New York Waiver of the Right to be Spouse's Beneficiary

Description

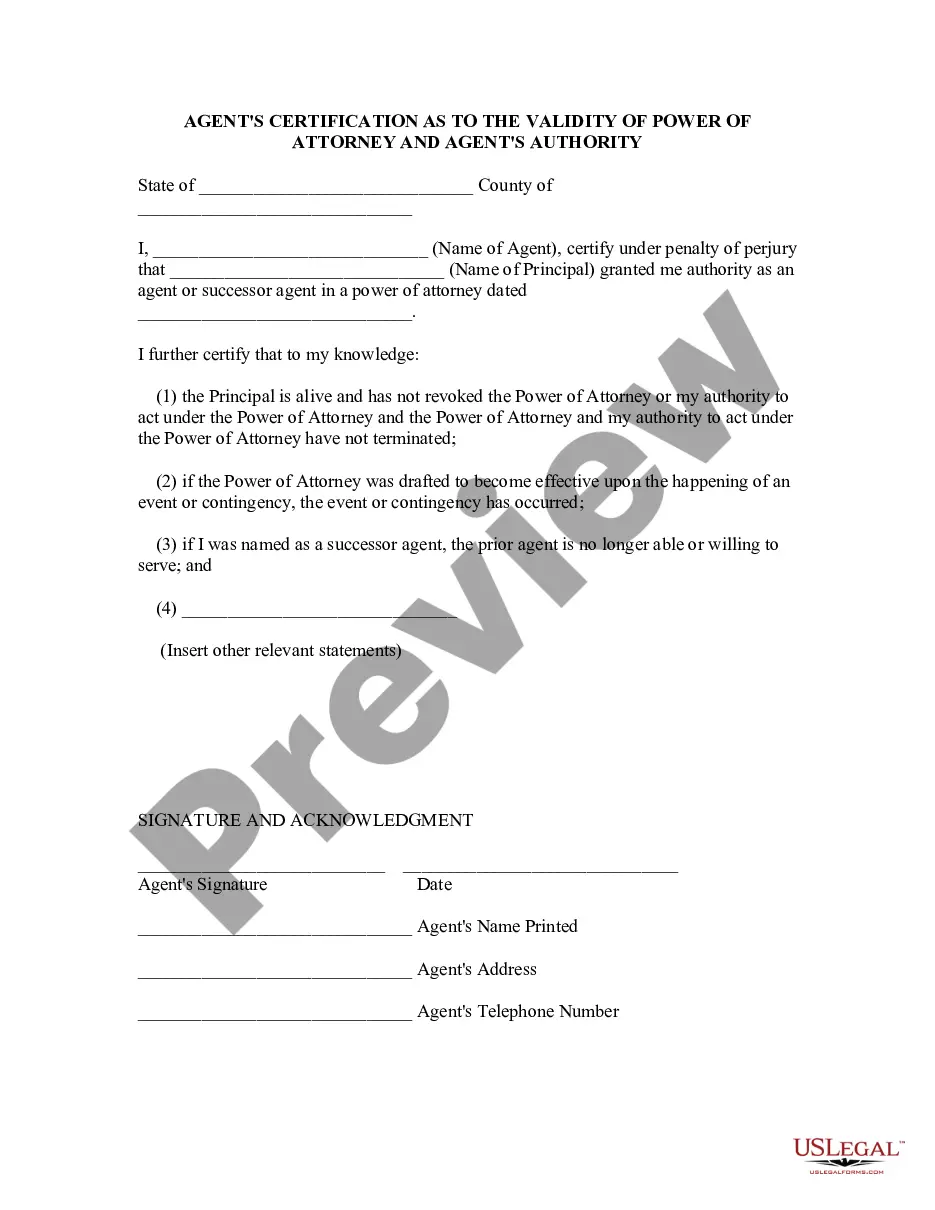

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

Have you been inside a placement in which you need to have papers for either enterprise or person uses just about every time? There are a variety of authorized record layouts available on the net, but finding versions you can rely isn`t simple. US Legal Forms offers thousands of develop layouts, much like the New York Waiver of the Right to be Spouse's Beneficiary, that are written to fulfill state and federal demands.

If you are already informed about US Legal Forms website and have a merchant account, simply log in. Next, it is possible to down load the New York Waiver of the Right to be Spouse's Beneficiary format.

Unless you come with an account and need to start using US Legal Forms, adopt these measures:

- Get the develop you want and ensure it is to the right metropolis/area.

- Make use of the Review key to review the shape.

- Browse the explanation to actually have selected the proper develop.

- In case the develop isn`t what you`re seeking, make use of the Search industry to obtain the develop that meets your needs and demands.

- When you find the right develop, click on Get now.

- Opt for the costs plan you need, submit the required information to produce your bank account, and buy the transaction making use of your PayPal or credit card.

- Decide on a practical data file file format and down load your version.

Get all of the record layouts you might have bought in the My Forms food list. You may get a further version of New York Waiver of the Right to be Spouse's Beneficiary any time, if required. Just click the required develop to down load or produce the record format.

Use US Legal Forms, by far the most substantial variety of authorized kinds, to conserve time as well as avoid errors. The support offers skillfully manufactured authorized record layouts that you can use for an array of uses. Generate a merchant account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

For a New York resident without a will, a surviving spouse inherits the entire probate estate if there are no children or other descendants. If there are descendants, the surviving spouse gets the first $50,000 and the balance is divided one-half to the spouse and one-half to the decedent's descendants.

If the decedent dies without a will and without children, the surviving spouse is entitled to the entire estate. If there is no will but there are surviving children, the surviving spouse is entitled to the first $50,000 in assets and one-half of the remainder of the estate.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

Generally speaking, inheritance law does not require that children inherit property. According to most state intestacy laws, both spouses must be deceased before their children can inherit any part of the estate. Meaning, so long as one spouse is surviving, they will receive the inheritance.

New York is not a community property state. This means that a spouse won't automatically receive most or all of the decedent's property following his or her death, according to New York inheritance laws.

Under the Philippine law of intestate succession, (the decedent left no will), the compulsory heirs (spouse and children) will automatically inherit the estate of the decedent at the time of death. The estate includes both real estate and personal properties owned by the decedent.

Every common law state has different guidelines, but most common law states' inheritance law allows the surviving spouse to claim one-third of the deceased spouse's property.

New York law forbids residents from completely disinheriting a surviving spouse. If a person is legally married at the time of their death, their spouse will automatically inherit a percentage of their assetseven if the spouse has been intentionally excluded from the deceased person's will or trust.

New York law forbids residents from completely disinheriting a surviving spouse. If a person is legally married at the time of their death, their spouse will automatically inherit a percentage of their assetseven if the spouse has been intentionally excluded from the deceased person's will or trust.