New York Bond to Secure against Defects in Construction

Description

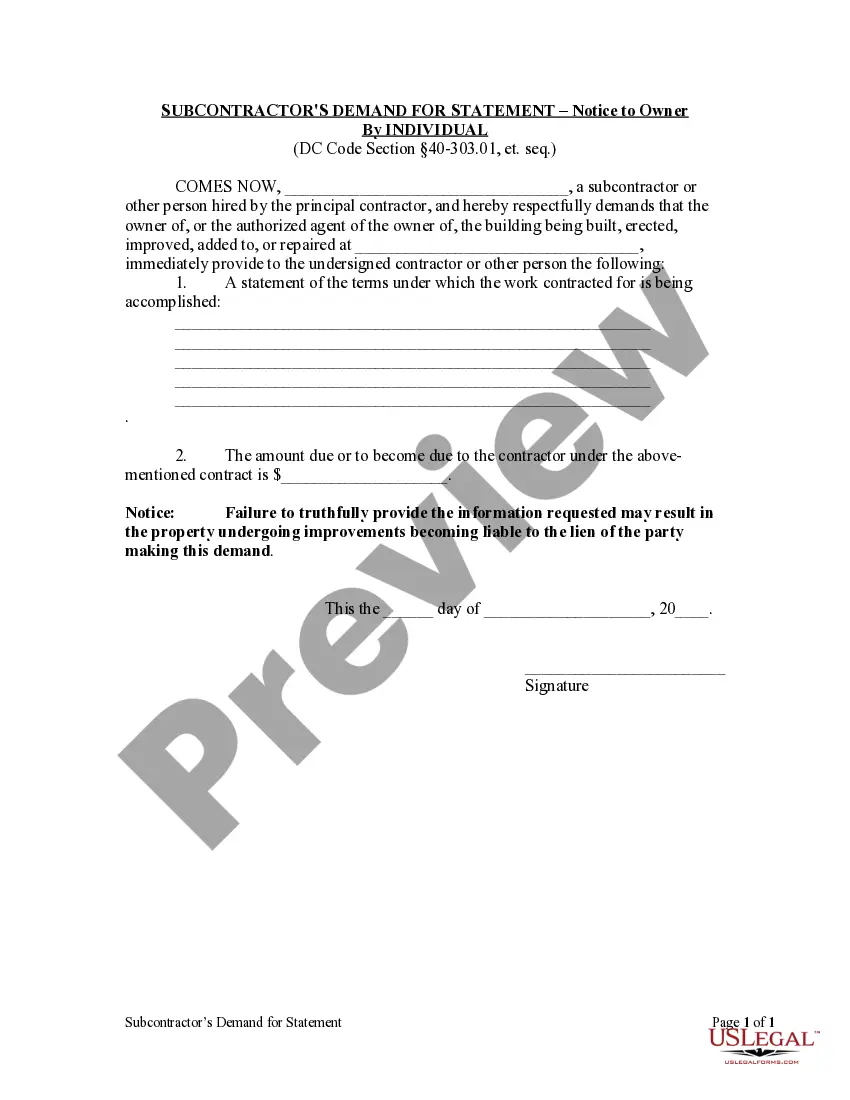

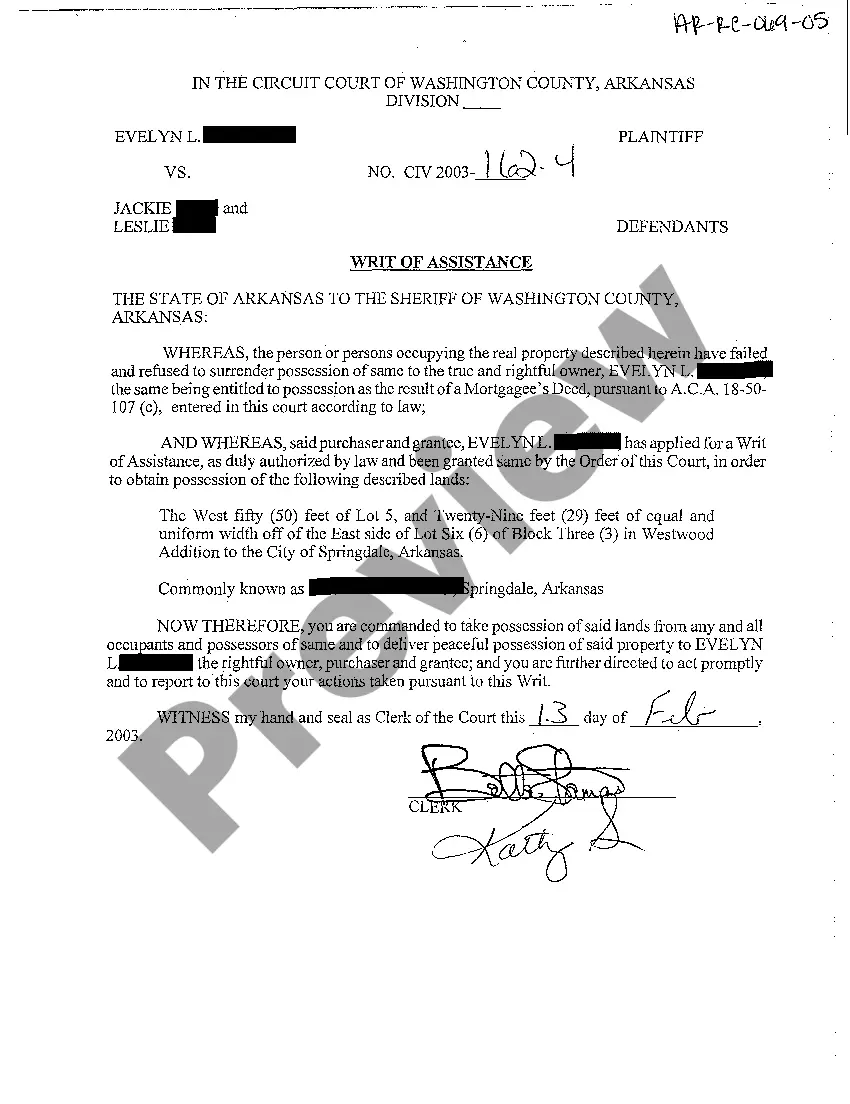

How to fill out Bond To Secure Against Defects In Construction?

Choosing the right lawful papers format might be a battle. Obviously, there are plenty of web templates accessible on the Internet, but how will you discover the lawful kind you want? Utilize the US Legal Forms web site. The service delivers a huge number of web templates, including the New York Bond to Secure against Defects in Construction, which can be used for business and personal requires. All the types are checked out by pros and satisfy federal and state requirements.

When you are currently listed, log in in your account and click on the Down load button to have the New York Bond to Secure against Defects in Construction. Utilize your account to look throughout the lawful types you might have purchased earlier. Proceed to the My Forms tab of your account and acquire an additional copy from the papers you want.

When you are a whole new end user of US Legal Forms, here are basic instructions so that you can adhere to:

- Initial, be sure you have chosen the right kind to your metropolis/county. You are able to look through the form making use of the Review button and read the form outline to make certain this is the best for you.

- If the kind fails to satisfy your preferences, utilize the Seach area to discover the correct kind.

- Once you are certain that the form is proper, select the Purchase now button to have the kind.

- Choose the prices strategy you would like and enter the necessary info. Make your account and purchase the order with your PayPal account or charge card.

- Select the data file structure and obtain the lawful papers format in your gadget.

- Complete, change and printing and sign the obtained New York Bond to Secure against Defects in Construction.

US Legal Forms will be the greatest library of lawful types for which you can see various papers web templates. Utilize the service to obtain expertly-created papers that adhere to state requirements.

