New York Contractor's Performance Bond with Limitation of Right of Action

Description

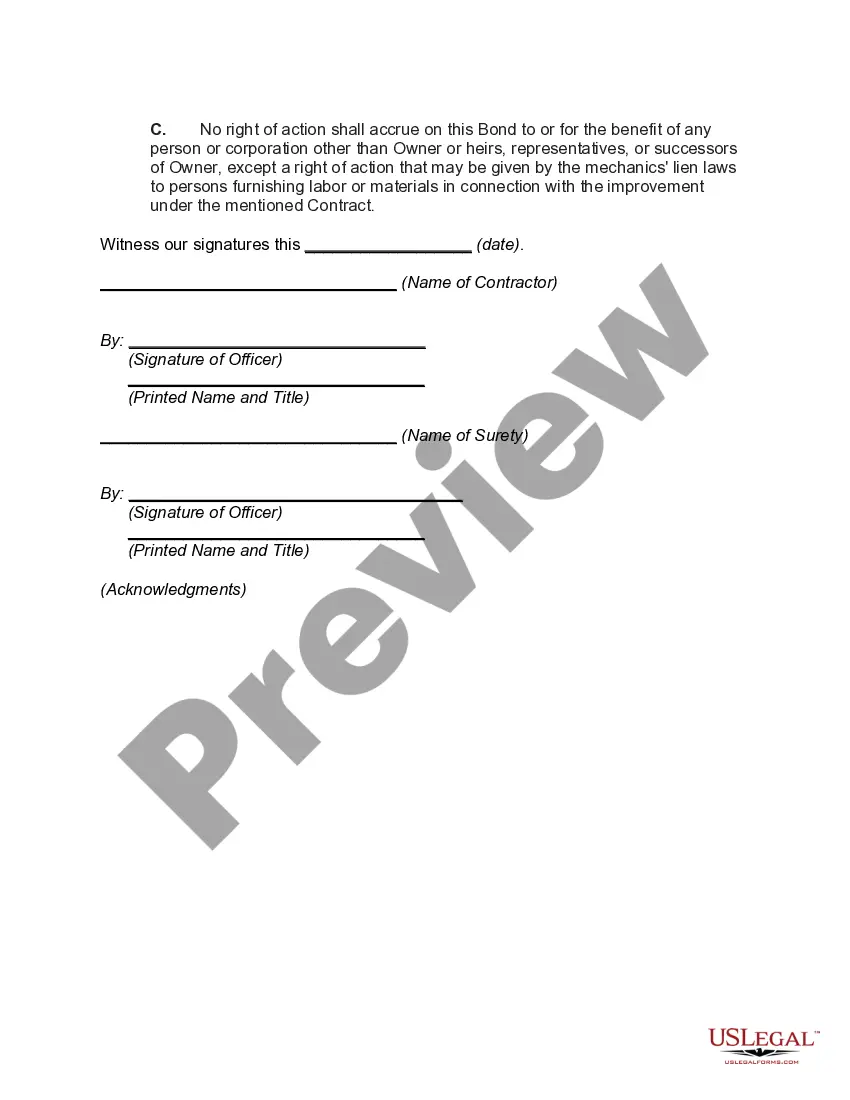

How to fill out Contractor's Performance Bond With Limitation Of Right Of Action?

US Legal Forms - one of the most significant libraries of legitimate varieties in America - delivers a variety of legitimate papers themes you are able to download or printing. Using the website, you can get 1000s of varieties for organization and person purposes, categorized by groups, says, or search phrases.You can get the most recent models of varieties such as the New York Contractor's Performance Bond with Limitation of Right of Action within minutes.

If you already possess a subscription, log in and download New York Contractor's Performance Bond with Limitation of Right of Action in the US Legal Forms catalogue. The Down load option will show up on every type you look at. You get access to all previously acquired varieties within the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, allow me to share basic guidelines to help you get began:

- Ensure you have picked the correct type for your personal metropolis/region. Click the Preview option to check the form`s information. Look at the type information to ensure that you have chosen the correct type.

- In the event the type does not suit your needs, take advantage of the Research discipline near the top of the monitor to find the one which does.

- Should you be pleased with the shape, confirm your decision by simply clicking the Get now option. Then, select the prices strategy you prefer and supply your qualifications to register for an bank account.

- Method the financial transaction. Utilize your charge card or PayPal bank account to finish the financial transaction.

- Pick the file format and download the shape in your system.

- Make adjustments. Fill out, revise and printing and signal the acquired New York Contractor's Performance Bond with Limitation of Right of Action.

Each and every format you added to your account lacks an expiration particular date and it is the one you have eternally. So, if you wish to download or printing yet another duplicate, just visit the My Forms portion and click on in the type you require.

Get access to the New York Contractor's Performance Bond with Limitation of Right of Action with US Legal Forms, the most extensive catalogue of legitimate papers themes. Use 1000s of expert and express-certain themes that satisfy your business or person needs and needs.

Form popularity

FAQ

Performance bonds, which are secured by a contractor before the beginning of a project, provide a guarantee to the project owner that contract obligations will be fulfilled. If the contractor fails to complete work ing to the contract terms, the property owner may be financially compensated.

(5) A payment bond assures payments as required by law to all persons supplying labor or material in the prosecution of the work provided for in the contract. (6) A performance bond secures performance and fulfillment of the contractor's obligations under the contract.

Usually, a performance bond is required for a contractor when the construction project is funded by tax dollars, which essentially means any public construction project will require bonding. However, a private company might also require a performance bond to help mitigate risk.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet the obligations of the contract. A performance bond is usually issued by a bank or an insurance company.

A performance bond guarantees that a contractor will perform the work ing to the conditions and requirements of the construction contract. These bonds protect the owner from financial loss as a result of a contractor default.

Performance Bonds guarantee that a product will be of a certain standard and a penalty is payable if they are not. This will usually be issued when a Tender Bond is cancelled.

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year.

Simply speaking, a surety bond is defined as a contractual agreement that guarantees certain obligations will be fulfilled. It is a different kind of insurance, as it involves an agreement between three parties.

A payment bond protects the project owner from liens against the property by guaranteeing that the policyholder (typically the GC) will pay all subcontractors and suppliers for their work and materials. Payment bonds are required on most public projects, but are also frequently used on commercial jobs as well.

A performance bond is a financial guarantee to one party in a contract against the failure of the other party to meet its obligations. It is also referred to as a contract bond.