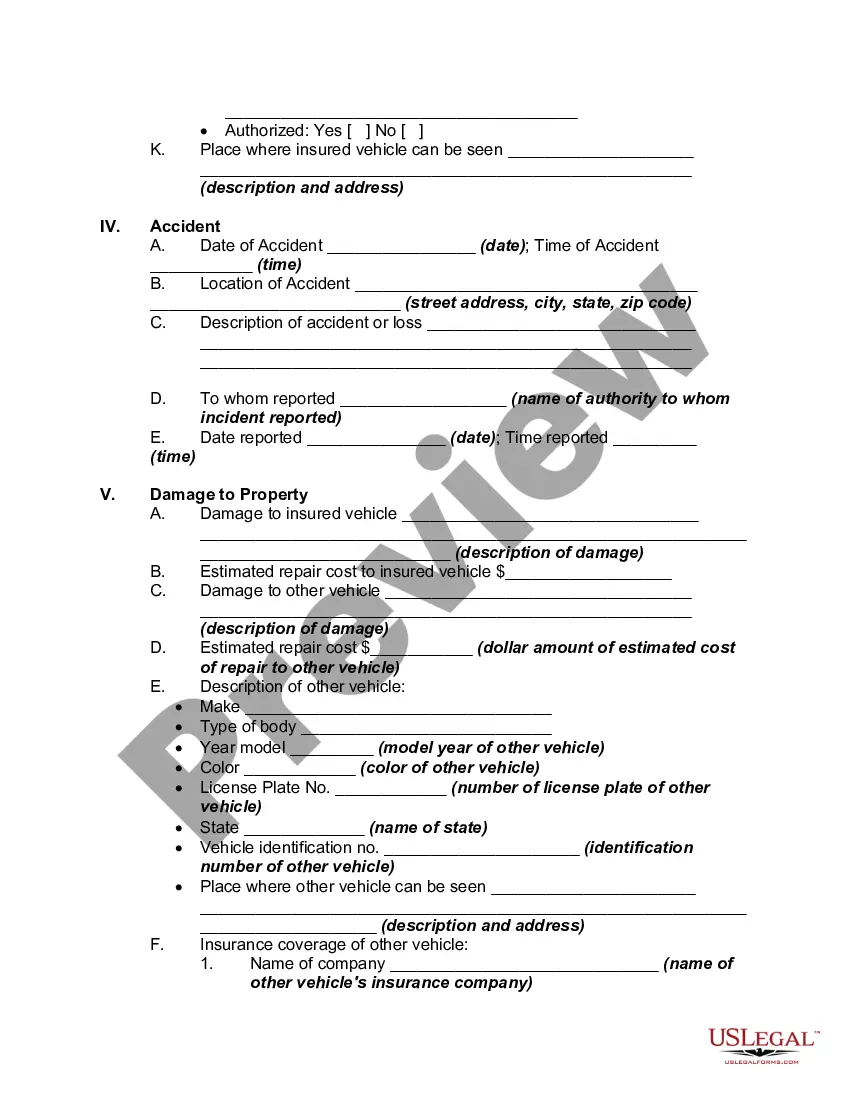

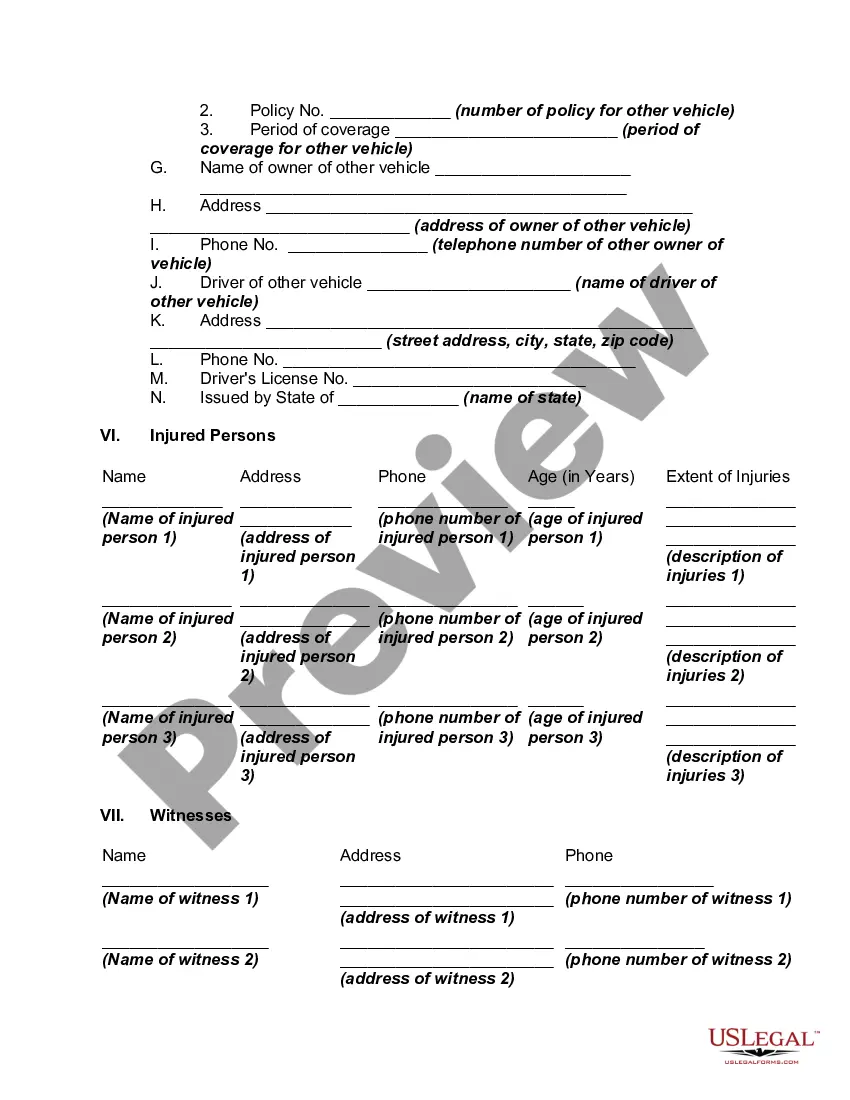

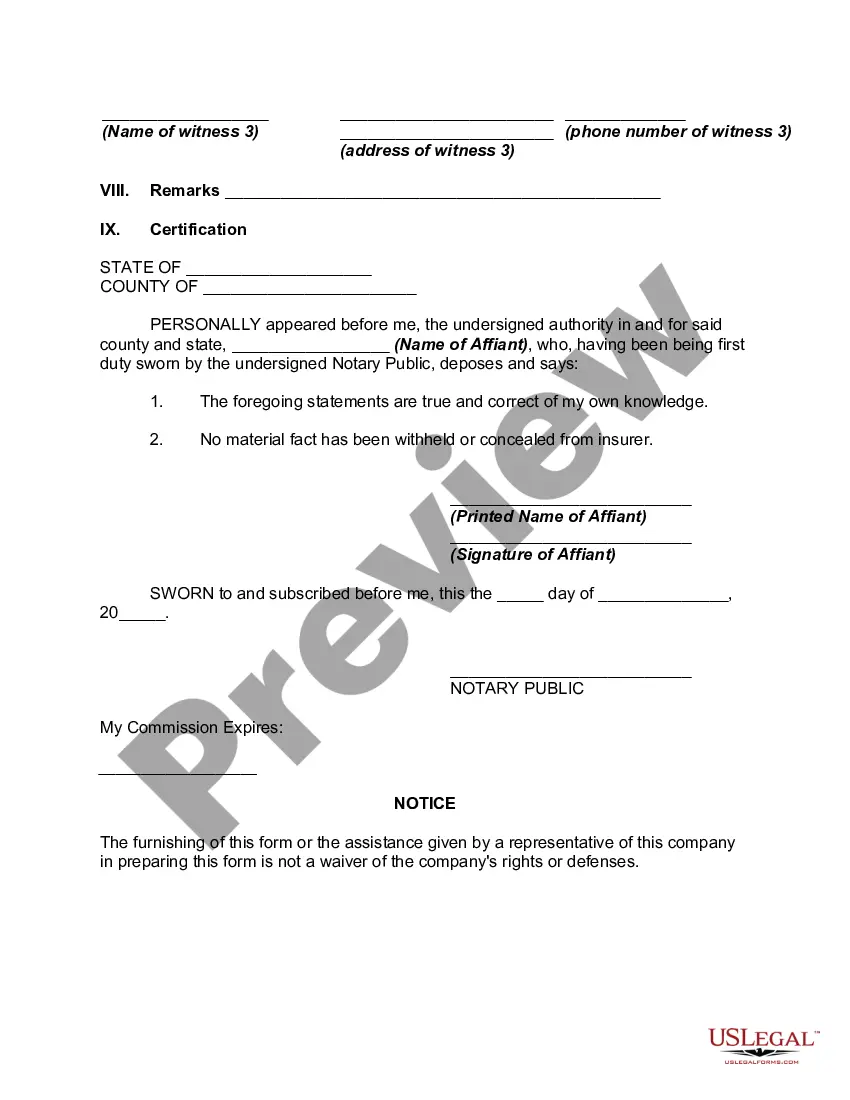

New York Sworn Statement regarding Proof of Loss for Automobile Claim

Description

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

If you wish to total, acquire, or produce authorized document templates, use US Legal Forms, the greatest selection of authorized varieties, which can be found on the web. Use the site`s simple and easy handy look for to find the paperwork you will need. Numerous templates for enterprise and individual uses are sorted by types and says, or keywords. Use US Legal Forms to find the New York Sworn Statement regarding Proof of Loss for Automobile Claim with a couple of click throughs.

Should you be presently a US Legal Forms buyer, log in for your bank account and click the Obtain key to find the New York Sworn Statement