A debt collector may not use obscene or profane language or language likely to abuse the hearer or reader. This includes abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

New York Notice to Debt Collector - Use of Abusive Language

Description

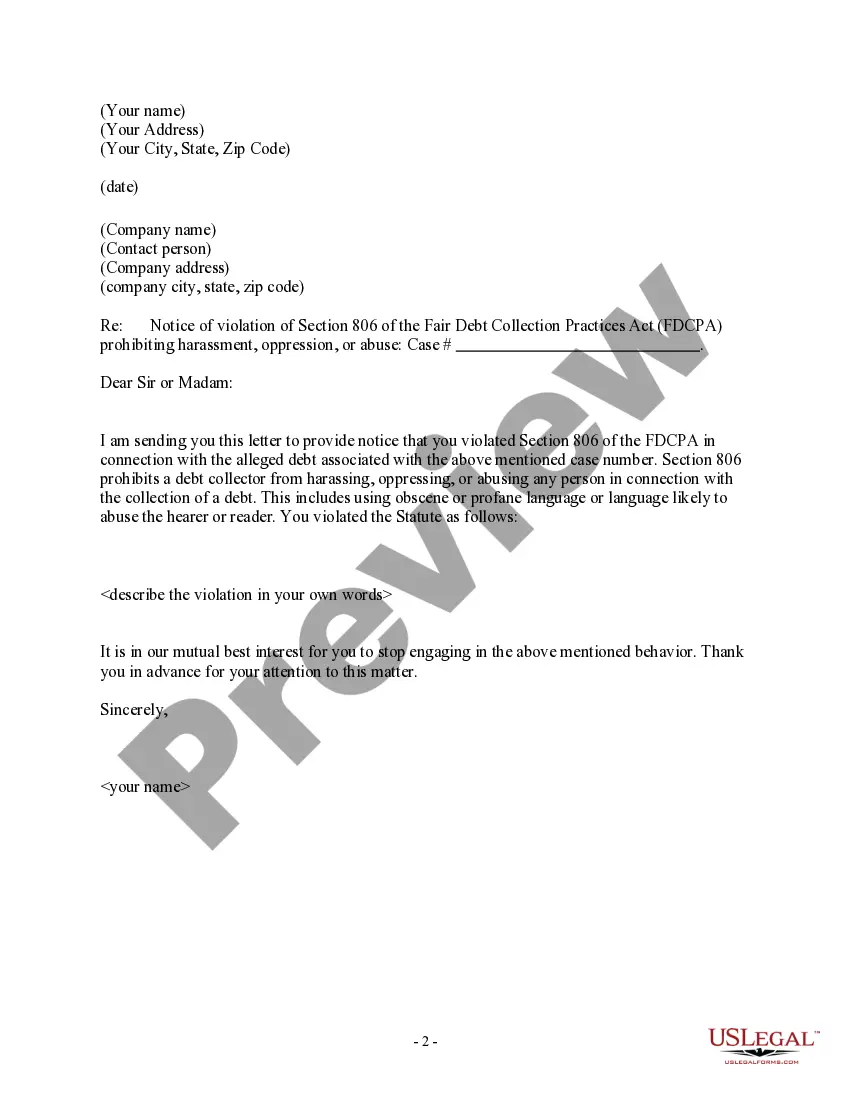

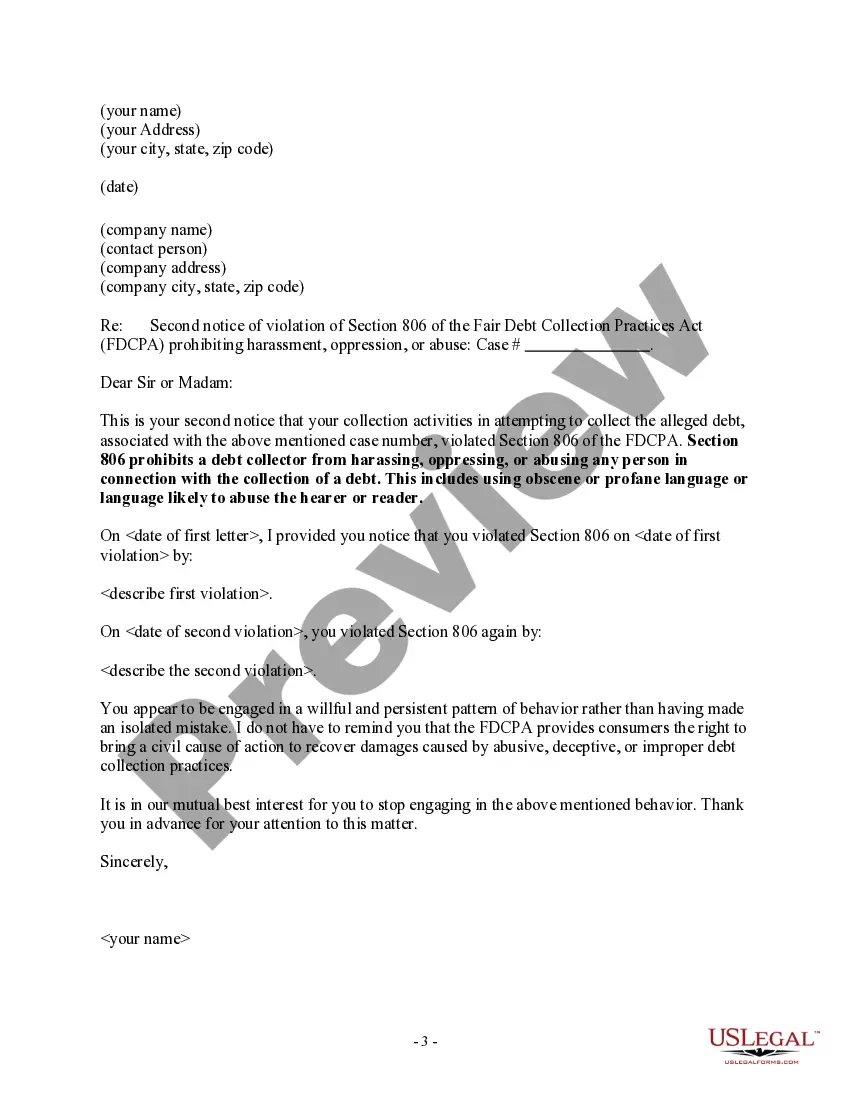

How to fill out Notice To Debt Collector - Use Of Abusive Language?

You can invest time online attempting to locate the official document template that complies with the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

You can indeed download or print the New York Notice to Debt Collector - Use of Abusive Language from our services.

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- You can then complete, modify, print, or sign the New York Notice to Debt Collector - Use of Abusive Language.

- Every legal document template you acquire is yours permanently.

- To retrieve another copy of the acquired form, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/area of your choice.

- Read the form description to confirm you have selected the right type.

Form popularity

FAQ

Yes. The federal Fair Debt Collection Practices Act specifically gives you the right to sue a debt collector for harassment. If a debt collector is found to have engaged in harassing behavior, you are entitled to up to $1,000 in damages, along with court costs and attorney fees.

How to Stop Debt Collector HarassmentWrite a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

9 Ways to Turn the Tables on Debt CollectorsDon't Wait for Them to Call. Consider picking up the phone and calling the debt collector yourself.Check Them Out.Dump it Back in Their Lap.Stick to Business.Show Them the Money.Ask to Speak to a Supervisor.Call Their Bluff.Tell Them to Take a Hike.More items...?

7 Ways To Defend a Debt Collection LawsuitRespond to the Lawsuit or Debt Claim.Challenge the Company's Legal Right to Sue.Push Back on Burden of Proof.Point to the Statute of Limitations.Hire Your Own Attorney.File a Countersuit if the Creditor Overstepped Regulations.File a Petition of Bankruptcy.

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

No. It is illegal for a debt collector to use profane or abusive language in order to strongarm you into making payments. That's a violation of the Fair Debt Collection Practices Act. Debt collectors can be very aggressive when trying to settle an account.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .