New York Sample Letter for History of Deed of Trust

Description

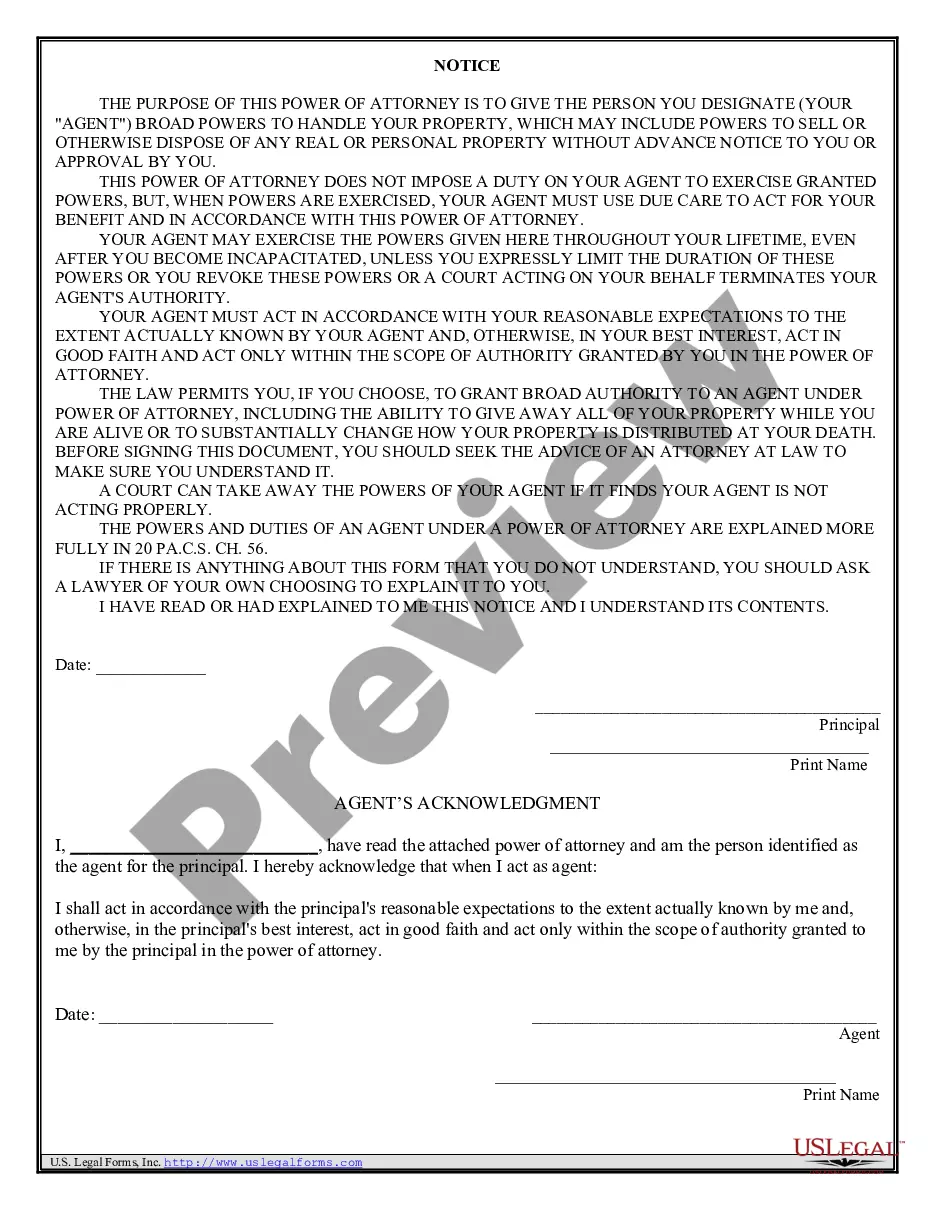

How to fill out Sample Letter For History Of Deed Of Trust?

US Legal Forms - among the largest libraries of authorized forms in the USA - gives an array of authorized papers layouts it is possible to acquire or print out. While using internet site, you may get 1000s of forms for business and person purposes, sorted by classes, suggests, or keywords.You can find the newest types of forms like the New York Sample Letter for History of Deed of Trust in seconds.

If you already have a subscription, log in and acquire New York Sample Letter for History of Deed of Trust from your US Legal Forms local library. The Download option will show up on every form you look at. You have accessibility to all earlier acquired forms in the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, listed below are straightforward instructions to help you get started out:

- Be sure you have picked the correct form to your city/region. Select the Preview option to examine the form`s articles. See the form description to ensure that you have selected the appropriate form.

- In case the form doesn`t satisfy your specifications, make use of the Look for area on top of the display to obtain the one who does.

- In case you are happy with the form, affirm your option by visiting the Buy now option. Then, opt for the rates plan you prefer and provide your references to register for an accounts.

- Procedure the purchase. Use your credit card or PayPal accounts to complete the purchase.

- Choose the structure and acquire the form in your device.

- Make modifications. Fill up, edit and print out and sign the acquired New York Sample Letter for History of Deed of Trust.

Every design you included in your money does not have an expiry particular date and it is your own property for a long time. So, in order to acquire or print out another version, just proceed to the My Forms area and click on around the form you require.

Gain access to the New York Sample Letter for History of Deed of Trust with US Legal Forms, by far the most comprehensive local library of authorized papers layouts. Use 1000s of expert and status-particular layouts that fulfill your business or person requires and specifications.

Form popularity

FAQ

A New York deed of trust is a loan security agreement wherein a trustee retains a property title for a lender until a debt has been satisfied by a borrower. Like a mortgage, a deed of trust gives the lender collateral for a real estate loan.

The real property transfer report (RP-5217) fee is $125.00 for residential or farm properties. The real property transfer report (RP-5217) fee is $250.00 for commercial properties. The transfer tax affidavit (TP-584) fee is $5.00 or $10.00, depending on the county.

If you wish to remove someone from a deed, you will need their consent. This can be done by recording a new deed, which will require their signature. If the person in question is deceased, you will need their death certificate and a notarized affidavit along with the new deed.

To change a deed in New York City, you will need a deed signed and notarized by the grantor. The deed must also be filed and recorded with the Office of the City Register. Transfer documents identifying if any taxes are due must also be filed and recorded with the City Register.

To change a deed in New York City, you will need a deed signed and notarized by the grantor. The deed must also be filed and recorded with the Office of the City Register. Transfer documents identifying if any taxes are due must also be filed and recorded with the City Register.

Obtain the original signature(s) of the Grantor(s) of the deed. Re-execute a deed or record a correction deed with property notarization and witnessing as required. Ensure that your selected instrument is recorded with the appropriate county office. Be sure to pay the required recording fees.

In California, many people sign a Deed of Trust to finance their house purchase. A Deed of Trust is commonly referred to as a mortgage. A Deed of Trust is a three party document prepared, signed and recorded to secure repayment of a loan.

New York requirements for real estate deed documents: - Documents must include the names of grantors and grantees, a legal description of the property, and the amount of consideration. - For a transfer of interest in real property subject to New York State Real Property Transfer Tax, the TP-584 must be filed.