regarding Proof of Loss for Automobile Claim. You can even gain access to varieties you in the past acquired in the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have selected the form for your appropriate area/nation.

- Step 2. Utilize the Preview solution to check out the form`s content. Do not forget about to read through the explanation.

- Step 3. Should you be unsatisfied with the type, utilize the Lookup area at the top of the monitor to locate other models from the authorized type design.

- Step 4. Upon having identified the form you will need, click on the Acquire now key. Pick the rates plan you choose and add your credentials to register on an bank account.

- Step 5. Procedure the purchase. You may use your bank card or PayPal bank account to finish the purchase.

- Step 6. Choose the formatting from the authorized type and acquire it in your product.

- Step 7. Total, modify and produce or signal the New York Sworn Statement regarding Proof of Loss for Automobile Claim.

Each authorized document design you buy is your own for a long time. You possess acces to each type you acquired in your acccount. Select the My Forms portion and select a type to produce or acquire once more.

Remain competitive and acquire, and produce the New York Sworn Statement regarding Proof of Loss for Automobile Claim with US Legal Forms. There are thousands of skilled and express-certain varieties you can use for your enterprise or individual needs.

Form popularity

FAQ

Even if every insurance company does not mandate the submission of a Proof of Loss statement form following a covered event, there are certain circumstances in which one might be required. This includes suspected fraud, questionable causes of damage or high-claim amounts.

