New York Stock Option and Award Plan

Description

How to fill out Stock Option And Award Plan?

Are you currently in a situation where you require documents for either business or personal uses almost every day.

There are numerous valid document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of document templates, such as the New York Stock Option and Award Plan, which are designed to comply with federal and state regulations.

If you find the appropriate document, click on Get now.

Select the price plan you desire, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Stock Option and Award Plan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for your correct city/state.

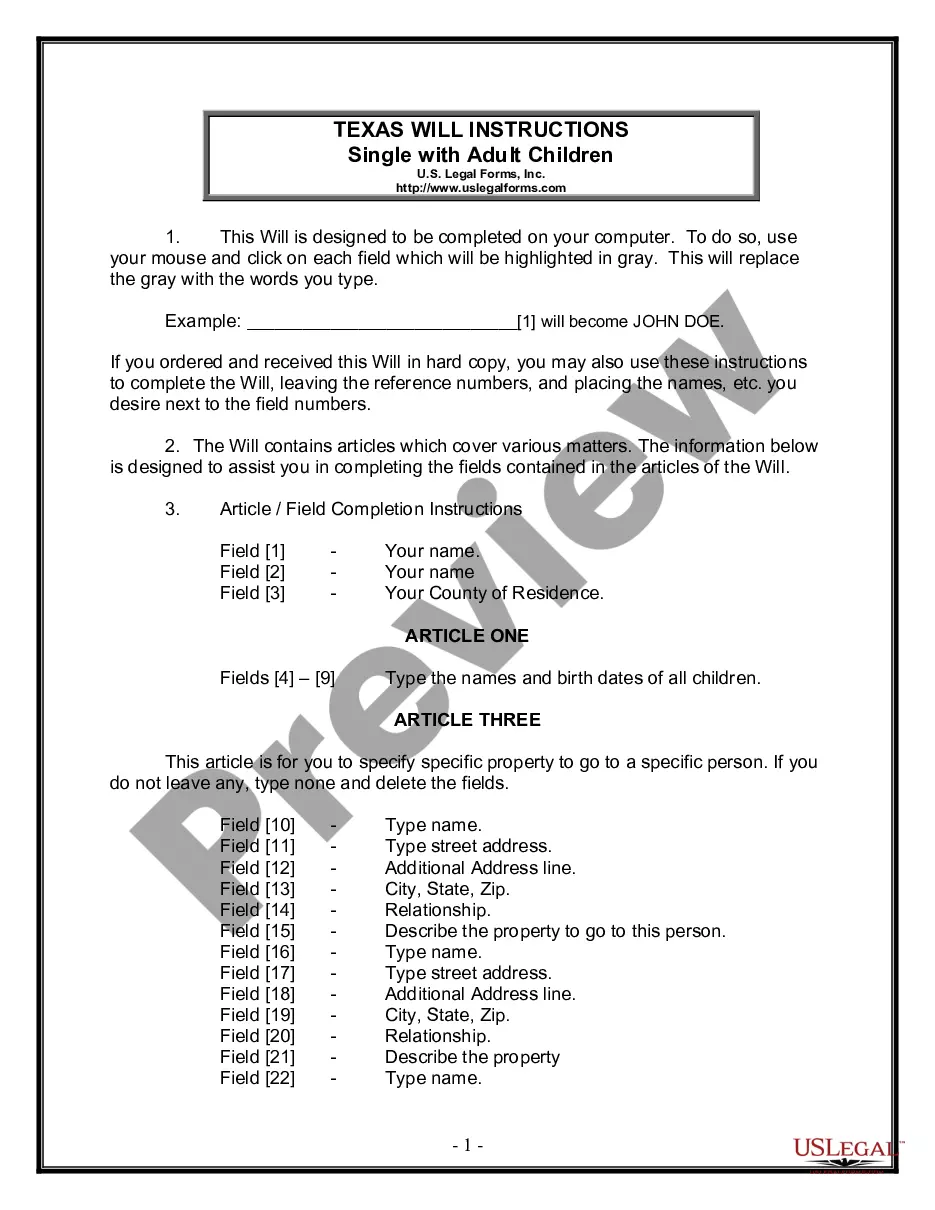

- Use the Preview button to examine the document.

- Check the description to confirm that you have selected the correct document.

- If the document is not what you are looking for, utilize the Search field to find the document that meets your needs.

Form popularity

FAQ

The 10-minute rule for the New York Stock Exchange (NYSE) gives companies time to report their earnings before trading can proceed after a significant announcement. This measure prevents abrupt trading swings and allows investors to make informed decisions based on the updated information. Understanding this rule can enhance your strategy if you're involved in the New York Stock Option and Award Plan.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").

An employee stock option is a contract that grants an employee the right to buy shares in his or her employer at a specific, fixed price, known as the exercise price, after a designated date.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

From the employee's standpoint, a stock option grant is an opportunity to purchase stock in the company for which they work. Typically, the grant price is set as the market price at the time the grant is offered.

A Restricted Stock Award Share is a grant of company stock in which the recipient's rights in the stock are restricted until the shares vest (or lapse in restrictions). The restricted period is called a vesting period.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

An award that gives you the ability to purchase shares of company stock at a specified price for a fixed period of time.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

Stock options are usually granted for a specific period (option term) and must be exercised within that period. A common option term is 10 years, after which, the option expires. While time-based vesting remains popular, companies are increasingly granting equity that vests upon meeting certain performance criteria.