New York Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Have you ever found yourself in a scenario where you require documents for various organizational purposes or specific needs almost daily.

There is a wide selection of legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, including the New York Assignment of LLC Company Interest to Living Trust, designed to meet state and federal requirements.

Once you find the right form, click on Acquire now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the New York Assignment of LLC Company Interest to Living Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is suited for your specific area/region.

- Use the Review button to inspect the document.

- Check the summary to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to locate the form that meets your requirements.

Form popularity

FAQ

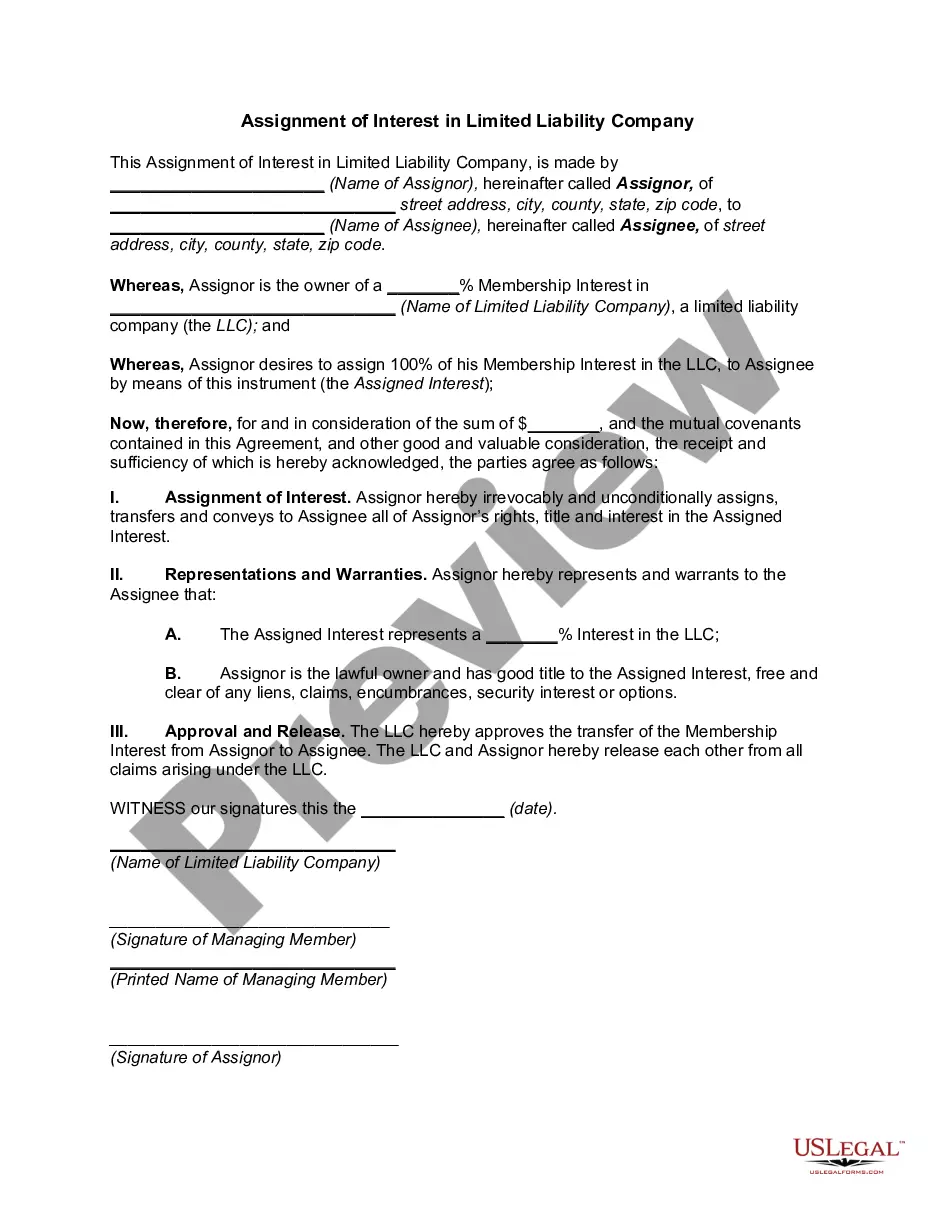

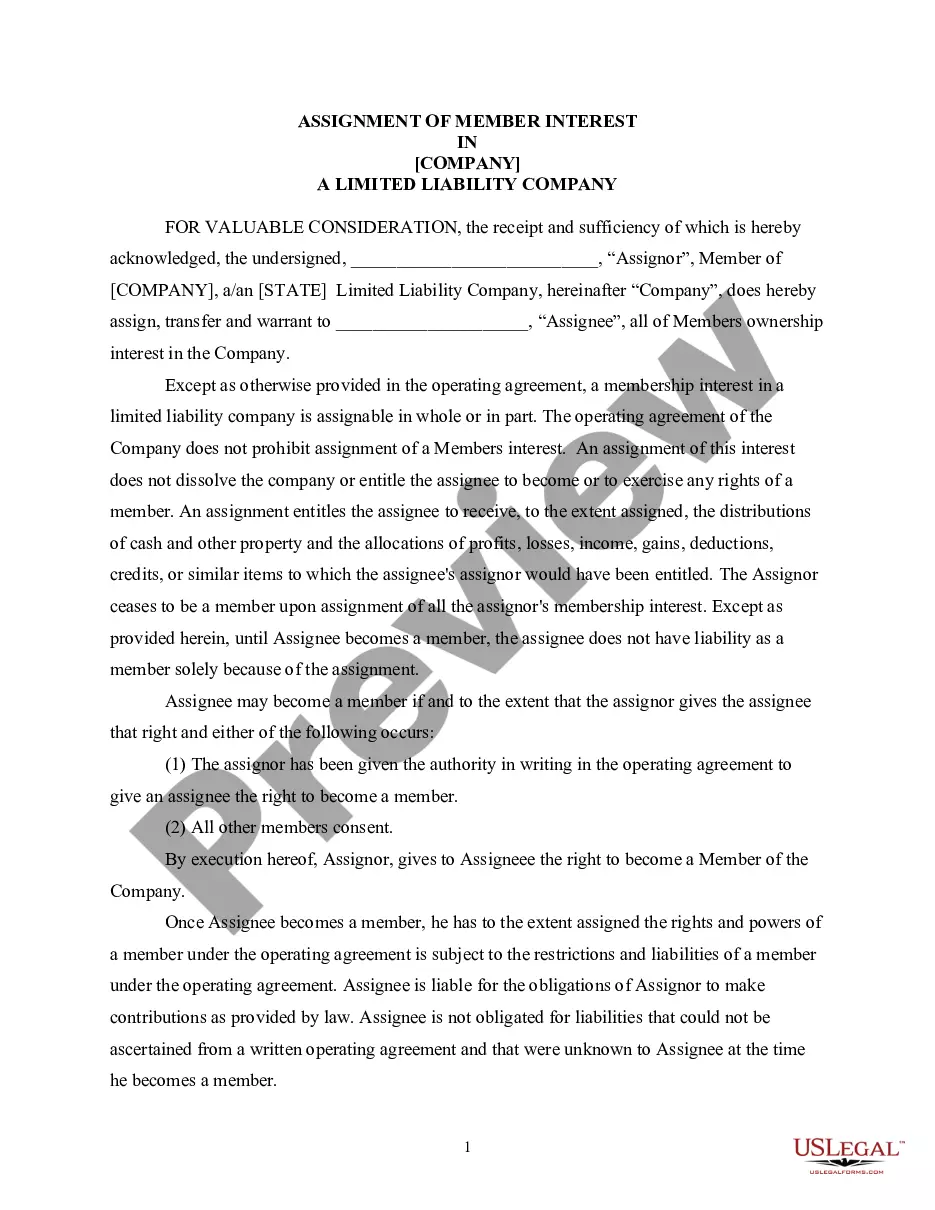

The settlor instead should execute a separate assignment of the settlor's LLC interest to the trust. For an LLC interest to be properly transferred to a revocable trust, the LLC must change the owner of record to the trust (specifically, to the trustee, as trustee of the trust).

The member (assignor) and the person assigned (assignee) sign a document called the Membership Assignment of Interest....The Membership Interest Assignment DocumentPercentage of interest that will go to the assignee.Whether the assignee will have voting rights.The signatures of the assignor and the assignee.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

Generally, holding each piece of real property in a separate limited liability company (LLC) owned by a revocable trust is an effective way of ownership with a number of business and estate planning advantages: Asset Protection. Owning property through an LLC maximizes the protection for your personal assets.

The assignment of interest is typically different from selling the ownership stake. Selling a member's ownership stake in the LLC requires unanimous approval by the other members. A departing member may also assign his membership to another member.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

Can a trust own an LLC? This is a common question when business owners are deciding on which type of business entity they would like to form. The answer to the question is yes; trusts are allowed to be owners of an LLC.

The answer is yes, a trust can own an LLC, either as the sole owner or as one of many owners.