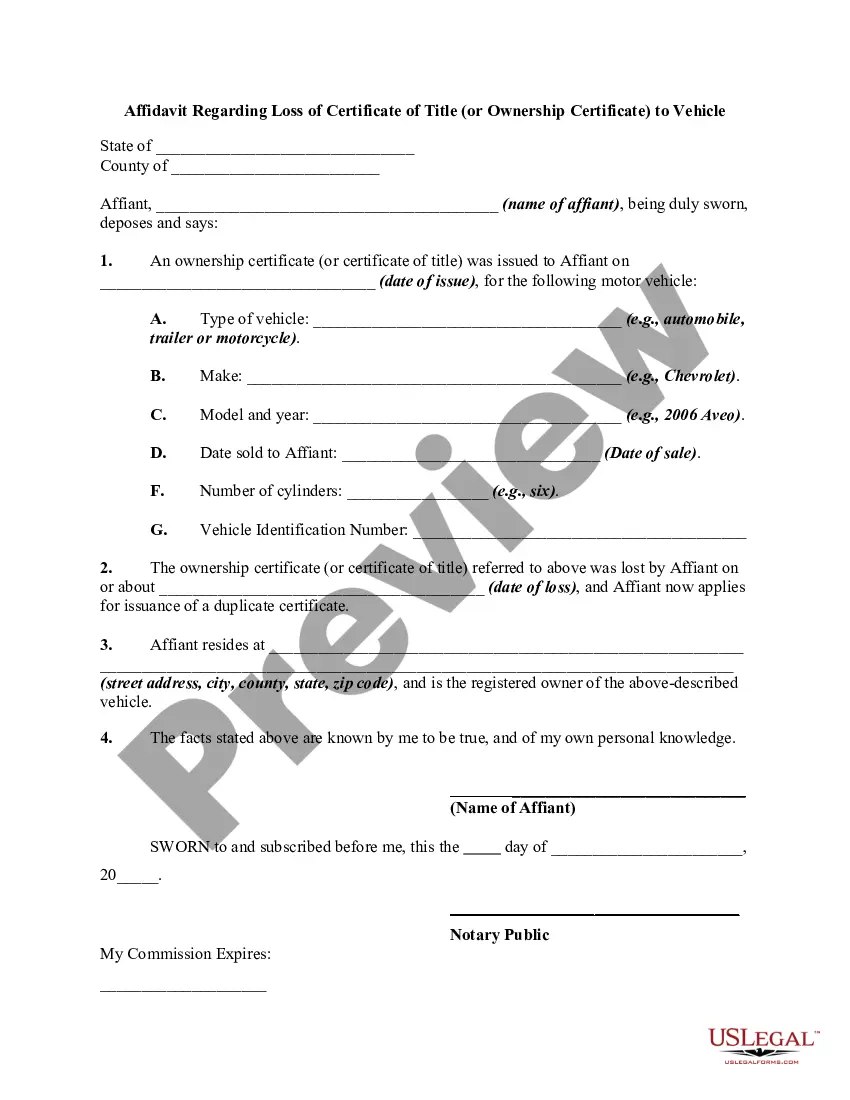

Proof of loss is a legal document that explains what's been damaged or stolen and how much money you're claiming. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property.

Once the proof of loss has been received, the insurer has 30 days to accept or deny the claim as submitted.

New York has a statute, Insurance Law §3407, which addresses proofs of loss. The statute requires a policyholder to ?furnish? the proof of loss to the insurer within sixty (60) days after the insurer requests it and provides the form.

