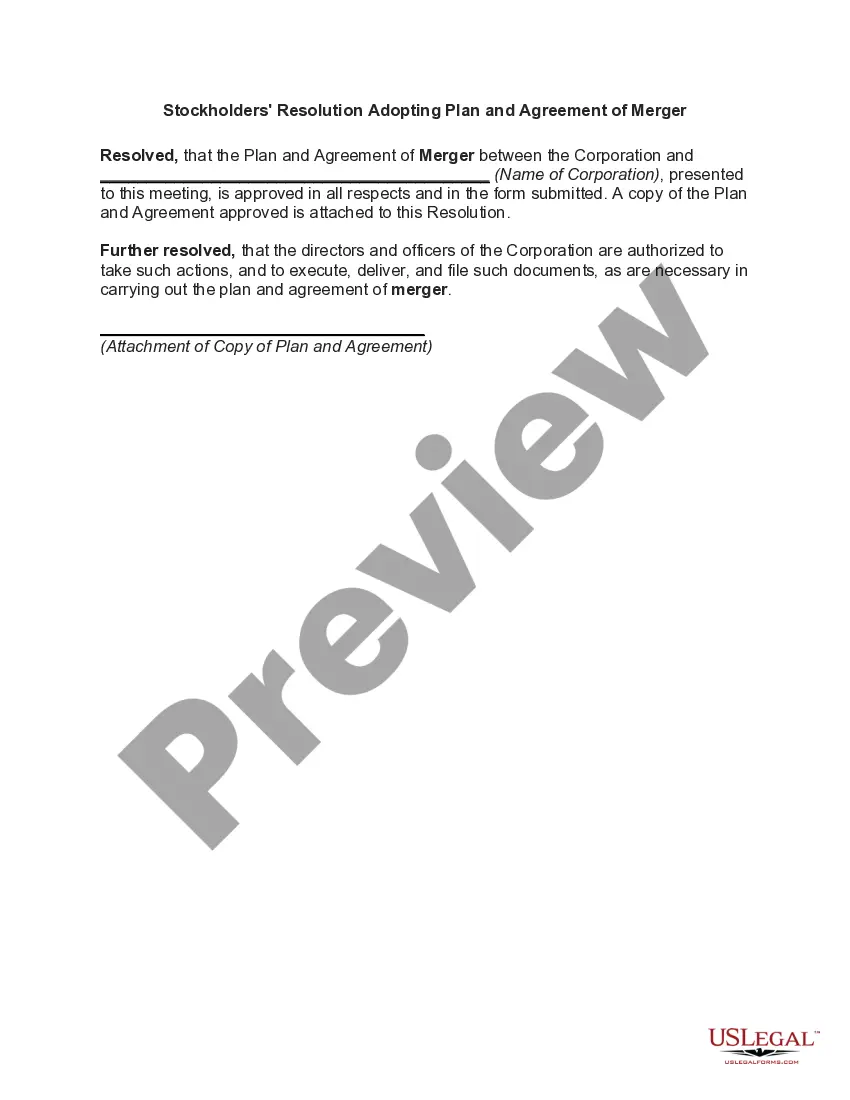

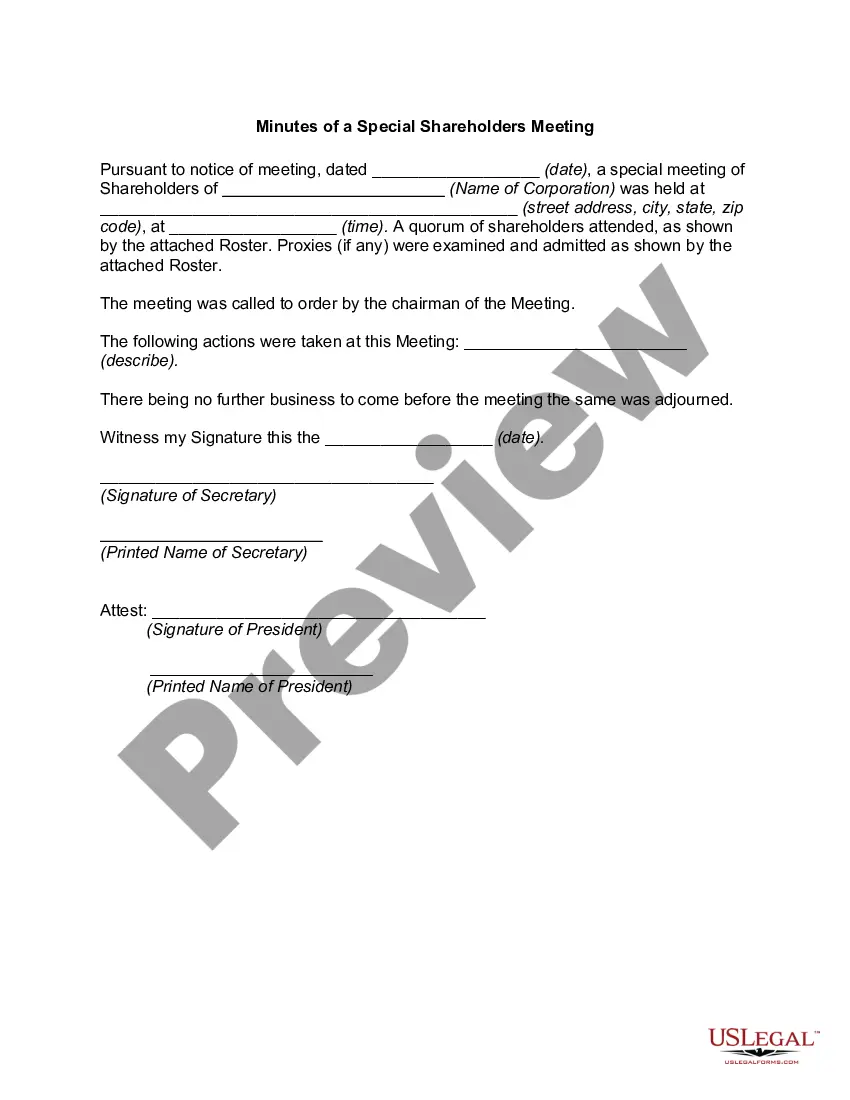

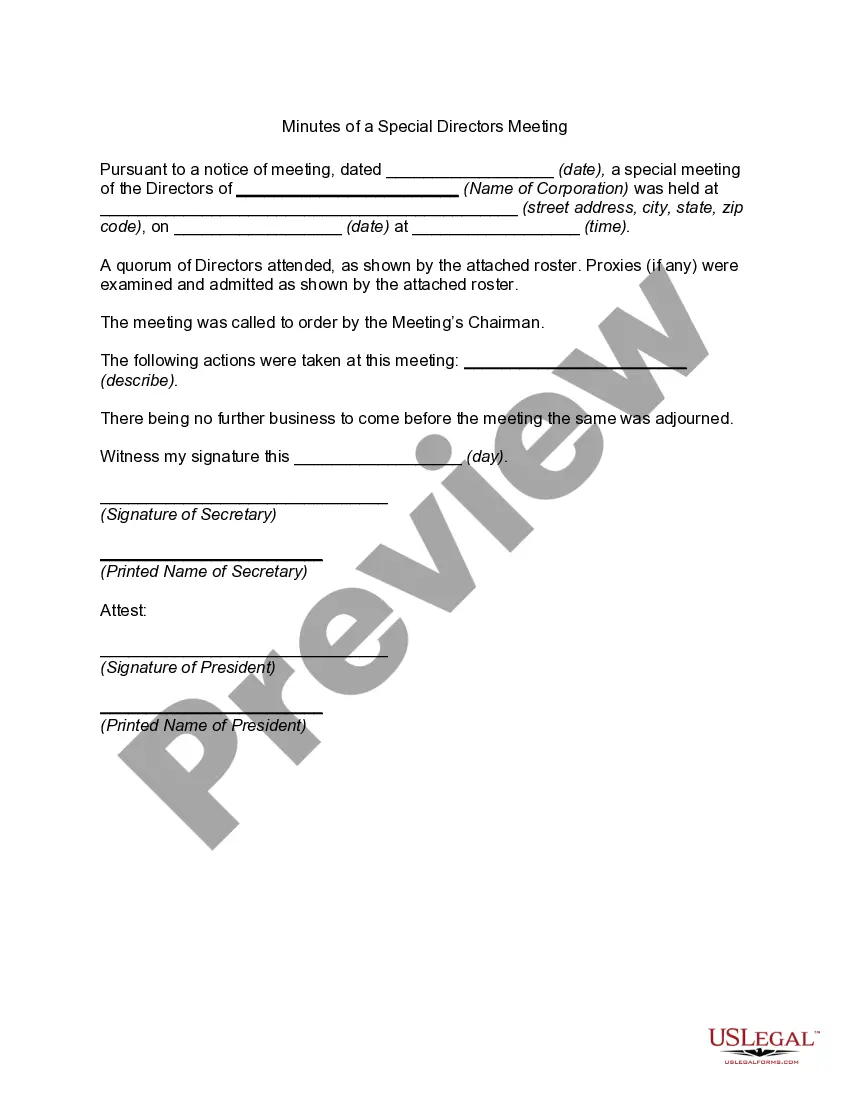

