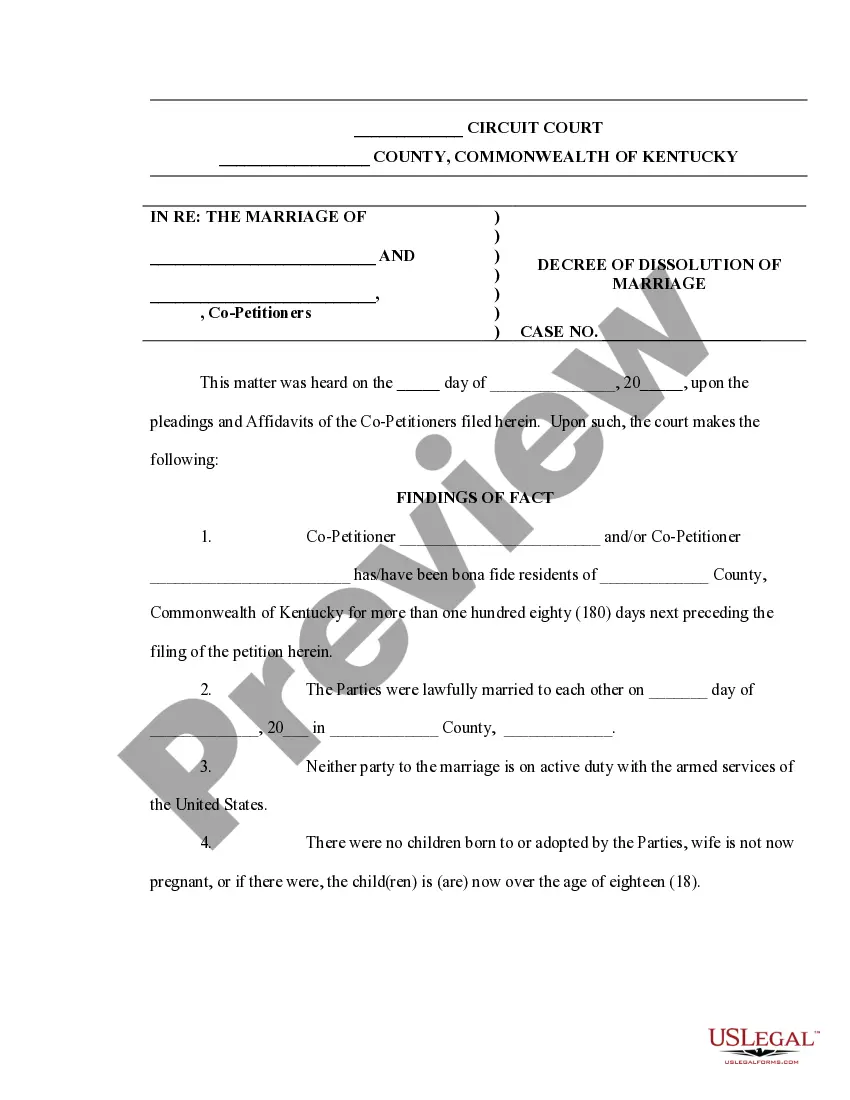

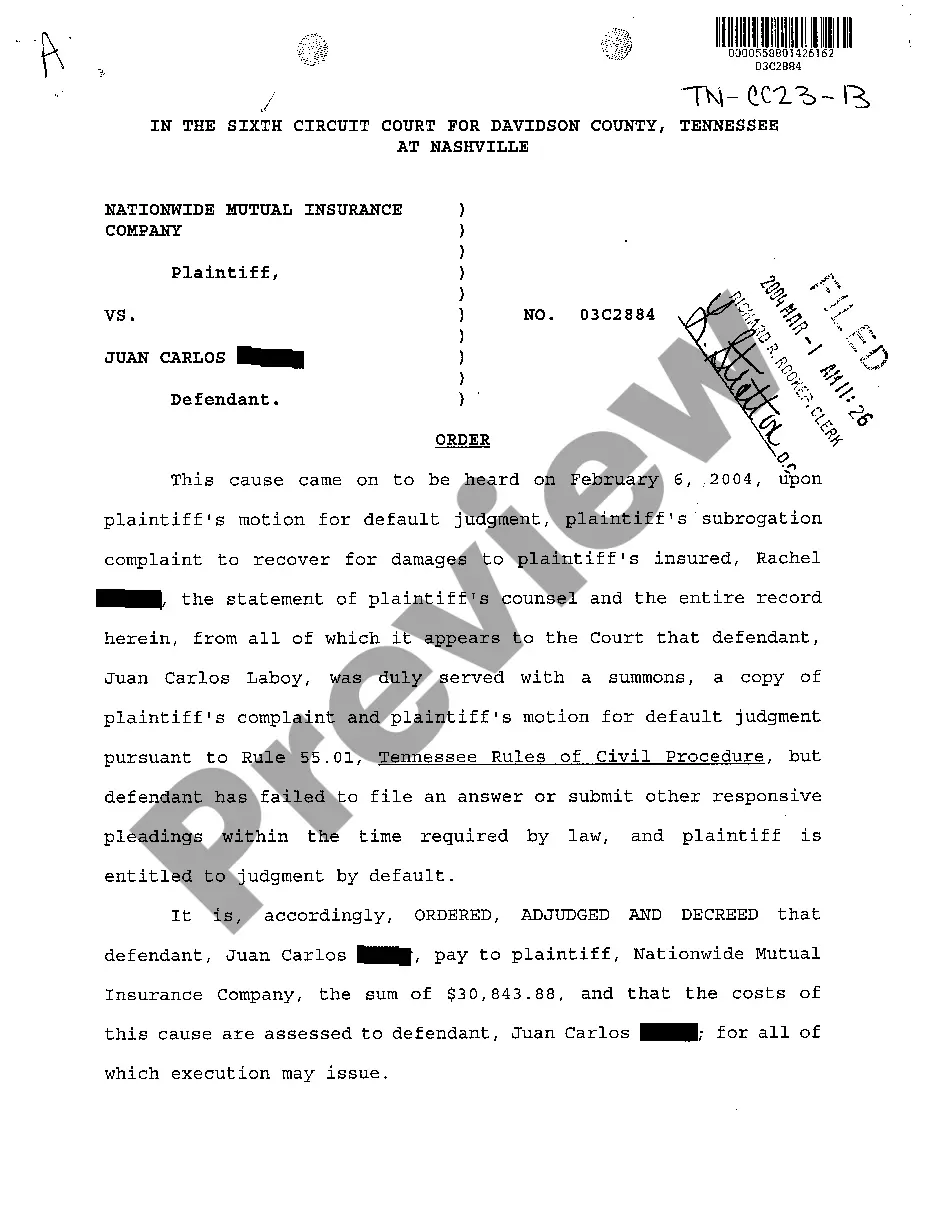

This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

New York Acquisition Divestiture Merger Agreement Summary

Description

How to fill out Acquisition Divestiture Merger Agreement Summary?

You can spend numerous hours online trying to locate the legal document format that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can easily download or print the New York Acquisition Divestiture Merger Agreement Summary from their services.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the New York Acquisition Divestiture Merger Agreement Summary.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of a purchased form, go to the My documents section and click the corresponding button.

- If you're using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the region/area of your choosing.

- Review the form details to confirm you have selected the appropriate template.

- If available, use the Preview button to examine the document format as well.

- If you want to find another version of the form, utilize the Search field to locate the format that fits your needs.

- Once you have found the format you wish to purchase, click Purchase now to proceed.

- Select the payment plan you desire, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa, Mastercard, or PayPal account to buy the legal form.

- Choose the format of the document and download it to your device.

- Make adjustments to the document if possible. You can complete, modify, sign, and print the New York Acquisition Divestiture Merger Agreement Summary.

- Download and print thousands of document templates from the US Legal Forms website, which provides the most comprehensive selection of legal forms.

- Utilize professional and state-specific templates to address your business or personal requirements.

Form popularity

FAQ

A certificate of merger is a legal document that officially states the merger between two or more corporations. This document includes key information such as the names of the merging entities and the effective date of the merger. Familiarity with this document is vital when navigating the complexities of a New York Acquisition Divestiture Merger Agreement Summary.

A divestiture refers to the process where a company sells off a portion of its business or assets to streamline operations or optimize financial performance. This tactic is often used in conjunction with mergers to enhance value and focus on core business areas. Understanding divestitures is crucial when preparing a New York Acquisition Divestiture Merger Agreement Summary.

The steps in a merger and acquisition generally include planning, due diligence, valuation, negotiations, and the final integration of the companies. Each phase is critical, ensuring that the New York Acquisition Divestiture Merger Agreement Summary is comprehensive and addresses all pertinent details. Following these steps can lead to a successful merger experience.