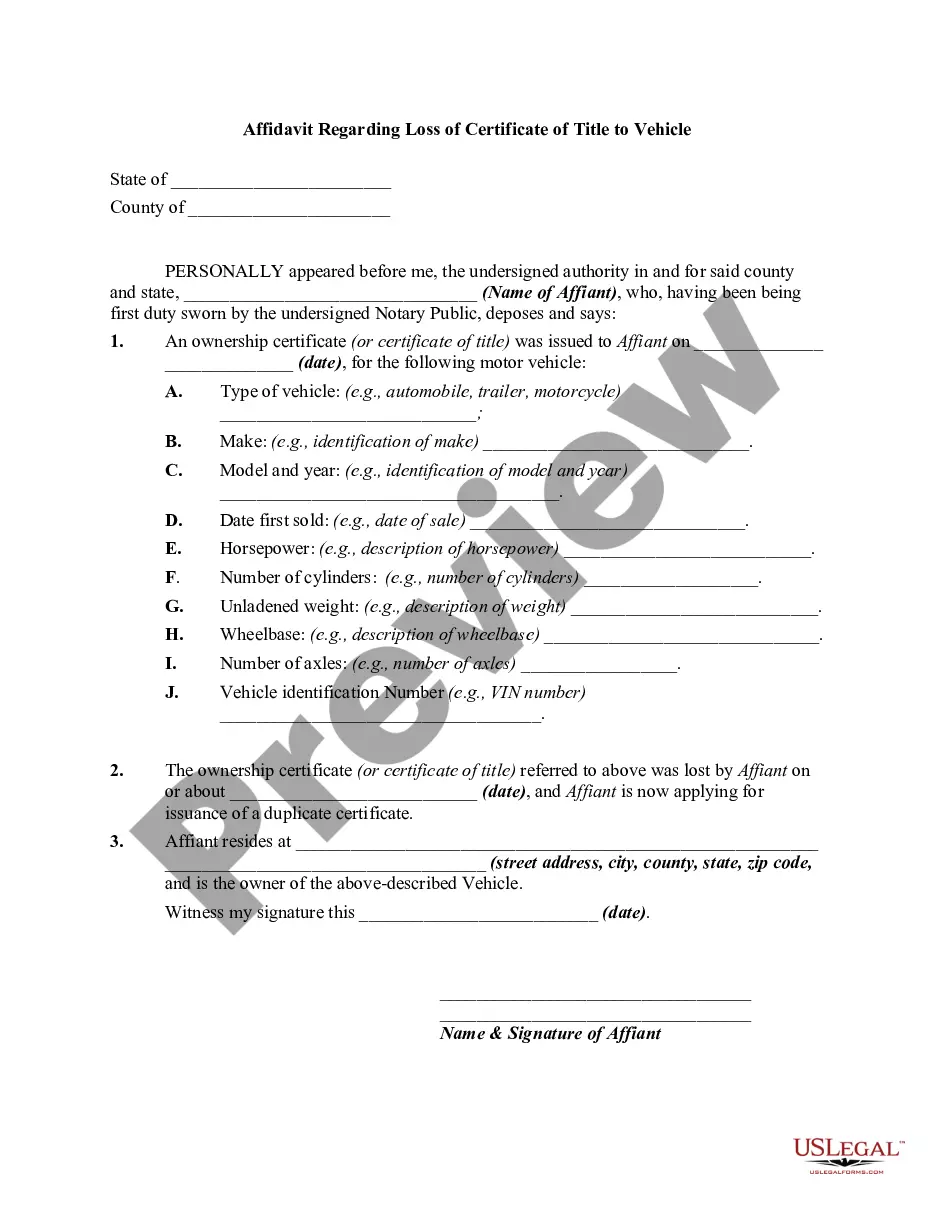

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred.