Form popularity

FAQ

When a contractor fails to abide by any of the conditions of the contract, the surety and contractor are both held liable. The three main types of construction bonds are bid, performance, and payment.

Completion bonds provide assurance for the project owner that the project will be completed on-time, within budget, and free of liens. They differ from performance bonds because they cover the completion of the project as a whole, not just a specific contract.

The 4 Main Types of Construction Bonds Explained 1) Bid Bond. ... Example. ... 2) Agreement to Bond (a.k.a. Surety's Consent or Consent of Surety) ... Example. ... 3) Performance Bond. ... Example. ... 4) Labour and Material Payment Bond. ... Example.

Maintenance bonds protect a contractor and property owner from financial liability due to defects found at the completion of a project. Maintenance bonds can have varying time periods but are only active for that stated period and, essentially, act as insurance policies on contractor workmanship.

A completion bond is a contract that guarantees monetary compensation if a given project is not finished. It provides protection if the contractor runs out of money or any other budgetary issues come up during the project.

A surety bond is a risk transfer mechanism where the surety company assures the project owner (obligee) that the contractor (principal) will perform a contract in ance with the contract documents.

?The main purpose of a construction bond is to provide the security, or guarantee, to the owner that the project he instructs the contractor to build will be completed in the case of failure or bankruptcy of the contractor's company,? says Robbert.

Construction bonds, also known as contract bonds, are a type of surety bond that guarantees the payment, performance, or bid of a project. It ensures that the contract will be completed to the standards specified in the initial agreement when the bid is won.