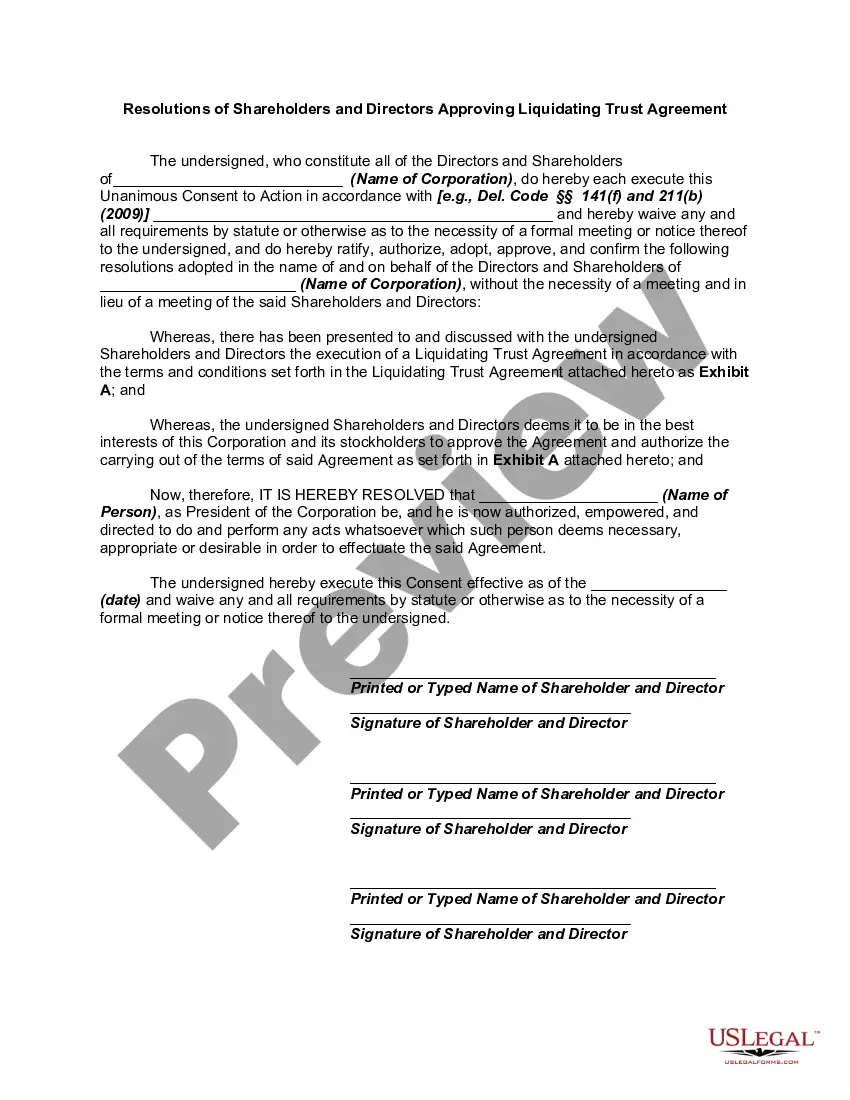

Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement

Description

How to fill out Resolutions Of Shareholders And Directors Approving Liquidating Trust Agreement?

