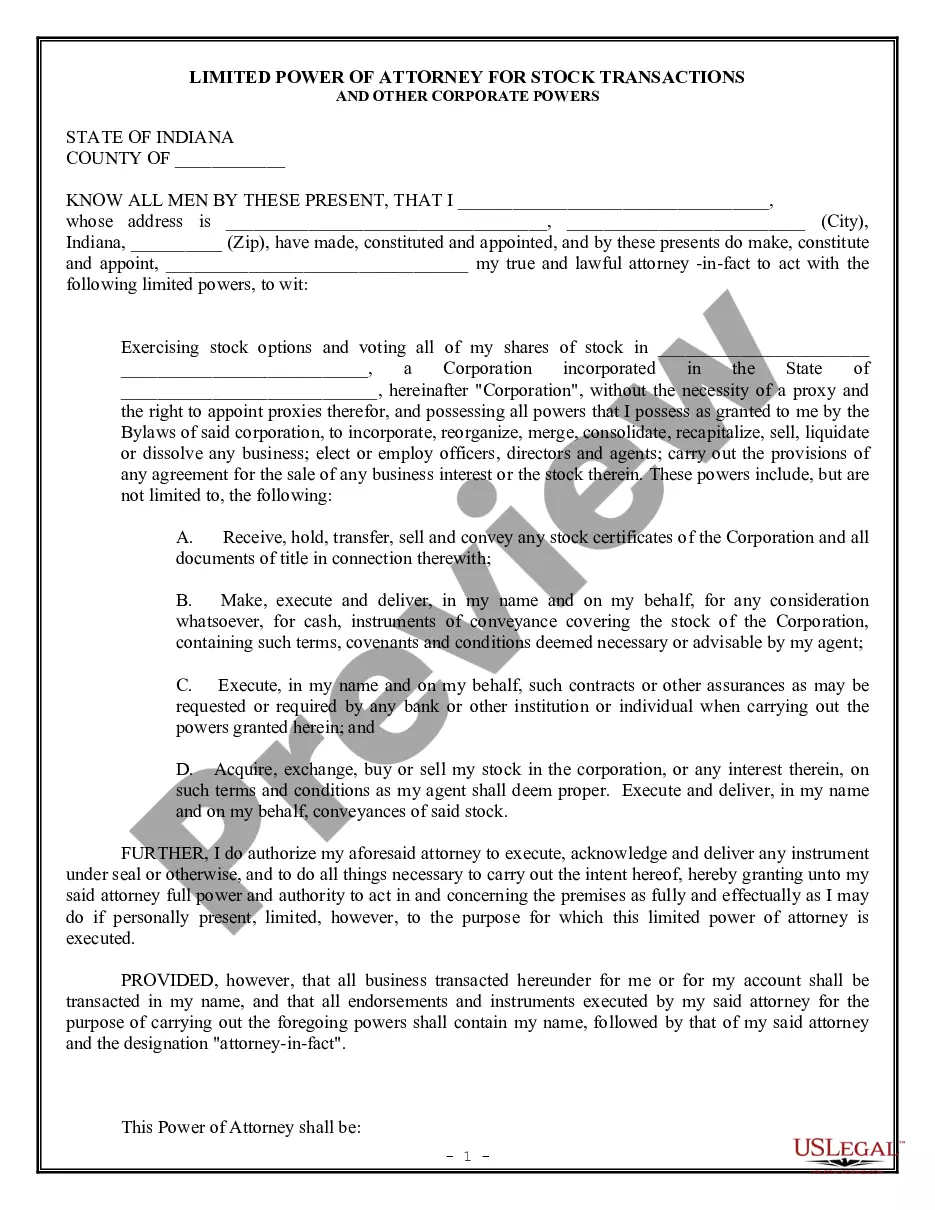

New York Nonqualified Stock Option Plan of ASA Holdings, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of ASA Holdings, Inc.?

US Legal Forms - among the greatest libraries of legal kinds in America - offers a wide range of legal record themes you are able to download or print. Using the website, you will get 1000s of kinds for enterprise and specific purposes, categorized by categories, claims, or search phrases.You will find the latest versions of kinds much like the New York Nonqualified Stock Option Plan of ASA Holdings, Inc. in seconds.

If you have a membership, log in and download New York Nonqualified Stock Option Plan of ASA Holdings, Inc. from your US Legal Forms catalogue. The Download button can look on every single form you view. You have access to all in the past delivered electronically kinds inside the My Forms tab of your account.

If you wish to use US Legal Forms the first time, allow me to share easy instructions to obtain started off:

- Make sure you have selected the correct form for your personal town/region. Click the Review button to check the form`s information. Look at the form outline to actually have selected the right form.

- In the event the form does not suit your specifications, use the Search discipline at the top of the monitor to get the one who does.

- In case you are satisfied with the shape, validate your option by clicking on the Buy now button. Then, choose the pricing program you want and supply your accreditations to sign up on an account.

- Procedure the deal. Utilize your credit card or PayPal account to accomplish the deal.

- Choose the structure and download the shape in your product.

- Make alterations. Fill out, revise and print and sign the delivered electronically New York Nonqualified Stock Option Plan of ASA Holdings, Inc..

Each and every design you put into your bank account does not have an expiry time and is also your own for a long time. So, if you wish to download or print yet another version, just go to the My Forms segment and then click around the form you want.

Get access to the New York Nonqualified Stock Option Plan of ASA Holdings, Inc. with US Legal Forms, by far the most comprehensive catalogue of legal record themes. Use 1000s of professional and express-distinct themes that meet up with your company or specific requires and specifications.

Form popularity

FAQ

The Cost Basis of Your Non-Qualified Stock Options The cost basis, generally speaking, is equal to the exercise price, multiplied by the number of shares exercised. In our example above, the cost basis is equal to 2,000 shares times $50/share, or $100,000.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

qualified stock option (NQSO) is a type of stock option that does not qualify for special favorable tax treatment under the US Internal Revenue Code. Thus the word nonqualified applies to the tax treatment (not to eligibility or any other consideration).

For example, RSU and NQSO have different rules about when they are taxed (RSUs at vesting, no choice) (NQSOs at exercise, choice of timing). It's also reasonable to assume that when offered the choice, you may get ?more? NQSOs than you would RSUs. And finally, RSUs do not cost anything to purchase, whereas NQSOs do.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

You can keep track of your options and shares from previously exercised options on your equity management platform. Difference between the fair market value (FMV) at exercise and the grant price is taxed as ordinary income and subject to federal, state and local income taxes in addition to payroll taxes.

NQOs are unrestricted. As such, they can be offered to anyone. That means that you can extend them to not just standard employees, but also directors, contractors, vendors, and even other third parties. ISOs, on the other hand, can only be issued to standard employees.