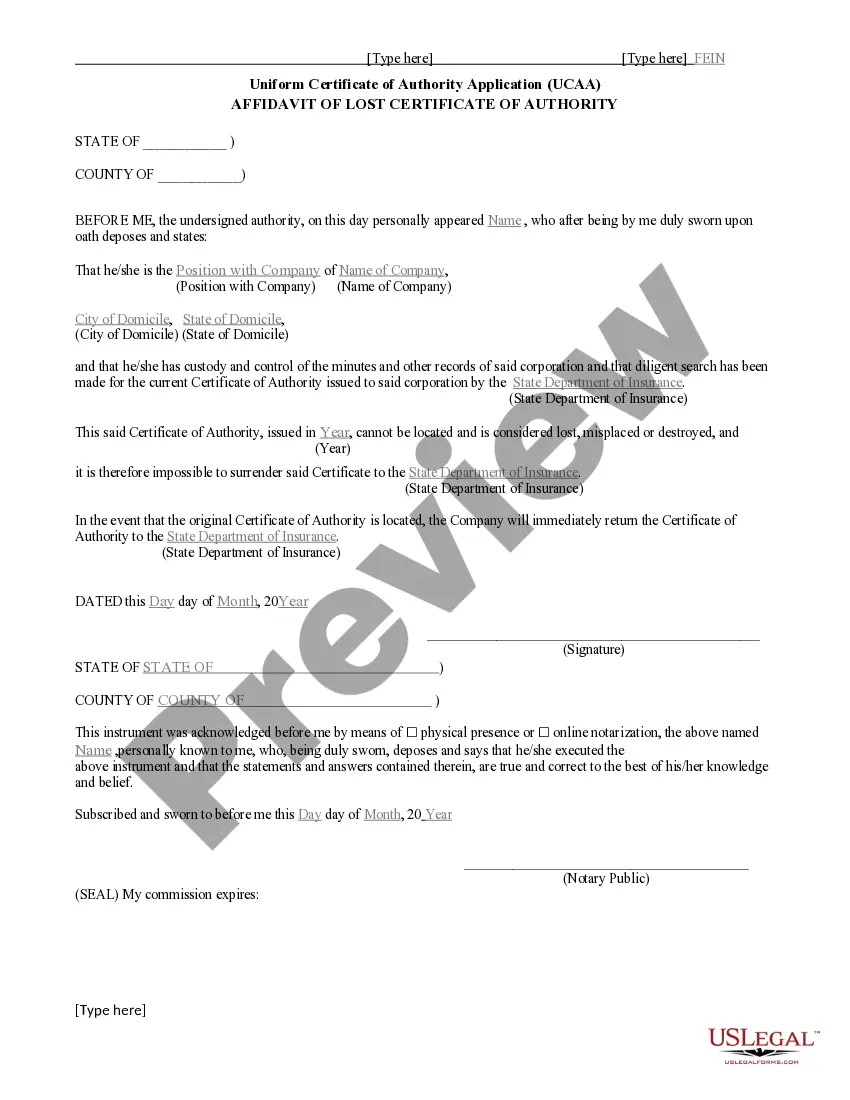

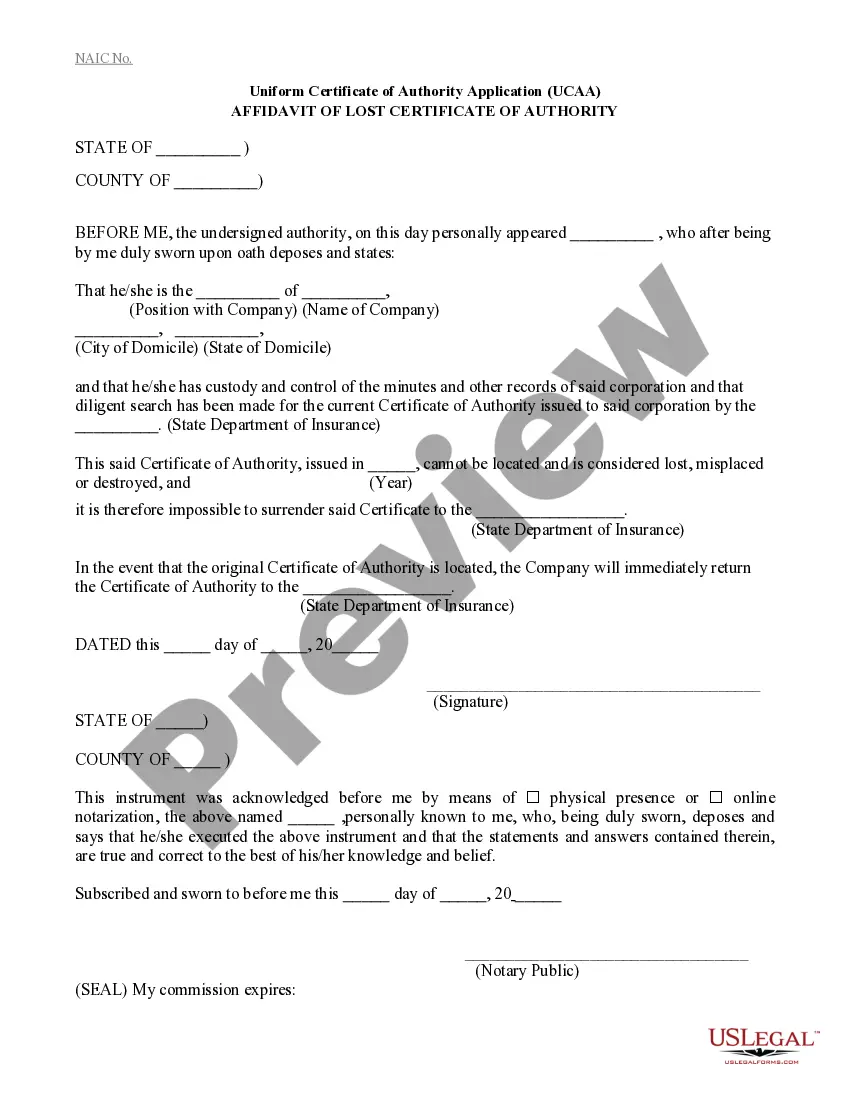

What is a Proof of Loss? A Sworn Statement in Proof of Loss outlines the basic details of your property damage claim and serves as a cover document for your supporting claim materials and documentation.

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.

What is FNOL? Formally known as First Notice of Loss, FNOL is the initial report made to an insurer detailing the damage, loss and theft of an asset. It marks the first step towards successfully making an insurance claim, which is usually under the management of a claims handler.