Finding the appropriate legitimate document format can be a challenge. Naturally, there are numerous templates accessible online, but how do you find the genuine form you need? Utilize the US Legal Forms website. The service offers thousands of templates, such as the New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, suitable for both business and personal needs. All forms are vetted by experts and comply with state and federal standards.

If you are already a registered user, Log In to your account and click the Download button to retrieve the New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. Use your account to browse the legitimate forms you have previously purchased. Navigate to the My documents tab in your account to obtain another copy of the required documents.

If you are a new user of US Legal Forms, here are some basic steps for you to follow: Initially, ensure you have chosen the correct form for your city/area. You can preview the form using the Preview button and read the form description to confirm that this is indeed the right one for you. If the form does not fulfill your requirements, use the Search box to find the appropriate form. Once you are confident that the form is suitable, click the Get now button to obtain it. Select your preferred pricing plan and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legitimate document format to your device. Complete, modify, print, and sign the received New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

- Select the appropriate form for your city/area.

- Preview the form using the Preview button.

- Read the form description.

- Use the Search box if the form does not meet your needs.

- Click the Get now button if you are satisfied with the form.

- Create an account and pay for the order.

Form popularity

FAQ

The purpose of a shareholder resolution is to empower shareholders to express their opinions on company matters, ranging from financial decisions to governance issues. These resolutions allow shareholders to advocate for changes that can significantly impact their investments, such as initiating a liquidation process through the New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. Engaging in shareholder resolutions fosters transparency, encourages participation, and enhances accountability within the company, ultimately benefiting all stakeholders.

A resolution to liquidate a company is a formal decision by shareholders to dissolve the company and sell its assets. This decision typically arises when the business can no longer operate profitably, and proceeds from the liquidation are distributed to shareholders. New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement are essential for guiding this process, ensuring that it adheres to legal requirements while protecting shareholder interests. It's a strategic move to maximize asset value, offering a clear path for all parties involved.

A shareholder resolution serves as a formal request or decision made by shareholders regarding company operations or governance. These resolutions can influence significant actions, such as approving the liquidation of a company through the New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. By participating in resolutions, shareholders have a voice in matters that affect their investments and can align with the company's future direction.

Yes, a liquidating trust typically requires an Employer Identification Number (EIN) to manage its financial operations legally. The EIN allows the trust to open a bank account, file tax returns, and report income distributions to beneficiaries. When creating a liquidating trust, it is essential to follow the guidelines set by New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement to ensure proper registration and compliance. This step helps facilitate smooth financial transactions and maintain clear records for the trust.

To liquidate a trust, the trustee must first review the trust’s terms and identify the assets to be sold. Next, the trustee applies the New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement to ensure compliance with legal obligations. After that, the trustee manages the sale of assets and the payment of debts associated with the trust. Finally, any remaining funds are distributed to the beneficiaries as outlined in the trust documents.

Liquidating trusts are generally treated as separate taxable entities, meaning they must file their own tax returns. Income generated during the liquidation process can be taxed at the trust level before distributions are made to beneficiaries. Understanding this taxation structure is essential, particularly when following the New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, to avoid unexpected tax liabilities.

The requirements for a liquidating trust typically include having a clear plan for asset distribution and following state-specific guidelines. Under New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, the trust must be established with transparent objectives that direct the liquidating process. Proper legal compliance ensures that the trust serves its intended purpose efficiently.

Dissolving a trust can have significant tax implications, depending on the type of trust and its assets. Usually, any gains realized during the dissolution could trigger capital gains taxes for the beneficiaries. Understanding the specific conditions outlined in the New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement is crucial to navigate these implications effectively.

A shareholder resolution to liquidate is a formal decision made by the shareholders to dissolve the company and distribute its assets. This process often involves New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, detailing how the assets should be managed. Ensuring proper documentation and agreement among shareholders can simplify the liquidation process.

Liquidating distributions are generally treated as sales of the shareholder's stock. Therefore, any gain or loss is subject to capital gains tax. When New York Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement are in place, it’s vital to report these distributions accurately to ensure compliance with tax laws. Consulting a tax professional can help clarify your specific situation.