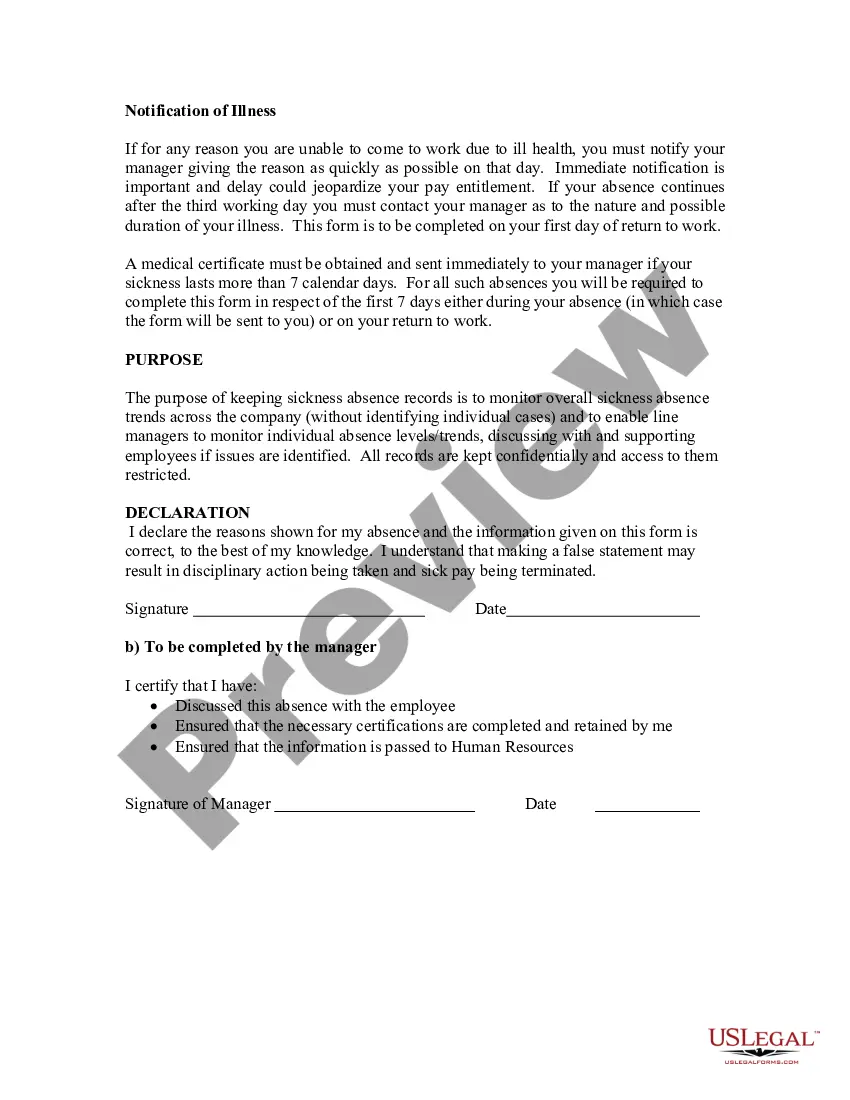

New York Record of Absence - Self-Certification Form

Description

How to fill out Record Of Absence - Self-Certification Form?

US Legal Forms - one of the largest collections of legal documents in the country - offers a variety of legal form templates that you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can download the newest versions of forms such as the New York Absence Record - Self-Certification Form within moments.

Click the Preview button to check the content of the form. Review the form description to confirm you have chosen the right document.

If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already have a monthly subscription, Log In and obtain the New York Absence Record - Self-Certification Form from the US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously obtained forms from the My documents tab of your account.

- To use US Legal Forms for the first time, here are simple steps to help you begin.

- Ensure you have selected the correct form for your city/state.

Form popularity

FAQ

My W-2, Wage and Tax Statement, shows an amount identified as SDI. What is this? SDI is an abbreviation for State Disability Insurance. This amount reported in box 14, Other, is not New York State withholding and cannot be included in your total New York State tax withheld.

107 (12/15) INSTRUTIONS. 1. This form is used principally as evidence of a claim for reimbursement by an employer for monies advanced to a claimant on account of compensation due under the provisions of the Workers' ompensation Law.

Employers in New York are required by law to provide state disability insurance (SDI) coverage for eligible employees. Employers can choose to cover the entire cost, or to withhold an allowed portion of employees' wages towards the cost.

Who Pays the Premiums for Disability Insurance? Disability (DBL) premiums may be paid entirely by the employer. The employee is permitted but not required to contribute to the cost. The employee may not contribute more than one half of one percent of the first $120 of weekly wages, to a maximum of $.

Paid Family Leave benefits provides up to 12 weeks of partially paid time-off along with job protection. The benefit amount may change a little bit every year: while it's set at 67% of your average weekly wage (AWW) capped at 67% of NY's Statewide Average Weekly Wage (SAWW), the SAWW is updated each year by the state.

Paid Family Leave provides eligible employees job-protected, paid time off to: Bond with a newly born, adopted or fostered child, Care for a family member with a serious health condition, or. Assist loved ones when a spouse, domestic partner, child or parent is deployed abroad on active military service.

SDI is an acronym for state disability insurance. Some states call it TDI for temporary disability insurance. Not every state has this tax, but those that do require payroll deductions that help fund short-term (generally a maximum of six months) disability benefits for workers who become disabled.

NYPSL-E. The NYPFL Program offers New York employees paid leave to care for loved ones or bond with a new child. There is a mandatory payroll deduction of 0.511% of the employee's weekly wage, up to the annual maximum of $423.71.

We previously reported the enactment of the New York Paid Sick Leave Law (NYPSL) as a part of New York State's 202021 budget. While NYPSL will not become available to employees until January 1, 2021, the law technically went into effect on September 30, 2020.

In the drop down box for box 14 of your W-2, report NYSDI as NY Nonoccupational Disability Fund. The payment may be deductible as a state and local tax if you itemize your deductions on Schedule A Itemized Deductions.