The certificate of merger must be signed by representatives of the involved corporations, specifically those with the authority to bind the company. Often, this includes the company's president or other senior officials. This signing ensures that all parties understand the terms outlined in the New York Acquisition Divestiture Merger Agreement Summary.

The filing of the certificate of merger is generally the responsibility of the surviving corporation in the merger. This entity must submit the signed certificate to the Delaware Secretary of State. If your business is looking for clarity in New York Acquisition Divestiture Merger Agreement Summary processes, be sure to know who holds this responsibility.

In Delaware, the certificate of merger is typically signed by an authorized officer of each merging corporation. Their signatures are crucial as they affirm the legitimacy and compliance of the merger with state regulations. For businesses considering a New York Acquisition Divestiture Merger Agreement Summary, understanding the signing authority is essential for a smooth merger process.

One well-known example of an acquisition is when Google acquired YouTube in 2006 for $1.65 billion. This acquisition allowed Google to expand its portfolio in digital video and online advertising. Such high-profile acquisitions illustrate how companies can leverage mergers to seize market opportunities and enhance their growth strategies. To explore more examples and insights, the New York Acquisition Divestiture Merger Agreement Summary is a great resource.

An acquisition summary provides a concise overview of a specific acquisition's key elements. It usually highlights the involved companies, transaction value, strategic reasons for the acquisition, and expected outcomes. This summary helps stakeholders grasp the essential information quickly, making it a useful tool in the acquisition process. The New York Acquisition Divestiture Merger Agreement Summary can further enrich your knowledge on this topic.

Divestiture in mergers and acquisitions refers to the process where a company sells off a portion of its business. This step often occurs to comply with regulatory requirements or to streamline operations. It enables firms to focus on core strengths while ensuring market competition is maintained. The New York Acquisition Divestiture Merger Agreement Summary provides valuable insights into how this works.

Divestiture can serve as an effective remedy in the US industry when it comes to mergers. By selling off certain assets or divisions, companies can address competition concerns raised by regulatory bodies. This process can help ensure a more competitive market, ultimately benefiting consumers. For a comprehensive understanding, consider exploring the New York Acquisition Divestiture Merger Agreement Summary.