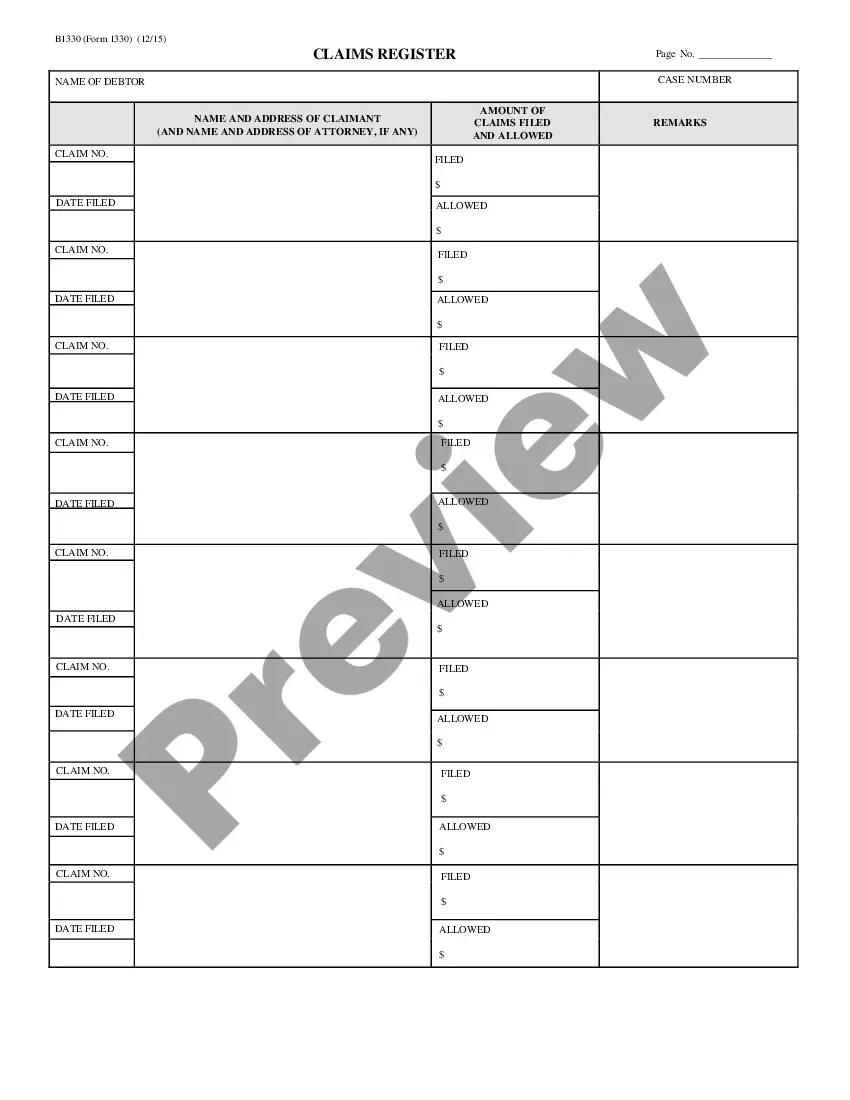

New York Claims Register - B 133

Description

How to fill out Claims Register - B 133?

US Legal Forms - one of the biggest libraries of legal varieties in America - offers a wide range of legal document web templates you can obtain or print out. While using website, you can get a huge number of varieties for business and person reasons, sorted by groups, claims, or keywords and phrases.You can get the most up-to-date types of varieties like the New York Claims Register - B 133 in seconds.

If you already possess a subscription, log in and obtain New York Claims Register - B 133 through the US Legal Forms collection. The Download button will appear on every kind you perspective. You have accessibility to all earlier downloaded varieties inside the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed below are simple recommendations to obtain started:

- Make sure you have picked out the correct kind for the metropolis/county. Select the Review button to examine the form`s articles. Browse the kind description to ensure that you have selected the right kind.

- In the event the kind does not match your needs, utilize the Search area near the top of the display screen to find the one who does.

- When you are satisfied with the form, affirm your selection by clicking the Purchase now button. Then, opt for the rates strategy you favor and offer your credentials to sign up on an bank account.

- Approach the deal. Utilize your charge card or PayPal bank account to perform the deal.

- Select the structure and obtain the form in your system.

- Make changes. Load, edit and print out and indication the downloaded New York Claims Register - B 133.

Each template you included with your bank account lacks an expiration date and is yours forever. So, if you would like obtain or print out one more version, just visit the My Forms segment and click in the kind you want.

Gain access to the New York Claims Register - B 133 with US Legal Forms, one of the most substantial collection of legal document web templates. Use a huge number of expert and state-certain web templates that fulfill your organization or person demands and needs.

Form popularity

FAQ

New York announced its 2023 unemployment insurance tax rates on the state labor department website on Feb. 17. Total tax rates for employers range from 2.1% to 9.9%, and the total tax rate for new employers is 4.1%.

The Unemployment Insurance program is an insurance fund that employers pay into based on their payroll. This fund is used to pay benefits to qualifying workers who have lost work through no fault of their own. Most employers pay quarterly contributions into the fund.

Calculating Normal Rate without being a successor to a liable employer, the new employer contribution rate is assigned. This rate is fixed each year ing to the size of the Unemployment Insurance Trust Fund. This rate cannot exceed 3.4%. For 2021, the new employer normal contribution rate is 3.4%.

New York Addition: The Income which is not reported in Federal but taxable in the state return is New York State Additions. New York Subtraction: The Income which is reported in Federal but not taxable in the state return is New York State Subtractions.

Beginning in 2022, the subtraction modification will be increased from 5% to 15%, and it will be available to: (a) sole proprietors with one or more employees and less than $250,000 of net business income or net farm income; (b) owners of New York S corporations and tax-partnerships with one or more employees and net ...

If you make $800 a week in New York, your estimated weekly benefit would be $416 for up to 26 weeks, ing to FileUnemployment.org. You can also check their unemployment calculator to determine the amount that would be more appropriate for your particular situation.

Your weekly benefit payment amount depends on how much you were paid during a ?base period.? A base period represents one year of your work and wages (four calendar quarters). Calendar quarters are the three-month blocks of time shown in the chart below.

The state's unemployment-taxable wage base in 2023 is $12,300, up from $12,000 in 2022, under state law.